A big key to value investing is being able to focus on what’s important: the fundamentals. The juiciest opportunities in the market arise when investors are far too distracted by background noise, not realizing that things aren’t as bad as they seem.

I like to call these plays “White Noise” stocks, and two current examples come from the steel sector: Stelco Holdings (TSX:STLC) and Russel Metals (TSX:RUS). As a result of all the worrisome news surrounding the industry, Mr. Market doesn’t seem to notice their strengthening fundamentals.

Let me explain.

It’s no secret that the steel and iron sector has been under pressure. First it was trade wars and tariffs that shocked the space, with President Trump imposing a steep 25% tariff on steel from Canada. And more recently, turbulence in Turkey has heightened worries.

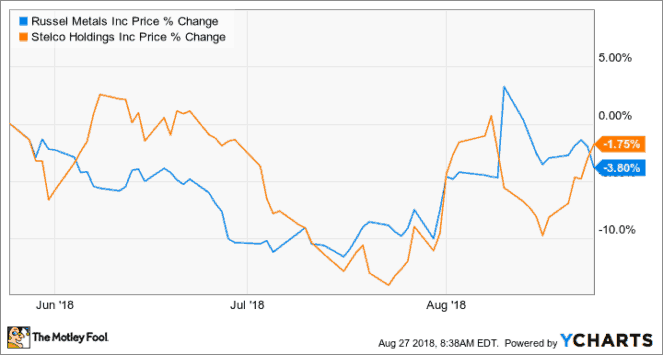

Check out the stock prices for both Stelco and Russel over the past three months:

While the two stocks haven’t collapsed by any means, investors are clearly still nervous about the space going forward.

But here’s the thing: that very sentiment could be providing us value-conscious Fools with an attractive buying opportunity. Why? Well, despite all of the negative headlines, the fundamentals of the steel industry actually seem to be improving.

As Credit Suisse analyst Curt Woodworth pointed out last week, global steel prices have remained surprisingly stable. In fact, Chinese iron ore prices reached their highest level since March just a few short weeks ago. Moreover, Woodworth says that the pullback in U.S. steel prices is mainly due to investors settling down after the initial tariff-fueled panic buying.

In other words, Woodworth believes it’s an opportune time to gain exposure to the space.

“Global and China steel-production data remain very bullish and while global scrap prices have seen sharp falls from the crisis in Turkey, we expect scrap prices to bounce back towards the end of 2018,” Woodworth wrote in a note to investors. “The sharp sell-off in equities and exchange traded metals in our view is overdone relative to solid physical demand.”

Demand for steel around the world remains strong, with China’s recent stimulus serving as yet another potent catalyst.

Thus, when you add those bullish industry factors to the seemingly improved NAFTA talks, the long-term setup for both Stelco and Russel looks particularly enticing. And with Stelco and Russel sporting a dividend yield of 1.7% and 5.3%, respectively, the tandem can pay you some decent income while you wait.

The Foolish bottom line

Drowning out the noise and focusing on what’s important is critical to investment success. Unless you’re able to lock in on the fundamentals of a given sector or company, you’ll always be at the whim of general investor sentiment, which is always extremely fickle.

When it comes to the steel industry, trade wars, tariffs, and Turkey turbulence all seem to be distracting from strengthening fundamentals. Stelco and Russel look like solid ways to take advantage of that oversight.

Fool on.