Marijuana stocks are currently heavily beaten down, as investor sentiment turned negative this year, leading to some popular names, like Aurora Cannabis (TSX:ACB)(NYSE:ACB) stock, trading at prices below their net book value.

Low price-to-book value (P/B) multiples are typical on value stocks (and they are usually accompanied by low price-to-earnings ratios and above-average dividend yields). As such, the plunge below accounting net asset value for pot share prices raises the question whether one might lock in a value discount on the affected names for outsized gains in the future.

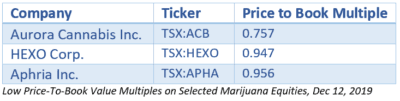

As illustrated by the P/B multiples above, investors are willing to pay just above 75% of the book value on ACB, but the applied discount on HEXO shares is just above 5%. Is Aurora stock therefore a bargain today?

Beware of past extravagant acquisitions

Book values of equity on several pot names that went on acquisition-led growth sprees between 2016 and 2018 are significantly bloated by goodwill. Goodwill represents the excess of the purchase price paid for the acquisition of an entity over the fair value of the net tangible and intangible assets acquired.

This accounting entry is allocated to business units that are expected to benefit from synergies created through combinations with acquired assets, and the amount isn’t subject to amortization but is annually tested for impairment.

Management teams overpaid for assets in earlier acquisition deals, when there was heightened frenzy on anything marijuana related, and goodwill has become the largest portion of the company’s balance sheet.

As of September 30 this year, the company reported a $5.6 billion balance sheet, showing $4.47 billion in net assets, yet the company’s market capitalization is around $3.5 billion at the time of writing. Judging from this data alone, the market is attaching a 25% discount to the company’s book value, and shares appear like discounted bargains with some margin of safety to new buyers today. However, this isn’t the case if we consider potential goodwill impairments.

For example, the firm acquired MedReleaf for $2.64 billion in 2018, but only $119 million was assigned to tangible property, plant and equipment, and the biggest chunk painfully went to intangible assets ($285 million) and goodwill of $2.14 billion!

In total, goodwill comprised $3.17 billion, or over 56% of the company’s total assets, and 71% of net assets allocated to equity investors by September this year.

Should there be any reason (any reasonable basis at all) for this goodwill to be impaired, the impact to the balance sheet could be catastrophic. And the ongoing production cuts at HEXO and construction project suspensions at the company due to lagging demand growth could be the early signs of trouble.

Intangible assets and high goodwill are naturally elevated for technology firms that have developed proprietary software systems and grown through acquisitions, but for cannabis farmers, retailers, and pharmaceuticals manufacturers, tangible assets should naturally comprise the bigger part of the balance sheet … but this isn’t the case here.

Foolish takeaway

The current discounts to book values on pot names doesn’t necessarily make them bargains today, not in the sense of the P/B valuation multiple.

That said, anyone bullish on the growth potential on these names will view current multi-year valuation lows as great entry opportunities for long-term holding while waiting for the nascent industry to claim its position among other big profit-generating giants.