To complete your order, it is necessary to enable JavaScript.

Hidden Gems Canada - 70% off!

Already a member? Login

Your Special offer expires in...

Congratulations! You’ve been selected to receive a special offer to join Hidden Gems Canada...

This is the absolute lowest price we've EVER offered, but this offer will expire at MIDNIGHT!

Read on to discover the stunning factor behind 94% of Canada’s best-performing stocks since the start of the decade!

This factor also happens to be our No. 1 investing advantage over Bay Street and Wall Street because, quite simply, they CAN’T effectively use it!

In fact, it’s so powerful that Warren Buffett himself once guaranteed that he could make 50% returns per year, if only he were able to use this factor in his investing decisions…

And even better, our members will be able to use this little-known factor to pick up under-the-radar stocks with high-potential for pennies on the dollar in volatile markets!

You can join this FIRST-EVER, SMALL-CAP investing solution from Motley Fool Canada that’s fully focused on this single, vital factor for 70% LESS than you'd normally pay — IF you join before this special offer expires at MIDNIGHT!

Best of all, you can"test-drive" this exciting new service for up to 30 days with our ironclad Membership-Fee-Back-Guarantee!

To say I was dumbstruck when I finally finished poring over the data would be the understatement of the century.

Not to mention that it would ultimately lead me to reevaluate everything I thought I knew about how to uncover those truly life-changing stocks we all dream of uncovering just once… maybe twice in a lifetime.

As the General Manager of Motley Fool Canada… someone who’s fiercely proud of her personal success as an investor (though admittedly I’m no analyst)… and an employee at The Motley Fool for more than 15 years now, it was humbling to say the least.

Let me show you the data I’m talking about…

![]()

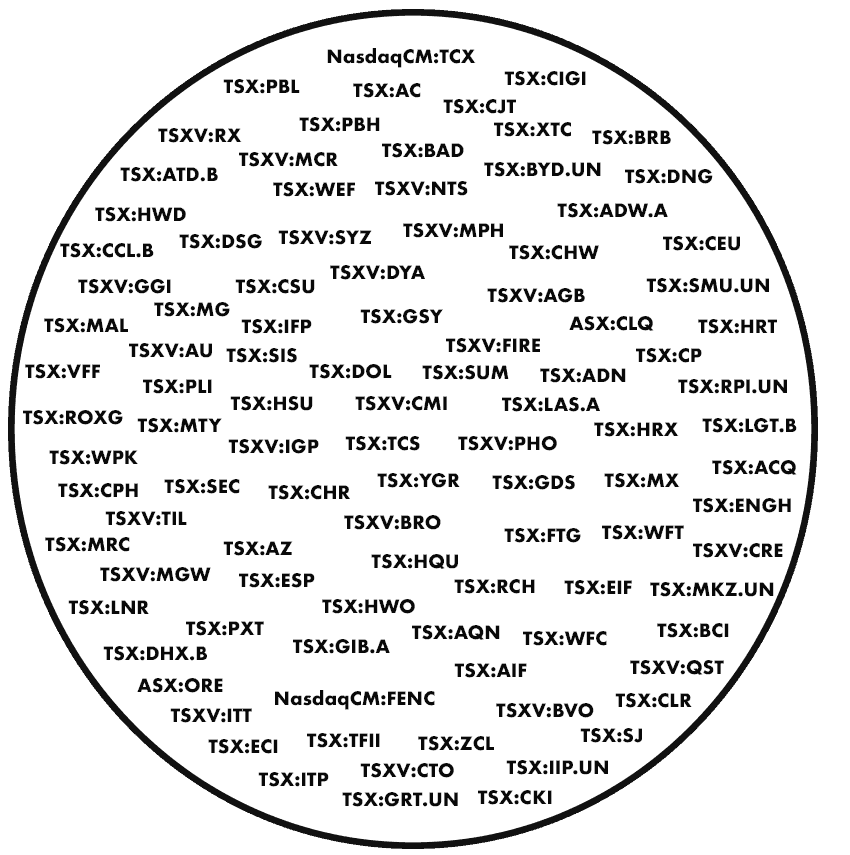

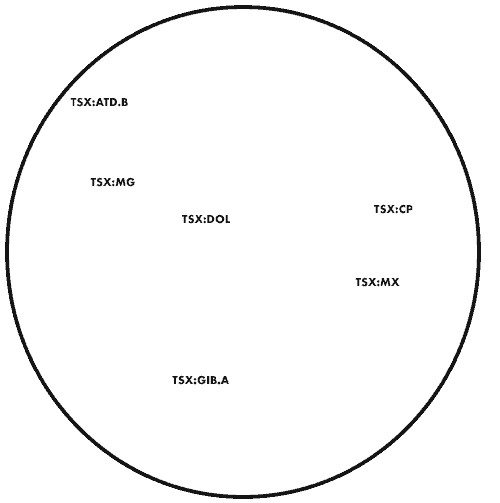

Instead of boring you with an Excel document, I had our designer whip up a simple graphic of the 100 highest returning stocks in Canada over the past decade...

Now look at how many of those initial 100 best-performing stocks DO NOT have one very particular trait associated with them...

Just six companies left. Out of 100!

Shopify (TSX:SHOP)

GDI Integrated Facility Services Inc (TSX:GDI)

ECN Capital Corp. (TSX:ECN)

Ceridian HCM Holding Inc. (TSX:CDAY)

Pollard Banknote Limited (TSX:PBL)

Ero Copper Corp (TSX:ERO)

As of June 30th, 2021

Meaning that a staggering 94 out of the 100 best-performing Canadian stocks since 2018 all shared ONE trait in common…

The first thing you’ll notice when I reveal this investing factor to you is how remarkably easy it is to detect.

You, me, or any other everyday investor could identify it within seconds. And in retrospect, it really does seem like such an obvious connection to make.

Yet to my knowledge, we’re the only ones in Canada that have reported on this 80% correlation. And outside of Canada, for that matter.

Because while every Bay Street genius wants to prattle on how about everything from a visionary founder… to an unparalleled competitive advantage… to fortunate timing… to a unique culture… to whatever is the key to finding the next big winner…

The cold, hard data clearly shows that this one simple trait is a major factor in being able to uncover the kind of stocks that could make any investor’s wildest dreams reality.

I’m talking about truly significant winners small cap winners like these, some of the Canadian market’s best performers between 2016 and 2021:

Aura Minerals (TSXV:ORA) -

+1,125%

Ballard Power Systems Inc. (TSX:BLDP) -

+495%

Capstone Mining Corp. (TSXV:CS) -

+433%

Champion Iron Ltd. (TSXV:CIA) -

+365%

goeasy Ltd. (TSX:GSY) -

+327%

Orla Mining Ltd. (TSX:OLA) -

+313%

SilverCrest Metals Inc. (TSX:SIL) -

+286%

Wesdome Gold Mines (TSXV:WDO) -

+283%

Marathon Gold Corp. (TSXV:MOZ) -

+258%

As of June 30th, 2021

That’s a list of some of the best-performing Canadian stocks over the course of the past 5 years or so… all of which shared this one trait.

What kind of effect would identifying just one of those stocks have? Well…

Since 2018, consider that $10,000 invested into Lithium Americas Corp. (the lowest performing stock of the 30) would have grown to $26,200.

Goeasy Ltd. would have turned a $10,000 investment into $32,700.

And Aura Minerals –the kind of winner we all dream of – would have turned an initial $10,000 investment into a mind-blowing $112,500.

Give me a few minutes, and not only will I reveal what this miraculous “fortune-making factor” is… I’ll also show you a quick, easy, and incredibly affordable way to begin harnessing it in your own portfolio starting TODAY!

I mean, just think about it. What could you do with even one big winner like that?

Buy that warm summer home in sunny Florida or that ski chalet in Whistler?

Jet-set around Europe in first class without a care in the world, or perhaps sail around the Caribbean in your very own personal yacht?

Put your children, and yes, even your grandchildren through university?

Or you could potentially speed up your retirement by a decade so you can do whatever it is YOU prefer to do in your leisure time – even if that’s simply kicking back, relaxing, and for once in your life, doing absolutely nothing at all!

Isn’t being able to fundamentally change our lives like that precisely what all of us really want out of our investments?

And if we agree on that, wouldn’t you also agree that those are the exact kind of stocks we should be laser-focused on?

Because we believe, to be quite blunt, the data clearly shows that investors are far less likely to ever hit a home run with any stock they pick if they AREN’T focusing on this specific factor in each and every investing decision that they make.

And that’s exactly why we think investing in small-caps stocks is so darned important.

Of course, it’s not totally surprising that small-cap stocks can put up such incredible gains. After all, by definition, they do have plenty of room to run.

Which is why when I saw that data, it actually spurred me to do a little research of my own, just to double-check this wasn’t simply a case of only cherry-picking the highest performers over the last decade.

Amazingly, what I ended up discovering blew me away even more…

You see, not only were 94 out of the 100 best-performing Canadian stocks of the decade small-cap stocks (including every single stock that made the list of top 10 highest returners)…

But to be clear, this incredible small-cap success isn’t limited to just Canada.

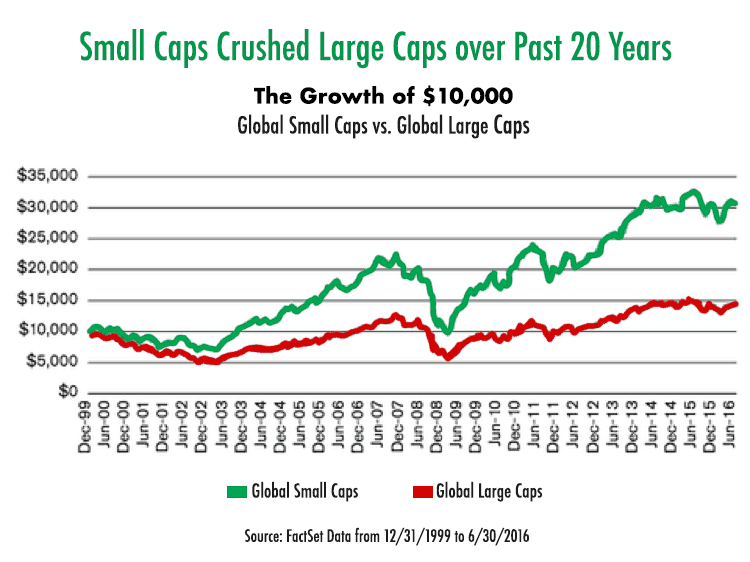

For proof, here’s a look at how $10,000 invested into global small-cap stocks performed versus their large-cap cousins, since the turn of the century.

As the chart clearly shows, not only would you have tripled your money in that timeframe simply by investing in Global Small-Caps, you’d currently have twice as much than if you’d instead invested in Global Large Caps.

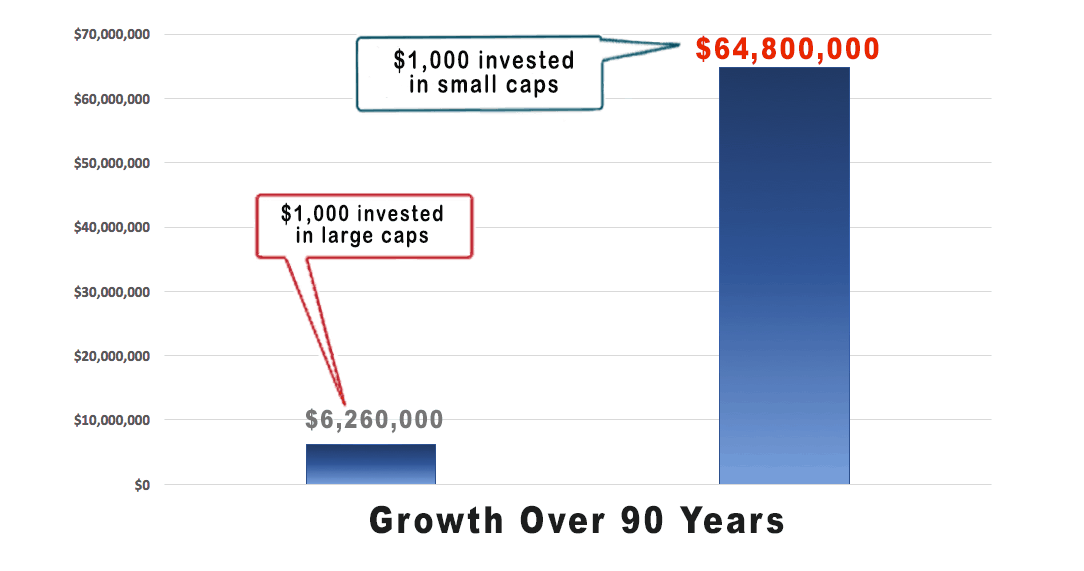

Zoom out to a longer timeframe, and the numbers become even more eye-popping.

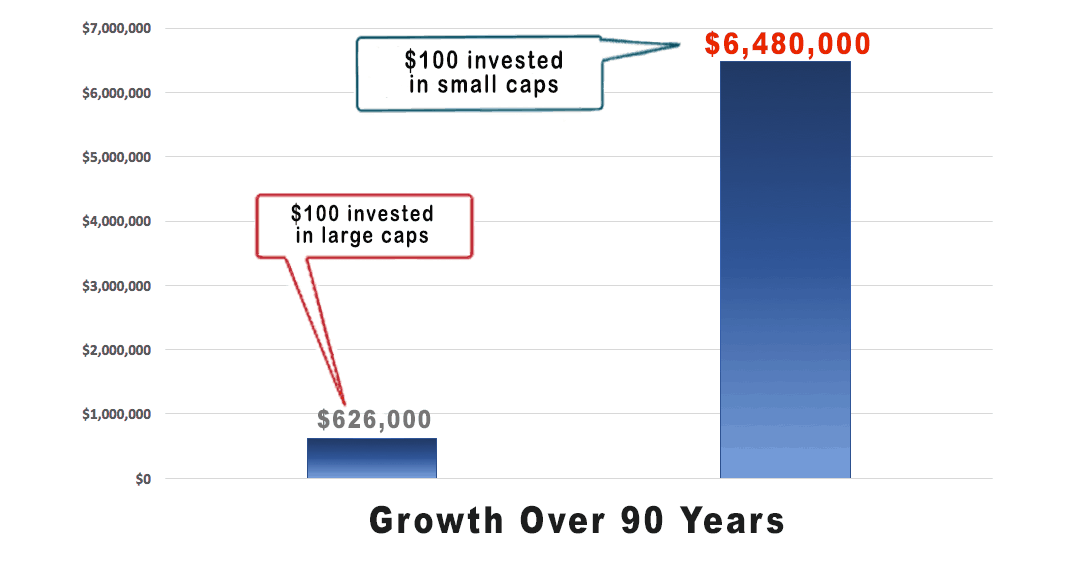

From 1926 through 2016 in the U.S., a model created by University of Chicago professors Eugene Fama and Kenneth French found that small-cap stocks returned 13.1% per year, while large caps returned just 10.2% annually.

And while that 2.9 percentage point difference may not seem that significant at first blush, here’s how it looks over time:

$100 invested in small-caps looks like almost $6.5M over 90 years! While if you look below, it takes 10x that much invested in large caps to get roughly $6.3M over the same amount of time.

$1,000 invested in small-caps would be almost $65,000,000 over 90 years!

Unbelievably, the value of $100 invested in U.S. small-caps back in 1926 would actually be a little bit MORE than $1,000 invested in large caps at the same time!

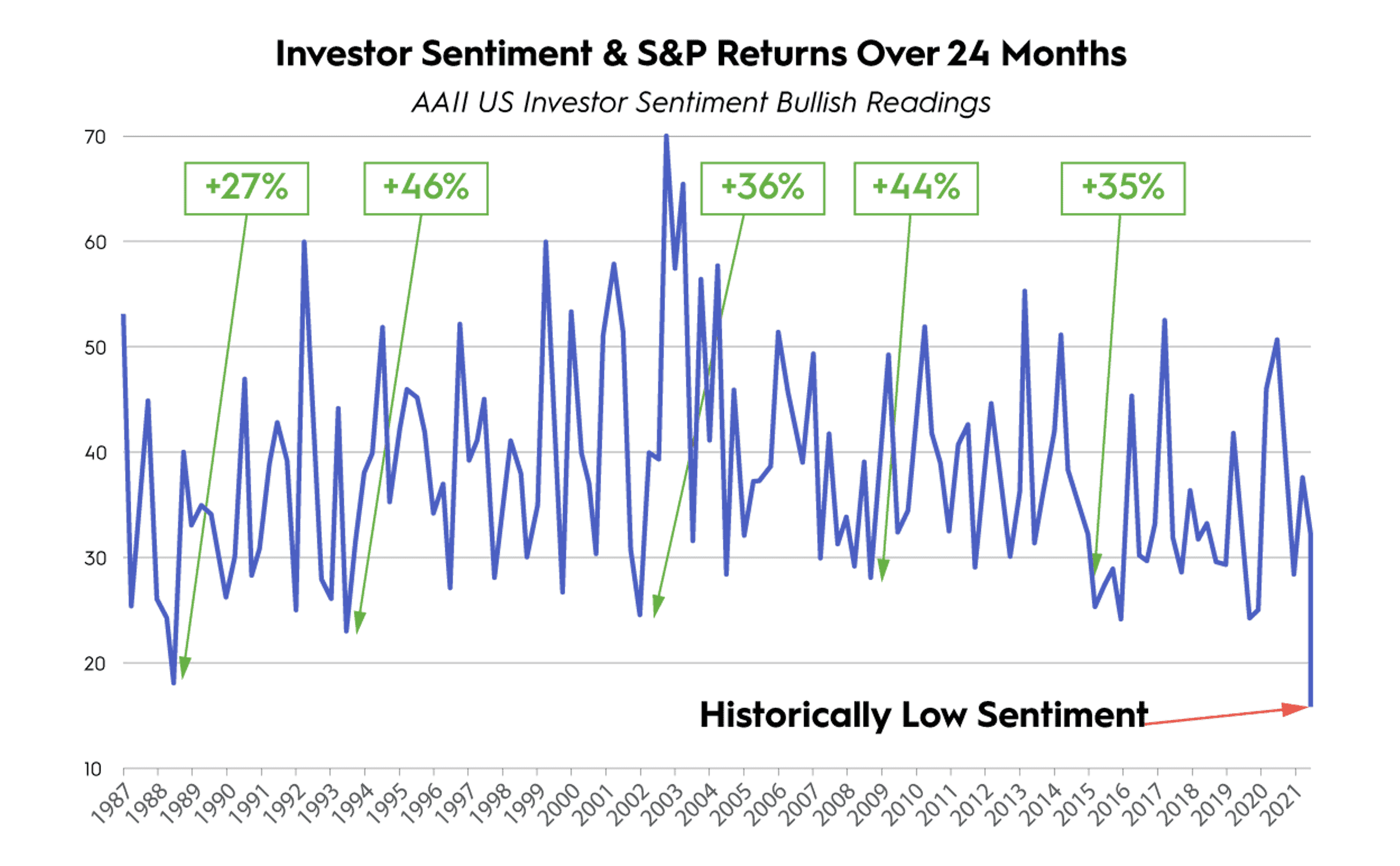

Even more recently, data suggests that small caps experience a particular “pop” following a market downturn… which means today could be an especially advantageous time to pile in!

See for yourself what’s happened over the past three decades when investor sentiment was as bad as it right now…

Just when investors have felt extremely uncomfortable and afraid, we’ve seen the market charge back with a vengeance.

Now, I don’t have a crystal ball. So I can’t guarantee you when this market will flip… but I will tell you that I think many of the stocks Motley Fool Canada are recommending will be worth more 3-5 years from now.

And our investors are actively buying stocks. In fact, some of our investors are buying stocks more actively than they have in the past two decades!

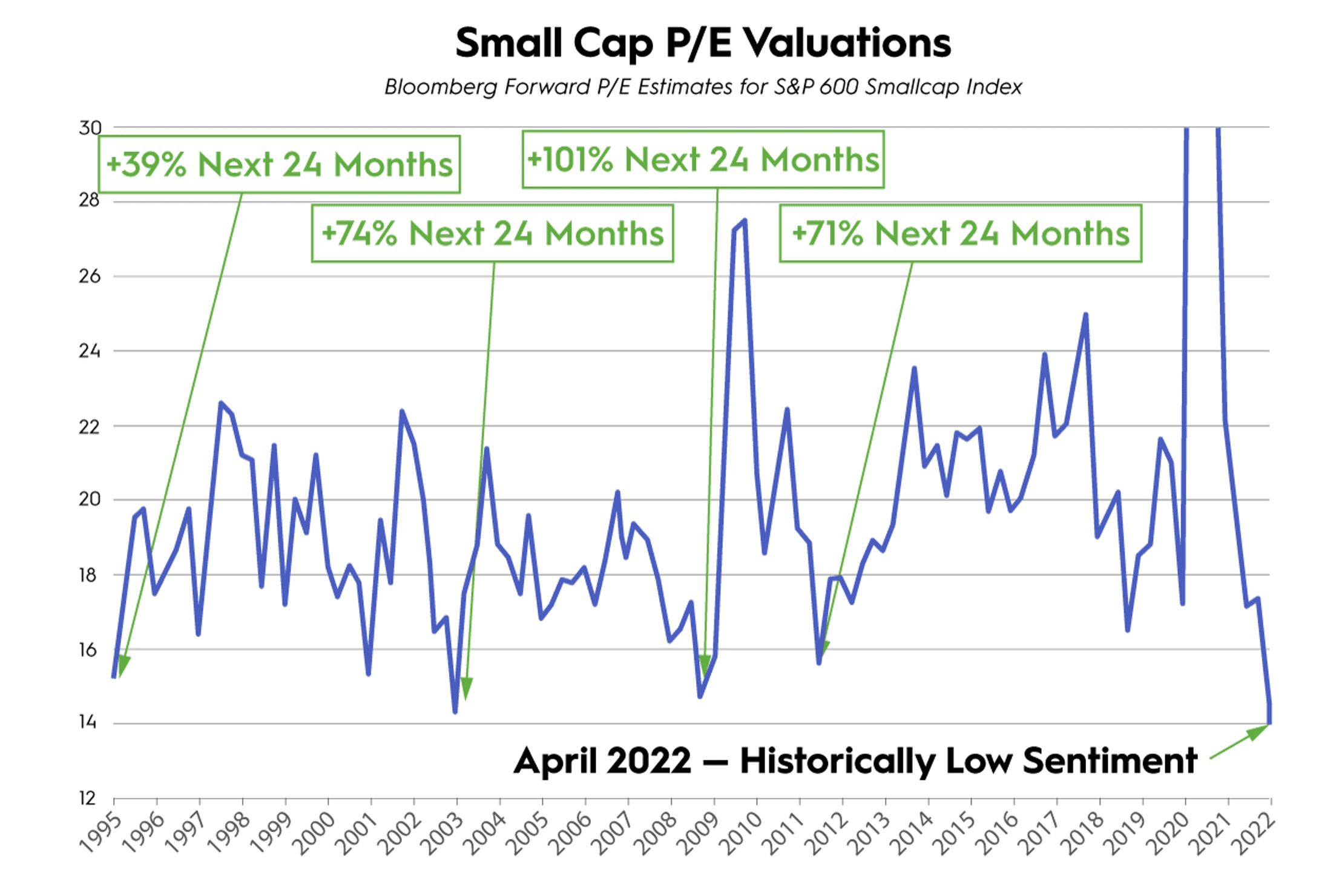

In terms of which stocks to buy, may I suggest we look at one final chart for an incredibly bullish signal on small-cap stocks specifically…

You can see that small-cap stocks are trading at the cheapest valuations they’ve traded at since 1995!

Needless to say, we’re seeing some absolutely incredible small-cap deals compared to where prices were just a few months ago.

Put that together with the fact that we often see extreme swings back to high valuations shortly after we hit these bottoms, and our entire Canadian investing team believes we’re looking at a very attractive buying opportunity right now when we look 3-5 years out.

On that note, please allow me a proper introduction…

My name is Jill Ralph, and as I said earlier, I’m the General Manager of Motley Fool Global.

And like you, I’m a hard-working investor who’s always on the lookout for ways to grow the money I’ve made into the wealth I want…

Mostly just so that I can help set my family… my kids… and perhaps even my grandkids up for a lifetime of comfort and security.

But also, if I’m being completely honest, so that I can make a few of my own lifelong dreams finally come true.

Which is why I jumped at the chance to come work at a company like The Motley Fool — where I could not only earn money, but also discover the very best ways to put that money to work for me.

After discovering first-hand the incredible fortune-building power of small-cap stocks – not to mention that it’s statistically improbable to find true home-run winners if you aren’t investing in small-caps – I’ve begun to completely rethink how I’m going to invest my money going forward.

My guess is after reading this, you may want to as well!

But even if you’d prefer not to take my word for all of this, I bet you’ll take the word of the greatest investor in the history of the world – a man I consider a personal investing hero of mine:

“I think I could make you 50% a year on $1 million. No, I know I could. I guarantee that.”

-Warren Buffett

That’s legendary Berkshire Hathaway CEO Warren Buffett guaranteeing how much money he could make per year if he were able to do nothing more than invest in small-cap stocks.

Not personal relationships with the founder, CEO, or anybody on the executive leadership team…

Not getting a glimpse at some magical insider financial document…

Not the ability to privately tour a company’s facilities and interact with their employees in person…

Nope, nothing more than, “If I could invest in small-caps, I’d return 50% per year.”

That’s the playground I want to play in!

Unfortunately for Buffett, because he’s in charge of a $475 billion company, he simply has too much money to meaningfully invest in small-cap stocks.

After all, small-caps in Canada can be anywhere from roughly $50 million to below $2 billion.

Not only do a lot of these smaller companies have extremely limited trading volume, but even if Buffett were able to buy shares in a meaningfully way, the effect of a massive share price increase would barely move the needle on his billions.

Which brings me to…

Our No. 1 – and perhaps our only – investing advantage over Bay Street and Wall Street!

Because if small-caps are too tiny for Buffett’s billions, imagine how much of a problem they pose for Bay Street and Wall Street’s trillions.

Despite the incredible amount of research showing that small-cap stocks have significantly outperformed other stocks over the years, it’s not even worthwhile for most institutional investors to play in small-cap pond.

No wonder that in addition to his earlier quote, Buffett also said, “It’s a huge structural advantage NOT to have a lot of money.”

Fortunately for you and me both, we don’t have that problem!

So not only can we reap the potential benefits of small-cap stocks can provide as much as we’d like, we can do so knowing that these companies are largely under-followed or even completely untouched by the investing industry at large.

It’s like our very own personal “small-cap investing playground,” that only everyday investors like us can be a part of.

Of course, just because the stocks inside the playground are small, that doesn’t mean the playground itself is.

In fact, last time I checked there are 2,874 small-cap stocks in Canada alone, across both the TSX and the TSX Venture Exchange. And the U.S. has a staggering 3,677 public small-caps across its various exchanges.

Put the two together, and you’re looking at a total small-cap universe of 6,551 companies!

And keep in mind, a lot of those are companies that have remained small-caps precisely because they have rubbish businesses…

Others are so volatile and unpredictable that they’re equally as likely to go bankrupt as they are to be a sound, long-term investment…

And still others are so tiny that it’s basically impossible to know much of anything about their business at all!

Point being, it’s not like you can simply scroll through a list of stocks and look for the ones that happen to be small-caps, or you’re probably going to be tossing good money into a fiery pit.

You have to know how to find the RIGHT small-caps, using the RIGHT strategy and the RIGHT philosophy.

Given not only that, but everything else we’ve talked about today, it really isn’t surprising that 4 out of 5 Motley Fool Canada readers just like you told us they’d be sincerely interested in an exclusively small-cap investing solution from us here at Motley Fool Canada…

Including guidance on precisely which small-cap stocks we think look like they could truly be the next addition to that “Top 10 Best-Performing Stocks of the Decade” list I shared above… and which ones investors should steer away from.

Which is why it gives me great pleasure to introduce you to the specific solution we launched on your behalf… Motley Fool Hidden Gems Canada!

This is the first-ever service from Motley Fool Canada SOLELY focused on small-cap stock recommendations.

Motley Fool Hidden Gems Canada took months of planning and preparation along with endless hours of intensive research, and early adopters have already been able to snag some truly great small-cap stocks…

And the really good news is that as per usual here at Motley Fool Canada, we are offering our ironclad 30-day, “Full-Membership-Fee-Back Guarantee,” which makes it possible starting TODAY for you to spend an entire month as a full-fledged member of Hidden Gems Canada in order to make sure it’s the right fit for you…

…then, if for ANY reason you aren’t totally convinced by everything you see inside the gates of Motley Fool Canada’s first-ever small-cap-exclusive investing solution?

Simply contact us by Day 30 of your membership, and we’ll happily refund your membership fee in full. No cable company run-around. No hard feelings. No risk to your membership fee whatsoever.

That said, you won’t even have to wait a SINGLE day to begin investing the Hidden Gems Canada way.

Because we already have a highly-vetted list of 70+ small-cap stock recommendations available right now on our private, members-only website – each accompanied by a comprehensive, deep-dive stock write-up straight from our analyst team, including…

An exploration of the company’s business model, and how that business model could change as the company continues to grow…

A thorough, yet easy-to-understand financial breakdown…

An examination of the company’s overall market opportunity, including why we love their potential upside as a small-cap company…

A full list of risk factors and threats to keep an eye on in the years and decades ahead…

…and much, much more.

And despite an up-and-down market, many of our stock recommendations in Hidden Gems Canada have already posted huge returns for our members who’ve followed along! In fact, the small-caps investing strategy we employ in this new service has quickly helped us discover winners like:

ShockWave Medical up +272% since we recommended it on August 16, 2019.

Fulgent Genetics up +195 since we recommended it on February 21, 2020.

GameStop sold for a +710% profit in just 4 months, when we recommended it in September 2020 and sold it in January 2021.

Acuity Ads up +178% since we recommended it on July 3, 2020.

Trisura Group up +168% since we recommended it on March 6, 2020.

Those sorts of returns are no small feat for stock picks that only date back a couple of years or less...

But there's no need to cherry-pick here... because the AVERAGE recommendation in Hidden Gems Canada has returned over 20 percentage points.

And remember, with our 30-day “Membership-Fee-Back Guarantee,” you can of course simply join today, read through each one, and then cancel your membership and end up with a full refund to your membership fee!

So if you’re ready to get started right away and dig into our entire collection of small-cap stock recommendations within the walls of Hidden Gems Canada, then just click the button below now to get started today - before your offer expires at MIDNIGHT!

Or if you’re the kind of investor who prefers to do a fair amount of due diligence before you plunk your hard-earned money down — personally, I’m right there with you — please feel free to read on and learn a little bit more about Hidden Gems Canada…

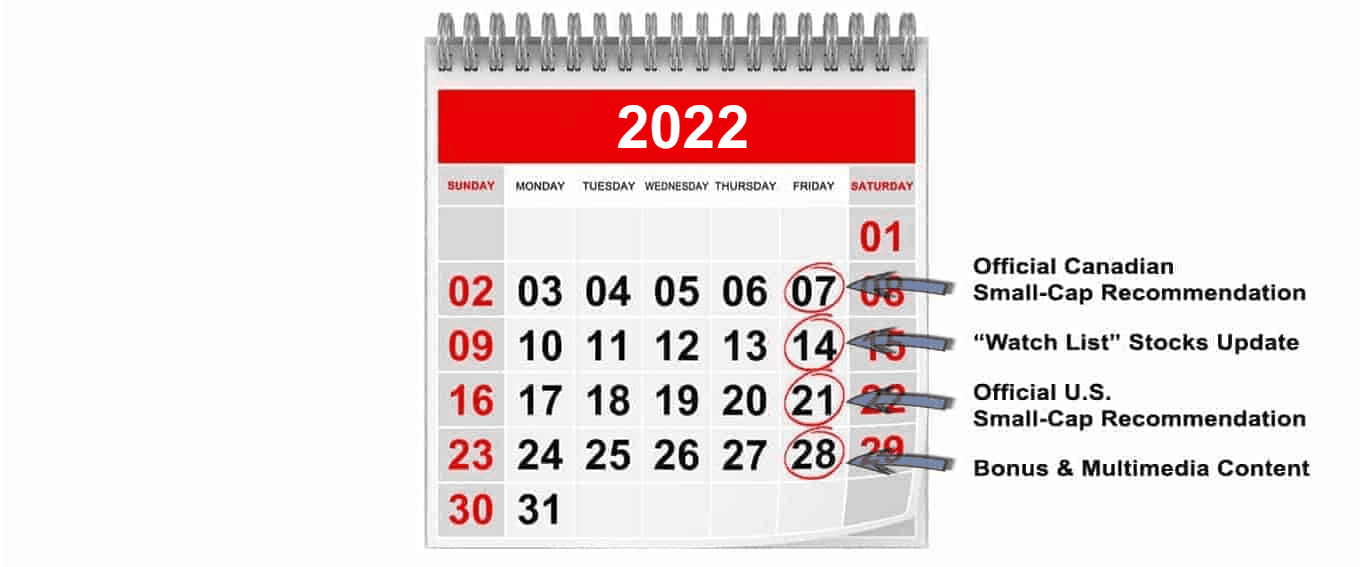

Here’s what the average month will look like as a Hidden Gems Canada member!

While it’s true that our Hidden Gems Canada team has indeed already peeled back the curtain on more than 70 small-cap recommendations (which are currently waiting for you as we speak), it’s not like they’re going to be slowing down any time soon.

In fact, they’re already busily preparing for the rest of 2022 (and beyond) as we speak. So have a look at what your average month in the life will look like, should you choose to join us as a Hidden Gems Canada member.

1st Friday of Every Month: Official Canadian Small-Cap Recommendation

After weeks of poring over hundreds of potential stock picks, our team will release a formal BUY notification of their No. 1 Canadian small-cap stock for new money now, along with a comprehensive write-up accompanying it on our private Hidden Gems Canada members-only website. And of course, you’ll be sent an urgent email alert the second the recommendation is live!

2nd Friday of Every Month: “Watch List” Stocks Update

These are where we put the companies our team has done a massive amount of research on and has a high confidence in, but for various reasons they aren’t quite ready to formally recommend to Hidden Gems Canada members quite yet. The valuation may be a bit too high. There could be rumours we’re waiting to sort out. A key executive may have just exited the company and our team wants to see who the replacement is.

3rd Friday of Every Month: Official U.S. Small-Cap Recommendation

You’ll receive the exact same quality and depth of coverage when our team officially reveals this month’s No. 1 Hidden Gem from the U.S.

4th Friday of Every Month: Bonus & Multimedia Content

This 4th Friday will serve as an exciting piece of bonus or multimedia content such as crucial updates on our current recommendations, video interviews with key C-level executives, podcasts with the entire analyst team, interactive live chats, and more!

And here’s how that will look month in and month out on your calendar.

In Motley Fool Hidden Gems Canada, you’ll never spend the entire month sitting around and waiting for new recommendations. We have regularly scheduled programming coming out every week, and will have loads of other great content dropping daily!

But here’s one of the best parts of the opportunity you have in front of you today...

If you join right now with the biggest discount we've EVER offered, you'll be able to join our Hidden Gems Canada members just in time to access our brand-new small-cap recommendation about to be released... AND the one we released just last week!

Which means all you have to do is sign-up right now and immediately check out our newest recommendation along with the full write-up on why we think it's a valuable stock to add to a portfolio.

…and even after getting all of this content, plus multiple new stock recommendations, you’ll still be able to receive a full refund of your membership fee by Day 30 of your membership!

So by now you may be wondering, “This all sounds great, but who’s going to actually lead me on this small-cap journey?”

Which is why right now is a perfect time for you to…

Meet our all-star Hidden Gems Canada analyst team!

Of course, there’s no doubt that perhaps more than any other investing style, small-cap investing relies on an analyst team with an intricate and nuanced understanding of the specific investing landscape of each country they’re looking at.

And because Motley Fool Hidden Gems Canada will indeed target both Canadian and U.S. small-caps, we thought it only right to have both Canadian and American analysts!

Starting with a couple gentlemen you’re likely well acquainted with already here at Motley Fool Canada…

Jim Gillies – Lead Advisor

Jim Gillies is a seasoned investing veteran who has worked shoulder to shoulder with some of the sharpest investing minds at The Motley Fool.

A dyed-in-the-wool value investor and lover of small equities, Jim also supplements his prudent portfolio with opportunistic options strategies. He believes that if you can’t tell a story with numbers, it’s probably not worth telling.

When not playing with financial matters, he’s honing his amateur chef skills, mashing around the country on one of his bikes, or futilely anticipating the return to glory of the Toronto Maple Leafs and New York Islanders (it’s been a long wait).

Iain Butler – Chief Investment Advisor

Iain Butler is Chief Investment Advisor for the Motley Fool Canada and is the Lead Advisor on its flagship Stock Advisor Canada product and Co-Advisor for Motley Fool Hidden Gems Canada.

Before joining the Fool, Iain was a “buy-side” analyst and through this experience is well-versed in the idiosyncratic ways of the Canadian market.

His investing interests are centered on scouring the market for interesting businesses that trade at reasonable prices and offer an appealing risk/reward relationship, which he's focused on doing on in Motley Fool Canada’s first-ever small-cap focused investing solution.

Buck Hartzell – Investor Learning and Operations

Having grown up in a family business, Buck developed an interest in compounding money early in life. He is forever indebted to his mother for introducing him to investing.

Buck earned a B.A. in Sociology from McDaniel College and an MBA for Wake Forest University. In 1998 he became a fulltime Fool, initially working in the Fool’s technology department.

He now heads up investor learning and operations working closely with the Fool’s world-class group of analysts. His Motley core value is… Be Learning, Always.

So with some of the best and brightest of both our U.S. and Canadian analysts, you can see why I think this may very well be the single most talented cast of investors we’ve ever assembled on one Motley Fool Canada service. An all-star team indeed!

But in our estimation, that’s simply what a tricky, yet often incredibly lucrative, focus on small-cap investing requires.

And make no mistake about it, our team’s goal is nothing short of finding largely unheard-of stocks that we believe have the ability to change our members’ life forever over the next 5… 10… and yes, even 25 years.

Which leaves us with just one final topic to discuss…

How much do think it’s worth to join Motley Fool Hidden Gems Canada today?

If you’ve ever done any research on premium small-cap investment products before, you may already be expecting Hidden Gems Canada to run you upwards of a thousand dollars per year, if not more…

But don’t worry, you won’t have to pay thousands of dollars… or even a thousand dollars to become a member of Motley Fool Hidden Gems Canada today.

In fact, you won’t have to pay anywhere near even half that…

That’s because we’re offering you a heavily discounted, 70% OFF list price of Hidden Gems Canada at just $149 for one year of membership.

When you break it down, that comes out to just $12.41 per month… $2.86 per week… and a measly $.40 cents per day for everything you get as a member of Motley Fool Hidden Gems Canada. Just take a look for yourself with...

A small sample of everything you get from membership to Motley Fool Hidden Gems Canada!

Our "Treasure Chest" of Over 70 Recommendations: These 70+ stocks are ones that our expert analysts have picked since we first launched in early 2018 — all of which are currently awaiting you RIGHT NOW on our members-only page, each accompanied by a comprehensive write-up.

2 Brand-New Monthly Recommendations: You'll receive one official Canadian and one U.S. small-cap recommendation each month, like clockwork, as long as you’re a member.

Multimedia Centre: Here's where you’ll be able to peruse the wide assortment of video interviews and other multimedia content that Hidden Gems Canada will be placing a greater emphasis on than any other Motley Fool Canada service. Some of our current content includes one-on-one interviews with the CEOs of KushCo Holdings, Viemed Healthcare, BioSyent, and MORE!

Private, Members-Only Message Boards – Where you can discuss your favourite small-cap stocks… general investing… or even day-to-day life with your fellow members, as well as our entire Hidden Gems Canada team.

Regular Updates – So you can always be the first to know about important developments affecting the companies our team has recommended.

"Watch List" and Best Buys Now – Full access to both Hidden Gems Canada’s official “Watch List” and “Best Buys Now” list (once it’s available), so you’ll always be clued into which small-cap stocks the team is considering recommending next and which of their current recommendations they are most excited about right now!

Additional Commentary and Guidance – Team commentary and general guidance on the topics that affect you most, including everything from macro-economic concerns to proper diversification to the nuances of small-cap investing.

Not to mention a slew of special reports that you’ll have access to the second you join Hidden Gems Canada, such as...

The Small-Cap “Amazon of the North” Has Arrived (Yours FREE!)

When The Motley Fool first recommended Amazon to its U.S. members in 1997, it was just a small-cap stock trading for roughly $1 a share... but many investors failed to take it seriously.

Fast-forward to today, Amazon's stock is up a mind-boggling +32,000% - turning every $5,000 invested into roughly $1.6 MILLION!

Now, a Canadian small-cap stock is being called "The Amazon of the North" by some market insiders.

The crucial data on this fast-emerging opportunity is presented in The Small-Cap “Amazon of the North” Has Arrived, a straightforward, easy-to-digest report (yours FREE when you join Hidden Gems Canada!).

The Motley Fool Investing Team’s 10 Highest-Conviction Small-Caps (Yours FREE!)

Using our private proprietary database called “Fool IQ” that incorporates data from our worldwide network of analysts, we compiled a top 10 list of highest-conviction small-cap stocks across The Motley Fool.

These are the SAAS superstars in hiding... the heavy-hitting healthcare companies... and even a company that resembles an early Berkshire Hathaway — before it became the $500 billion company we know today.

Quite simply, these are the consensus small-cap picks spanning our entire Motley Fool network, and while there's no such thing as a guarantee in the world of investing, you can rest assured we have the highest conviction in these companies.

Valued at $116, this report is yours FREE when you join Hidden Gems Canada today!

And not only that… you’ll also receive a BRAND NEW REPORT featuring our #1 TSX small cap pick for new money right now! Talk about hot off the presses…

Small-Cap Sleeping Giant: One Tiny Canadian Stock Ready to Wake From Its Slumber (Yours FREE!)

The supply chain has been one of the hottest topics of the past 12 months, and this little-known Canadian dark horse is a key player in solving supply chain issues with their cutting-edge software.

Our Hidden Gems Canada team has recommended this tiny TSX stock not just once… but TWO times - that’s how high their conviction is.

Now, they’re pounding their fists on the table once again as this stock is down 50% from where it was six months ago even though the business continues to outperform expectations.

It’s safe to say that 5 years from now, many investors may wish they’d have grabbed this stock for their portfolios. Why wait 5 years just to regret potentially missing out? Get all the details today with our brand-new report!

You get access to all of the content AND reports above for just $.40 a day… or less than it would cost you to buy a pack of chewing gum.

With that said, there is just one final thing you need to keep in mind…

That your access to our 70% OFF Hidden Gems Canada Special Sale will be gone at MIDNIGHT…

Because Hidden Gems Canada is indeed dealing exclusively in small-cap stocks, we’re concerned that if we open up our gates to an unlimited amount of hungry investors all at once, many of our brand-new members would quickly lose the opportunity to get in at the particular share price we’re recommending the stock at.

Which is why we’re currently only marketing this Motley Fool Hidden Gems Canada offer exclusively to Fools like you, and we'll be closely monitoring how many members take us up on it.

So remember that by joining today you can…

Immediately access all 70+ small-cap stock recommendations our team has ever issued…

And lock in your limited-time, 70% discount that will save you $350... which you can immediately put into some of the under-valued stocks we see on the market right now...

Grab that brand-new Top 10 Highest-Conviction Small-Caps report worth $116... plus the new report featuring our #1 TSX small cap right now…

Join our top analysts and thousands of other savvy Canadian investors on the hunt for small-cap stocks...

And simply contact us by Day 30 of your membership period if you're not completely satisfied and we’ll refund your entire membership fee. No questions asked.

But if you wait too long, this offer WILL expire at MIDNIGHT, and…

You WILL no longer be able to get our small-cap investing solution, Hidden Gems Canada, for this completely unprecedented price.

So hurry! Please don't risk missing out by leaving this page.

Just click the button below to get started now!

Jill Ralph

General Manager

Motley Fool Global

P.S. Still have questions about Motley Fool Hidden Gems Canada or your personal invitation? Just send them to [email protected], and we'll get back to you shortly! Just make sure to act quickly because your offer will expire at MIDNIGHT!

Returns as of 5/23/2022 unless otherwise noted. John Mackey, CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Fool contributor Buck Hartzell has positions in AcuityAds Holdings Inc., Berkshire Hathaway (A shares), Berkshire Hathaway (B shares), and Fulgent Genetics, Inc. Fool contributor Iain Butler has positions in AcuityAds Holdings Inc., Biosyent Inc., Fulgent Genetics, Inc., Shopify, and Viemed Healthcare Inc. and has the following options: short July 2022 $45 puts on Fulgent Genetics, Inc. Fool contributor Jill Ralph has positions in Amazon and Shopify. Fool contributor Jim Gillies has positions in AcuityAds Holdings Inc., Amazon, Berkshire Hathaway (B shares), Biosyent Inc., Fulgent Genetics, Inc., Shopify, TRISURA GROUP LTD, and Viemed Healthcare Inc. Fool contributor Nick Sciple has positions in Berkshire Hathaway (B shares) and Shopify. The Motley Fool has positions in and recommends AcuityAds Holdings Inc., Biosyent Inc., Fulgent Genetics, Inc., GDI Integrated Facility Services Inc, Shopify, TRISURA GROUP LTD, and Viemed Healthcare Inc. The Motley Fool recommends Amazon, Berkshire Hathaway (B shares), POLLARD BANKNOTE LIMITED, and ShockWave Medical.

Hidden Gems includes U.S. stocks. All billing is in CAD. You will be billed according to your choice below and then $499 for each year thereafter.

Having trouble ordering or have any questions for us? Just send them to [email protected], and we’ll get back to you ASAP!