To complete your order, it is necessary to enable JavaScript.

Motley Fool Canada - Order Now!

Already a member? Login

Fools, there’s a monumental buying signal flashing right now

You’re invited to peek inside the Motley Fool Canada’s most exclusive $561,439 “founder-led” portfolio…

Satisfaction GUARANTEED!

When you become a member of The Partnership Portfolio.

You’ll gain access to the complete U.S. and TSX portfolio that Iain Butler and our team will be backing with over $500,000 of The Motley Fool Canada’s own money! You’ll be able to sleep well tonight knowing your entire membership is backed by the Fool's satisfaction guarantee!

Dear investor,

With share buybacks setting all-time highs…

And select company management teams “backing up the truck” on their company’s stock…

We think now could be an incredible moment for individual investors like you to start investing alongside them...

Sure, it may not be a moment when everyone feels “excited” about the market.

But for those who know what to look for, there’s a monumental “buy signal” flashing right now…

And frankly, if the past year or so has taught us anything as investors…

It’s that when the world gets turned upside down and panic sets in, having a well-crafted game plan for your investment portfolio can allow you to take advantage of market dips and potentially accelerate your progress toward investing goals by years…

Or even decades…

...while NOT having one can be absolutely ruinous to you and your family’s wealth!

So if you’re like so many other Motley Fool Canada members I’ve spoken with over the years who are always looking to improve their returns, I’d like you to imagine knowing exactly which stocks make up a complete portfolio…

Which stocks boast strong management teams and high insider stock ownership…

And which of these stocks ones to buy, which to sell, and how much money you should commit to each trade.

Imagine having the confidence of knowing you don’t have just one or two great stock picks but an entire portfolio of stocks working together to deliver you potentially market-crushing returns.

If you’re like me, you don’t want a patchwork of random stocks… you demand explicit asset allocation guidance that simply removes all the guesswork. And although past performance isn’t an indicator of future results, you want a track record that shows the guidance has worked — even through market volatility like we’ve seen this year.

Thankfully, I’ve got great news for both of us.

Allow me to quickly explain...

Regardless of how long you’ve been following The Motley Fool, I’m sure you’re familiar with the world-class, market-beating track record we’ve established over more than two decades in our U.S. investment services.

After all, I don’t know of another company in the financial industry that has matched The Motley Fool’s ability to consistently lead investors like you to some of the most life-changing investment returns the market has ever seen…

Even accounting for the recent market pullback!

I am, of course, talking about U.S. recommendations like:

Netflix (up 13,039%)

Amazon (up 16,185%)

Nvidia (up 8,093%)

Shopify (up 1,157%)

Tesla (up 14,641%)

Salesforce.com (up 2,117%)

MercadoLibre (up 6,504%)

Now, as you’d expect, not every pick has performed as well, and some have even fallen in value. That said, we have helped thousands of our individual members rack up winner after winner, we’ve had countless investors ask us to share the “secret” behind this enviable success.

And while many companies in the financial service industry would prefer to keep their “edge” hidden from the public eye, here at The Motley Fool, we tend to do things a bit differently.

In fact, we’re happy to share the formula behind our success with as many investors as possible!

Which is why several years ago, Motley Fool CEO Tom Gardner commissioned a comprehensive review of the various investing strategies, factors, and screens we’ve used to identify promising stocks at The Motley Fool U.S. over the past THREE decades.

And while nearly all The Motley Fool U.S.’s strategies have crushed the market over the decades, Tom’s team discovered that the most lucrative returns have been generated by betting on a small group of stocks with one unusual — yet extremely powerful — factor.

Namely, they discovered that investing solely in The Motley Fool’s U.S. recommendations of founder-led stocks would have allowed any investor to absolutely crush the market!

I know that may be a bit surprising — but take a look back at the stocks (and life-changing returns) I just mentioned above...

Amazon, Netflix, Nvidia, Tesla, and Salesforce… all are among The Motley Fool’s most lucrative U.S. recommendations… and all these businesses have company founders as their CEOs…

Boasting high degrees of insider ownership, too, of course.

And this incredible performance has not been limited to just a handful of stocks…

Time and again, this founder-focused investing philosophy has consistently led The Motley Fool’s top investors directly to the market’s most game-changing stocks.

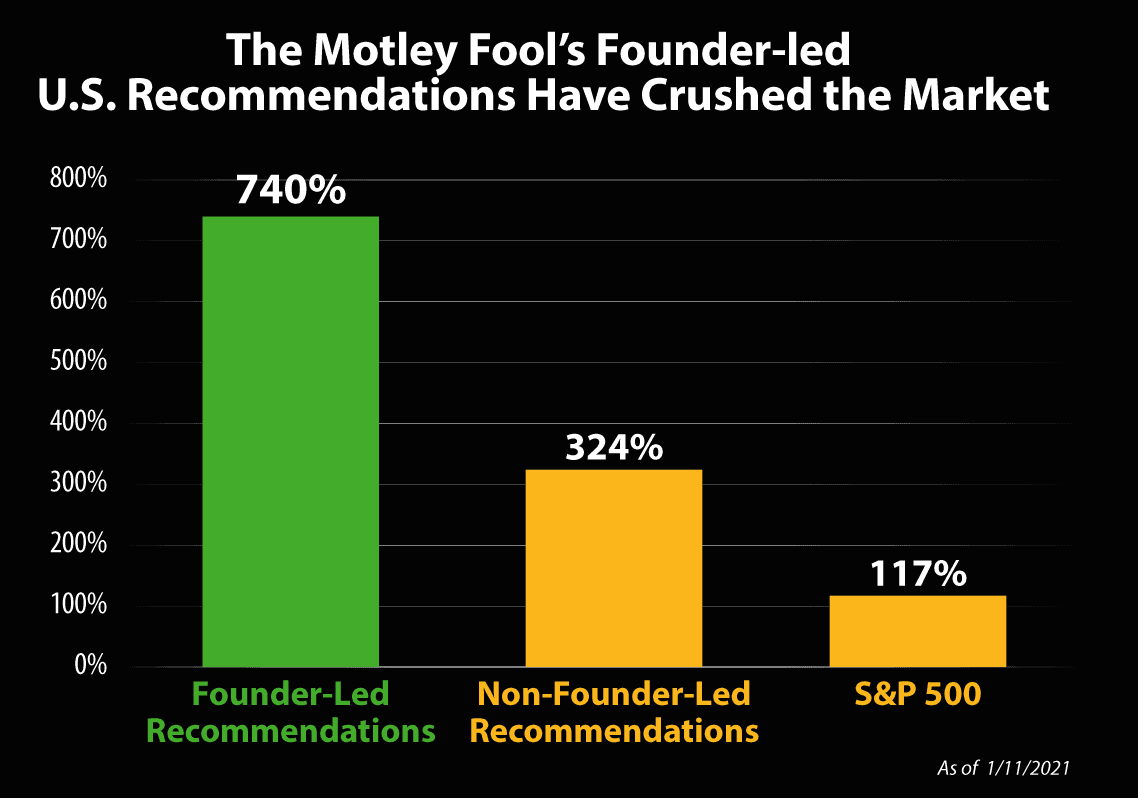

The chart below summarizes the findings from our analysis of over 800 historical U.S. stock recommendations, which was completed in 2021.

Data as of 1/11/21. Chart refers to U.S. market and The Motley Fool U.S.’s recommendations.

As you can see, when it comes to founder-led stocks and non-founder-led stocks, The Motley Fool U.S. crushed the market in both categories.

However, investors have achieved the best historical returns — by far — simply by following our recommendations of companies still run by their founders.

But listen, I’m not writing to you today to give you a history lesson or make you feel like you’ve missed out on some of the returns other investors have already been able to achieve.

I’m writing to you today because you’re being given the opportunity to invest in a small group of founder-led stocks — from both the U.S. and Canada — that we here at Motley Fool Canada believe represent one of the greatest buying opportunities we’ve seen.

For a limited time only, we’re inviting new members into our “highest conviction ever” portfolio — The Partnership Portfolio… pulling back the curtain on the 29 U.S. and Canadian stocks we believe offer the sheer greatest upside potential for investors who get in today.

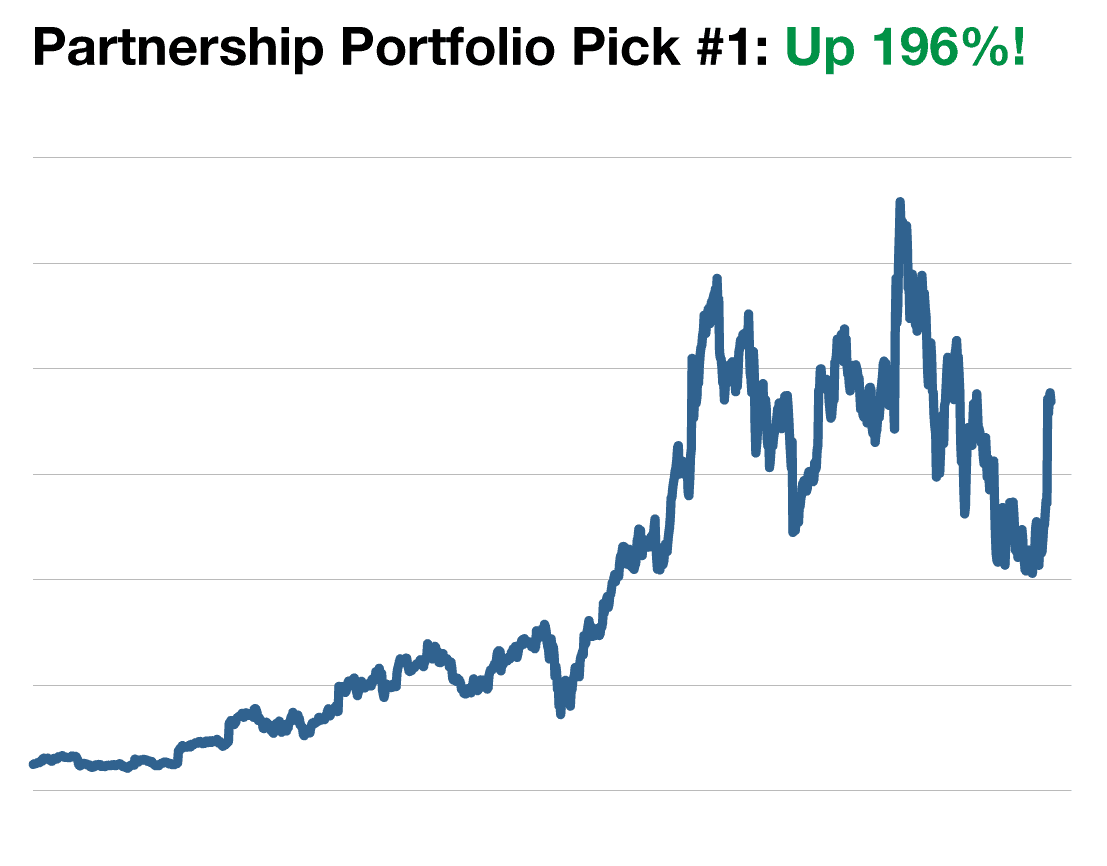

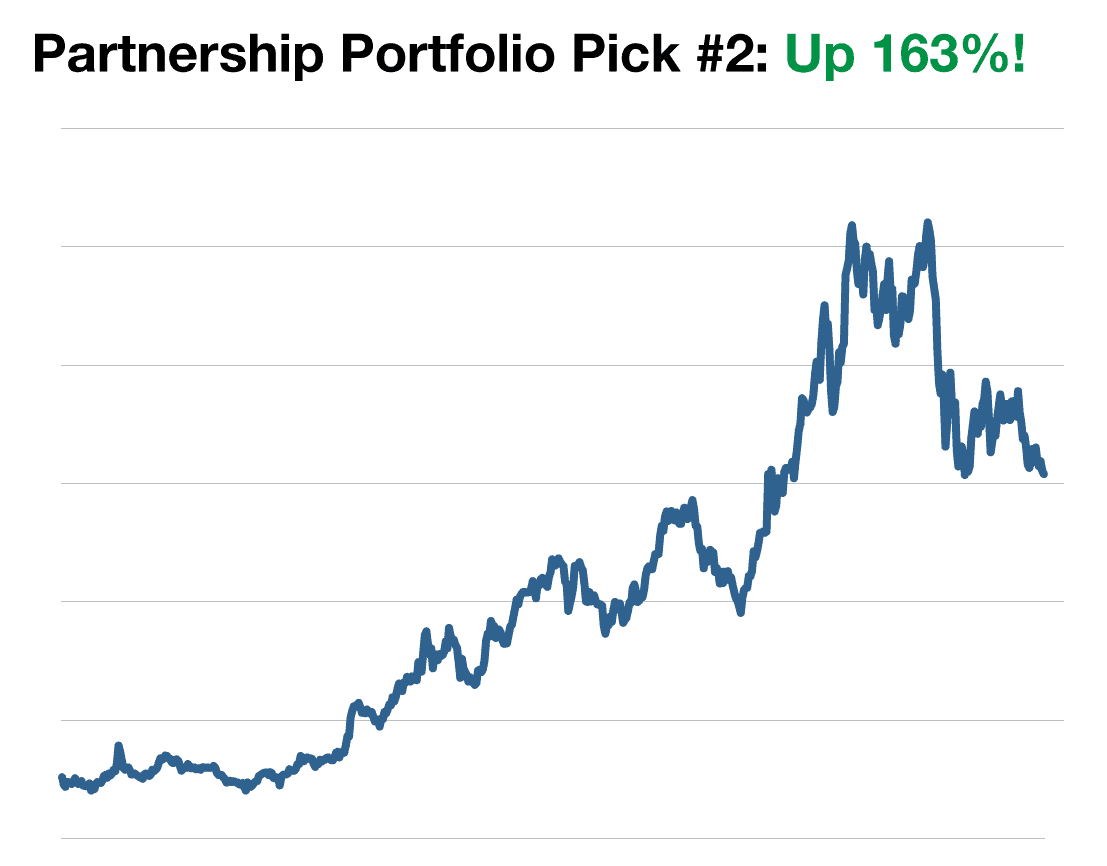

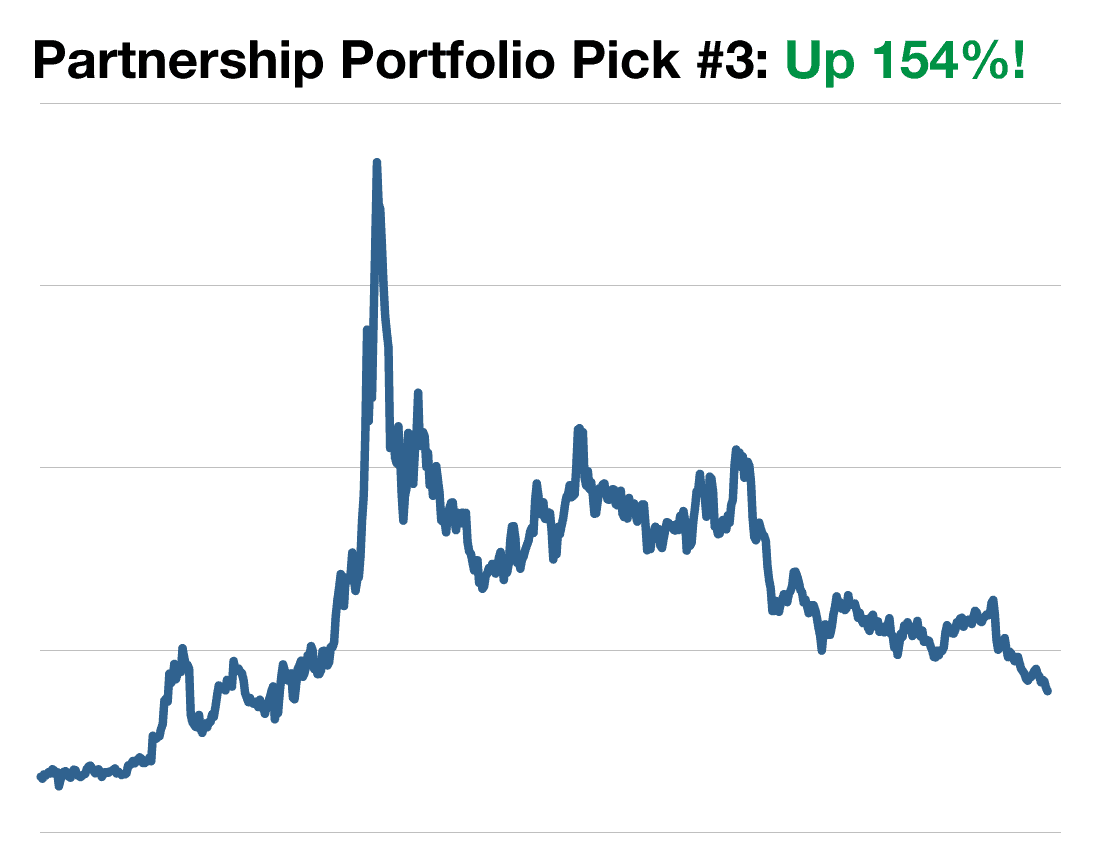

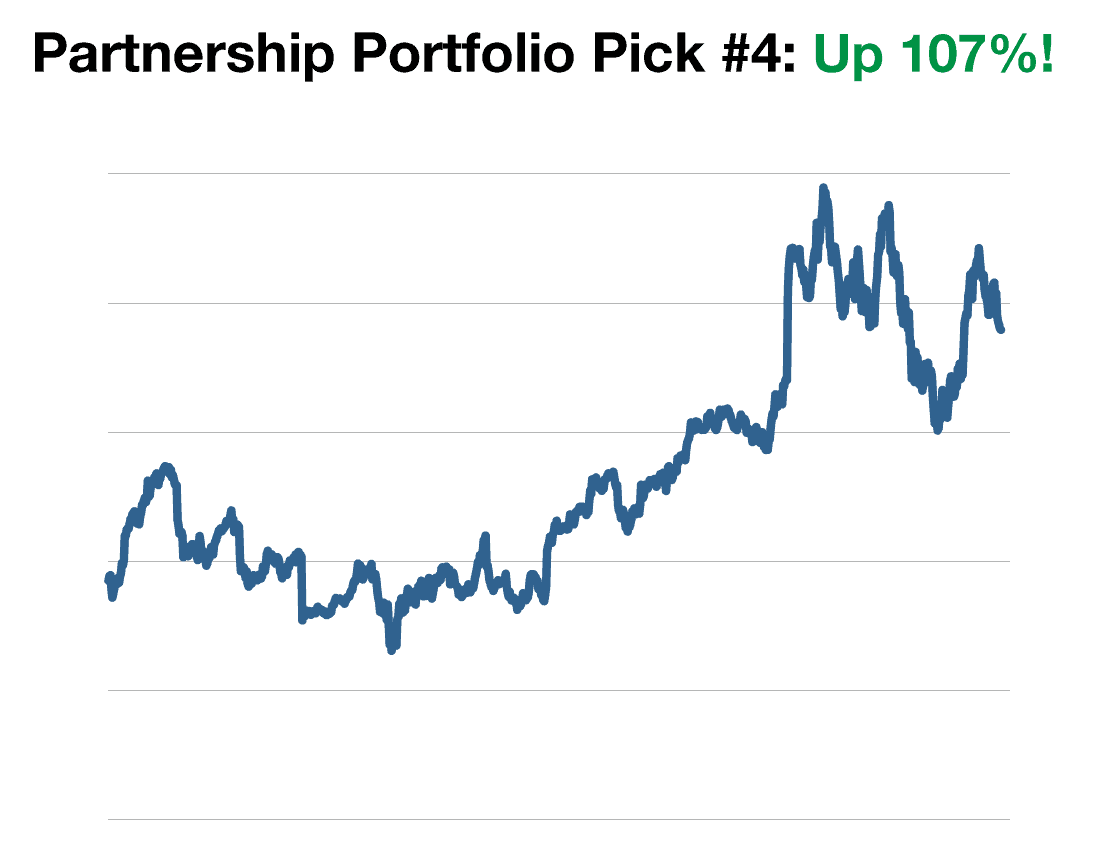

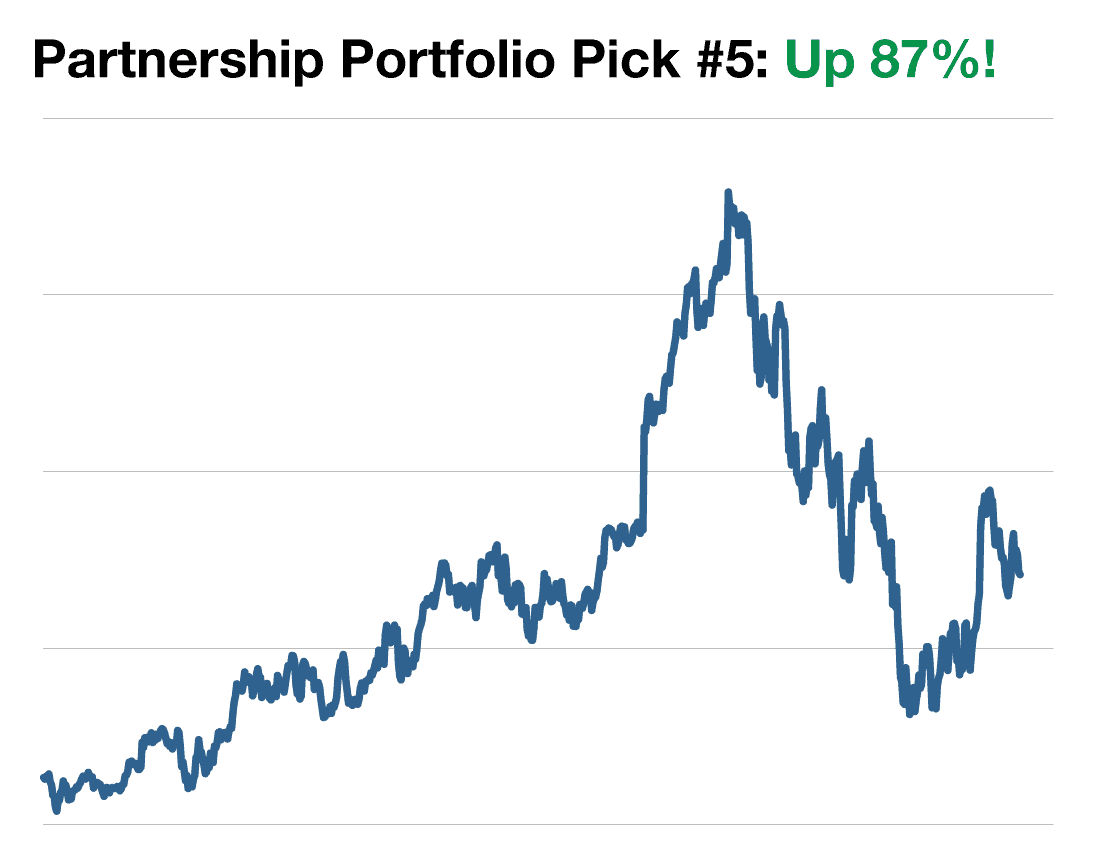

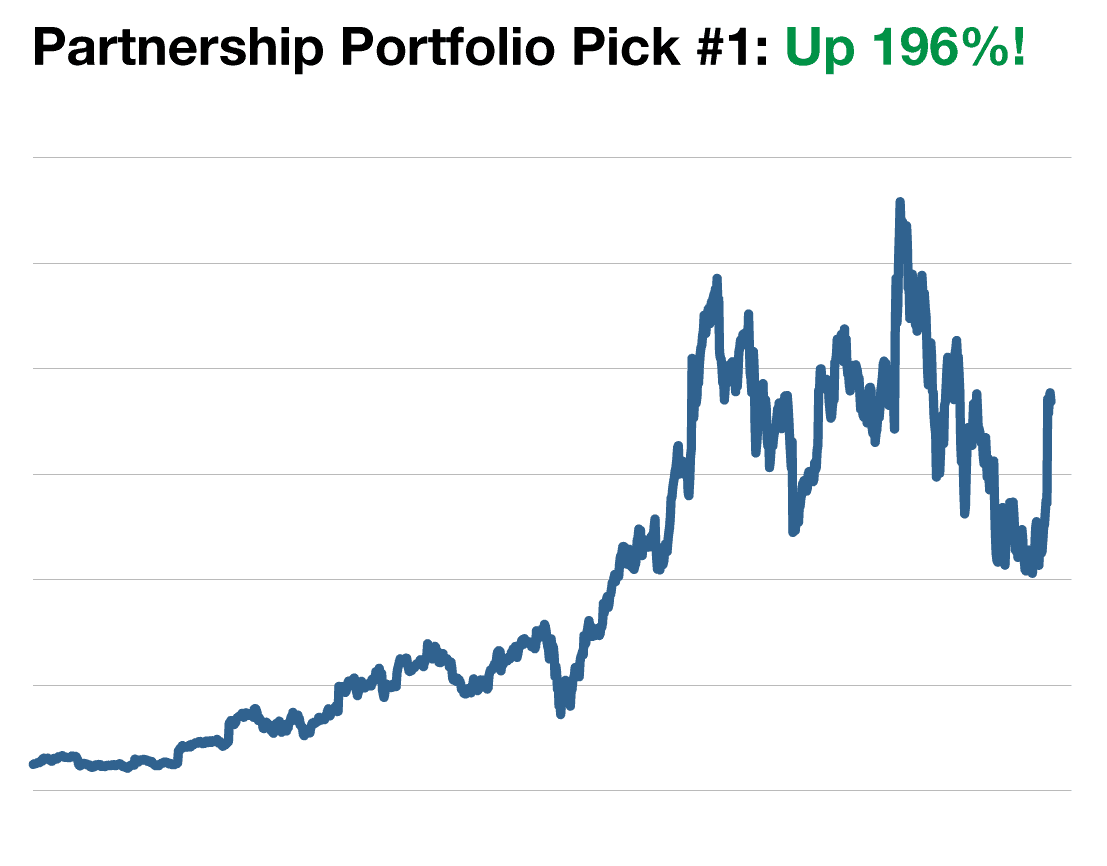

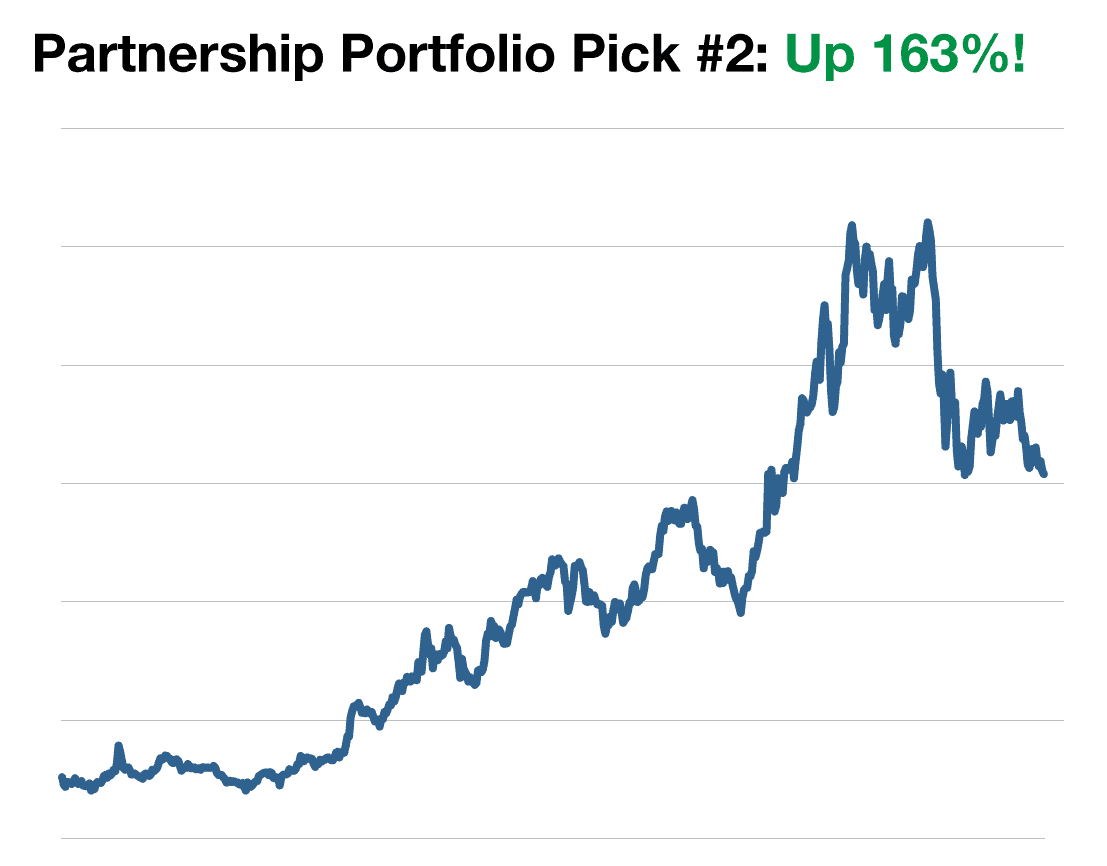

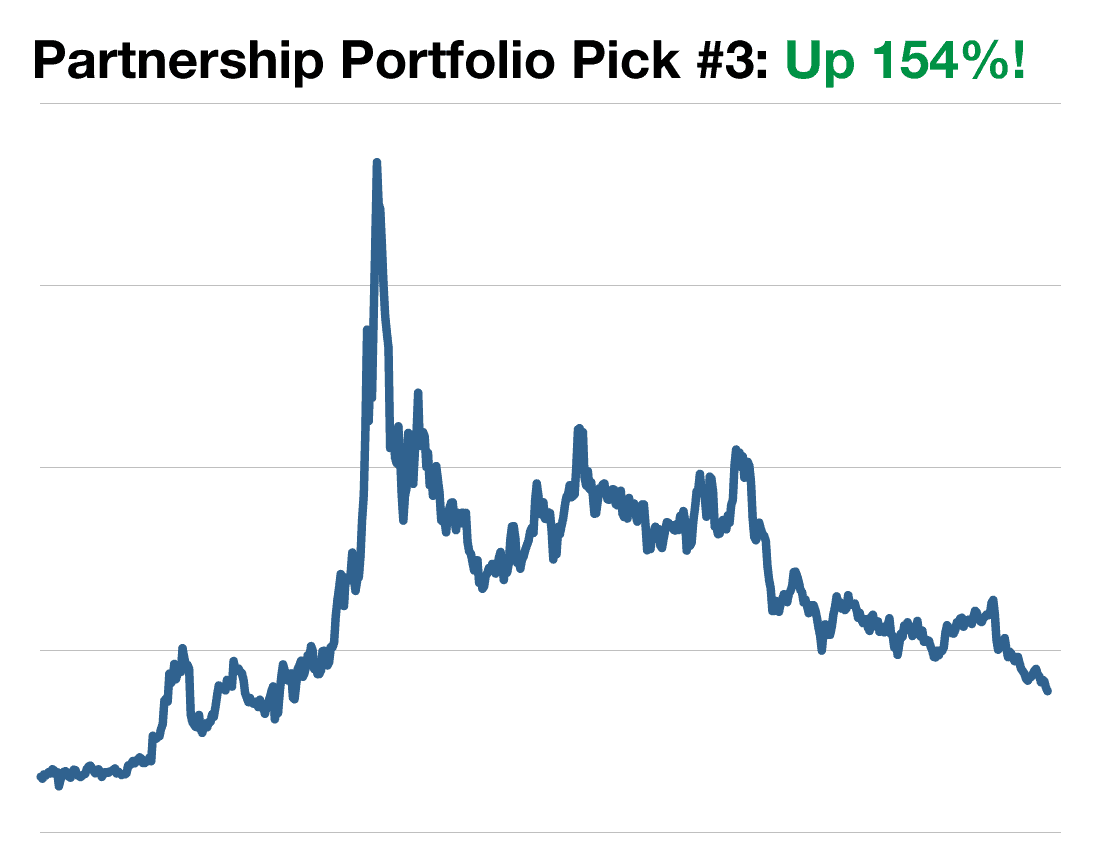

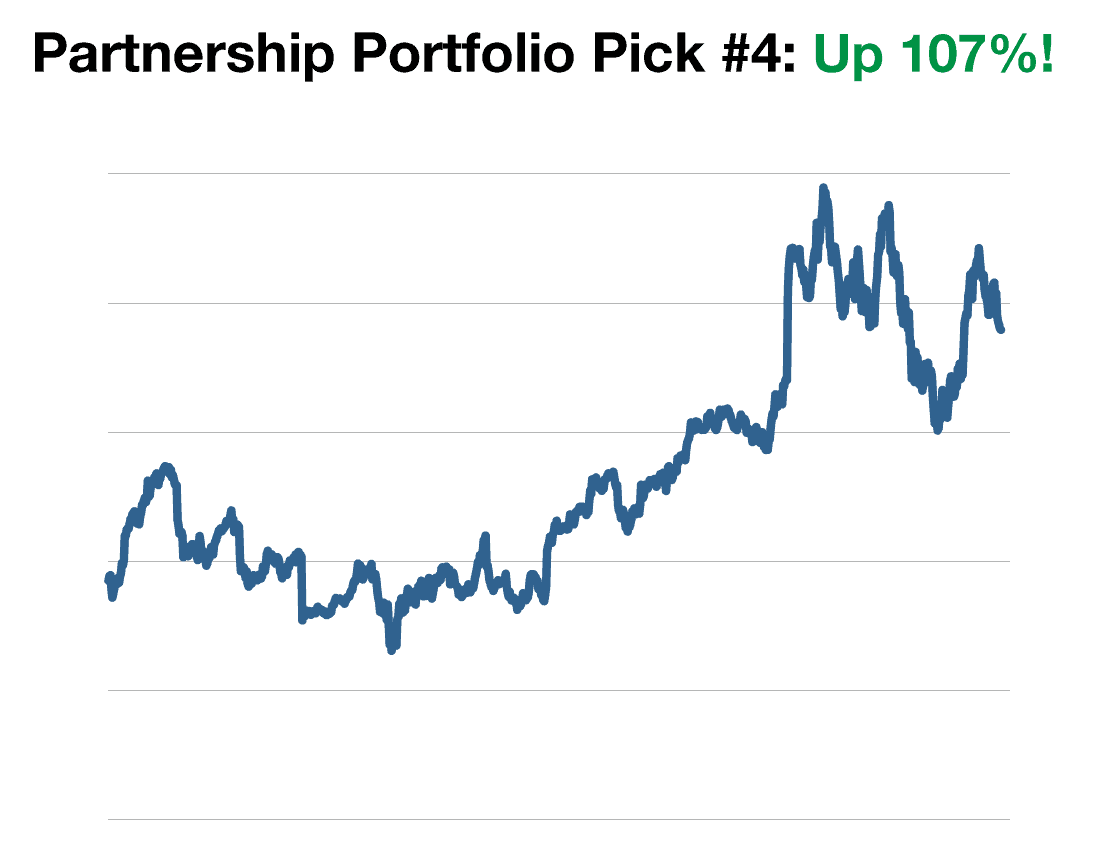

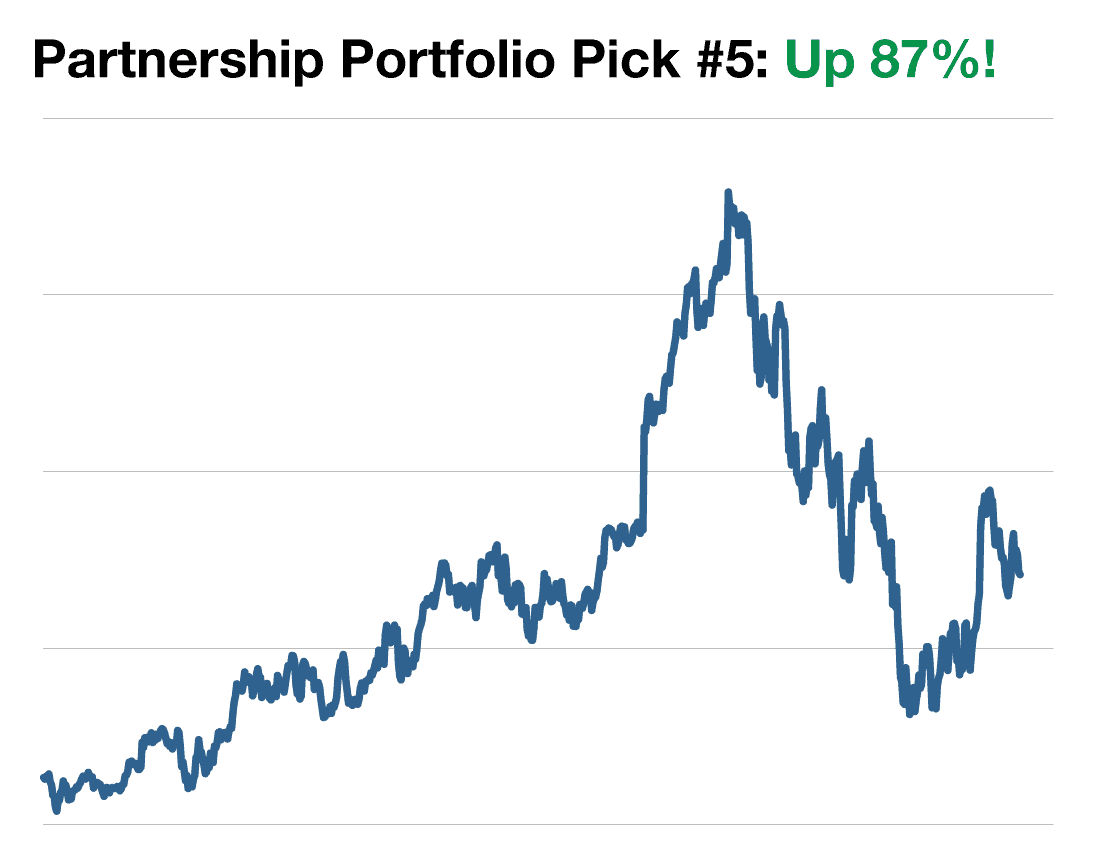

I’m speaking of stocks like these…

As you can see from the results that we’ve laid out here, members who’ve followed alongside some of our Partnership Portfolio recommendations have been rewarded with some market-crushing returns.

It’s why I feel so strongly about bringing this strategy to Motley Fool Canada members like you… right at the moment this incredible “buy signal” is flashing!

So here’s what you need to know now:

The Partnership Portfolio is designed to eliminate 100% of the guesswork that comes with building a portfolio in what we believe are today’s most promising founder-led stocks.

Instead of having to venture out, wade through, and vet every founder-CEO in the market, we do all the work for you.

From analyzing financial statements… to digging through SEC documents… to conducting market research…

We built The Partnership Portfolio to be the one-stop shop for founder-led investing… Our top companies boasting high degrees of insider ownership!

But before I explain how you can join us in The Partnership Portfolio…

Allow me to tell you about our proven system that has historically successfully identified some of the market’s most promising and profitable founders.

As you’ve seen from the incredible returns we’ve shared so far, we believe investing in the market’s greatest entrepreneurs could be the surest way of owning shares in today’s highest-upside U.S. and Canadian companies.

And while past performance is no guarantee of future results, you may never have considered using this unique factor that has a way to increase the chances of finding the next Netflix- or Amazon-like stock, it makes sense when you think about it...

Seventy years ago, what was the key difference between McDonald’s and the tens of thousands of other restaurants across America?

It certainly wasn’t better burgers...

It was Ray Kroc.

What was the difference between Walmart and the thousands of other Main Street stores it outhustled and outcompeted on its way to dominance of American retail?

Sam Walton.

And why did Apple turn every $10,000 invested in its IPO into more than $2 million today?

Steve Jobs.

Of course, that doesn’t mean any old founder-led company is necessarily a great investment.

In fact, you'd be surprised how many of the world's most "popular" founders are running companies with shockingly low upside...

Which is why our system for evaluating founder-led companies contains several more crucial steps.

By that, I mean it solely focuses on founder-led companies with…

Rock-solid brands (like Reed Hastings did with Netflix)...

Exceptional competitive advantages (like Jeff Bezos has done with Amazon)…

Long-term-focused, shareholder-friendly management (like Warren Buffett has done with Berkshire Hathaway)...

An ability to create products and services that feed consumer demand (like Tobi Lütke has done with Shopify)...

And a plan for long-term expansion (like Mark Zuckerberg did with Facebook)...

... that we think can continue to grow their market, crank out cash, and reward long-term shareholders for years or even decades to come…

No matter WHAT the overall market does.

Still, to make big returns on founder-led stocks, you must find leaders who fit nearly all of these criteria!

It’s no easy task, believe me…

In fact, many investors have lost a fortune precisely because they went “all in” on a company that looked great for two or three of these factors, but was sorely lacking in the others…

Which is exactly why we’re so selective with the stocks we select for the Partnership Portfolio… narrowing it down to just our 29 favourite “best bets”…

And you don’t have to take my word for it that this strategy has worked well!

I’ll show you a sample of some of our best-performing picks just one more time…

So you can see why I'm so convinced practically every Canadian investor should have exposure in their portfolio to these sorts of founder-led companies.

And if you agree, then I'd love to quickly tell you why I think accepting this invitation to The Partnership Portfolio could be the single most important decision you make for your investment portfolio during this wild year of investing…

Especially since you’ve got the chance to “front run” our next round of trades!

As you may know, most investing solutions that solely target high-conviction stocks that have the potential to hand investors returns of 5x or more typically offer just a handful of stocks...

Then, over the course of several years — as more and more companies are researched — it's standard for these services to eventually contain a portfolio with a dozen or more stocks.

Which would be a completely understandable way to run something like The Partnership Portfolio.

Because as you'd expect, finding founder-led companies that meet all of the criteria I look for in potentially market-beating stocks is extremely rare.

To start with, 90% of the founder-led companies I review almost immediately go in the trash bin.

And as I just explained, my process isn't some "screen" run by a computer spitting out a series of numbers and companies — it's real human analysis that I have spent my entire adult life honing and perfecting.

While this process has been able to consistently produce big winners... it also takes a lot of time.

But when I say The Partnership Portfolio is designed to give you instant exposure to all 29 of our best ideas that fit these criteria, I mean it!

Because with The Partnership Portfolio, you won't have to wait years for me and my team to slowly construct a portfolio that diversifies risk AND gives members access to our most high-conviction founder-led recommendations...

In fact, you won't even have to wait months... or weeks… or even one day!

Because my team and I have already built a full portfolio of 29 high-upside, founder-led stocks that not only are fully vetted, but are ALL available the moment you join...

And you’ll be able to join us in our very next round of buys, of course getting in before we do!

It's also worth noting… The founders and companies featured in The Partnership Portfolio are NOT large-cap blue chips like Amazon and Netflix.

While we love those companies, today we're looking for the next generation of game-changing founders.

That's why founders you will find in The Partnership Portfolio tend to be higher-risk/higher-reward investments.

In order for a company to be included The Partnership Portfolio, my team and I must believe the stock has 500% or even more upside potential over the next decade.

By installing this strict, high-upside criterion, we think we’ve been able to identify some of the most visionary CEOs in the market today — I'm talking about leaders like:

A brilliant, top-of-his-game, 65-year-old founder who was not only one of the earliest investors in Google (demonstrating his unbeatable eye for high-upside tech opportunities) but is now running his own show with a revolutionary open network operating system that’s servicing the world’s largest companies as we speak.

A 44-year-old founder who's leading the charge to disrupt a US$725 billion advertising industry. With his personal stake in the company already worth billions, we believe this trailblazing founder is "all in" on stealing market share from slow-moving competitors.

A 37-year-old founder who's running a small US company that has been growing like gangbusters, using one of the most innovative subscription business models I've seen since Netflix reinvented movie rentals 20 years ago.

Those are just three examples of the amazing companies and founders that you'll have access to the moment you respond to this limited-time invitation and become a member.

And while many of the higher-upside holdings inside of The Partnership Portfolio can often be more volatile than sleepy blue-chips, you can be sure we're recommending only companies we believe you can rest easy at night owning...

Because as I mentioned above, Motley Fool Canada is investing its own money right alongside you.

In fact, this portfolio is our sheer biggest and most valuable.

And in all, we’ve already committed $561,439!

Simply put, we believe this real-money investment demonstrates the strength of our conviction with these picks…

And shows how much we truly believe The Partnership Portfolio is a complete investing solution designed to expose you to our highest-conviction founder-led companies.

And as you’re likely aware, many other investment services across the globe just love doling out their “brilliant” investment advice... tips... tricks... picks... strategies... etc.

But when it comes to literally putting their money where their mouth is, they’re somehow nowhere to be found.

Which raises an unsettling question... If they don’t have enough conviction in their recommendations to put their own cash behind it for the long haul, then why the heck should you?

Fortunately, that’s not a problem you’ll ever encounter in The Partnership Portfolio.

When we win with The Partnership Portfolio, you win! That’s the way we believe investing should work.

And just to be clear... you, as a member, do NOT need $561,439 to invest alongside The Partnership Portfolio. Or even $50,000.

Rather, The Partnership Portfolio is a complete do-it-yourself solution designed with the goal of turbocharging a portfolio’s returns. You can replicate The Partnership Portfolio in most brokerage accounts with ease.

The Partnership Portfolio is a simple but powerful investing solution that allows investors who are serious about founder-led investing to instantly act on the absolute best opportunities we see in the market today.

And not only does this limited-time invitation give you access to all 29 of our top founder-led stocks, but you’ll also be receiving our most up-to-date allocation guidance...

Just like everything else you’ve read about today, all this information is available the second you join as a member...

All 29 founder-led stocks (12 U.S. stocks and 17 TSX listings) that we believe have the potential to gain 500% or more over the next decade…

The up-to-the-minute suggested allocations…

Our very next round of trades, and every move you need to make to match us play for play!

Given how much potential I see ahead, and the favourable membership terms you’re about to discover…

And the monumental insider buying signal flashing right now…

And your ability to “front run” our next round of buys…

I’m going as far to say that this could be the best possible time to be joining The Partnership Portfolio.

Especially once you get a look at the details of this very special, deal… and understand exactly what you’re getting when you accept this offer today.

The Partnership Portfolio is unlike anything we've ever offered before — but if you’re still on the fence, here's a bit more about what you can expect inside.

To help you decide if you're ready to access what I believe is the most unique and powerful solution Motley Fool Canada has ever offered…

Here are the exact details on what you'll find inside The Partnership Portfolio and why it has the entire Motley Fool Canada team buzzing with excitement.

The first and most important thing: you'll gain access to all the high-conviction U.S. and Canadian stocks featured in The Partnership Portfolio — positioning yourself for possibly greater gains, along with securing the confidence that comes with being a member of one of the most forward-looking and dedicated investment solutions we've ever offered.

And keep in mind, you'll have the peace of mind that your interests are perfectly aligned with ours, because your money is invested right alongside (and in some cases, before!) ours — increasing the likelihood that we reach our goals together!

What’s more, I also wanted each recommendation you'll receive in The Partnership Portfolio to contain the highest quality and unique research Motley Fool Canada has ever produced.

Especially because many of the founder-CEOs featured in The Partnership Portfolio are not household names!

And since I can imagine most new members of The Partnership Portfolio will maybe have heard of only one or two of these founders and their companies...

My team and I have built a special research hub where new members can quickly and easily find information on the portfolio and the founders featured inside, including:

In-depth research reports on each founder and company: Each research report gives you our full profile on the CEO, a complete view of the company's strategy and potential risks, and a full analysis of each recommendation's upside potential.

The X-Factor Formula: An exclusive research report detailing how we found each company. I created this special report to fill you in on nearly everything you need to know about founder-led stocks, including how to fit The Partnership Portfolio into your existing portfolio.

Ongoing updates: We don’t simply recommend a bunch of stocks and then leave you to wonder what’s happening. Each quarter, we’ll update you on everything you need to know about our holdings. And of course, if anything changes significantly with any of our portfolio companies at any time, we’ll make sure you have the information you need right away.

Our brand-new VIP Platinum Package, worth over $700—but yours FREE! More on this directly below…

Because you’re a loyal Motley Fool Canada reader standing with us at this historic moment, I’ve also decided to throw in a suite of bonus gifts, never before offered…

Investors have been hit hard this year, and it’s time we equip ourselves to fight back. That’s exactly why we built the VIP Platinum Package – to give every day Canadian investors the hard data they need to make informed decisions and grow smarter, happier, and richer now and over the long-term.

We dedicated over 15,000 words of hard-hitting analysis towards shining a light on what we see as the best opportunities in the stock market right now, including:

5 Top Energy Plays for 2023 And Beyond: A grossly overlooked sector with an explosive underlying catalyst in 2022 that could rain down profits for years to come.

5 Value Plays You Can Buy Today: Our favourite beaten down stocks trading for prices that look silly cheap in today’s market.

5 Stocks to Generate Steady Income Now: A collection of passive income producing assets that can serve as an inflation hedge and help investors build wealth while they sleep.

This brand-new bundle of high-value reports (and 15 individual stock picks) is valued at $726, but it can be yours today for FREE.

How much will it cost to put Partnership Portfolio to work for you starting today?

We’ve set the 1-year price to join us in Partnership Portfolio and take advantage of access to our fully allocated portfolio – at $1,199.

Of course, accepting this invitation means a lot more than simply getting your hands on a group of high-conviction, high-upside potential stocks...

And access to our next round of buy recommendations.

You see, for as long as you remain a member of The Partnership Portfolio, you’ll also have full view of all future trades and adjustments we make to this real-money portfolio.

Even though The Partnership Portfolio will have specific, up-to-the-minute allocation guidance for each holding in the portfolio, we realize CEOs and businesses change.

That's why, over the coming years, my team and I will be strategically managing and optimizing this portfolio, so it’s always set up to aim for maximizing returns.

So if you ask me, all of the benefits I’ve outlined above make today’s offer one of the best and most advantageous we’ve ever put in front of Foolish investors like you.

Yet there's one important "perk" that's personal to me and really takes the cake...

Now, given how generous today's invitation is — offering you upfront access to all the stocks in The Partnership Portfolio and the 15 additional picks you’ll find in the VIP bonus reports simply for hearing me out today…

It should be noted, we cannot offer cash refunds on this service.

As you'll understand, offering refunds is not fair to committed, long-term investors.

We built The Partnership Portfolio for Motley Fool Canada investors who are committed to building a portfolio full of high-upside stocks with the right strategy.

If a group of short-term traders were able to buy The Partnership Portfolio, quickly make use of its recommendations, and then cancel without paying their fair share...

They could push up the prices of these tiny stocks and do a huge disservice to investors who are committed to this strategy for the long run.

But, if you take advantage of this offer TODAY, you’re protected by our full Satisfaction Guarantee. It’s simple. If, at the end of 30 days, you’re not completely happy with your Partnership Portfolio membership?

Just email our friendly Member Services team. They’ll transfer your credit to any of our other Motley Fool Canada portfolio services.

It’s that simple, and that easy. No hassle. No runaround.

As heartfelt thanks to Motley Fool Canada members eager to get access to what we consider some of our very highest-conviction and most actionable ideas right now – as well as committed to investing with us for the long haul.

After all, it’s called a “Partnership” for a reason!

We’d love to be able count you as a new Partnership Portfolio member, starting right now!

Just click the button below, before it’s too late!

To getting invested alongside the best management minds of our time,

Iain Butler

Iain Butler

Chief Investment Officer

Lead Advisor of The Partnership Portfolio

Motley Fool Canada

Returns as of 9/19/2022 unless otherwise noted. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool's board of directors. John Mackey, CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Fool contributor Iain Butler has positions in Apple, MercadoLibre, Meta Platforms, Inc., Nvidia, and Shopify. The Motley Fool has positions in and recommends Shopify. The Motley Fool recommends Amazon, Apple, MercadoLibre, Meta Platforms, Inc., Netflix, Nvidia, Salesforce, Inc., Tesla, and Walmart Inc. The Motley Fool has a disclosure policy.

The Partnership Portfolio includes U.S. stocks. All billing is in CAD. You will be billed according to your choice below and then $1199 for each year thereafter.

This product is non-refundable.

Having trouble ordering or have any questions for us? Just send them to [email protected], and we’ll get back to you ASAP!