Canadians across the country are preparing for another market downturn. Every penny counts in today’s market, and unfortunately the worst could be yet to come. Yet a surprising turn of events has caused retail stocks to become one of the few places investors can find some defensive stocks.

Not all retail stocks are created equal, however. In fact, during the last market crash most retail companies struggled to make ends meet. Brick and mortar stores closed around the world. This caused some companies to even close for good.

However, for those retail companies that saw an opportunity rather than a challenge, shares soared. Even today, with the stock market starting to dip as we head into fall, these stocks have continued to do well. In fact, once another crash hits, these stocks stand the best chance to dig out of that crash sooner than the rest of the markets.

So what stocks should you add to your watch list? Shopify Inc. (TSX:SHOP)(NYSE:SHOP) and Goodfood Market Corp. (TSX:FOOD).

Goodfood

Goodfood quickly found its feet during this pandemic. New clients across the country who couldn’t go to grocery stores went to Canada’s most popular meal kit service for help. The company became swamped by new customers. But once the growing pains were over, many saw the company rebound by leaps and bounds.

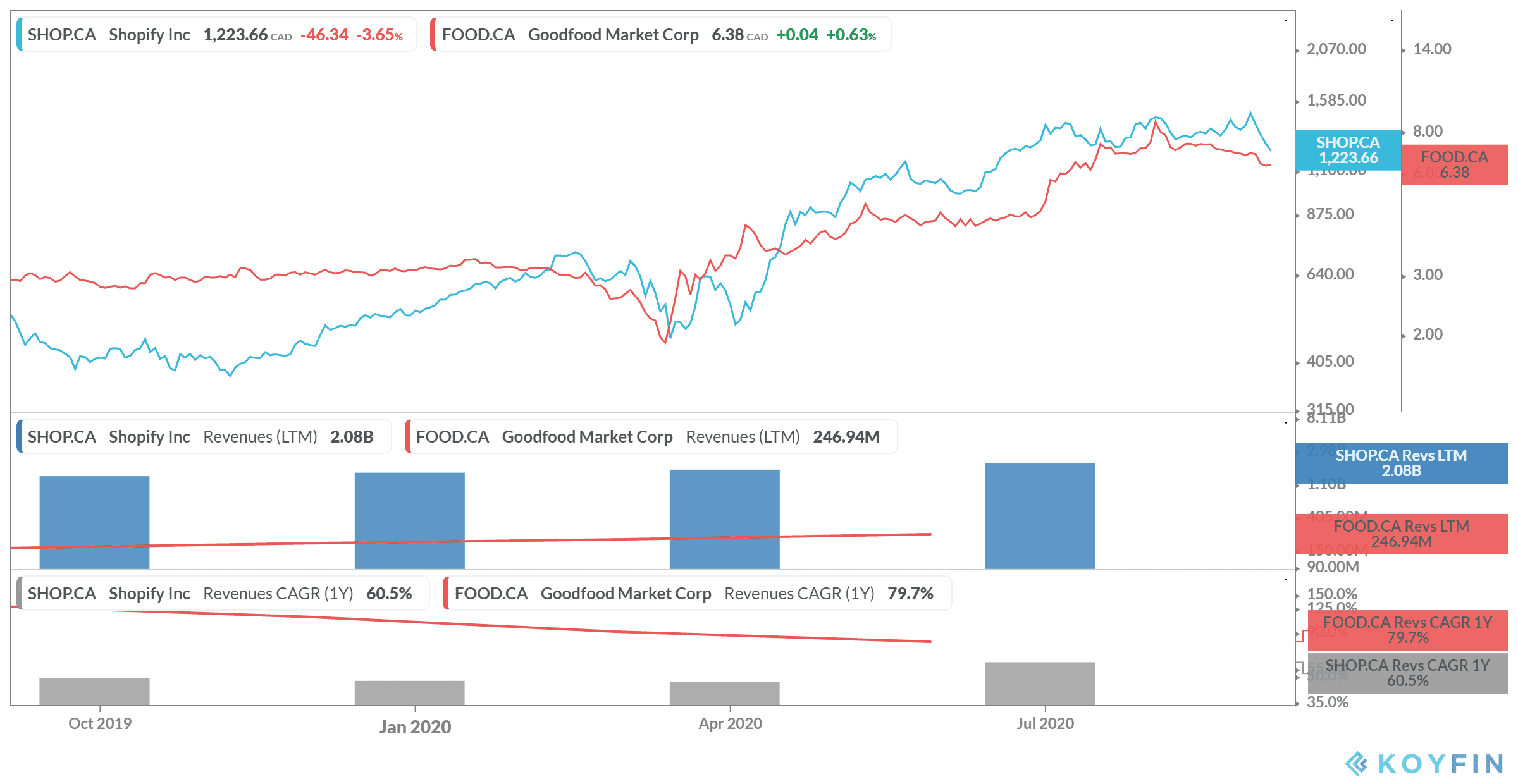

During the last few months, this retail stock has doubled in share price. Before the pandemic, shares were at about $3 per share. As of writing, those shares have more than doubled to about $6.50 as of writing, dropping down from an all-time high of $9.20 — tripling your money in just a few months.

As you’ll see above, revenue has also continued to climb, as the company signs on more customers. During the most recent quarter, revenue soared by 74% compared to the same time last year, up to $86.6 million.

Given that this retail stock is still in its infancy compared to other meal kits services, there is still a long way for this company to go within this billion-dollar industry.

Shopify

I’m not going to sit here and pretend Shopify doesn’t exist. There are a lot of articles out there touting the next Shopify, but Shopify is Shopify. And when another market crash happens, you’ll want to grab this retail stock again and again.

Shopify continues to exceed expectations through its performance. The company keeps making partnerships with huge companies such as Wal-Mart, bringing its bottom line up even higher. The exciting part is that the company is still in partnership mode, so investors have the fruits of these partnerships to look forward to.

It’s no secret that shares have soared this year, but it’s likely the company will continue to climb high for years to come. Already just this year shares are up 300% year to date! While I might expect this to slow down in the future, I wouldn’t say it’s going to crash any time soon.

Much of this is due to its continued revenue growth through recurring business, such as its subscriptions. While many are month-to-month subscriptions, its enterprise business Shopify Plus now have yearly subscriptions for larger clients. Second-quarter revenue soared by 97%, beating expectations yet again.

Bottom line

If you’re able to continue seeing these stocks rise during the pandemic, you could be in for serious cash. Let’s say you used your Tax-Free Savings Account (TFSA) room of $69,500 and put half toward each stock. If these stocks continue to grow by 300% each in the next year, it would turn your initial investment into an incredible $208,500!