To complete your order, it is necessary to enable JavaScript.

Motley Fool Canada - Order Now!

Already a member? Login

Discover how the economic recovery could deliver potentially stunning profits…

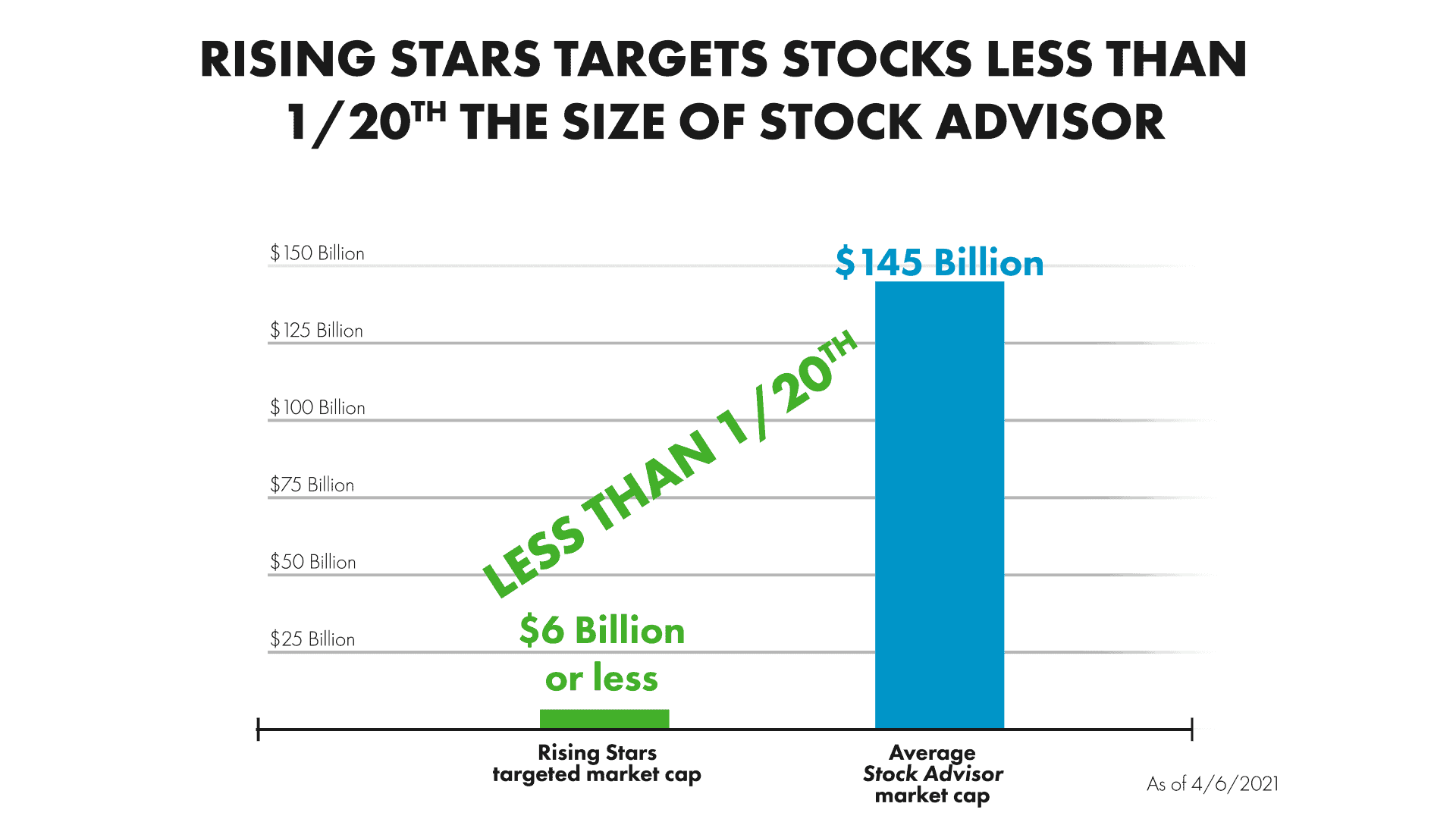

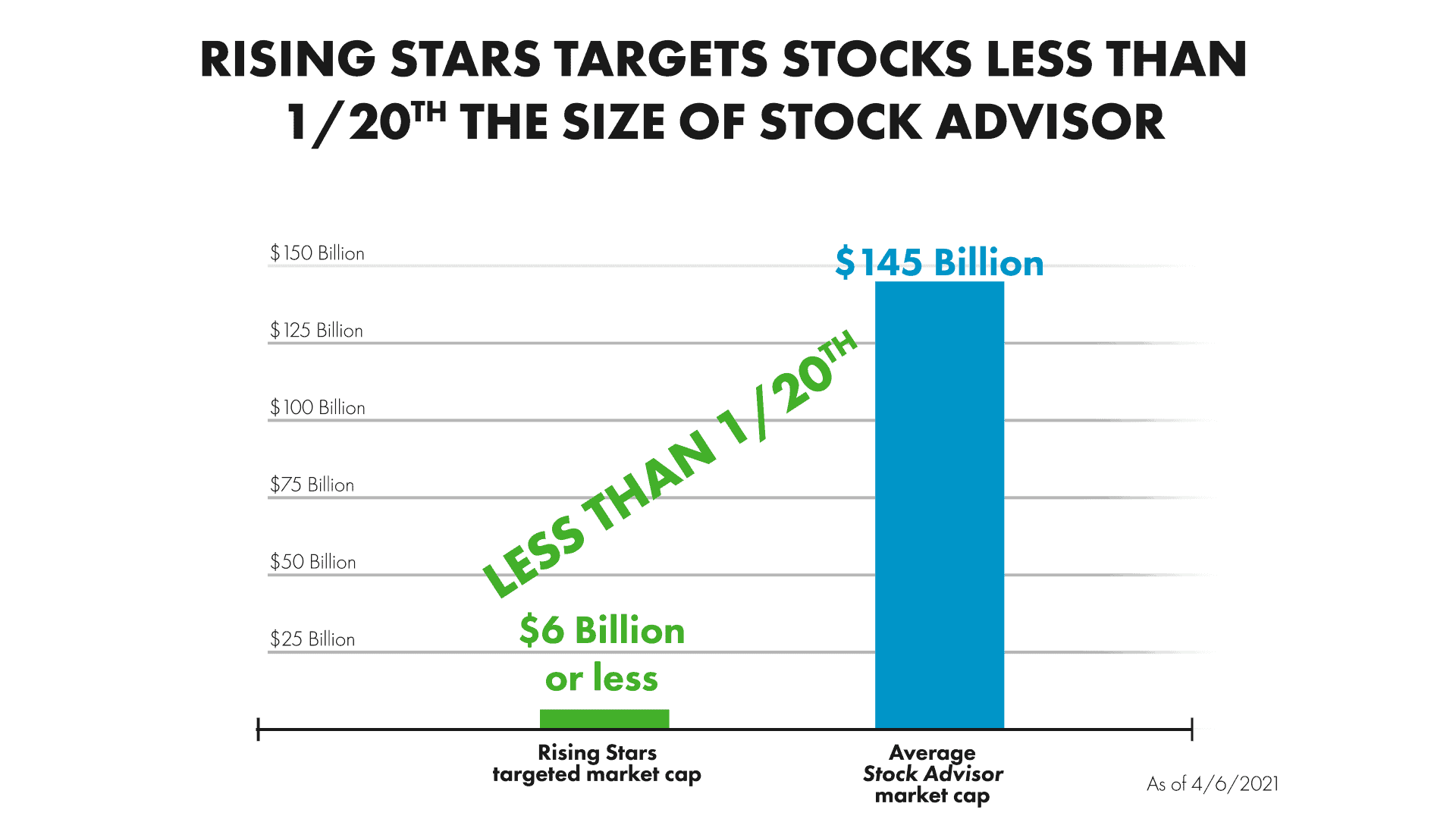

By targeting the ambitious, little-known stocks (1/20th the size of the average Stock Advisor Canada pick) that we believe can deliver massive wealth injections to bold investors.

Dear fellow investor,

As COVID lockdowns ease around the country and the economy kicks into gear… I believe one key question should be on the mind of every investor:

“Who’s poised to benefit as everyone finally reopens?”

Do an internet search, and you’ll get all the big names. Disney! Boeing! JP Morgan! American Airlines! Johnson & Johnson! Carnival!

As if everybody hadn’t already figured out last year that travel companies and banks were likely winners as the economy takes off.

Frankly, if there’s anything I’ve learned in my 20 years of investing, it’s that once everyone “already knows” about something, it’s too late to profit from it.

The stock market is forward-looking, and it prices in conventional wisdom.

Which means that, if you want to seek an advantage over the stock market, well…

You’ll probably have to be unconventional.

You have to get in early. BEFORE everyone else figures out the next big opportunity.

So — if you’re looking for something more than the same tired old massive stocks trying to grind out 10% gains for their investors, then I’ve got some good news.

First: Over the last 30 years, in economic situations like we find ourselves in today — U.S. small-caps have wildly outperformed the broader market.

That’s right — unlike The Motley Fool’s best-known U.S. services like Stock Advisor and Rule Breakers, which focus on large-cap stocks like Amazon, Disney, Netflix, and Apple — we believe the biggest winners in 2021 could be quite a bit smaller and less well known.

Put differently, we’re confident that the big winners for 2021 won’t be named Disney, Apple, Carnival, Boeing, JP Morgan, or other “obvious” names.

In fact, our research is centering on U.S. stocks that are less than 1/50th the size of JP Morgan or Johnson & Johnson….

And less than 1/20th the size of the average U.S. Stock Advisor pick!

Chart refers to U.S. market and USD.

Why are we focusing on little-known small-cap stocks?

Historical facts.

You see, over the last 30 years, whenever the U.S. has suffered an annual GDP decline… once the economy turns back to growth, the U.S. market has always gained the next year — by an average of almost 9%!

Small caps have always gained too.

On average by 34% — or about 4x the broader market. All in that next year.

I mean, if I told you that something had historically enabled investors to quadruple their returns within a year… you’d want to do it, right?

The way I see it, now’s your chance.

About three and a half years ago, Motley Fool CEO Tom Gardner decided to take all of the knowledge we’d heretofore gained and put it toward a decidedly ambitious goal:

Target the handful of U.S. microcap and small-cap stocks that he thought could deliver far superior returns… concentrating his bets in the handful of “rising stars” that represented his highest-conviction ideas.

The results validated his plan… pretty spectacularly. The original Rising Stars portfolio has beaten the broader U.S. small-cap indices by 2.5x since inception!

Now, many investors would probably have been content to just rest on their laurels. Beating small caps by 2.5x in just a few years is an impressive enough outcome.

But not Tom.

Which is why, two years later, in late 2019, Tom decided to prove that it wasn’t just a “flash in the pan.”

He rolled out the Rising Stars 2020 portfolio. And the results speak for themselves:

That’s right: Rising Stars 2020 has outperformed small caps (as measured by the Russell 2000) by nearly 3x.

It’s also beaten the broader market by quite a bit more, as you can see — again, proving out the value of getting in early on these fantastic stocks…

This formula has delivered massive success to the Rising Stars portfolios… in full view of the handful of Motley Fool members who were bold enough to follow Tom Gardner and his Rising Stars team as they picked these aggressive, visionary companies – before any other portfolio service team at The Motley Fool.

And this “early bird” success is a big part of why I’m confident you’ll never see well-known stocks like Tesla, Apple, Shopify, Amazon, and Netflix recommended in a Rising Stars portfolio.

After all:

#1: They’re just too big. Rising Stars is all about targeting small-cap and microcap stocks — with the team aiming for market caps of US$6 billion or less. In fact, the team is targeting stocks less than 1/20th the size of the average U.S. Stock Advisor pick.

Chart refers to US stocks.

#2: These stocks are simply too well known. I don’t think you need a premium service like Rising Stars to tell you about Netflix, or Apple, or Shopify, or Tesla. The team is happy to leave those kinds of picks to the broader internet.

#3: These stocks are already Fool recommendations many times over. And again — the whole point of Rising Stars is to find under-the-radar U.S. stocks early.

That “early bird” focus was key to Rising Stars’ smashing successes with Fiverr, Appian, and Fulgent Genetics.

Plus — and I can’t emphasize this enough…

We can’t ever guarantee that any stock first identified by the Rising Stars team will even be picked later by another team.

The Rising Stars team is looking for a precise type of stock that matches the “Rising Stars formula” — and their aggressive approach is simply not shared by every other Motley Fool analyst team.

With Rising Stars targeting stocks that are less than 1/20th the size of the average Stock Advisor pick, it’s just a matter of math — I’m confident that plenty of the stocks earning the title “Rising Star” will never be recommended outside this unique suite of products.

Why we believe now is the perfect time for aggressive investors to follow the “Rising Stars formula” in pursuit of what could be massive gains

I won’t spend a lot of time rehashing why the macro situation appears to be so favorable to U.S. microcap and small-cap investing — with Bank of America saying small caps will be “clear winners” even in the event of a market downturn, I think it’s pretty clear that we could be in a true “win-win” situation where U.S. small-caps and microcaps could win whether the market goes up or even down!

No — the reason I’m really most excited about pursuing the “Rising Stars formula” right now is… simply…

Because we now have enough data that I think even the most skeptical investor will agree that the “Rising Stars formula” has been a smashing success!

Look — I 100% understand why plenty of U.S. investors chose not to join Rising Stars in 2017.

After all, this was an unproven formula. And even though our CEO Tom Gardner and the broader analyst team here at The Motley Fool were highly confident in its eventual success, I’m sure plenty of our members were skeptical.

Of course, they missed out on what’s been an incredible run ever since.

Take Coupa Software, up 417% since first introduced to The Motley Fool US via its Rising Stars debut in September 2017 — actually down 26% since it was later recommended in U.S. Stock Advisor in December 2020.

Or Appian, again up 439% since its “early bird” Rising Stars recommendation, versus “just” a 211% average return by the other services outside Rising Stars.

And again — that 211% return is great in any scenario… except when you compare it to what investors could have achieved with Rising Stars.

That’s the benefit of getting in early, plain and simple.

Now, when we launched Rising Stars 2020, I’m sure there were some who thought the Rising Stars team just got lucky and couldn’t duplicate — much less improve upon — those results.

Of course, they did just that. And members who failed to act missed out on winners like Fiverr, or Live Oak Bancshares, another company that has never been recommended in U.S. Stock Advisor or Rule Breakers.

Live Oak Bancshares’ average recommendation outside Rising Stars is up 41%. Not bad in any scenario! But its “early bird” first recommendation ever at The Motley Fool in Rising Stars 2020… that one’s up 204%.

Again, the benefit of getting in early on these picks with the Rising Stars franchise.

And as I noted earlier — since Rising Stars 2020’s inception, it beat our U.S. Stock Advisor by 61 percentage points in just eighteen months. That’s the difference between turning a $500,000 portfolio into $920,000 by following Stock Advisor… and turning the same $500,000 portfolio into a $1.52 million portfolio with Rising Stars 2020. In just eighteen months!

That’s money, plain and simple.

So again — we have a systematic approach that has consistently beaten the broader market in the Rising Stars portfolio…

And then we ran it again in Rising Stars 2020…

At this point, I think it’s fair to say that Tom Gardner and his team have proven their ability to drive massive returns for investors… if they’re bold enough to follow them into these aggressive, ambitious, high-growth U.S. stocks.

Now, listen — if you’re beating yourself up for not joining the original Rising Stars portfolio (which was only offered in the U.S.) or Rising Stars 2020 (which we were able to offer to Canadian Fools), please don’t.

As I said — the “Rising Stars formula” was unproven in its early days. So I can entirely understand why plenty would have chosen to sit on the sidelines.

And regardless, this is all in the past.

There’s nothing to be done about it at this point.

The only thing that matters now is: Knowing the power of the “Rising Stars formula,” what do you do next?

Because we’re seeing a time-sensitive opportunity in the “12x scenario” — and we’re determined to take full advantage.

Which is why I’m very pleased to announce this special offer to join Rising Stars 2021.

Tom Gardner’s “all-in-one” U.S. small-cap and microcap-focused investing solution.

In it, he and his analyst team have taken all the lessons of the past two Rising Stars portfolios — and the “Rising Stars formula” that has twice delivered such incredible results…

Every ounce of talent and knowledge they can bring to bear…

Not to mention countless hours of research and analysis…

And applied it all straight to identifying their highest-conviction high-growth U.S. small-cap and microcap stocks for 2021 and beyond.

When you join Rising Stars 2021 today, you’ll get:

Instant access to all the U.S. stocks in the Rising Stars 2021 portfolio. We’re targeting stocks we think can deliver 500%+ returns in the coming years. Stocks like…

The little-known healthcare stock targeting 88x potential business growth as it transforms its successful research platform into a growth engine. A true rising star, and NEVER BEFORE RECOMMENDED BY THE MOTLEY FOOL.

The tiny stock aggressively targeting a US$344 billion total potential opportunity — it’s currently just 1/426 the volume of the market leader, but it’s rapidly expanding (adding a new office every 1.5 days, on average) as it gobbles up market share. Again, NEVER BEFORE RECOMMENDED BY THE MOTLEY FOOL.

The recent IPO (joining the NASDAQ in December 2020) with a differentiated artificial intelligence-based business model that gives the company what I view as a clear advantage over the competition. Strong 108% net dollar retention makes this little-known company a slam dunk, in my opinion. And, yet again, NEVER BEFORE RECOMMENDED BY THE MOTLEY FOOL.

Our fully allocated game plan — backed up by The Motley Fool LLC’s own investment cash. No guessing about allocation here — every investment recommendation in the Rising Stars 2021 portfolio will be backed by cash from The Motley Fool LLC, so you can see EXACTLY how our team of professional analysts allocate money to each stock so it’s not just a disparate group of stocks but a team of companies welded together with the goal of helping members take full advantage of this time-sensitive small-cap/microcap window as effectively as possible.

Ongoing trade alerts. The team plans to allocate additional cash (and make additional stock purchases) quarterly for the next year. Plus the team may tactically recommend “Scout Positions” for those members looking to invest in the most bleeding-edge ideas that the team is excited about but which haven’t as of yet earned an “official” recommendation nod. And of course — should the team decides to sell any positions, they’ll alert members so they can close out their investment first.

Now, I must note that since Rising Stars 2021 is a unique solution designed to give you access to some of The Motley Fool’s most cutting-edge small-cap and microcap research… much of which will be delivered immediately as soon as you join…we simply cannot offer cash refunds on this offer.

You see, we created Rising Stars 2021 for investors who are committed to building forward-looking portfolios with what we believe is the right strategy.

So, if a group of short-term traders were able to gain access to it — they could quickly trade on the stock picks within and then cancel without paying their fair share.

They could push up prices of the stocks and do a huge disservice to investors who are committed to this strategy for the long run.

However…

Special Access

All members joining through this Special Member Invitation are also covered by The Motley Fool’s exclusive satisfaction guarantee!

All members joining through this Special Member Invitation are also covered by The Motley Fool's exclusive satisfaction guarantee! If for any reason you’re not completely satisfied with Rising Stars 2021 in the next 30 days…

Then simply contact our helpful customer service team and they’ll happily work with you to provide your membership fee as a credit to one of our other Motley Fool Canada portfolio services.

We built this opportunity for investors like you!

We’ve offered such uncommonly generous membership terms today because we’re so confident in everything Rising Stars 2021 has to offer.

So if you have any interest at all in taking advantage of the most cutting-edge investing research at The Motley Fool…

…Including the “early bird” effect that we’ve seen drive such incredible historical gains for bold investors…

…Then you simply do not want to delay. And remember, you're protected by our Satisfaction Guarantee!

I'm extremely proud of the work that's been done to make Rising Stars 2021 the ultimate solution for investors seeking to capitalize on the massive, time-sensitive opportunity we see unfolding in U.S. small-caps and microcaps… And I hope you'll join this incredible community we've created.

To your wealth,

Michael Douglass

Michael Douglass

Analyst, The Motley Fool

The Motley Fool

Returns as of 04/11/2022 unless otherwise stated. John Mackey, CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Andy Cross owns shares of Appian, Fulgent Genetics, Inc., Johnson & Johnson, Netflix, and Tesla. Asit Sharma owns shares of Fulgent Genetics, Inc., Johnson & Johnson, and Walt Disney. Bill Mann owns shares of Appian, Shopify, and Walt Disney. David Gardner owns shares of Amazon, Apple, Netflix, Tesla, and Walt Disney. Meilin Quinn owns shares of Fulgent Genetics, Inc. and Tesla. Tim Beyers owns shares of Amazon, Appian, Apple, Netflix, Shopify, and Walt Disney. Tom Gardner owns shares of Appian, Fiverr International, Netflix, Shopify, and Tesla. The Motley Fool owns shares of Amazon, Appian, Apple, Coupa Software, Five9, Fiverr International, Fulgent Genetics, Inc., Live Oak Bancshares, Netflix, Shopify, Tesla, and Walt Disney.

Rising Stars 2021 includes U.S. stocks. All billing is in CAD. You will be billed according to your choice below and then $1,999 for each year thereafter.

This product is non-refundable.

Having trouble ordering or have any questions for us? Just send them to [email protected], and we’ll get back to you ASAP!