Many pot stocks have surged strongly recently. The cannabis industry is convinced that U.S. president Joe Biden will decriminalize pot at the federal level. And voters in several U.S. states approved the legalization of marijuana in the same November ballot that brought Biden to power.

This has strong implications for Canadian pot companies that are doing business in the United States. Canopy Growth (TSX:WEED)(NYSE:CGC) and Village Farms International (TSX:VFF)(NASDAQ:VFF) are two top pot stocks to buy in February. These pot companies look especially well positioned to profit from legalization south of the border.

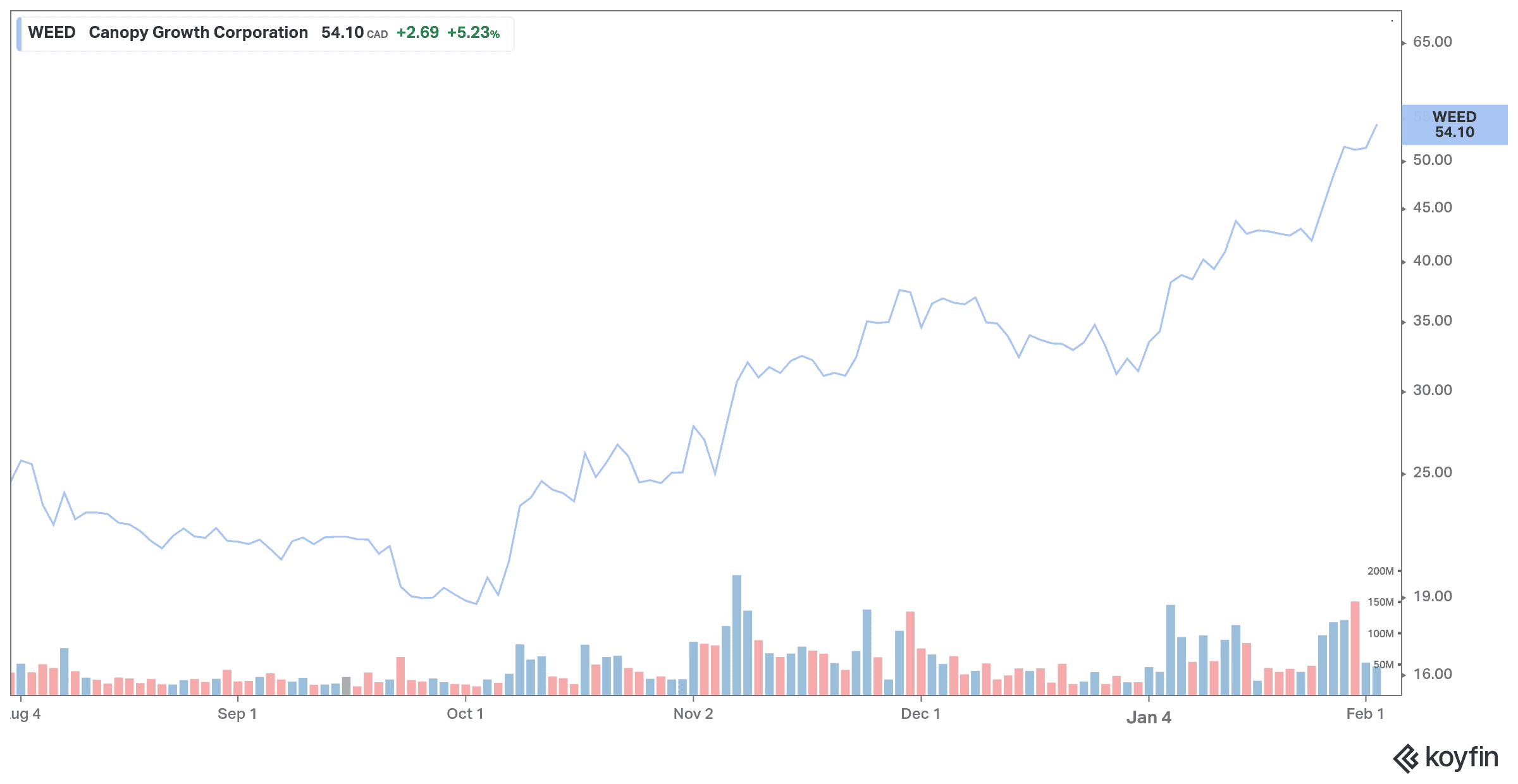

Canopy Growth

Canopy Growth saw a strong post-election rally, as did those of U.S.-focused cannabis operators. The stock has jumped more than 100% in the past six months.

Canopy CEO David Klein is confident that the pot giant will be in the United States in about a year. Canopy will have an advantage over its Canadian counterparts in the United States, as it has warrants to acquire multi-state operator Acreage Holdings Inc. no later than 60 days after cannabis clearance in the United States. The pot company also owns a 21% stake in TerrAscend Corp., another major player in cannabis in the U.S.

Canopy Growth is one of the most established pot stocks on the market today. The company is backed by Constellation Brands and has improving financials and a strong cash position. It is well positioned to benefit from secular tailwinds in its main operating markets.

Going forward, Canopy Growth expects continued growth in its Canadian recreational pot business, with new store openings and improved dried flower market share.

The recent launch of the “Martha Stewart CBD for Pets” line helped to drive shares higher. The CBD-infused dog treats claim to help reduce dogs’ stress and keep their joints healthy. The real story is that having sharply cut production during the pandemic, Canopy is said to have “resized” itself for a market with more growth potential.

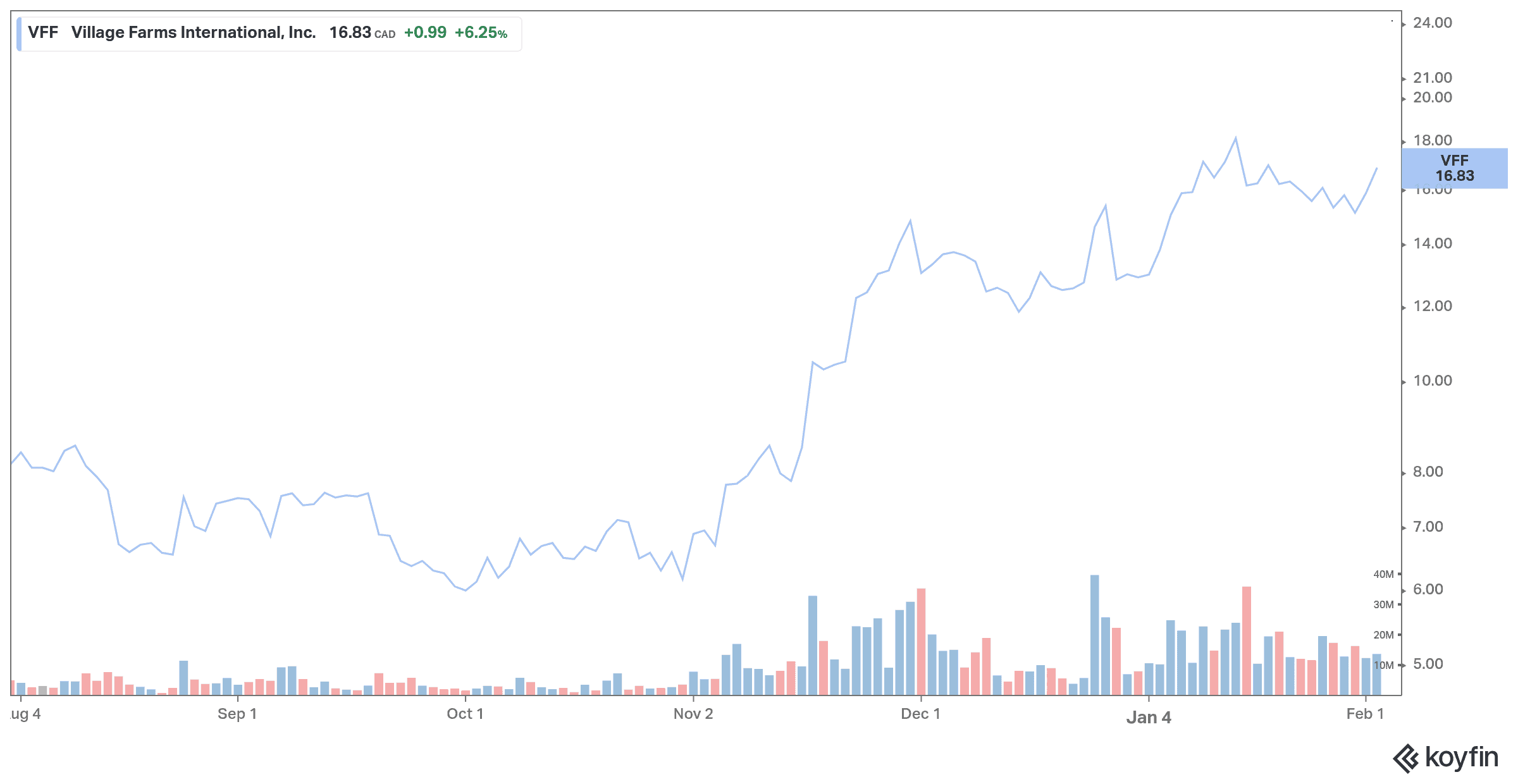

Village Farms International

Village Farms has had a good run lately. The stock price has doubled in value in the past six months.

In 2018, Village Farms changed its strategy from its core fruit and vegetable business and started producing cannabis in a joint venture with Emerald Health Therapeutics and Pure Sunfarms. Emerald would buy 40% of Pure Sunfarms’s production for the years 2018 and 2019, completing its acquisition in November 2020.

Since obtaining its retail licence in the third quarter of 2019, sales of Pure Sunfarms’s have been on a steady upward trend. In the third quarter of 2020, it was the best-selling brand of dried flower products in Ontario, Canada’s largest provincial market. According to the Ontario Cannabis Store (OCS), Village Farms had a 15% dried flower market share by volume.

Village Farms is positioned as a high-tech, low-cost, vertically integrated company focused on agricultural consumers and is actively seeking high-growth opportunities in emerging legal cannabis and related markets in the United States, Canada, and Australia.

The company’s Texas site is ready for hemp production when it receives a green light from the U.S. Food and Drug Administration (FDA). In Canada, it aims to increase the number of stores in Ontario from 300 to 1,000 next year. The company also has a presence in Europe — last year it became one of six equal shareholders in a Netherlands-based cannabis company.