To complete your order, it is necessary to enable JavaScript.

Motley Fool Canada - Order Now!

Already a member? Login

YOUR OFFER EXPIRES IN...

Discover why, for the first time ever, The Motley Fool is throwing down $50,000 of cold, hard cash into a radical group of “moonshot” stocks we believe have near-term potential for 10X returns…

And how we’re inviting YOU and an extremely select group of growth-hungry investors to follow along trade-for-trade!

Please note:

This first-of-its-kind program is a high-risk, and what we hope turns out to be an extremely high-reward opportunity that we do not recommend for every investor. That’s why we’re exclusively inviting qualified investors and are only making a very limited number of seats available.

Once those spots are filled, you will no longer be able to access this exclusive new investing program. No exceptions.

If you’re reading this now then that means there are still a limited number of spots available… so while there’s still time, please review your full invitation below to discover:

How this renegade group of moonshot stocks has beaten some of The Motley Fool’s most profitable stock picks by as much as 10X in just 3 years…

Why some of the world’s smartest and richest investors WISH they could invest in these moonshot stocks but simply can’t…

How you can get a heavily discounted seat at the table as we unveil the first investing solution that we’ve EVER released exclusively targeting these explosive stocks…

But remember, this “Ground Floor” VIP invitation that we just announced this morning (complete with a $500 discount) is available until MIDNIGHT tonight only.

We’re also only accepting a very limited number of members into the program, which means this invitation could disappear before midnight… so you’ll need to hurry!

Dear Fool,

Microcaps have been some of the hottest stocks on earth.

Over the past year alone, microcaps (as measured by the Russell Microcap Index) have rocketed 65% on average.

That’s nearly double the return of the S&P 500, which climbed a mere 35% over the same time frame.

If you’ve been following along, you know microcaps are tiny companies that trade beneath the radar of many of the industry bigwigs on Wall Street and Bay Street…

Stocks that offer perhaps the highest risk/reward ratio of ANY other equity class…

And because of their small size, they’re able to grow in ways that are virtually impossible for large companies.

With huge stocks like Amazon and Apple and their market caps of $1.7 trillion and $2.5 trillion respectively, you’d be lucky to get a double from here.

The days of 10X returns from those market behemoths are likely long gone.

Microcaps are different. They allow you to get in as close to the ‘ground floor’ as most investors possibly can, before the most explosive growth occurs.

Despite their mouth-watering potential, some investors hate microcaps with a passion…

Others are head-over-heels in love with them.

Some lose thousands of dollars almost overnight chasing so-called “penny stock pipe dreams”…

And others become millionaires in record time by placing smart, calculated bets on up-and-coming dynamos.

Whatever your opinion is on microcap stocks, no one can deny the incredible allure that many investors feel for them.

We’ve noticed it first-hand on the Stock Advisor Canada forums with threads running rampant with hundreds upon hundreds of posts about one ant-sized company after another.

So, a little less than a month ago, we sent out a little poll to check the pulse on how many Motley Fool Canada members would be interested if we put our analysts to work in a major way on these sorts of companies, and…

…over 3,500 members raised their hand!

To be honest, I can’t say I was all that surprised.

Because I think thousands of your fellow members are clamoring after these microcap “moonshot” opportunities for the same reason I’ve personally invested a significant portion of my own portfolio into them.

You see, if you’re an investor, you’ve got your head on a swivel for opportunities that will turn $1 into $2, but you’d probably leap right out of your chair at an opportunity to turn $1 into $10.

You also know there’s no such thing as a guarantee…

But if the risk-reward ratio lines up heavily in your favor, you’re willing to play ball.

After all, a homerun gets you a lot farther, a lot faster than a series of bunts.

If you’ve been with us here at Motley Fool Canada for a few years, then you know our track record of homeruns firsthand…

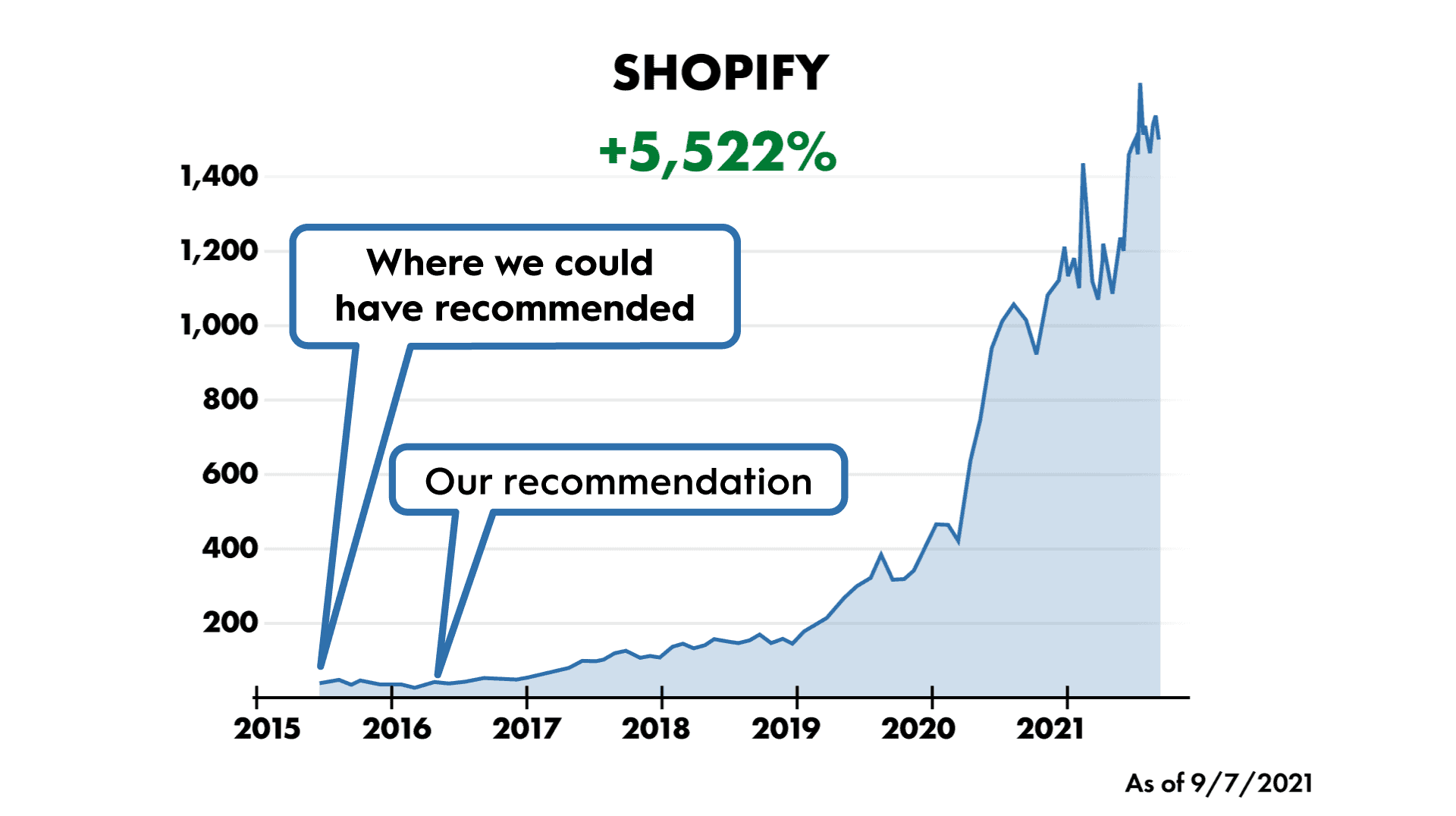

You were there when we picked Shopify at $34.59 a share and roughly a $2 billion market cap in March 2016… before it became a global giant and a $230 billion company to boot.

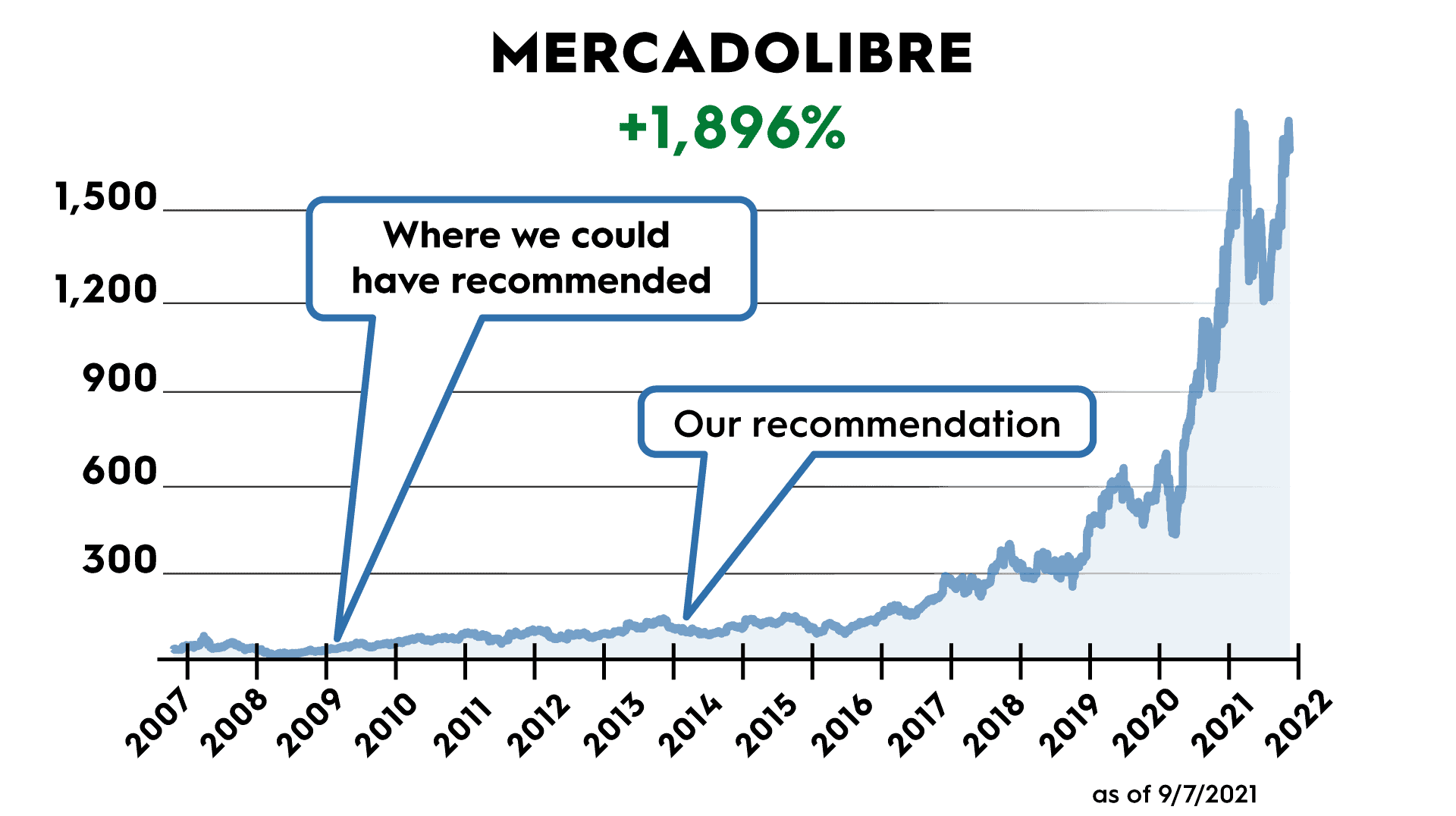

And you rode shotgun when we alerted members to another ecommerce play in Latin America – MercadoLibre.

Since our 2014 recommendation which saw the stock trade for $97.84 a share with a $4.4 billion market cap, members have seen phenomenal returns.

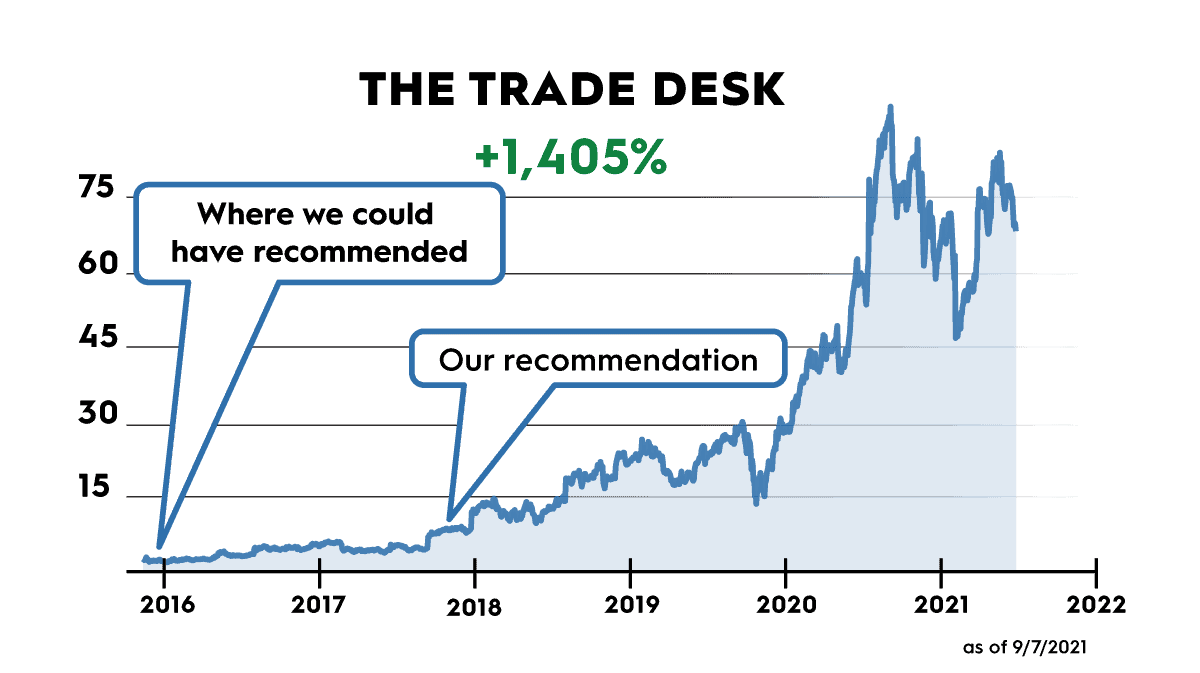

How about The Trade Desk? We got into that stock fairly early in August 2017, and we’ve seen shares soar from a split-adjusted $5 a share to just north of $77 today.

In other words, its market cap has skyrocketed from $2 billion to over $37 billion – more than 18X!

Here’s the thing… those companies were not always the household names for investors that they are now.

In fact, they were once much smaller companies with microscopic market caps compared to their Godzilla-like size today.

That’s what got me thinking…

See, like I said, we recommended Shopify in 2016 at $34.59 a share, back when it had a $2.3 billion market cap.

All in all, I’d say we got in pretty early, and investors who listened have reaped the rewards with 50X returns.

But I still couldn’t help but imagine what would have happened if we were a little bolder… took a little more risk… and we issued a buy alert on it when it was smaller, riskier, and first popped up on our radar at a measly $31.25 a share with a market cap of $1.5 billion.

Maybe that seems like a minor difference to you… I know it did to me at first!

But instead of the 5,522% return we’re sitting on today… we’d be hovering at a 6,093% return. That’s a +571% beat!

In other words, that’s an extra $28,550 of profit for every $5,000 invested.

Now listen – I’m never going to complain about a +5,000% return… but I’ll also never say no to an additional +500%!

If you roll the tape with those other stocks I mentioned, you get shockingly similar results. In fact, in some cases, they’re even more outlandish!

Take The Trade Desk. Our August 2017 recommendation at $5 a share and a $2 billion market cap looks pretty good in hindsight… after all, it’s resulted in a 1,405% return and over $70,000 of profit for ever $5,000 invested.

Not too shabby if you ask me!

But I still couldn’t help but think about if we’d been bolder… taken a little more risk… if we’d bought it when we first saw the company making waves in late 2016… back when it was significantly smaller and hovering around a $500 million market cap.

Our return would look more like 2,807% – a total profit of $140,350 for every $5,000 invested!

In other words, nearly DOUBLE the profit if we’d dove in headfirst less than a year earlier!

If you ask me, this last example blows them all out of the water.

We recommended MercadoLibre in 2014 at $97.84 a share when it sat at a $4.4 billion market cap.

Our return since then? 1,896%. Nothing to sneeze at!

But if we’d been even more contrarian and taken a swing in 2009 when it was hovering around a $500 million market cap… we’d be sitting on a return of roughly 11,493%!

Doing the math, that’s an additional $474,850 of profit for every $5,000 invested!

Are you seeing the same trend I am?

Getting in earlier on some of these first-class companies – sometimes even just a handful of months earlier – can mean the difference between an extra five figures in your portfolio… or an extra six!

Practically speaking, that profit differential could mean the difference between having to choose between that cozy cottage you’ve had your eye on or that dream car you’ve been craving…

Or simply buying BOTH – in cash I might add!

But listen – playing the “what if” game doesn’t add up to real money in your pocket.

So, let’s get real.

Let’s take a look at what’s happened when we actually HAVE been as bold as we possibly can and recommended stocks before they were even a blip on anyone else’s radar.

Because based on data-backed reasons, you’re about to see with your own eyes why…

Microcaps might be the sneakiest investing shortcut for everyday investors to snag themselves a few 10-baggers sooner than later… heck, even a 100-bagger in the years to come!

See, investing in small stocks before they step up to the big leagues is nothing new to The Motley Fool.

If you’ve been with us for a little while, you already know we’re huge fans of buying quality businesses before they blow up and become the toast of Wall Street.

After all, those are the sort of stock calls that The Motley Fool is famous for, like Amazon (up 22,616%), Netflix (up 31,746%), and Tesla (up 11,419%).

It’s also exactly why we started our own small-cap investing service right here in Canada in 2018 called Hidden Gems – to find the next Amazon’s and Netflix’s and bring them to our investing community before everyone else has caught on.

Typically, these companies range in size of anywhere from $200 million to $4 billion, and our team has had some incredible wins fishing out stocks from this small-cap pond – all in a very short period of time.

See for yourself!

Our team recommended Trisura Group, a specialty insurance company in Canada valued at $439 million, on March 6, 2020. In a little over a year, it’s grown into a $1.9 billion giant – more than TRIPLING shareholders money.

Or how about HubSpot, a small cloud-based marketing company that our team recommended on May 18, 2018.

Just over 3 years later HubSpot has seen astronomical growth, and shareholders have enjoyed sky-high returns of more than 5X.

Or another Canadian example, Tecsys, a supply-chain software developer valued at just $203 million when we recommended it on July 6, 2018. Now, it’s more than tripled in size and sits at a $839 million market cap. Another 3X return for shareholders!

While it goes without saying that not all picks perform THAT well, as you can see, fishing in the small-cap pond has often proved to be highly profitable… and often in short order.

Not only has the total collection of Hidden Gems Canada recommendations beaten the market by more than 3X in just 3 years’ time, but we can see this trend play out in the broader markets as well.

In fact, from 1926 through 2016 in the U.S., a model created by University of Chicago professors Eugene Fama (a Nobel Prize winner) and Kenneth French found that small-cap stocks returned 13.1% per year, while large caps returned just 10.2% annually.

And while that 2.9 percentage point difference may not seem that significant at first blush, here’s how it looks over time:

As you can see, $1,000 invested in small caps would be worth almost $65,000,000 over 90 years – a 10X greater return that that same $1,000 invested in large caps.

Now, I don’t think you or I have the patience (or longevity, for that matter!) for a 90-year investment, but it certainly shows the incredible compounding potential of investing in smaller stocks.

The thing is, the deeper we dug into the data, the more we started to realize that there might be incredible returns to be had by narrowing our scope even further than just simply looking at small-caps.

That’s when our attention turned to another class of stocks that might be even more profitable than small-caps.

This group of microcap stocks – or “moonshots” as we’ve taken to calling them – is almost completely unknown to most everyday investors. In fact, they get next to ZERO attention on Wall Street or Bay Street either!

Our small-cap Hidden Gems Canada team rarely ventures into this neck of the woods… instead landing closer to a $200 million market cap as a minimum starting place.

But when they have gone even smaller than that, they’ve seen returns up to 10X greater from these microcap moonshot stocks than even their best small-cap picks.

What we came to realize is that this is not a one-off phenomenon.

Using one of the largest market benchmarks in the US, the Russell Indexes, we can see a similar theme play out…

As much as we’ve raved about small-caps, the even smaller and often completely ignored microcap stocks have outperformed the small-cap Russell 2000 Index by 38%...

And they’ve absolutely CRUSHED the large-cap Russell 1000 Index by 144% – more than 2X!

So as profitable as many of The Motley Fool’s small and large cap stock picks have been over the years, you can see that…

A potential GOLD MINE could be hiding in plain sight with these microcap stocks!

Now, if you were able to watch our special “Project Moonshot: Motley Fool’s 100-Bagger Game Plan Revealed” event this morning, then you’re already ahead of the game.

You know that these are often the UNloved, UNDERestimated, UNDERvalued, and often completely UNknown companies.

They’re the sort of stocks that Warren Buffett himself, arguably the world’s most successful investor of all-time, said he thinks he “could make you 50% a year on $1 million. No, I know I could. I guarantee that.”

But here’s a reality check: Warren Buffett can’t invest in these microcap stocks.

The fact is, these are the sort of companies that big-time investors like Buffett can’t touch with a ten-foot pole.

You see, not only do a lot of these smaller companies have extremely limited trading volume, but even if the institutions were able to buy shares in a meaningfully way, the effect of a massive share price increase would barely move the needle.

So, despite the incredible amount of research showing that tiny stocks have significantly outperformed larger stocks over the years, it’s not even worth the price of admission for most institutional investors to drop a line in the microcap pond.

On the other hand, it can be extremely profitable for everyday investors like you and I to invest in high-quality microcap stocks.

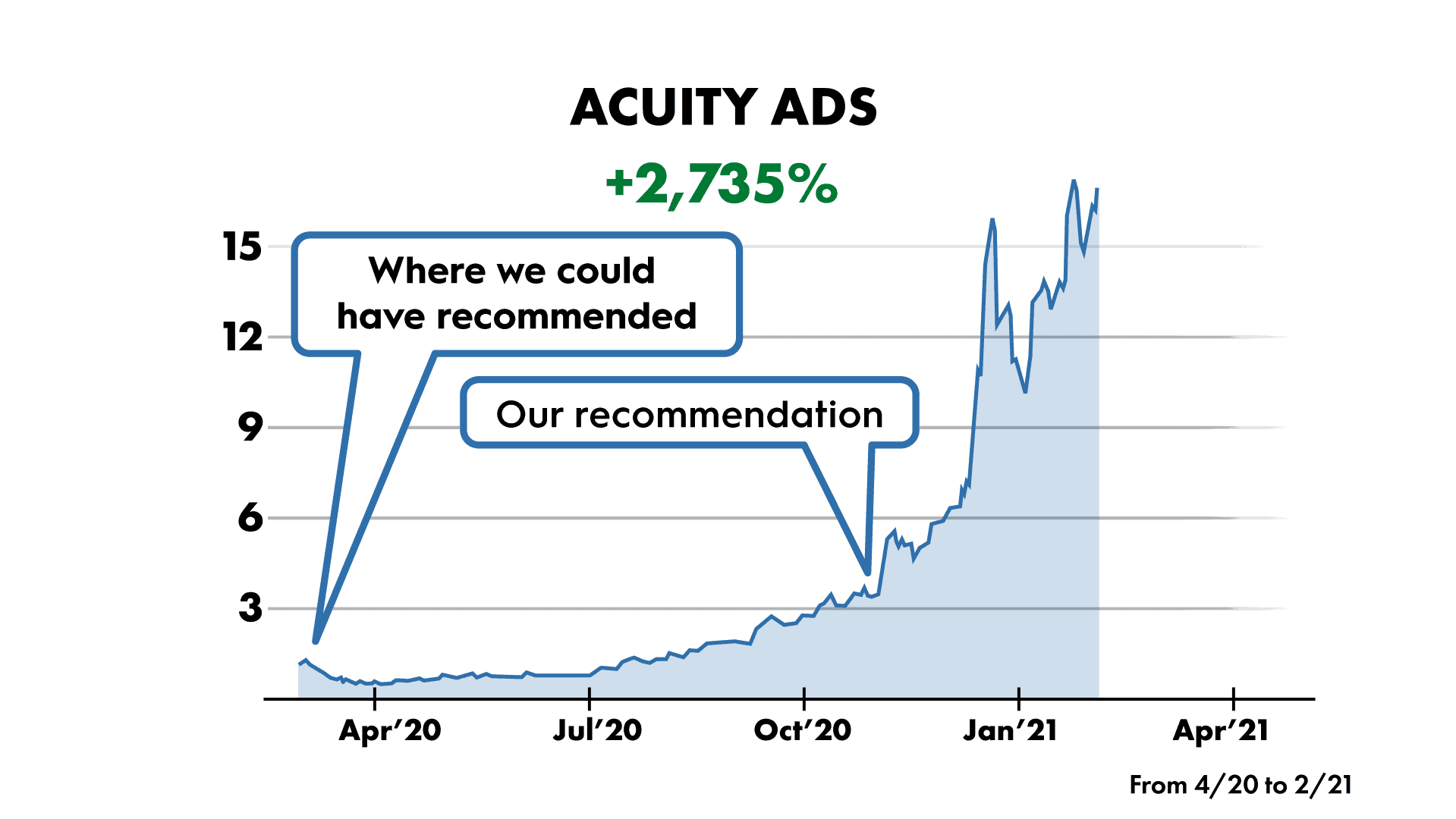

A prime example is Acuity Ads, a (then) tiny Canadian programmatic advertising business similar to mega-behemoth The Trade Desk.

Our small-cap investing team recommended this stock to Hidden Gems Canada members in March 2020, and it quickly became one of the most profitable recommendations we’ve ever made… in possibly the shortest amount of time!

We recommended Acuity Ads at just $1.14 a share on July 3, 2020, when it had a measly market cap of just $54 million. Talk about tiny!

This was one of the boldest recommendations our team had ever made in Hidden Gems Canada up to that point, and spoiler alert: It’s paid off in a BIG way.

In fact, less than a year later, the stock had already skyrocketed by over 27 TIMES!

Investors who acted quickly on our recommendation witnessed their investment soar by 2,735%... and every $5,000 they invested turn into $141,750 – all in less than a year!

Think about it. More than most people’s yearly salary… maybe even two years’ worth of salary… all from just one microcap “moonshot.”

Now, as microcaps often do, Acuity Ads has dipped since then to more reasonable (yet still absolutely incredible) levels, but that’s the sort of volatility that can come with microcaps and why we advocate holding companies for the long-term instead of trying to time the market.

But the point is that if we’d waited until the $200 million mark as we often have, those returns would look much different…

As you can see, by diving into Acuity Ads even earlier than our small-cap team typically would, they netted over +2,000% greater returns in that timeframe!

All in all, that adds up to an additional $104,400 in profit for every $5,000 invested.

No small potatoes!

As you can imagine, we’ve spent countless hours analyzing that recommendation and others like it to try and reverse engineer exactly what it was that made these investments so successful.

What we discovered caught us by surprise, and quite frankly, it made some of us a little uncomfortable…

You see, our team that picked Acuity Ads in 2020 followed a very similar process to how we pick many of our top-performing stocks.

Founder-led with significant inside ownership? Check.

Growing revenues at a rapid clip? You bet.

Profitable or on a clear pathway to profitability? Of course.

Trading at a mouth-wateringly attractive valuation? Very much so.

But there’s one thing we did very differently than almost all of our stock recommendations in The Motley Fool universe…

We went smaller – MUCH smaller – than we usually dare to go.

We were significantly bolder.

We took more risk (carefully calculated, of course!).

The results? One of the most profitable recommendations in Motley Fool Canada history – and it’s still early!

By now, you might be thinking, “Hey, it looks like all I have to do is buy tiny stocks and I’ll get rich!”

Well, hold your horses, because that couldn’t be further from the truth.

We didn’t land on AcuityAds by throwing a dart at a board filled with a random assortment of tiny stocks…

And AcuityAds’ stock did NOT simply skyrocket because it was a puny company.

Let me say with emphasis…

Simply investing in tiny stocks is NOT a sure-fire way to 5X… 10X… or 20X your money.

The fact of the matter is that last I checked, there are 2,875 small cap and microcap stocks in Canada alone across both the TSX and the TSX Venture Exchange. And the U.S. has a staggering 3,036 public microcaps across its various exchanges.

Put the two together, and you’re looking at a total universe of roughly 5,911 companies.

But keep in mind, many of those are companies that have remained so small precisely because they have businesses built on a wing and a prayer…

Others are so volatile and unpredictable that they’re equally as likely to go bankrupt as they are to be sound, long-term investments…

And still others are so tiny that it’s practically impossible to know much of anything about their business at all!

Point being, it’s not like you can simply scroll through a list of stocks, look for the ones that happen to be microcaps, and plunk your money into whatever you find.

That sounds more like a recipe for lighting good money on fire!

You have to know how to find the RIGHT stocks, using the RIGHT strategy and the RIGHT philosophy.

Just like we did with larger companies like Shopify… The Trade Desk… MercadoLibre… and the strategy we followed to a tee with microcaps like Acuity Ads.

That’s why I’m incredibly excited to make this announcement:

For the first time ever, we’re releasing a brand-new service exclusively focused on primarily Canadian microcap stocks, and we’re bankrolling it with $50,000 of The Motley Fool’s own money! Introducing…

Thousands of your fellow Motley Fool Canada members have spoken out with interest in a microcap service led by our Foolish investing team, and I’m thrilled to say that the day we deliver on that interest has finally arrived.

You’ve seen for yourself the sort of wild profits that can come from dipping a toe in the microcap pond, but you’ve also seen the high-level of risk that comes with the territory.

Now, for the first time ever, our Motley Fool Canada team is walking qualified investors through the microcap minefield and shining a spotlight on what we see as diamonds in the rough.

What exactly is our mission?

10X returns – NOT altogether average (albeit respectable) 10% gains.

Microcaps headed for the moon – NOT run-of-the-mill “safe” plays.

Diamonds in the rough – NOT penny stock pipe dreams bound to crash and burn.

Will there still be risk? You bet.

Will some stocks end up being a dumpster fire? Quite possibly.

But that’s the price of admission in the world of microcaps, and we think that the Pareto principle will work its magic in this portfolio like it does in almost every other area of life.

The Pareto principle, or 80/20 rule as its also called, essentially states that roughly 80% of results come from 20% of causes.

In other words, we think that 80% of our returns will likely come from 20% of the stocks in the Microcap Mission portfolio.

Some of these microcaps will fail, but we think that others will pick up the slack and then some.

Listen – you don’t get an omelette without breaking a few eggs, and you don’t get the 10 or 20-baggers of the world without going through a few stinkers along the way.

That said, hunting for 10X returns in the world of microcaps is not for the faint of heart.

I say all of this to make sure that only battle-tested, experienced investors join us in this venture.

But let me be frank with you… I’ve seen this brand-new portfolio with my own eyes, and I’m convinced there are more than a few Acuity Ads-like gems with sky-high potential.

In fact, from my perspective, 10X returns might end up being too low of a bar.

I wouldn’t be surprised if we see Motley Fool Canada’s first 100-bagger come out of this fully loaded Microcap Mission portfolio.

Now, because of just how small these companies are and how few spots we’re making available to investors like yourself, I can’t in good faith reveal any of their names.

BUT I can give you a sneak peek at a handful of them.

Microcap No. 1: A tiny Canadian e-commerce disruptor playing in the same arena as Shopify and Amazon while growing at an absolutely explosive rate (think triple digits!). This is one of the fastest-growing companies in the portfolio, and we’re hoping it quickly becomes The Motley Fool’s third fortune-making e-commerce company.

Microcap No. 2: A founder-led Canadian cloud phenomenon that was first to market and features a plethora of industry “heavy hitters” on the board. It’s no surprise to us that it’s growing by greater than 63% per year and was recently named to the top 100 fastest-growing SaaS companies in the world.

Microcap No. 3: A Canadian cash-flow cow on the heels of a game-changing merger that could spur record-setting growth in the quarters ahead. Shareholders have already more than doubled their money since 2020, but after this recent powerplay, our microcap team thinks the best might be yet to come from this company.

I hope I’ve whetted your appetite for what lies within Microcap Mission’s highly exclusive, members-only walls… and let me say, that’s just the tip of the iceberg.

If you grab one of the limited seats we’ve made available to Motley Fool Canada members today, you won’t just get a handful of exciting stock ideas… you’ll get a whopping total of 20 microcap stocks right out of the gate!

Perhaps even more exciting than that, 15 of these stocks are homegrown Canadian stocks with 5 US stocks to round out the 20.

These stocks get very little to no attention from mainstream analysts and are flat out ignored by most big-time investing firms.

Just like AcuityAds when we recommended it at a mere $54 million market cap… before it graduated to the TSX… then went public on the NASDAQ… and long before it became the market sensation it is today, scooping up analyst coverage left, right and center.

Now, you might be wondering… just how small of stocks are we hunting for? Some of the smallest stocks you’ll find in the entire Motley Fool universe.

After all, this is about being bold and hunting for the “moonshot” stocks with blue sky potential.

That means we’re going tiny… as in “Honey I shrunk the kids” tiny.

For Canadian stocks, which will make up roughly 75% of this portfolio, we’ve set a $200 million market cap as our ceiling.

Bigger than that? We won’t touch it.

For our U.S compatriots, we’ll go as high as $1 billion due to the sheer market size we’re contending with, but we’ll still aim for as small as possible to maximize the potential runway ahead.

And remember, we’re putting our money where our mouth is with the stocks we’ll be recommending to members because…

The Microcap Mission portfolio will be backed by $50,000 of The Motley Fool’s own capital, starting with a $20,000 injection into the first 20 recommendations!

Of course, we’ll be waiting to deploy our first round of cash until members have had ample opportunity to buy these stocks themselves.

We’re member-first here, which means you deserve the most attractive entry point – even if it impacts our own potential returns somewhat.

In the long run, we’re not sweating a few percentage points from a late entry point… especially since we’re aiming for 10X returns, not 10%.

Now, investing in plain Jane stocks is one thing, but putting your money into microcap “moonshots” is a whole other ballgame.

That’s why we’re not just giving members the names of 20 microcap stocks right out of the gate and setting them loose in the wild to fend for themselves.

Besides thoroughly detailed coverage on each and every stock, we’re ALSO giving members a roadmap straight from our veteran investing team that walks you through exactly how to invest in these risky, yet potentially highly profitable stocks.

That includes comprehensive investing guides that will form the bedrock of member’s microcap investing journey, like…

“Microcap Moonshots: The Makings of a 10X Microcap Stock.”

Discover exactly how we separate potential 10-baggers we believe are poised to take shareholders on the profit-laden ride of a lifetime from the penny stock pipedreams bound for bankruptcy. Not only will members learn why we picked the stocks in the Microcap Mission portfolio, but they’ll be able to use this checklist to spot their own potential microcap moonshots.

“Microcap Mandate: Mastering the Limit Order.”

If you don’t understand how to use a limit order, you’re probably better off staying away from microcaps altogether. In this detailed guide, members will learn exactly how limit orders work and how they can avoid overpaying based on temporary price surges. Our Foolish mission is to ideally help members pay LESS and make MORE from the microcaps they buy.

“Microcap Mindset: Managing the Highs and Lows”

There’s no way around it: the microcap minefield comes with a boatload of volatility. There will be days where you’re tempted to sell at a loss, and days when you want to over-allocate funds to your winners. Investing in microcaps requires the right mindset, and our team’s decades of market experience can give you the tools you need to succeed.

“Microcap Management: Portfolio Allocation 101.”

Which stocks to buy is one question – how much money to put into each stock is another question altogether. Find out what percentage of a portfolio our team recommends carving out for microcaps as a whole and how to approach allocations for individual microcap stocks within that segment.

Every new member of Microcap Mission will instantly receive this Bedrock Bundle made up of what we consider four absolutely essential investing guides to start their microcap investing journey with.

That’s not all, though. If you join today, you’ll also gain access to…

Member Bonus

Members-only Video Q&A with the Microcap Mission team

What better way to set yourself up for maximum value from the Microcap Mission portfolio than a full-on video Q&A with the team? This is a prime opportunity to grab some face time with the team and get much deeper insights into the portfolio.

They’ll answer questions about the stocks in the portfolio… the next batch of recommendations to come in the not-so-distant future… and anything on yours and other members’ minds!

It’s your show, and our team is just there to help you get started, while having a little fun in the process. Of course, please remember that while we’re happy to discuss all things about our Microcap Mission, we simply cannot offer any personalized investment advice.

If you ask me, that’s a chock-full offer just as it stands right there.

But at The Motley Fool, we never settle for “good enough,” which means we’re going to up the ante wherever we can. That’s why…

Members who join us today before the midnight deadline will lock in the “Ground Floor” VIP package including a $500 discount on their membership AND a bonus bundle, complete with…

“Level Up Booster Pack.” – $375 value

Our team turned over countless stones before they dug up the “diamonds in the rough” they landed on for the Microcap Mission portfolio. At the same time, some of the stocks they came across were just slightly above our market cap parameters, which means they simply couldn’t be included in the portfolio. Still, these 5 “level up” stocks remain 1) incredibly small, 2) brimming with potential from our perspective, and 3) we’d likely deem them worthy of inclusion in the portfolio if only they were smaller, so the team felt compelled to put together some of their high-level analysis for “Ground Floor” VIP members.

“Foolish Five: Highflying Small-Caps from Fool Universe.” – $500 value

Between small-caps and microcaps, the Fool isn’t new to tiny stocks. In fact, in just the last year alone there have been a handful of exciting stocks that our various investing teams around the Fool universe have issued buy recommendations on. In this Foolish Five report, we’ve handpicked 5 stocks that jumped out at us and that we’re convinced will give “Ground Floor” VIP members unique (and potentially quite profitable) ways to play mega-trends like artificial intelligence… streaming… programmatic advertising… game-based learning… and more. All from companies that remain incredibly small and under-the-radar to many everyday investors.

At this point, I should remind you that we are ONLY making a very limited number of seats in Microcap Mission available at this time. This seat cap has already been locked in internally.

To put it in perspective, we’re opening this up to less than 1% of total Motley Fool Canada members…

And to add a little more context, here’s the response that some of our Day 1 service launches have been met with in the past:

Blast Off 2021 – 514 new members

Marijuana Masters – 676 new members

Hidden Gems – 695 new members

Next-Gen Supercycle – 731 new members

So you can see that not only are we being fairly restrictive as to how many members we’ll accept into Microcap Mission, but also that we’ve experienced a massive flood of members quite frequently in the past.

In other words, we could hit our seat cap in 5 minutes… 5 hours… frankly, I have no idea.

Especially when you consider that over 3,500 of your fellow Fools already raised their hand in interest for this brand-new service!

So listen – while this is the first time in nearly three decades of The Motley Fool’s history we’ve ever done something like this, and of course, we want as many members as possible to take advantage of it, please remember that…

Whenever that seat cap gets hit, this page goes dark and this portfolio is firmly off limits to new members.

So, if you’ve seen enough and are ready to lock in your “Ground Floor” VIP offer now, simply click the button below.

Now, because this brand-new service is absolutely jam-packed with content like…

20 upfront microcap stock recommendations (15 Canadian, 5 U.S.)…

The “Bedrock Bundle,” so investors know exactly how to handle themselves in this space…

Members-only video Q&A session with the team…

Exclusive CEO interviews (We’ve already got a few of these scheduled in the upcoming weeks!)…

Biweekly mailbag feature where members can get their on-going questions answered…

Monthly rankings, so you know exactly which stocks in the portfolio we’re especially keen on at any given moment…

Monthly round-up of “newsworthy” highlights related to individual stocks in the portfolio…

And much more…

…we’ve decided that $1,999 is a more than reasonable price for a full year’s membership.

Of course, as I’ve already mentioned, you can slash $500 OFF that membership price until midnight only with this “Ground Floor” VIP offer.

But there’s one more important detail I should mention.

Since these stocks are so darn small and volume is incredibly low, we’ve decided that there will be absolutely no refunds for Microcap Mission.

I mean, just think if a group of short-term traders joined, bought all the stocks and raised the entry prices in the process, only to promptly cancel their membership.

That wouldn’t be fair to you or your fellow members, so we simply won’t allow it.

That said, with the stocks we’ve already got waiting for you in the portfolio and the companies in our crosshairs to roll out next quarter, I think the last place you’ll want to go is anywhere else.

Because let me clarify…

Not only will you be met with 20 fully vetted microcap moonshot stocks the second you join us in Microcap Mission today, but you’ll have a front row seat for the stocks we release in the quarters to come.

Our plan is to release 3-5 brand-new recommendations each quarter, reserving the right to issue sell recommendations or double down as appropriate along the way.

And our ultimate mission is to build…

The biggest portfolio full of the smallest stocks in the entire Motley Fool universe – clocking in at a grand total of 50 microcap recommendations when all is said and done.

That means you’ll have exciting new releases to look forward to on the regular so long as you remain a member.

That’s not to mention the CEO interviews… biweekly mailbag interactions with our investing team… and monthly rankings along with “newsworthy” portfolio updates calling out individual stocks.

All in all, you’ll have an embarrassment of premium content to stay plugged into over the weeks, months, and years ahead.

And make no mistake, this is ultimately a multi-year journey, Fools.

We believe in buying quality companies with exceptional business plans and then letting experienced management execute on those plans over the course of years.

That’s why our usual Foolish holding principle of 3-5 years still applies to these tiny companies.

Of course, if something critical changes with any of the stocks we recommend, we’ll be sure to let members know post-haste and inform them if selling might be wise.

All that said, I think it’s time for you to make a decision.

Are you interested in getting in on the ground floor of Motley Fool Canada’s first-ever, BRAND-NEW real-money portfolio service that’s 100% dedicated to finding the most exciting microcap stocks with 10X potential?

If the answer is yes, then I suggest you hurry.

Because our top 20 microcap moonshot stocks are waiting for you in the members-only portal right this very second, and as you’ve been reading this, your fellow Motley Fool Canada members have been busy securing their spots.

Considering over 3,500 members already expressed serious interest in this new service and we only have a very limited number of spots available, there’s no telling how soon the doors may close…

But regardless of how quickly those seats fill up, you can rest assured that this “Ground Floor” VIP offer complete with a $500 discount and bonus bundle worth $875 will be gone at midnight.

So, if I can give you one piece of advice, it’s this…

Don’t put this off. There’s always a reason to say, “not today” or to be on the fence, and that’s been the case with many of The Motley Fool’s top stock picks as well.

After all, many in the investing community laughed at us when we first recommended Amazon in our scrappy U.S newsletter start-up way back in 2002…

Many more rolled their eyes when that same U.S. newsletter picked Netflix right after that in 2004…

And even more recently, those same skeptics thought our Canadian team was caught up in the hype when they recommended Shopify to Canadian investors in 2016.

Well, $5,000 invested in each of those stocks when we picked them is worth over $2.8 MILLION USD today.

So… who’s laughing now?

Listen – you can always find a reason not to take a risk, but history shows that some risks are well worth taking. For my money, this is one of them.

Don’t pass up what I believe could very well be one of the most lucrative — and timely – opportunities we’ve ever offered.

To lock in a spot and join our team as they hunt for 10X microcap moonshots, and to get started right away with our top 20 stocks, just click the button below…

…before your “Ground Floor” VIP offer expires at midnight, and the price immediately shoots up.

Here’s to taking risks and reaping the rewards,

Jared George

Jared George

Microcap Mission analyst

Motley Fool Canada

Returns as of 9/8/2021 unless otherwise stated. John Mackey, CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Tom Gardner owns shares of Netflix, Tesla, and The Trade Desk. The Motley Fool owns shares of and recommends AcuityAds Holdings Inc., Amazon, Apple, MercadoLibre, Netflix, Shopify, TRISURA GROUP LTD, Tecsys Inc., Teladoc Health, Tesla, and The Trade Desk. The Motley Fool recommends the following options: long January 2022 $1,920 calls on Amazon, long January 2023 $1,140 calls on Shopify, long March 2023 $120 calls on Apple, short January 2022 $1,940 calls on Amazon, short January 2023 $1,160 calls on Shopify, and short March 2023 $130 calls on Apple.

Microcap Mission includes U.S. stocks. All billing is in CAD. You will be billed according to your choice below and then $1,999 for each year thereafter.

This product is non-refundable.

Having trouble ordering or have any questions for us? Just send them to [email protected], and we’ll get back to you ASAP!