It’s hard to believe that Bitcoin has already been around for more than a decade. The controversial digital currency was created back in 2008 and released in 2009, and since then has made several investors millionaires many times over.

When the idea first spread, many were quick to dismiss it. Even over the years, as it has risen dramatically in value, many investors and experts have dismissed it as simply a bubble.

It certainly has the makings of a bubble, yet each time the volatile digital currency crashes in value, the next rally seems to always set a new high.

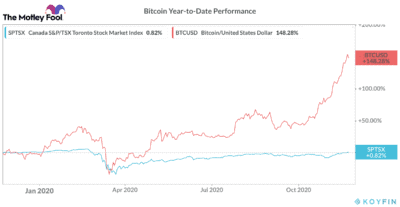

So far in 2020, Bitcoin is up a whopping 150%, and it’s not even close to one of the top-performing cryptocurrencies. But with consistent gains that are beating the market, it’s hard to keep ignoring the digital currency, and slowly but surely, many big-name investors have been gaining exposure.

This has led many retail investors to consider investing in Bitcoin or wonder if it’s even worth it. But before we can decide if we want to invest in Bitcoin, we first need to understand what it does and why it has value.

Why does Bitcoin have value?

Like anything else, the main reason Bitcoin has value is because people believe it does. Since it was introduced over a decade ago, it has paved the way for other digital currencies.

And with the strong belief that digital currencies are the future and Bitcoin is the biggest name in the industry; naturally, it attracts a tonne of investment.

It’s also widely owned because it’s the main cryptocurrency trading pair. To buy most other cryptocurrencies, no matter how small, you almost always need to own Bitcoin first. It’s like the U.S. dollar in the crypto world in that it can essentially be exchanged for any cryptocurrency out there.

Another reason that Bitcoin is seeing a major increase in value is because it’s treated similarly to gold. As a matter of fact, some have referred to it as digital gold because it’s a great hedge against inflation.

The risks you should know

Clearly, Bitcoin’s past performance is impressive. However, you should be aware that there are significant risks, especially with a coin whose value is so volatile. First, Bitcoin isn’t regulated at all, and there is a slight learning curve. If you send coin to the wrong wallet by accident, for example, it’s unlike sending an e-transfer to the wrong email. The money is gone. Furthermore, sending money at all can be quite costly.

Another risk with owning Bitcoin is there are now several other cryptocurrencies that do the same job as Bitcoin but do it better and cheaper. Right now, Bitcoin is the most popular because of its brand. It’s unclear how long that may last.

The last risk to know is that with the rise of new crypto technology, Bitcoin does very little. It was a brilliant way to prove that blockchain works, and investors still use it to trade, but as an actual currency, several options are much better.

Should you buy Bitcoin as an investment?

More and more investors are gaining some exposure to Bitcoin or other cryptocurrencies. This is what’s been driving the rapid appreciation as of late. So while you may want to add some to your portfolio, too, you definitely shouldn’t have a large amount of your portfolio in cryptocurrency.

There are also certain Bitcoin stocks you could buy instead. For example, you could gain exposure through a stock like Hive Blockchain Technologies. Hive derives most of its income from mining Bitcoin, a higher risk business model. Owning Bitcoin stocks would be advantageous if you planned to do it in a TFSA to save on the tax.

However, most investors would likely be better off just to buy Bitcoin, which is increasingly becoming easier with the mass adoption that’s driving the prices up. Companies like PayPal are now making it extremely easy to buy Bitcoin, which on top of making it easy for you to buy, is one of the main catalysts of the coin’s soaring prices today.

So if you’ve been thinking about gaining exposure to Bitcoin, I’d take a small position and be careful, but I wouldn’t wait any longer.