To complete your order, it is necessary to enable JavaScript.

Motley Fool Canada - Order Now!

Already a member? Login

Based on a recent research discovery, we now believe...

The Motley Fool’s “No. 1 Technology for the 2020s” looks poised to skyrocket 33X over the coming decade and beyond!

So if you’re still kicking yourself for missing out on decade-defining tech trends like the rise of the smartphone over the past 10 years… e-commerce in the early 2000s… or even the birth of the internet itself in the ’90s, this could be your ONE and ONLY chance to make up for it!

Despite early 5X returns over the past few years from our No. 1 technology sector of the 2020s, we’ll explain straight ahead why one of the most respected executives in the world believes the industry is a mere 3% of the way into a staggering US$3.7 TRILLION total market opportunity.

Just how big do we believe this technology will be? After almost 30 years at the company, Motley Fool co-founder and CEO Tom Gardner has created an investing solution 100% dedicated to capitalizing on a single technology phenomenon – until he revealed Cloud Disruptors!

But you’ll need to hurry… because this opportunity may not last long!

Dear fellow investor,

Here at The Motley Fool, we believe there is one truly dominant, wholly transformative technology trend that defines each decade.

Without a doubt, there are always numerous smaller tech innovations and trends that you can also go back and identify…

But if you really dig down deep, you find they generally plug into one overarching technological phenomenon that alters everything it touches over the course of that decade.

Think about the birth of the internet in the 1990s as companies like AOL put the world’s collective knowledge just a mouse click away…

…allowing their stock to skyrocket more than 70,000% over the course of the decade alone… and making millionaires out of those who made a mere US$1,500 investment.

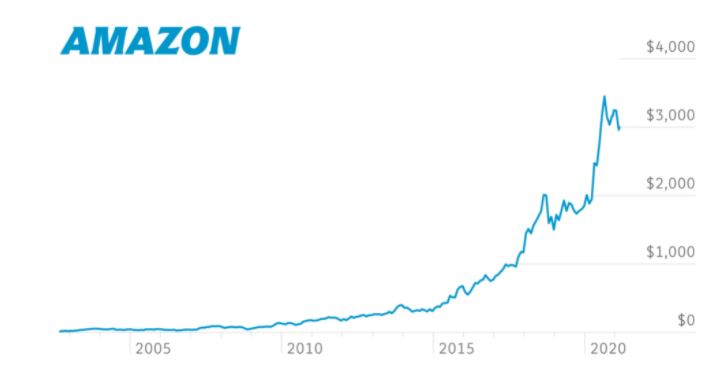

Or at the turn of the century when you had retailers racing online with the rise of e-commerce – shuttering tens of thousands of brick-and-mortar stores and setting the stage for Amazon to become perhaps one of the most powerful companies in the world today.

And, of course, we’ll forever remember this past decade for putting an iPhone into nearly every hand in North America…

…turning Apple into the first trillion-dollar company on the planet and delivering investors 3,163% returns since they first released that “do-it-all” pocket supercomputer.

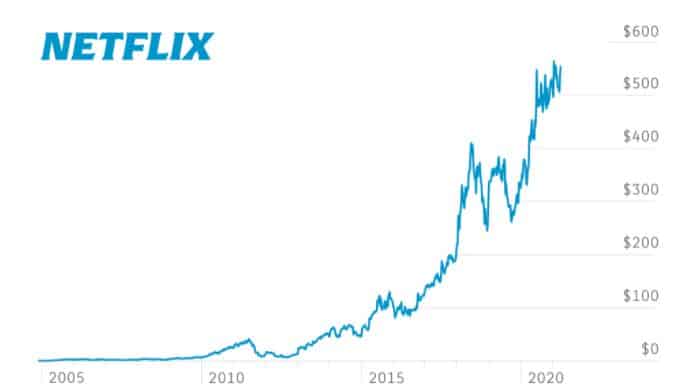

Not to mention fostering the “app culture” that allowed companies like Netflix to shoot up more than 5,940% over the past decade alone!

Think about these technological phenomena like waves building in the ocean.

Anybody with two eyes and one brain can see the wave once it’s crashing down on the shore…

But it’s darn near impossible to peer far enough out into the horizon to be able to spot it when it’s first building, miles off the coast.

Of course, you and I both know the simple truth of the matter is this…

If you can identify that single “foundational technology of the decade” ahead of time, you’ve set yourself up with the potential to make a literal fortune.

Unfortunately, many investors are only too aware of the other side of that story…

That if you CAN’T identify that all-important foundational technology up front, you spend the following years downright haunted by the life-changing gains you missed out on.

Because, deep down, we believe that’s the way real wealth gets made.

Transformative wealth.

The kind of wealth you likely cannot obtain from sticking your hard-earned investment dollars into yet another Steady Eddie index fund or ETF…

If you’re tired of doing that and you’re equally tired of the middling returns that come along with it, you’re in luck: You are exactly the kind of person I’m writing to today.

Because today, I’m giving you the opportunity to invest in the technology The Motley Fool believes will likely control the decade ahead…

And ultimately be the foundation on which all smaller technologies in the near future are built.

As I’ll explain shortly, there’s reason to believe this No. 1 Motley Fool technology of the 2020s has an estimated 33X growth potential for investors savvy enough to see the wave just starting to build miles out on the horizon.

Now, let me be clear: I’m not talking about artificial intelligence…5G…or the so-called “Internet of Things.”

Nor am I referring to augmented reality…virtual reality…or any other kind of reality.

And it’s not big data…cybersecurity…or blockchain, either.

While I’m proud to say The Motley Fool has been at the forefront of a good many of those massive technology trends over the years, the fact of the matter is that without the all-powerful technology I’m talking about, it’s entirely possible that exactly NONE of them would have amounted to anything.

You see, like the sturdy foundation of a building, cloud computing underlies essentially every major technological advancement we see in the world today.

And that’s why it’s The Motley Fool’s No. 1 technology for the new decade!

That’s right…

As we move into the 2020s, months of rigorous research by a special task force handpicked by Motley Fool co-founder and CEO Tom Gardner himself has isolated cloud computing as the next in line of the decade-dominating technology shifts I’ve been describing.

Which may leave you wondering…

“Hasn’t cloud computing been around awhile already?”

And you’re absolutely right.

In fact, dozens of cloud companies recommended by The Motley Fool U.S. have soared over the past few years.

Like legendary Motley Fool U.S. recommendation Netflix. Many investors aren’t aware of this, but the streaming king had previously been using its own servers, before ultimately conceding and making a huge shift to the cloud.

Amazingly, five Motley Fool U.S. recommendations of NFLX are above 12,000% returns, with the highest now sitting at over 32,000%!

Or take Amazon, whose Amazon Web Services division has become the runaway market leader in cloud computing.

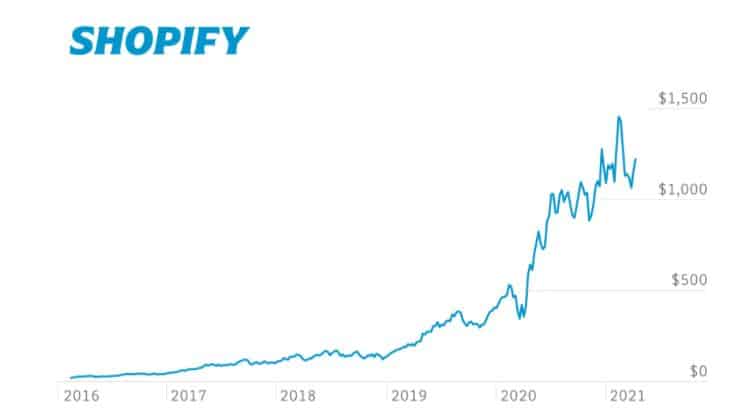

There’s also Shopify – one of the best-performing Canadian and American stocks of the past half decade – which uses the cloud to provide online retailers with a simple and easy-to-use framework to conduct business online.

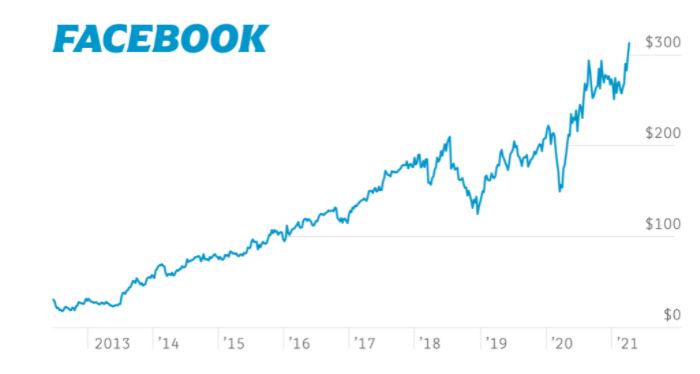

And how about Facebook, which has pushed wholeheartedly into the cloud as well?

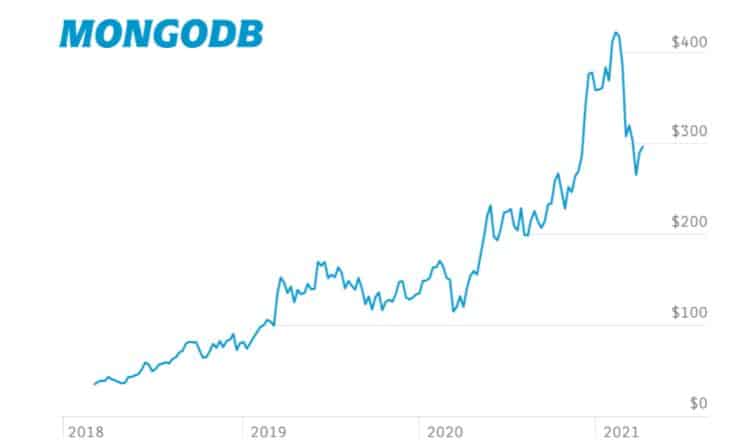

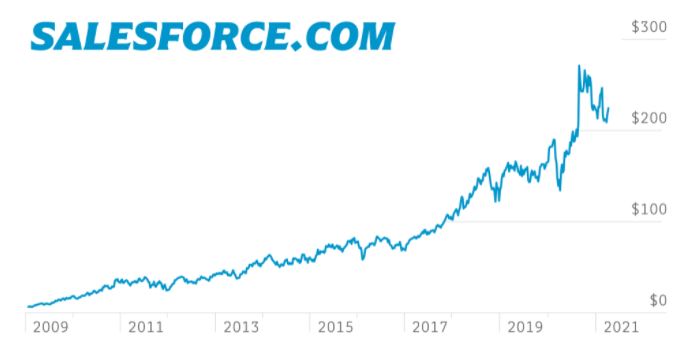

Or MongoDB, as pure a play on the cloud sector as you’ll find…

Of course, it would be wrong not to include Salesforce.com, which basically founded the industry.

Beginning to notice a trend here? Wherever the cloud goes, not only gigantic returns, but companies whose names are known the world over, follow.

And to be clear, there’s no need whatsoever to cherry pick returns…

In fact and very few people know this - cloud computing has been perhaps the single best performing U.S. industry over the past half decade or so.

Chart refers to U.S. cloud industry measured against U.S. market indices. This chart reflects the theoretical performance of the BVP Nasdaq Emerging Cloud Index (EMCLOUD). The index began October 2, 2018.

As you can see from the chart, headed into 2020, cloud computing had amassed massive outperformance relative to the indexes held by many investors.

And even after the recent market drop, this still holds true. As of January 3rd, if you turned back time to 2013 and invested in the S&P 500 or the Dow Jones Index, you’d currently be looking at about a 204% or 148% return on your money, respectively.

And if you had instead put it in the NASDAQ Index, you’d have about 385% returns by now – doubling your money. Not bad, right?

But if you had invested exclusively in the 51 U.S. companies on the NASDAQ that currently operate in the cloud computing space, you’d already be sitting on 4,255% returns at the start of this new decade…

Nearly sextupling your original investment in just seven years!

But here at The Motley Fool, you know we aren’t remotely concerned with past returns. We’re concerned with future ones.

So if you’re worried you may have missed the boat, I suggest you think again.

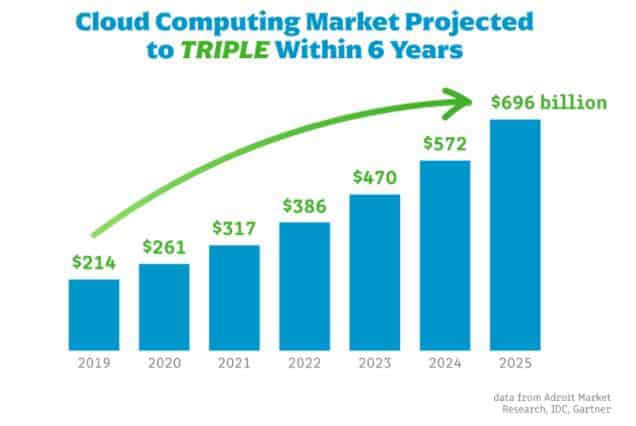

Chart refers to U.S. market.

As you can see from that chart, the cloud computing market is expected to more than triple from US$214B to US$696B in just half a decade.

Because the fact of the matter is that while many investors think we’re in the seventh inning stretch of this investing story, the truth is that not only are we still in the first inning… we’ve only just had the first pitch!

You see, despite those massive recent returns, Andy Jassy, the heralded CEO of Amazon Web Services, stated that a mere 3% of the staggering US$3.7 TRILLION addressable market of this “Foundational Technology of the 2020s” has been tapped thus far.

Do a little back-of-the-napkin math and that remaining 97% market opportunity means you’re looking at 33X potential returns from investing in the cloud industry – starting here in 2022!

Plus, bear in mind that’s not a single outlier stock you have to hit the lottery with… that’s for the industry as a whole.

No cherry-picking required!

Now, just try to imagine getting in on the ground floor of Google or Amazon when the internet was just 3% built out…

Or investing in Apple when just 3% of total iPhone sales had taken place…

At long last, this is your chance to make up for missing out the first time.

And to never have to say, “WHAT IF?” again.

Of course, that does raise one important question…

Why does our team believe “right now” is the perfect time to get invested in the cloud?

Despite the incredible returns we’ve seen from cloud computing stocks to date, the fact is that only NOW – after 20 long years – has the basic foundation of the cloud finally been solidified so that we can truly start building on it.

And that means, from this point forward, the traditional idea of “business as usual” is about to change forever.

As the past CEO of Verizon said…

“Cloud computing is the third wave of the digital revolution.”

– Lowell McAdam, former CEO of Verizon

Think about the cloud like the U.S. Interstate Highway System (IHS) and the internet like the American automobile.

In case you’re not quite familiar with this history, I’ll explain…

The automobile started to become widely available in America going back to the 1920s.

The IHS, on the other hand, wasn’t commissioned until 1956.

And up until that very point, the full utility of the American automobile was never realized. People thought it was because there was no real way for them to imagine otherwise.

But it took until the completion of the IHS to truly showcase how powerful the automobile’s effects could be on a nation as geographically massive as the United States.

All of a sudden, highways enabled American mobility from coast to coast… the spread of mass commerce via chain restaurants and national grocery stores… and even the rise of suburbs.

But here’s the kicker… although it was founded in 1956, the Interstate Highway System wasn’t considered “completed” until 1992 – a mind-blowing 36 years later.

Meaning it took a long time for them to roll the entire infrastructure out.

(And it’s not like we started from a small baseline in the first place…)

Here’s the point…

After a similarly long ramp-up period, we’re finally seeing the cloud begin to showcase the full utility of the internet, much like the Interstate Highway System did with the automobile!

As Forbes says…

“Like it or not, any software being created today is being done with the cloud as its central architectural design philosophy.”

-Forbes

Or, if you’d prefer a less subtle form of praise from them…

“The Cloud Is Eating the World”

-Forbes

In the past, companies would spend weeks… perhaps even months with dozens of techie developers working 15 hours a day to build out and test their internal servers and payment processors just to be able to sell their products online.

Nowadays, with the advent of the cloud, forget months… weeks… or even days. You’re looking at a matter of hours to get an entire business fully up and running.

And much like first-time drivers on the Interstate in 1992, the companies that are being founded RIGHT NOW are the first ones able to take advantage of this fully built-out cloud architecture from the get-go.

“I don’t think people have really understood how big this opportunity really is.”

-Former Google CEO Eric Schmidt

For the first time in history, getting on the cloud is no longer an option for companies going forward; it’s mandatory.

And the basic necessity of these cloud companies going forward — combined with what Amazon Web Services CEO Andy Jassy himself describes as an industry just 3% of the way into its US$3.7 TRILLION opportunity — is all we need to know to crown it as our No. 1 technology investment of the 2020s…

Much like the final completion of the Interstate Highway System, the ramp-up period is finally over, and the accelerator is about to be pressed to the floor.

“Cloud computing has moved past its "self-centered teenage years" to become a "turbocharged engine powering digital transformation around the world.”

-Forrester

Which is precisely why Motley Fool co-founder and CEO Tom Gardner has decided to make this year the year that he finally goes “all in” with a Motley Fool service called Cloud Disruptors.

Announcing… Motley Fool Canada Cloud Disruptors!

If you have any remaining doubt as to how dominant cloud computing will be over the decade to come, consider the following…

Not only is Cloud Disruptors the first time we’ve ever dedicated an entire service specifically to the cloud computing industry, even though we’ve been following the industry for going on 15 years now…

It’s also the first time in The Motley Fool’s almost 30-year-history in the U.S. that any service led by Tom Gardner has exclusively focused on not only technology… but a single technological SECTOR.

And of course, it’s the first time we’ve offered such a service to our Canadian members like you!

That’s how excited we are to go after the 33X potential upside of the U.S. cloud computing industry.

So here’s how it works…

Cloud Disruptor intends to ultimately put US$500,000 of The Motley Fool LLC’s very own investment capital behind 34 of the top cloud computing stocks that we expect to dominate the next decade…

And because we’ve heard from members like you that you are excited for the recommendations, you’ll receive our first batch of 34 top cloud stocks the moment you join Cloud Disruptors…

But unlike many services here at The Motley Fool, we aren’t stopping once we build out that initial portfolio stocks…

Because if you’ve been a Motley Fool member for some time now, you’ve probably caught on to the two primary ways our services operate.

The first method is more of the “monthly newsletter” style.

Each month, you get our best recommendation or two for that particular service’s strategy – be it dividends, small caps, high-growth stocks, etc.

It’s a simple and easy way for members to always know exactly what our favorite stocks are each month and when you can expect them to arrive in your inbox, and it allows you to easily space out your investments over the course of the year.

The second method is that we give you either a basket of stocks or a fully allocated portfolio, accessible the instant you join the service.

But Cloud Disruptors intends to be the best of both worlds.

Naturally, our team will give you a comprehensive breakdown of every position, including specific allocation guidance, all with the goal of building out a cloud portfolio that absolutely crushes the market over the coming years…

Remember, we’ve identified cloud computing as the overall No. 1 technology trend for the new decade. Not cybersecurity… not augmented reality… not blockchain… not the “internet of things”… or even artificial intelligence.

And, as I’ve already shown you today, not only is the industry as a whole projected to more than TRIPLE by 2025 alone…

But there’s reason to believe that, to date, we’ve unlocked just 3% of an overall US$3.7 trillion opportunity that could result in 33X upside starting today!

Which is precisely why Tom’s staking US$500,000 of cold, hard Motley Fool LLC cash behind Cloud Disruptors!

You know, here’s something I find odd.

So many celebrity stock pickers, hedge fund managers, and talking heads on CNBC and BNN are more than happy to emphatically toss out BUY and SELL recommendations.

But when you ask them whether they’re backing those very same recommendations with their own money, they’re looking for the closest exit.

My advice? If you ever come across somebody who does that, RUN — don’t walk — the other way.

See, our humble philosophy here at The Motley Fool is this…

If you aren’t more than willing to put your own money on the line right where you’re telling other people to put it, you’re probably not worth listening to.

That “skin in the game” is incredibly important to us to ensure YOU KNOW we’re on the same team.

When you win big, we win big. And when you’re feeling the pain from the market, you know we’re right there with you.

Now, don’t get me wrong. This is an investing decision for us too…

Tom Gardner’s putting US$500,000 behind these Cloud Disruptors recommendations because he firmly believes this “No. 1 technology investment of the 2020s” is the single best place to allocate that capital not only right now… but for the entire decade to come!

After all, Tom’s the co-founder and CEO of an investing business that he and his brother built from the ground up out of a woodshed in the backyard.

If you think he doesn’t vet every last capital allocation decision he makes to within an inch of its life, you’re out of your gourd!

Of course, Tom knows something you may not. And because you’ve stuck with me for this long, it’s probably time to let you in on the secret…

Meet your “Secret Weapon” for the coming cloud computing bonanza!

If you’re a long-time Motley Fool member (and you particularly like to follow our U.S. tech stock offerings), you may have heard the name Tim Beyers more than a time or two.

Tim’s a veteran analyst here who worked hand in hand with Motley Fool co-founder David Gardner for years before coming over to work directly alongside Tom as part of his dedicated “Discovery” team of senior analysts.

He’s also one of the brightest investors I’ve ever met.

But what most Fools are not aware of is that Tim was actually one of the original analysts to begin following the cloud back when it was just the whisper of an idea…

And he’s been closely following the industry ever since, to the point that he’s become the “King of Cloud” internally here at the Fool…

That’s a bit of a fancy title, but I’m far more impressed by the track record that Tim has racked up in the now 15 or so years that he’s been following the U.S. cloud computing industry.

(Lean in if you’re ready for some truly shocking numbers…)

Over the past decade and a half, Tim has recommended a whopping 47 U.S. cloud companies on behalf of Motley Fool U.S. members.

So when Tom Gardner had firmly decided that cloud computing would be the single biggest technology investment of the 2020s, he knew Tim absolutely had to be involved in the construction of the service we were building to take advantage of this once-in-a-decade opportunity.

Speaking of which, you may be wondering…

Precisely what kind of returns ARE we targeting inside Motley Fool Canada Cloud Disruptors?

It should be no surprise that we fully expect Cloud Disruptors to be one of our best-performing services in company history.

When it comes to individual positions, our team will be biased toward stocks they believe have the potential to at least triple over the coming half decade.

And for the portfolio on the whole, our team is targeting overall returns of 7X over the coming 10 years, as this “decade of cloud computing” really begins to play out.

That said, as valuable as Tim may be to the stock-picking side, we think he may be even more valuable in another area…

You see, we all know cloud computing isn’t always the easiest industry to understand.

Which is why Tim has spent months painstakingly building a comprehensive resource vault right on our Motley Fool Cloud Disruptors website to help educate you on every aspect of this opportunity.

Our Cloud Disruptors Strategy Hub will have you in line to be a seasoned pro in the industry within no time!

Because, as I think you’ll agree, while getting our top 34 cloud stocks is a great start… it doesn’t necessarily mean a whole lot if you don’t fully understand what you’re investing in.

With our simple-to-use Cloud Disruptors Strategy Hub, getting up to speed on the cloud computing industry is a breeze.

You’ll get a little bit of everything, including…

A monthly “cutting through the noise” recap by Tim Beyers himself that will briefly recap everything you need to know about what happened in cloud computing that month…

Our “Tom & Tim Talk Tech” podcast series quickly and easily breaks down the cloud computing industry, all in plain English…

Our “Disruptive Forces Guide,” which rates every stock in the Cloud Disruptors portfolio on a rating from Category 1 to Category 5, signifying the strength of its “Disruptive Force.” The higher the rating, the greater our belief in the potential long-term annualized return from investing in the company!

So by now, I’m guessing you’re pretty interested in one final, all-important question…

Just how much is access to Cloud Disruptors going to cost?

You probably already know that premium-tier services like Cloud Disruptors often go for around $3,000 per year in the U.S.

And it may not surprise you to learn that we’ve actually sold a very similar service for US$5,000 for a single year of membership!

From everything you’ve seen today and the fact that you’ve read this far down into your invitation, you probably agree that the impending cloud computing tidal wave is only the beginning of something huge.

Tom is ready to roll up his sleeves and keep going.

And while we could easily just go ahead charge US$3,000 like we often do in the U.S., Tom wants as many Canadian investors as possible directly alongside him for the decade of cloud computing.

He truly believes that if you aren’t a member of Cloud Disruptors, you’re missing out on part of something the likes of which we’ve rarely done in the past…

A genuine, fortune-making opportunity to get in on the ground floor of the next decade’s No. 1 technology trend, when the cloud market has unlocked a mere 3% of its eventual US$3.7 TRILLION upside.

Remember, that could mean the cloud computing industry is about to soar 33X over the coming decade and beyond…

Which is why instead of our frequently higher per-year pricing, we’ve decided to set the price of membership in Cloud Disruptors at just $1,999 CAD.

While that isn’t cheap by any means, I do believe it represents a tremendous bargain.

Imagine how quickly you could make that back if just a SINGLE one of these initial 33 Cloud Disruptors you’ll get access to pops?

You could literally make that $1,999 back in mere minutes.

I must also note that because so much of the value of Cloud Disruptors is being delivered within the first few days and weeks of the membership period, we absolutely cannot offer refunds on this service.

Tom and his team built Cloud Disruptors for Motley Fool investors who are committed to using the right strategy to build a portfolio full of extremely high-upside cloud computing stocks.

If a group of short-term traders were able to buy Cloud Disruptors, quickly make use of its upfront recommendations, and then cancel without paying their fair share…

Well, they could push up the prices of these stocks and do a huge disservice to investors who are properly committed to this investment strategy for the long run.

However, all members joining through today's invitation are also covered by The Motley Fool Canadas exclusive satisfaction guarantee!

If for any reason you're not completely satisfied with our Cloud Disruptors portfolio, asset allocation guidance, and continuing recommendations in the next 30 days...

Then simply contact our helpful customer service team, and they'll happily work with you to provide a credit to one of our other portfolio services.

But in good faith, I must issue one final warning…

If you’re even remotely interested in everything you’ve seen today from Motley Fool Cloud Disruptors, this is the time to get in.

With all that said, I leave you with this…

As heralded Amazon Web Services CEO Andy Jassy said, we may very well be just 3% of the way into a US$3.7 TRILLION cloud computing opportunity.

An opportunity that Tom Gardner and team expect to be THE defining technology of the new decade.

The only question remaining is this…

Will you be there alongside them to grab your fair share of the pie?

…Or will this be yet another in the line of “WHAT IFs?”

Let’s end that narrative once and for all.

If you’re ready to get started with the wealth-building journey of the coming decade right this instant, just click the button directly below.

To never saying “What if?” again,

David Hanson

Director of Membership

The Motley Fool

Returns as of April 14, 2022 unless otherwise noted. John Mackey, CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to its CEO, Mark Zuckerberg, is a member of The Motley Fool's board of directors. David Gardner owns shares of Alphabet (A shares), Alphabet (C shares), Amazon, Apple, Facebook, and Netflix. T.J. Piggott owns shares of Amazon, MongoDB, and Shopify. Tim Beyers owns shares of Alphabet (A shares), Alphabet (C shares), Amazon, Apple, MongoDB, Netflix, Salesforce.com, and Shopify. Tom Gardner owns shares of Alphabet (A shares), Alphabet (C shares), Facebook, MongoDB, Netflix, Salesforce.com, and Shopify. The Motley Fool owns shares of Alphabet (A shares), Alphabet (C shares), Amazon, Apple, Facebook, MongoDB, Netflix, Salesforce.com, and Shopify. The Motley Fool Canada owns shares of Shopify. The Motley Fool has a disclosure policy.

Cloud Disruptors 2020 includes US stocks. All billing is in CAD. You will be billed according to your choice below and then $1,999 for each year thereafter.

This product is non-refundable.

Having trouble ordering or have any questions for us? Just send them to [email protected], and we’ll get back to you ASAP!