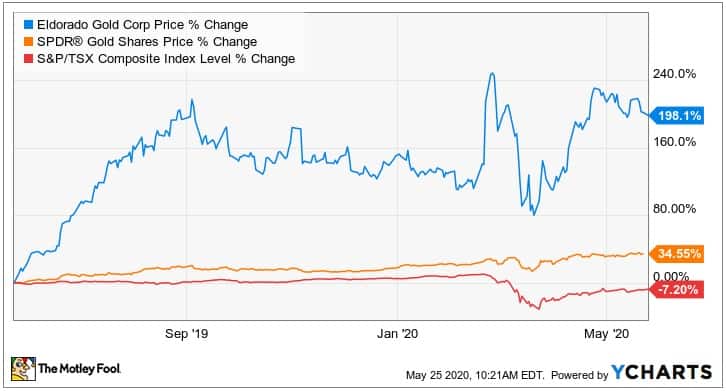

Beaten-down TSX-listed gold miner Eldorado Gold (TSX:ELD)(NYSE:EGO) has been a key beneficiary of gold’s latest rally. Over the last year, Eldorado’s stock soared by a notable 198%, substantially outpacing gold, which gained 35%.

This has sparked speculation that Eldorado may not experience a rally as strong as many other intermediate gold miners when the yellow metal rallies again.

Improved outlook for gold stocks

In 2018, TSX-listed Eldorado gold was struggling to unlock value from its assets due to a series of setbacks regarding its Turkish and Greek mining operations. There were fears towards the end of that year Eldorado may not survive due to a looming cash crunch and low gold prices. While there were red flags, the miner has turned around its operations and is fully benefiting from higher gold prices.

Key has been the ablity to bring all four of its gold mines to commercial operations. As a result, first-quarter 2020 gold production shot up by 40% year over year to 115,950 ounces. Eldorado also made progress with reducing expenses. All-in sustaining costs (AISCs) of US$952 per ounce sold were 16% lower than a year earlier, bolstering profitability.

This saw free cash flow for the first quarter climb to US$7 million compared to a negative US$64 million a year earlier. El Dorado reported a US$5 million net loss against a US$27 million loss for the equivalent period in 2019. That clearly boosts the gold miner’s prospects of surviving, even in the current harsh operating environment.

Those solid numbers also leave El Dorado on track to meet its 2020 guidance. Annual gold production is forecast to be up to 550,000 ounces, or 39% greater than 2019. It is predicted that AISCs could fall by as much as 18% to US$850 per gold ounce sold.

When those factors are coupled with substantially higher gold prices, it bodes well for a marked increase in profitability and earnings.

Strong fundamentals for a gold miner

Another aspect of El Dorado’s first-quarter numbers to note is its improved balance sheet and considerable liquidity. By the end of the period, El Dorado had almost US$364 million in cash and an additional US$36 million in available liquidity on an existing credit facility. Its debt was a manageable US$635 million. These are important attributes for a gold mining stocks because of the industry’s capital-intensive nature.

This gives El Dorado considerable financial flexibility, allowing it to take appropriate measures to respond to the coronavirus pandemic.

The miner has reduced staffing levels at its operations to 75% of capacity in response to the pandemic. Management doesn’t expect this to have any short-term impact on 2020 production or guidance.

If the coronavirus pandemic is longer than anticipated, it would force El Dorado to reduce operational capacity for longer than originally anticipated. That would have a negative affect on the miner’s operations and annual performance.

Foolish takeaway

Canadian gold mining stocks will perform strongly, because of firmer gold. Eldorado Gold is one of the few TSX-listed gold miners to have made all the right moves. After a near-death scare, it has significantly improved its operations and strengthened its balance sheet. There is every sign that Eldorado Gold’s earnings will grow as forecast during 2020. Those factors coupled with firmer gold and a positive outlook for the yellow metal will cause El Dorado’s stock to rally further, making now the time to buy.