If you like dividends, you should love these stocks simply because their business models revolve around generating stable cash flows that support their growing dividends.

Get a juicy yield of 6.2% from Enbridge

End your search for juicy dividends with Enbridge (TSX:ENB)(NYSE:ENB). It is a global leading energy infrastructure company and is the largest in North America.

About 98% of its EBITDA (a cash flow proxy) is regulated, as the company has positioned itself to be a pure regulated pipeline and utility business. Additionally, 93% of its clients are investment grade. Consequently, its cash flows are highly predictable.

The Canadian Dividend Aristocrat has actually increased its dividend for 23 consecutive years. And it’s a rare opportunity to find ENB stock offering an attractive yield of more than 6%, as it does now!

ENB Dividend Yield (TTM) data by YCharts.

Currently, Enbridge has about $16 billion of commercially secured projects to support near-term growth. The stock increased its quarterly dividend by 10% this year and is set to do the same for next year.

The payout ratio will be about 66% of distributable cash flow (DCF) this year. This aligns closely with ENB’s targeted payout of less than 65% of DCF.

Get a juicy yield of 6.9% from Brookfield Property

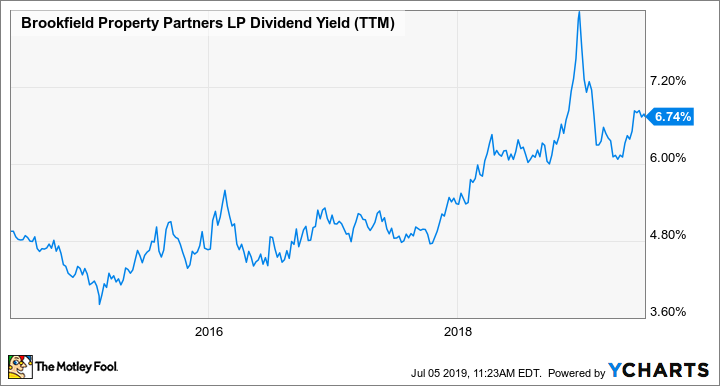

Brookfield Property Partners (TSX:BPY.UN)(NASDAQ:BPY) is a great choice for dividend lovers. It currently offers a compelling yield of 6.9%, which is at the high end of the yield range since inception. This indicates that the stock is an excellent value.

BPY Dividend Yield (TTM) data by YCharts.

Here’s what makes the company’s cash flow stable. It gets rental income from its global quality real estate portfolio. Its best-in-class core office and retail assets make up about 80% of its balance sheet.

The high quality of the assets is characterized by their locations. Moreover, there’s a top-notch management and operating team that run the show. Altogether, it leads to high portfolio occupancy and the opportunity to increase the rent on expired leases.

As a part of its overall strategy, Brookfield Property also has about 20% of its balance sheet in opportunistic investments that target higher returns compared to the core portfolio. Booking gains from this portfolio is a normal course of action for the company. This act also helps to support BPY’s cash distribution.

BPY stock makes a good addition to retirement accounts (RRSP or RRIF) due to the nature of its cash distributions, which can consist of interest, dividends, other income, and return of capital that are sourced from the U.S. or otherwise.

Foolish takeaway

You’ve gotta love these two stocks if you like dividends! Enbridge and Brookfield Property are low-risk dividend stocks that offer safety of principal, growing dividends, and solid upside potential from current levels.