To complete your order, it is necessary to enable JavaScript.

Motley Fool Canada - Order Now!

Already a member? Login

Please take a minute to consider this limited-time offer for NEW MEMBERS ONLY… including a $726 bundle of free bonus gifts and actionable research!

Is this the biggest buying opportunity in the stock market since 2009?

The recent losses have been painful — but internal Motley Fool research reveals they may have now set us up for a potential “10X Sweet Spot"!

Read on to discover our team’s full 10X turnaround game plan...

Including the proprietary research that could point to the biggest "10X Sweet Spot" since the financial crisis...

And help you build a portfolio of high-potential TSX small caps which we’re convinced could rocket in the weeks and months directly ahead…

But this exclusive offer—complete with a whopping $726 in free bonus gifts and additional research—can’t last. Find out more below!

Dear fellow investor,

Let me take a moment to address the elephant in the room:

The bad news about the stock market has been coming thick and fast...

And if your portfolio looks anything like mine, it's been a painful and uncertain year so far.

And just for the record... I'm down more than 29%.

So, if the stock market is the LAST thing you want to think about today — and I wouldn't blame you — please feel free skip this timely new research altogether.

However, if you are interested in the proprietary research that points to what could be a rare buying opportunity, I think you'll find the information below incredibly valuable.

In fact, I think what follows has the potential to end up being the single most lucrative communication you ever read from us here at The Motley Fool.

For reasons I’ll explain in detail below, we currently believe that a once-in-a-decade “10X Sweet Spot” indicator recently began flashing.

A 10X beacon that hasn't lit up our radar so brightly since all the way back in 2009…

You see, when it comes to pinpointing 10X stocks, our team has a remarkable track record.

And even with the recent losses, The Motley Fool has still racked up some pretty impressive wins over the years. For example…

Our CEO and co-founder Tom Gardner’s “turnaround" recommendation in Sherwin-Williams resulted in +1,300% gains for bold members who followed along.

And here’s the thing…

Tom issued his “BUY” alert in the turmoil of the global financial crisis of 2008…. after the stock had dropped over 23%.

In Tom's own words at the time, Sherwin-Williams was a "beaten-down-yet-not-out" home improvement company.

Well… If you'd invested at the time, that +1,300% return would have been enough to turn a $20,000 investment into over $250,000 today!

Or take Cintas, the largest provider of rental uniforms and other garb for millions of workers around the globe, from casino dealers to grocery clerks....

Cintas stock had dropped a whopping 49% when in December of 2008 Tom jumped on the stock.

That contrarian approach, smack-dab in the middle of a financial crisis, once again resulted in a remarkable return...

A whopping +2,300% gain that would have turned every $20,000 invested into well over $500,000 today!

Of course, not all picks perform as well — nothing in the stock market is guaranteed, and any potential 10X stock can go on to become a loser.

But let me share just one more example of a 10X turnaround winner The Motley Fool recommended when almost everyone else had written the stock off completely because…

Booking.com, or Priceline at the time, had an even more profitable turnaround.

You see, the company had lost a staggering 97% of its value in the aftermath of the dot-com bust…

By 2004 many people had written the company off entirely. Only four analysts were following the company’s earnings closely.

But we saw the company was turning things around and alerted members to the buying opportunity…

In 2006, Priceline merged with Booking to create Booking.com, a brand that’s since changed the course of online travel history, rewarding opportunistic investors with a simply massive +10,600% return.

That’s not just 10X or 20X but 100X your money… so a $20,000 investment at the time would be worth a small fortune of over $2 million today!

So, if you're in the same boat as me and so many Foolish investors like us, and your portfolio has also taken a bad hit in recent months... I think you will find our team's latest research VERY interesting.

For one simple reason:

This up-to-the-minute, proprietary research—commissioned by Tom Gardner himself—uncovered the specific market conditions when stocks that delivered at least 10X returns appear at nearly five-fold the normal rate!

We call these rare moments “10X sweet spots” here at The Fool.

They allow bold investors to snatch up some of the highest-upside businesses at a 20%-50% discount…

And set themselves up to potentially make a fortune in the process.

And given the current volatile market conditions, we might be smack-dab in the middle of a “10X sweet spot” right now!

These buying opportunities are rare and extremely time-sensitive.

In fact, with every day you wait to act, the window to capitalize on this “10X sweet spot” could be getting smaller and smaller.

And here’s the thing…

In a market that is being whipped around as violently as this one by Russia’s war on Ukraine, the tech meltdown, anxiety about inflation and further interest rate hikes…

I don’t blame anyone who’s looking at their portfolio and is thinking about cutting their losses.

However…

Arguably some of the world's smartest investors agree that NOW could be a huge buying opportunity.

Warren Buffett famously said, “Be greedy when others are fearful.”

Billionaire Carl Icahn said his entire investing philosophy is generally to “buy something when no one wants it."

And Tom Gardner himself said that when volatility is here, "it's time to take advantage of it.”

And as it turns out, our latest 10X research concurs.

In fact, we could be smack-dab in the middle of a “10X sweet spot.”

So, while many investors are looking at the stock market meltdown through a lens of fear… We see it as an incredible opportunity.

Not because we’re blindly optimistic.

And not because the recent losses don’t hurt — they do.

But because we’ve seen this happen before!

Specifically, the dot-com bubble in the early 2000s and the financial crisis of 2008. And while it doesn’t happen often — only a couple of times in the last two decades that we’ve identified…

You see, Tom Gardner, our CEO and co-founder, wanted to know everything there is to know about 10X stocks, their specific characteristics, and maybe most importantly WHEN they appear in the market.

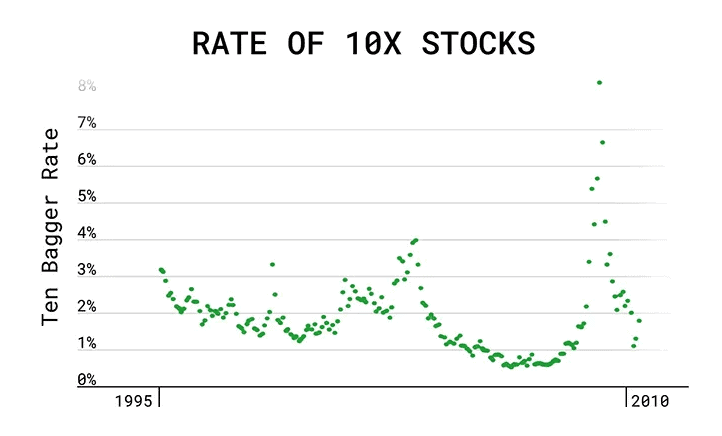

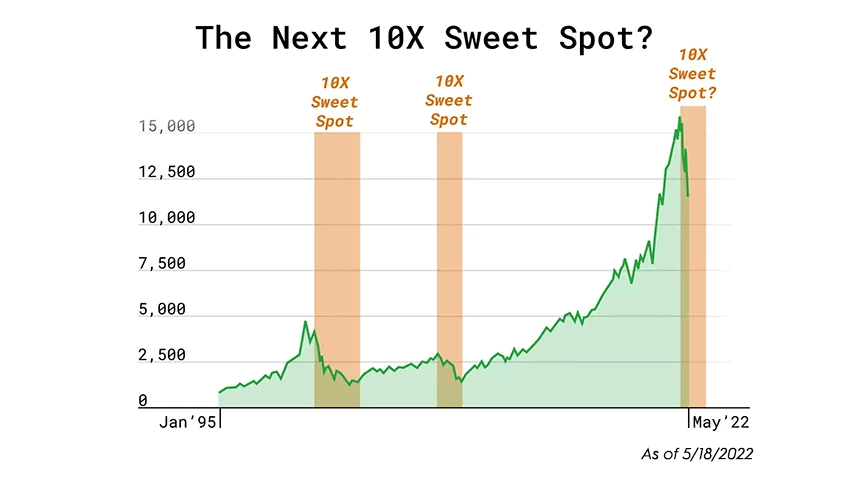

So, we plotted the rate at which 10X stocks appeared over time, from 1995 to 2010.

Chart refers to U.S. market.

The higher up a dot is on the chart, the higher the percentage of stocks that returned 10X at that particular time.

Our data showed the standard rate of 10X creation was 1.8%.

Meaning just 1.8 in 100 public U.S. stocks, on average, went on to 10X over the time period shown.

Now, 1.8% is the average. But do you notice the spikes?

You can clearly see the rate jumped up after the dot-com bust in the early 2000s — the 10-bagger rate jumped as high as 4%.

Chart refers to U.S. market.

You don’t need to be a mathematician to realize that’s more than twice the standard 1.8% 10X rate that our research here at the Fool uncovered.

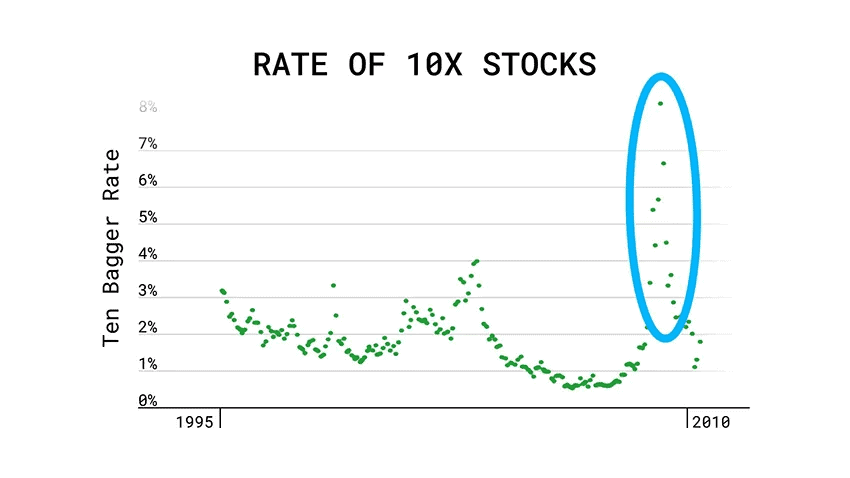

And we saw the same thing happen again in the aftermath of the financial crisis of 2008.

Chart refers to U.S. market.

Except this time the 10X rate even reached an apex of nearly 8.5%.

Now, here’s what’s incredibly important to keep in mind:

The average rate of 10-bagger stocks is only 1.8%.

But each time we have one of these volatile times in the aftermath of a market drop, a 10X “opportunity window” appears to follow.

These are what we like to call “10X Sweet Spots.”

Simply put, a “10X Sweet Spot” is a specific time window in the aftermath of a market crash when the rate of stocks with 10X potential skyrockets to extraordinary levels.

During the first sweet spot after the dot-com bubble burst, the 10-bagger rate was DOUBLE the average rate.

During the sweet spot after the financial crisis, it was almost FIVE times the average rate.

Chart refers to U.S. market.

And with the latest tech meltdown, everything we’re seeing points to the fact that we could be smack dab in the middle of the next “10X sweet spot!”

What’s more, we’re seeing more potential 10X turnaround opportunities in the market now than maybe ever before!

In fact, as Bloomberg has reported, the number of Nasdaq stocks down 50% or more is almost at a record.

So, whatever the fundamental and macro considerations may be, there is no doubt that many investors have been selling first and trying to figure out the rest later.

But as we’ve seen, the beauty of a market correction is it creates incredible deals on high-quality stocks and businesses with 10-bagger potential.

Which means there may be dozens of potential 10X turnaround opportunities similar to the ones The Motley Fool capitalized on with Sherwin-Williams, Cintas, or Booking in the market right now.

I’ll admit it takes some guts to invest in these potential 10-baggers while the market is in turmoil.

After all — Peter Lynch who ran the best-performing mutual fund in the world said that “volatility… is a great opportunity,” while adding that “in the stock market, the most important organ is the stomach, not the brain."

That’s certainly been true this year so far — especially while the financial media fuels the fire by publishing new headlines every day, which really pushes fear-based, short-term thinking.

But remember: The other option is to potentially miss out on some of the highest-upside businesses in the world — while they’re on sale.

On the other hand, imagine coming home from work one day and telling your spouse, “Guess what — another one of our stocks is up 10X...”

Imagine the look on their face when they realize you were the only “genius” who somehow knew that stock was about to turn around deliver those kinds of gains over the coming years.

And we’ve already seen that snatching up turnaround winners while they’re on sale, can really pay off for opportunistic, long-term investors.

Especially during 10X sweet spots like the data suggests we’re in now. Remember, we’ve seen it before…

Remember Booking Holdings, or Priceline at the time — the company had lost a staggering 97% of its value in the aftermath of the dot-com bust.…

…only to turn around and change the course of online travel history, rewarding opportunistic investors with a +10,600% return!

The question is…

How do you know WHICH companies will bounce back and become 10X turnaround winners from here?

Of course, during the dot-com bust, as you may remember, some companies imploded spectacularly. And rightfully so...

Pets.com went from IPO to liquidation in just 268 days, due to its expenses far exceeding revenues.

Or take WebVan’s home delivered grocery service — another poster child for failed dot-coms.

But at the same time, some great businesses got overly punished, too…

At one point, Amazon lost more than 90% of its value — but long-term investors still got rich.

Case in point, The Motley Fool recommended Amazon in 2002... for a staggering +12,500% return.

Which if you’d invested at the time is enough to turn a single $20,000 investment into over $2 million dollars.

So, how do you separate the losers that will only crash and burn from here…

…from the 10x turnaround winners that could propel a portfolio to the next level?

In fact, you might be wondering whether hunting for 10X stocks is simply too risky anyway…

And look, I know you know this, but I want to be very clear and say it anyway: yes, of course, if you’re looking for 10X returns you’re going to see more volatility.

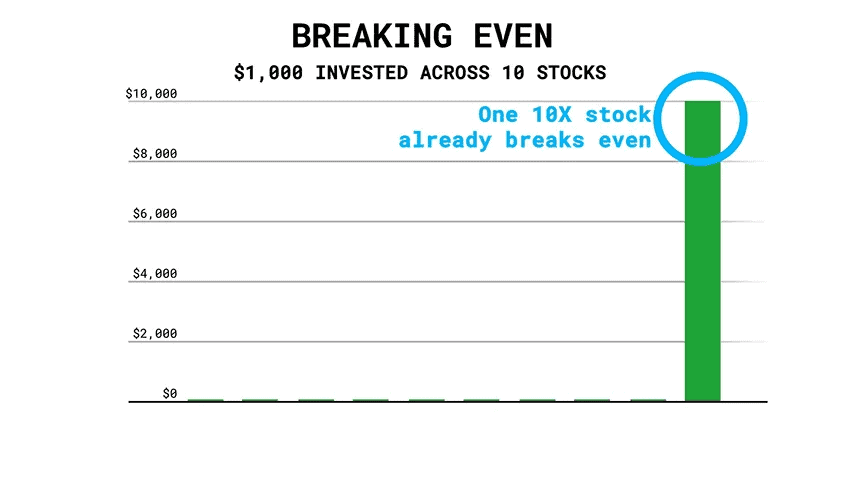

Which is why it’s so important to not just buy one or two stocks, but at least 25 stocks… and hold them for at least 5 years.

That way, if you have 10 stocks with the same amount of money — say $1,000 — invested across them, and nine of those stocks go to zero (which is highly unlikely, of course) and just one stock goes up 10X, you’ve already broken even.

Chart refers to U.S. market.

So, in this unlikely scenario, despite the literal worst-case scenario with 90% of your original investments, you’re still at your original $10,000 investment.

And as we clearly saw from previous “10X sweet spots,” when 10-bagger stocks emerged at an almost 5-fold higher rate, right now the odds could be in our favor.

What I can tell you right now:

The 10X turnaround winners we’ll see from here almost certainly won’t be Booking, Amazon, Sherwin-Williams or any one of the well-known 10X turnaround winners I shared so far. Here’s why…

They’re simply too big now!

Booking.com, which was “on sale” by as much as 97%, is now a massive US$97 billion company.

Sherwin-Williams, which had dipped more than 23% when Tom and his team recommended it, is now a US$55 billion giant.

And of course, Amazon, despite the recent pullback, is still a massive trillion-US-dollar company.

The businesses that are “on sale” now that are the most likely to 10X from here are much smaller, largely unknown stocks… especially here in Canada.

As our internal research show, THIS is the one trait that makes a stock among the most likely to 10X… without taking on unnecessary risk!

In fact, this is another insight from our proprietary 10X research, and to my knowledge, we’ve never shared this with members before…

The ONE trait that makes a stock among the most likely to 10X… without taking on unnecessary risk… is its market cap.

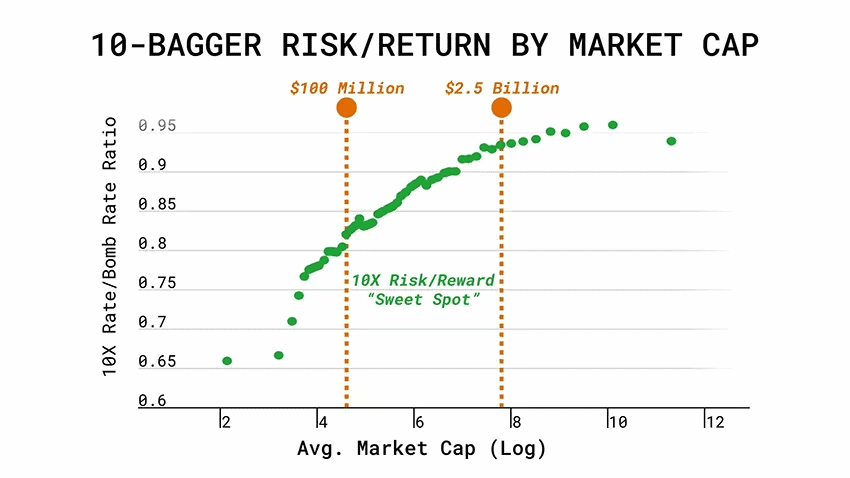

You see, we looked at what SIZE of companies that are the most likely to 10X… while at the same time reducing the risk of basically going bust. And what we found is very clear.

Just take a look at this chart:

Chart refers to U.S. market.

What it says is simply that companies between US$100 million and US$2.5 billion in market cap offer what we consider to be the best risk-return tradeoff when we’re looking for 10X returns.

In other words…

Companies smaller than US$100 million are too risky.

Companies bigger than US$2.5 billion are less likely to 10X.

Companies worth between US$100 million and US$2.5 billion offer the best tradeoff between risk and returns.

And what’s interesting is when you look at our historical 10-baggers, many of them fall exactly into this group.

For example, Booking Holdings was just a US$894 million company when we alerted members to BUY after the dip… and it went on to deliver that life-changing 100X return.

Of course, that’s just one indicator… And we’re not dismissing larger companies either if all the other factors point to it being a SCREAMING buy. It’s simply one of the useful guidelines we use as we’re evaluating potential 10X opportunities.

So, considering that the “10X sweet spot” we’re seeing in the market right now, with an almost record number of potential 10-baggers “on sale” the question remains… exactly which ones should YOU buy?

Because the fact remains that, regardless of whether we’re in a sweet spot or not, picking stocks with 10X potential is still incredibly difficult.

And unless you know what you’re doing — or have somebody who knows exactly what they’re doing to help you out — you’re more likely to lose your house than you are to strike it rich.

Which is why I’m excited to announce today that our team is launching a brand-new 10X investing game plan to help bold members navigate this volatile market…

And we’re making the announcement today for a very specific reason.

Given the “10X sweet spot” we believe we’re in RIGHT NOW, we don’t want any of our members to miss the chance to capitalize on this compelling investment opportunity.

Which is why I’m both proud — and excited — to introduce you to Discovery Canada… and show you how you can put it to work for you starting today!

Discovery Canada is closely modeled after the first-of-its-kind, wildly in-demand Discovery offering that Motley Fool co-founder Tom Gardner, made available to Motley Fool members in the U.S. just a few years back.

You see, over the years, Tom became convinced that The Motley Fool could offer investors like you a unique solution that would — if designed properly — unlock the secret behind the Fool’s incredible history of picking stocks with life-changing returns in its U.S. services…

So he and his team went to work on building Discovery with the explicit goal of helping U.S. investors pinpoint the next generation of stocks that have a specific factor that Tom believes can allow them to soar 10X… 20X… even 100x in value…

… While also increasing these investors' exposure to a strategy that's proven to be The Motley Fool's greatest way to build wealth: buying small-cap stocks before they become huge, household names and holding all the way throughout as they skyrocket upward!

(And even continuing to buy more while they shoot up.)

What’s more, Tom was adamant that Discovery be set up in such a way that investors who made use of it wouldn’t have to spend countless hours doing all the up-front research and due diligence that typically go along with successful small-cap investing.

In other words, he wanted Discovery to be the kind of easy-to-use investment solution where all the “heavy lifting” would be taken care of for you by an experienced team of veteran investors.

But it really wasn’t until after they launched Discovery in the U.S. — and saw the record-setting response it drew — that Tom and his team truly began to realize just what a powerful and valuable tool they had created.

And as soon as they did, they immediately began exploring opportunities to bring a similar solution to Foolish investors all over the globe — starting right here with the launch of Discovery Canada!

In just a moment, I’ll give you the full details on everything that awaits you inside Discovery Canada — and show you how you can get your hands on it for just a small fraction of what many investors in the U.S. gladly paid for Discovery.

But before I do, let's get one thing straight...

We’re not talking about some strategy we're hoping to begin using here in Motley Fool Canada…

We’ve already seen just how powerful — not to mention how incredibly profitable — small-cap plays can prove to be for hardworking individual investors like you.

In fact, our portfolio also includes some stock picks that have in fact rocketed so HIGH we’ve felt compelled to trim our positions!

But, to be fair, we’re keenly aware that a focus on buying small-cap stocks is really just the beginning…

And we know that unless it’s coupled with a systematic approach and expert execution from a team of talented and highly experienced small-cap investors (exactly like we’re seeking to deliver in Discovery Canada)…

This strategy likely won’t turn out to be nearly as successful as Tom Gardner’s study first suggested.

So we didn’t feel we were risking much by revealing our incredible findings, which I think actually bears repeating before we go any further…

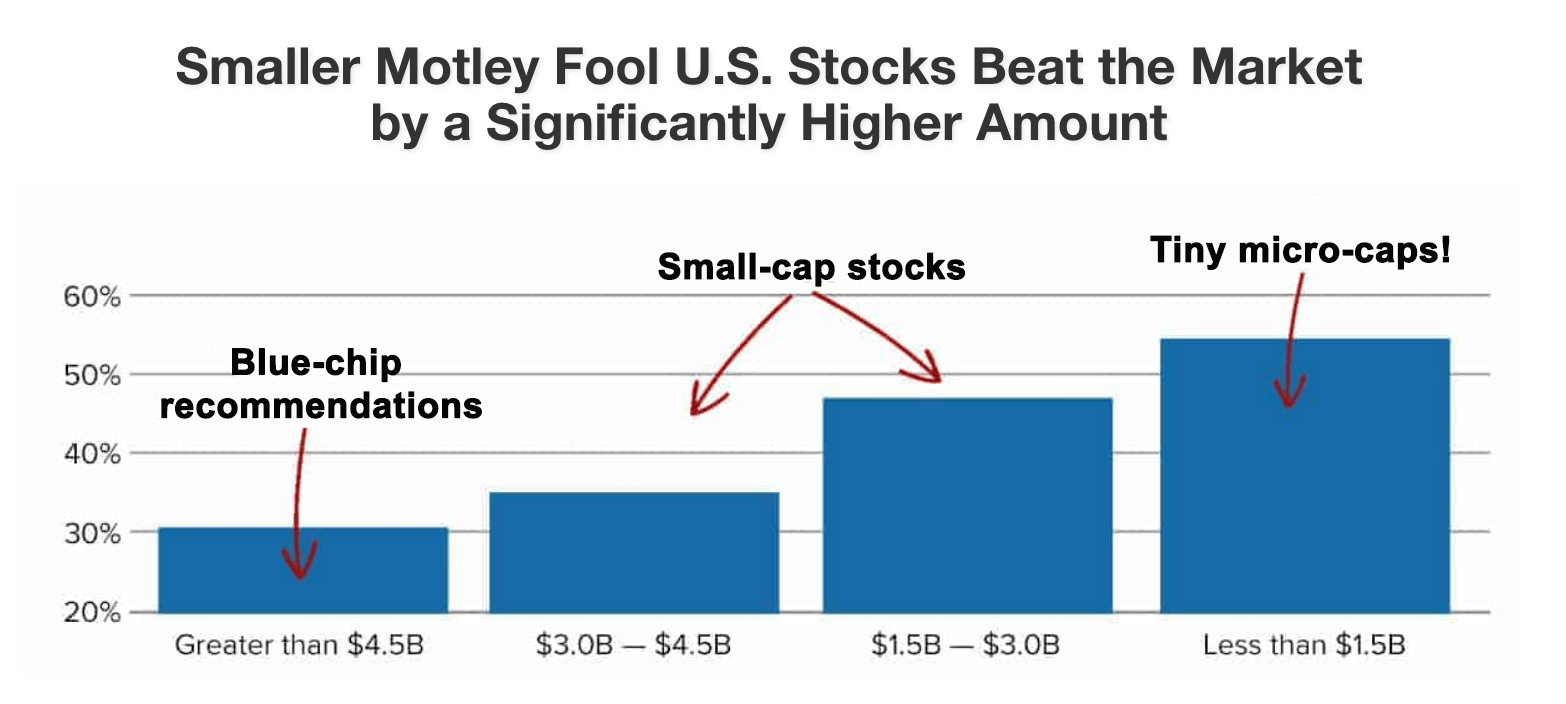

The results of Tom's study offered conclusive evidence that the No. 1 way investors earned 10X+ returns from The Motley Fool's U.S. services was to buy a select class of under-the-radar stocks…

Namely small-cap (or even micro-cap) stocks — with market values merely a fraction the size of already giant, extremely well-known stocks like an Apple, a Walmart, or a Royal Bank of Canada.

Remember what I said earlier — generally speaking, the smaller the recommendation, the MORE money Motley Fool members in the U.S. ultimately made on it!

The average returns have increased like clockwork... steadily growing as the picks get smaller and smaller.

In fact, according to a study we conducted in 2016, the smallest picks produced a staggering average return of 54% above the normal market average.

Study concluded 12/31/2016. Calculated from 1,490 recommendations across Motley Fool services. Each market capitalization category is measured against the S&P 500 Total Return.

Time and time again, Tom Gardner and The Motley Fool's best investors have been able to pick out some of the world's most incredible companies before they became household names.

Now we’re using this exact same strategy right here in Canada, with a full portfolio representing our sheer best ideas.

Frankly, given the past returns this strategy has delivered, we feel it’s imperative we offer investors like you a small-cap-focused solution like Discovery Canada right now.

And it should give you a good sense of just how BIG we believe the current opportunity is.

Besides, considering the special new member offer we’ve put together for you, I expect you’ll find your decision is an easy one.

More on that in a moment.

In the meantime, I think it’s about time you ask yourself a simple question…

"If I’ve already committed to investing in stocks… why WOULDN’T I buy the best possible type of stocks?"

It might seem like a silly question… but in my experience, it’s one that investors ask themselves far too seldom.

And it often winds up costing them big-time!

(Heck, that’s another big reason we’ve arranged this VERY special membership offer.)

But I think you’ll also agree it’s about time that we stop focusing on past successes … and start focusing on how all of this can help Canadian investors like you to earn some meaningful returns starting today.

Discovery Canada is the ONLY solution we offer in Fool Canada that’s dedicated to Tom's small cap investing system

And while this exciting offering is closely based on Tom’s original Discovery offering in the U.S., there are a few key differences you should be aware of…

For starters, unlike its predecessor, Discovery Canada is focused solely on leading investors like you to what we believe to be the very best and most compelling small-cap opportunities currently trading on Canadian exchanges.

(Though, as you’ll see in just a moment, if you join Discovery Canada today, you’ll be in the unique position of also being able to discover some of Tom and his team’s best U.S. small-cap ideas from the original Discovery U.S. service as well.)

Another way that Discovery Canada is different — and far better suited to Canadian investors like you — is that every single one of the small-cap ideas within Discovery Canada have been picked, researched, and vetted by a team of investors highly experienced in investing in Canadian markets.

This includes everyone from our Canadian-born-and-bred Chief Investment Advisor Iain Butler (who you likely know, also serves as the lead advisor of both our Stock Advisor Canada and Rule Breakers Canada services)…

…to U.S.-based investors who have now spent years focused on Canadian markets, like Nate Parmelee …

If you’ve been part of our Fool Canada community for a while, then you already know you simply couldn’t ask for a team more experienced in the Canadian markets, nor one more dedicated to doing whatever it takes to help you achieve your financial goals.

And you should know that Discovery Canada is also quite unlike anything we’ve ever developed here in Fool Canada…

As you’re likely well aware, most investing solutions — including many of those we offer across our Motley Fool universe — tend to launch with just a handful of stocks for you to buy right off the bat…

Then, going forward, these services tend to add new recommendations in regular intervals — and keep you more or less up-to-date about developments with previous recommendations.

Granted, we think this is a perfectly fine way to run most investment services… but we also believe that it’s simply NOT the best way for investors like you to take advantage of our unique small-cap investing system…

Remember… while U.S. small-cap stocks have proven to be the best bet for many of our members down south to earn life-changing returns of 1,000%+ or more, actually finding those monstrous winners is extremely rare — even for highly experienced and incredibly successful investors like Tom Gardner and Iain Butler…

Which is why they believe it’s so crucial that rather than just “picking and choosing” a few small-caps to buy here and there over the course of a few years, you instead commit to build a well-diversified portfolio of at least 25 solid small-cap opportunities…

That way, you won’t have to lose any sleep if one of the small-caps you purchased suddenly hits a snag and its stock sells off — but you’ll still be well positioned to make some BIG money if one of them suddenly takes off.

It’s also why with both Discovery and now Discovery Canada, Tom Gardner insisted we do something that up until then we’d never done before across The Motley Fool’s quarter-century history…

Namely, offer a real-money portfolio solution — backed by The Motley Fool LLC's own money!

In all, the Discovery Canada team is releasing the full details on our entire portfolio they believe could be the next 1,000%+ winners that investors will be talking about five…10… even 25 years from now!

Remember, ALL of these small-cap stocks:

Have been hand-picked by longtime Foolish investors with years of small-cap investment experience, including many you’re already probably very familiar with, like Jim Gillies, Nate Parmelee, and Iain Butler…

Have been personally vetted by Tom Gardner…

Represent what our Discovery Canada team believes to be your absolute best shots at getting invested in the next generation of 1,000%+ winners — before they go on to become the stuff of legends…

Frankly, I can’t imagine a better time to join Discovery Canada.

After all, The Motley Fool as a whole has now been around for over a quarter-century…

And with a little more than ten years under our belt, Motley Fool Canada has now been around for roughly a third of that.

Additionally, I should point out that we’re not only doing this because we believe we can grow that stake by leaps and bounds over time as some of these small caps turn into three-baggers… five-baggers… and even ten-baggers…

OR because we believe it perfectly aligns our interests with those of our members (which we hope you’ll agree it certainly does!)…

But also because it’s the best way we know of showing you exactly how much of your portfolio we think you should allocate to each of our Discovery Canada selections!

You see, with Discovery Canada, you’ll not only get the names, tickers, and our full research write-ups on all of these ultra-promising small-cap companies… but you’ll also get to see exactly what percentage of our capital we’re putting behind each one…

*Example allocation

That way you can exactly match our allocations in your own portfolio — and rest easy knowing your small-cap portfolio is so well positioned that we’re staking our own money on it too.

And as we mentioned, judging by the number of winners we’ve already picked in Discovery - like Trisura Group (+61%) and Tecsys (+65%) - we’re confident in our ability to use those profits to outperform the market and help your portfolio grow at an equally rapid pace.

In another moment, I want to share the details of the incredible low price we’re offering to new members who join us today. But first, let’s look at some of the other benefits you’ll enjoy as a brand-new member.

What kind of experience should you expect in Discovery Canada?

On our research hub, you’ll find all of the following and more:

![]()

An in-depth research report on each of our top 30 small-cap recommendations:

Each research report includes a company overview, potential risks, and a full analysis of each Discovery Canada recommendation's upside potential.

Perhaps needless to say…

They contain powerful research that tells members exactly what makes each of the opportunities deserving of inclusion in our Discovery universe.

A custom-built small-cap investing report:

Our team has created a special report to fill members in on virtually everything we think they need to know about small-cap stocks.

This even includes how to position Discovery Canada’s 30 recommendations with regards to an existing portfolio!

Specific allocation guidance for every stock:

Since Discovery Canada isn't "just" a collection of stock recommendations, but a full portfolio of incredible small-cap stocks that the team believes have ten-bagger potential, every single stock in Discovery Canada comes with specific allocation guidance.

This information helps members pinpoint exactly how much of each stock our team believes they should own.

And don’t forget, we’re backing every single one of these picks with our company’s own money!

How to gain IMMEDIATE ACCESS to Discovery Canada…

(Hint: you’ll want to do so ASAP!)

Now that you've gotten your "sneak peek" inside Discovery Canada, I think it’s about time I gave you the full details on how you can start putting it to work for you right away.

But first, here are a few very important things you should know:

You see, Discovery Canada is built for only the most serious investors, who are interested in our most high-conviction recommendations from Canada and the US.

Tom is obsessed with more of our members seizing the advantages that high-potential-upside small-cap stocks offer.

But since any small-stock solution is by nature a limited opportunity (if too many investors join, they can start "popping" share prices)...

Tom wanted only the most committed of investors to have "first crack" at signing up for Discovery Canada.

After all, we want you to get the best possible price on every single one of these stocks.

How much will it cost to put Discovery Canada to work for you starting today?

We’ve set the 1-year price to join us in Discovery Canada and take advantage of access to our fully allocated portfolio at $1,199.

Is that cheap? No, it’s not…

But I do believe it represents a tremendous bargain.

After all, Tom paying a staff of 40+ different analysts in seven different offices across the world to research small-cap stocks isn't cheap, either.

That said, at The Motley Fool… and especially here in Motley Fool Canada… we aren’t interested in just delivering “pretty good value.”

And when we make a product as exciting and potentially transformative as Discovery Canada available, we don’t want members like you to come away wondering “How can I afford to buy that?”

…We want you to come away thinking “How can I afford NOT to buy that?”

But that’s not all…

In fact, because you’re a loyal Motley Fool Canada reader standing with us at this historic moment, I’ve also decided to throw in a suite of bonus gifts… worth over $700!

Bonus Gifts

As I’ve said, investors have been hit hard this year, and it’s time we equip ourselves to fight back. That’s exactly why we’re offering YOU our VIP Platinum Package – to give every day Canadian investors the hard data they need to make informed decisions and grow smarter, happier, and richer now and over the long-term.

We dedicated over 15,000 words of hard-hitting analysis towards shining a light on what we see as the best opportunities in the stock market right now, including:

5 Top Energy Plays for 2023 And Beyond: A grossly overlooked sector with an explosive underlying catalyst in 2022 that could rain down profits for years to come.

5 Value Plays You Can Buy Today: Our favourite beaten down stocks trading for prices that look silly cheap in today’s market.

5 Stocks to Generate Steady Income Now: A collection of passive income producing assets that can serve as an inflation hedge and help investors build wealth while they sleep..

This brand-new bundle of high-value reports (and 15 individual stock picks) is valued at $726, but it can be yours today for FREE when you accept this offer.

It’s true. You won’t pay a single dollar extra for that complete set of additional research and gifts.

And considering Discovery Canada is a fully allocated portfolio and not simply a hodgepodge of random stocks, I think you’ll definitely appreciate the quarterly updates, annual rebalances, and, yes, new additions to the portfolio that come with being a long-term member.

Now, if just $1,199 for one year seems unreasonable to get access to the investing system and philosophy that has produced these kinds of returns… then to be honest, this product probably isn't for you.

In fact, there are probably plenty of investors for whom Discovery Canada is not right.

For example…

If you're not at the point where your portfolio size can justify the cost of Discovery Canada today: Then this solution is likely not for you. We generally recommended investors have a portfolio of at least $25,000 to take full advantage of Discovery Canada.

If you're expecting to buy only a single stock: Discovery Canada is a full portfolio of our top ten-bagger ideas across the microcap and small-cap space. If you plan to buy only a single stock in hopes it'll shoot up 10X or more, then this product is not for you. Discovery Canada is for committed investors who want to use this proven investing system without introducing unnecessary risks.

I must also note that we will not be offering refunds on this product.

Why?

Well, unlike all of our other services, where we deliver you valuable new picks, features, tools, and benefits over the course of your membership, with Discovery Canada, a great deal of the value is delivered directly up front…

Meaning all of the countless hours of hard work, research, and due diligence on our end will have been put in by the time you access the service.

And most importantly, offering our standard refund is simply not fair to committed, long-term investors.

You see, we built Discovery Canada for investors who are committed to building a portfolio full of high-upside stocks with the right strategy.

So if a group of short-term traders were able to buy Discovery Canada, quickly make use of its recommendations, and then cancel without paying their fair share…

They could push up the prices of the stocks and do a huge disservice to investors who are committed to this strategy for the long run.

However...

Our Ironclad 30-Day Satisfaction Guarantee

Member Exclusive

All members joining through this special New Member invitation are fully covered by The Motley Fool’s exclusive satisfaction guarantee!

If for any reason you’re not completely satisfied with our Discovery Canada portfolio, asset allocation guidance, continuing recommendations, and market updates in the next 30 days…

Then simply contact our helpful customer service team and they’ll happily work with you to provide a credit to one of our other portfolio services.

There’s just one catch: an offer this good can’t last!

So, if you’re ready to go ahead and put Discovery Canada to work for you — all while scooping up $726 in additional research — we’ll need to hear from you right away!

We're extremely proud of all the work that's been done to make Discovery Canada the ultimate solution for investors seeking to unearth what could be the next generation of legendary 1,000%+ winners…

And we’d ask that you please simply scroll down to the secure order form below so that you can begin putting it to work for you today!

To finding your first — or next – ten-bagger,

![]()

Liz Cherry

Liz Cherry

Director of Membership

Motley Fool Canada

Data as of 3/28/2023 unless otherwise stated. JThe Motley Fool Canada owns shares of Apple, Chipotle and Shopify. The Motley Fool has a disclosure policy.

Discovery Canada includes U.S. stocks and Canadian stocks. All billing is in CAD. You will be billed according to your choice below and then $1,199 for each year thereafter.

This product is non-refundable.

Having trouble ordering or have any questions for us? Just send them to [email protected], and we’ll get back to you ASAP!