To complete your order, it is necessary to enable JavaScript.

Motley Fool Canada - Order Now!

Already a member? Login

Introducing: IPO Trailblazers!

Discover the proprietary “4X IPO Factor” formula

Target what could be massive returns in the RED-HOT IPO market

"If you can't convincingly argue for a stock to QUINTUPLE its share price at the bare minimum, don't even bother bringing it to the table"

- Motley Fool CEO Tom Gardner

Dear fellow investor,

Do you ever feel like you’re getting left behind?

Like everyone around you has made a fortune on dogecoin or some dumb stock tip while you’re grinding out 5% and 10% gains here and there with a lot more research and due diligence?

Like, by playing by the rules, by being responsible, by targeting 25+ stocks in your portfolio, you’re falling behind?

Listen, I get it.

Because for a long time, I felt the same way.

And then a colleague here at The Motley Fool showed me something that changed my investing life.

Put simply: The IPO market is on fire.

In fact, an early-2021 report showed that 2021 had already minted 199 new tech unicorns ($1 billion+ valuations)… that exceeded the number of unicorns in any of the past nine years.

And I believe it’s only a matter of time before a new IPO rapidly delivers enormous gains to early investors.

As you know, IPOs have some serious advantages over other stocks.

They’re NEW!

They’re fresh.

They’re often disruptors very early in their potential growth cycles.

Analysts haven’t had much time to figure out what to make of them – or to initiate coverage.

And at its core, that’s what makes IPO investing so potentially lucrative.

There is no “conventional wisdom.” These stocks aren’t usually well-known before their IPO.

Now, the key is to find the right IPOs.

Because of course, not every IPO spikes up immediately… or at all!

Plenty of them fall apart and never recover.

It’s why, for years, I stayed well clear of IPOs.

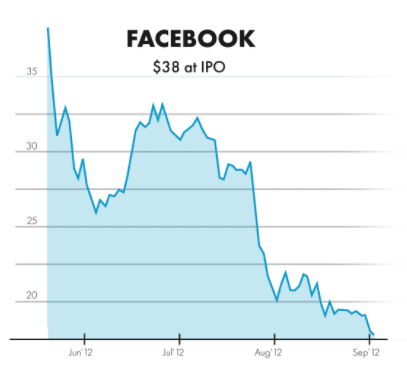

I remember when Facebook IPO’d in 2012…and promptly sank by more than 50%.

I remember thinking “whew, good thing I don’t buy new IPOs…”

Of course, you know what happened next…

Of course, Facebook’s just another example of that rare “IPO winner.”

Because the vast majority of IPOs don’t pan out for investors.

In fact, according to proprietary research study of 2,100 past IPOs going back to 1995, The Motley Fool found...

- Just 40% of IPOs outperformed the market in their first five years...

- A mere 47% made money at all…

- The median IPO underperformed by nearly 38% after 10 years…

- And here's the real kicker. Just 3.4% of all IPOs accounted for the US$2 trillion in total economic gains. That’s a mere 74 companies out of over 2,000.

It’s sobering data for any individual investor. And it shows just how insanely difficult investing in the IPO market can be if you are doing it on your own.

But with that kind of money on the table, you don’t just say “great IPOs are rare” and close the file.

No, our research team spent time looking into patterns.

Similarities.

Predictive characteristics.

All with the goal of building a portfolio that could deliver outsized gains.

And they found something.

From that, they built a simple formula with four “4X IPO factors” that they’ve used in IPO Trailblazers with the aim of delivering a quintuple with every stock they pick.

I’ll reveal the full details of the formula here in just a moment, but first, I want to delve in a little deeper into the research to firmly rebut the biggest mistake I see people making in this incredibly hot IPO market:

“So all I have to do these days is buy any old IPO that comes along… right?” Dead wrong! Here’s why…

As nice as it sounds, if that were true, then everybody and their grandmother would be getting filthy rich off IPOs.

And as we’ve discovered from our own research, that certainly isn’t the case.

In a study of 2,100 past IPOs going back to 1995, The Motley Fool found…

Just 40% of IPOs outperformed the market in their first five years...

A mere 47% made money at all…

The median IPO underperformed by nearly 38% after 10 years…

And here's the real kicker. Just 3.4% of all IPOs accounted for the US$2 trillion in total economic gains. That’s a mere 74 companies out of over 2,000.

It’s sobering data for any individual investor. And it shows just how insanely difficult investing in the IPO market can be if you are doing it on your own.

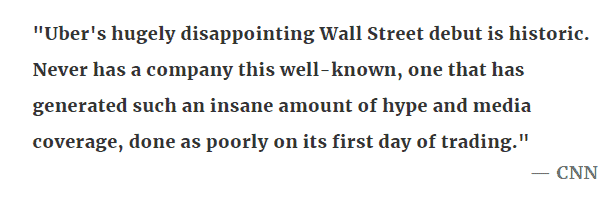

After all, ridesharing service Uber (NYSE: UBER) was the most anticipated IPO since Facebook when it went public in May 2019.

Everybody was excited for Uber to finally go public, after years of anticipation.

Then what happened…?

Investors actually saw a loss of 7.6% on the first day of trading. And Uber’s IPO was deemed such a flop it prompted a flood of headlines like…

“Uber’s Colossal I.P.O. Flop May Be The Worst Ever On Wall Street”

-Vanity Fair

“Uber Is One of the Worst Performing IPOs Ever”

-Fortune

“Uber's IPO Joins Ranks of Wall Street Flops”

-Bloomberg

“Congratulations to Uber, the Worst Performing IPO in U.S. Stock Market History”

-Gizmodo

Yikes! But that's not the half of it...

Investors who grabbed a piece of Uber on Day 1 lost an estimated total of $655 million, prompting CNN to state:

And it makes sense when you think about it.

From where I sit, the whole point of IPO investing is to get in on little-known companies early in their growth cycles.

Before everyone has an opinion on them.

Before analysts have established their price targets.

Before all the gains are gone!

Not super well-known companies like Uber.

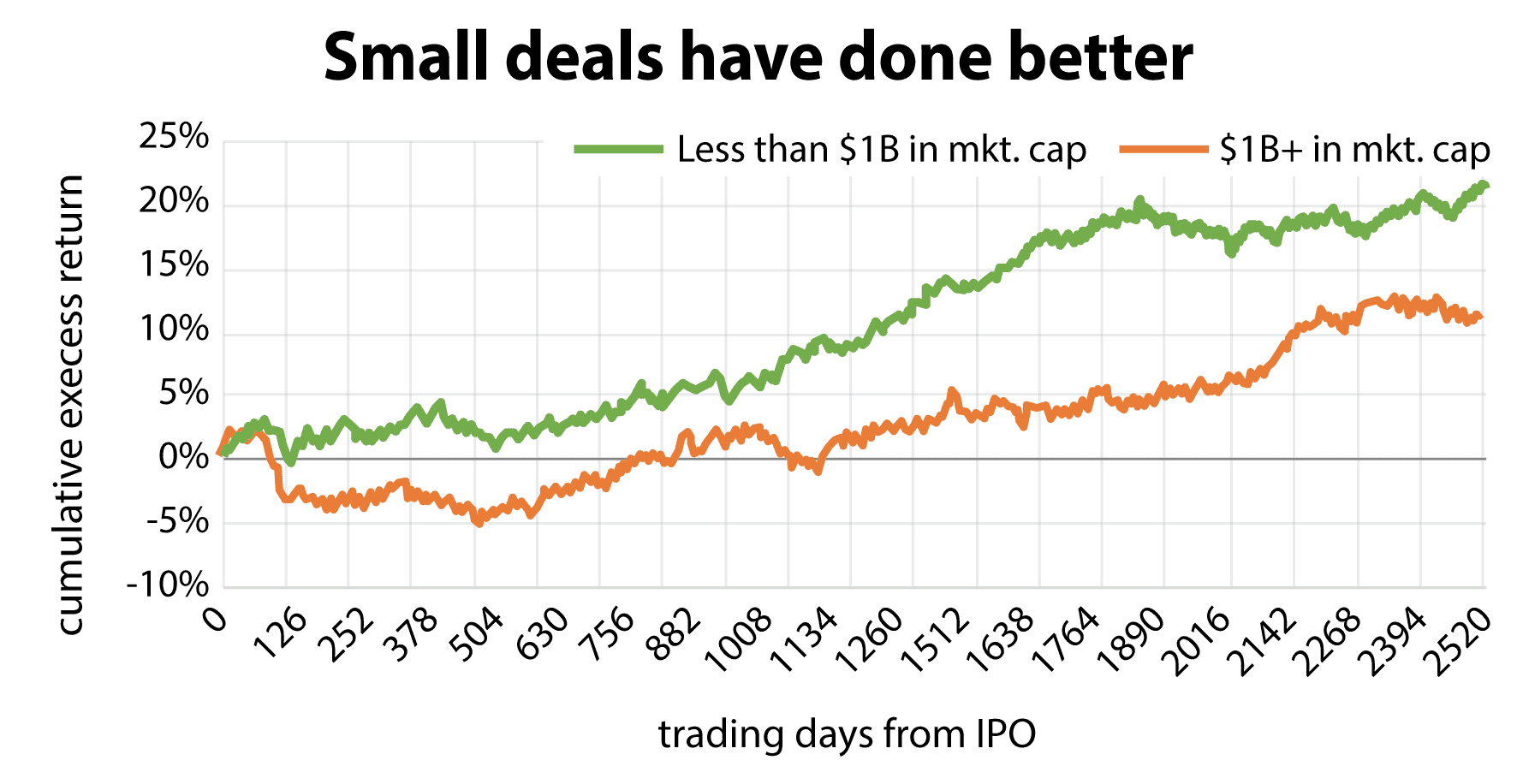

The data backs that up.

In analyzing 1,479 past IPOs, our in-house research team determined that companies that were valued at less than $1 billion in market cap when they went public significantly outperformed those "unicorns" that were valued above $1 billion.

But let’s face facts – finding those tiny stocks early…investing in them at the right moment…well, it’s difficult!

Again – according to our proprietary study, just 3.4% of IPOs made all the money!

Which is why Tom Gardner believes successful IPO investing requires a tried and true “system”

You see, after countless hours of research and refinement over the past few months in the lead-up to this first-ever launch of IPO Trailblazers, Tom has solidified a list of “4X IPO Factors” that will form a huge part of his decision-making process.

Tom considers these factors to be of the utmost importance when it comes to determining whether a stock genuinely has the ability to shoot up 4X its current value.

Even if you decide not to join us in IPO Trailblazers today, you’d do well to keep these factors top of mind anytime you’re considering buying into an IPO.

“4X IPO Factor” No. 1 – Uniqueness

The main area where IPO investing distinguishes itself from all other forms.

Because when it comes to a company going public, it has a legitimate chance to bring something to the public markets that currently does not exist.

...Something that NO other company presently out there can accomplish.

And when it comes to getting in on the ground floor of not the currently great...but the NEXT great businesses of our time, it's the single factor that most excites Tom Gardner about IPO investing above all others.

“4X IPO Factor” No. 2 – Leadership

It's pretty easy to see why brilliant leadership is not merely important but absolutely paramount when it comes to IPO investing.

Just consider that when Tom and his team first start researching some of these IPOs, many still haven't even released a publicly available financial document yet. Not one.

All you get is private equity firms spitballing what they think the valuation should be.

If you're lucky, you may learn whether the company is profitable or not.

On top of that, you don't have any kind of history of how the company has done in relation to itself. No revenue growth rates. No same-store sales numbers. No subscriber growth figures.

And when it's hard to tell exactly how successful a company actually is financially, the importance of having a leader you wholeheartedly believe in gets amplified. BIG TIME.

Which is why it's so vital that Tom Gardner has an advantage shared by very few other IPO investors on the face of the earth...

He's not merely evaluating IPOs – as the CEO of The Motley Fool, he's also running his very own nine-figure business on a day-to-day basis!

Meaning Tom can stare CEOs right in the eyes and ask exactly the right questions to discern whether they're working harder to grow their investors' wealth than they ever had to work to get it in the first place.

After all, that's exactly what he's doing day in and day out for his own company!

Just a few years ago, Tom identified another leader just like that in Shopify CEO and founder Tobias Lütke.

Lütke is the company's single largest shareholder – with a stake worth around $10.43 billion!

Tom believes a CEO with proper skin in the game is THE key to determining whether IPOs have what it takes to skyrocket up 400% or more.

And after nearly 30 years as a businessman and professional investor, he's pretty good at identifying them.

It's not like this is a new concept, though. Think about it...

Seventy years ago, what was the key difference between McDonald's and the tens of thousands of other restaurants across America?

It certainly wasn't better burgers...

It was Ray Kroc.

What was the difference between Walmart and the thousands of other Main Street stores it outhustled and outcompeted on its way to dominance of American retail?

Sam Walton.

And why did Apple become the household name it is today?

Steve Jobs.

Point being, if you can identify these transformative leaders early in the process, you're almost guaranteed big returns down the line.

And if you guess wrong, you're probably setting yourself up for disaster.

Which is why actually having one of these great company leaders – Tom Gardner – personally on your side for every IPO decision recommended in IPO Trailblazers you make is truly invaluable.

After all, as the co-founder and CEO of The Motley Fool, Tom's been in countless meetings with board members and venture capitalists who've pressured him to take the company public.

And he knows that many private companies are only going public because they're being compelled to by their board or VCs...or they're drowning in debt and simply have no other choice!

That's what makes his wealth of experience all the more important on behalf of everyday investors like you: being able to spot those hundreds of companies from a mile away and steer well clear.

Tom knows that process from start to finish because he's seen how it works, up close and personal.

“4X IPO Factor” No. 3 – Market Opportunity

How big could this company get if it achieved 100% of its marketplace?

It's a question so few investors ask themselves, despite being perhaps the single most important question you can ask.

There's a reason that every single one of the biggest companies in the world runs a business that basically everybody needs.

Apple sells smartphones.

Amazon lets you easily buy stuff on the internet.

Google makes it possible for you to search the internet at all.

Microsoft creates the software that makes your computer work.

Without any of these companies, the world would be a very different place for a whole lot of people.

Which is why their "market opportunities" are essentially limitless...not to mention why their companies have created countless fortunes for investors over the decades.

Unfortunately, if you turn on CNBC nowadays, they're all you'll hear about.

And while we of course love and appreciate the life-changing returns we've received from these companies over the years, the truth is that it's going to be borderline impossible for them to replicate those gains going forward.

It's also why in IPO Trailblazers, we're looking for companies that are the next version of the ones you see above. Companies with potential markets so big they make your eyes water.

Remember, Tom has mandated that every single company that makes it into the service have a bare minimum of 4X potential returns upside.

If you don't have a sizable addressable market in the first place, that's incredibly difficult to accomplish.

“4X IPO Factor” No. 4 – Competitive Advantages

Tom Gardner and the team are looking for companies with beloved brands...broad scale...or high switching costs.

And for my money, competitive advantages are among the most overlooked factors when it comes to IPOs.

Year after year, you see dozens of IPOs that get hyped up mostly because consumers have simply heard the name of the company and...that's about it.

Think about the well-known meal-kit service Blue Apron, which went public back in June 2017 at $10 a share. It was the first meal-delivery service to IPO, and it was on the tip of everybody's tongue at the time.

Just a few years later, the stock has pretty much stayed flat. So what happened?

A better question to ask is this: What exactly can Blue Apron do that HelloFresh, Sun Basket, Plated, Gousto, Home Chef, or 10 other meal-kit services you can name off the top of your head can't do?

Absolutely nothing.

Sure, you can cut your prices. But then what happens when retail giants who're used to operating on razor-thin margins like Amazon and Walmart decide they want in on the action?

You're probably going to lose. Badly.

All starting to make sense now? Good.

Now that we've explained the primary factors that Tom and his team look for when they're sifting through IPOs with 4X returns potential, let's talk more about the service itself.

Simply put – IPO Trailblazers is unlike any service we’ve ever opened here at The Motley Fool. Here’s how it works…

If you’ve been a Motley Fool member for some time now, you’ve probably caught on to the two primary ways our services operate.

The first method is more of the “monthly newsletter” style. Each month, you get our best recommendation or two for that particular service’s strategy – be it dividends, small caps, high-growth stocks, etc.

It’s a simple and easy way for members to always know exactly what our favourite stocks are each month and when you can expect them to arrive in your inbox, and allows you to easily space out your investments over the course of the year.

The second method is that we give you either a basket of stocks or even a fully allocated portfolio on Day 1 that you can invest a large lump sum in the instant you join the service.

This works great for when we’re trying to capitalize on an ongoing theme or trend – like cannabis, crypto, AI, or even just a market downturn – and we want to show you how to get fully invested right away – without having to wait months or years to have a fully built-out portfolio.

IPO Trailblazers is the best of both worlds.

You see, because Tom Gardner is so incredibly excited about the “Golden Age of IPOs” that we’re currently in, he believes it’s absolutely necessary that you get the full slew of his very top IPO recommendations right up front.

Remember, Tom’s stated time and time again that the single most powerful factor of IPO investing is that it’s literally the one and only way to get in on the ground floor of the fortune-making stocks we’ll still be talking about 10… 20… even 50 years from now.

You can bet your bottom dollar there's no way Tom Gardner is sitting on the sidelines for that...

Which is why the second you join IPO Trailblazers, you'll get access to all 75+ of Tom's top IPOs right off the bat.

They're waiting for you on our private, members-only website as we speak – each one accompanied by in-depth research write-ups explaining why we see such a massive opportunity in every company.

How much confidence does Tom have in all of these current IPO Trailblazers stocks?

For starters, every single one of them has passed his "4X IPO Factors" test with flying colors.

Don't forget – unless Tom sees at least 4X returns upside in an IPO, it's specifically prohibited from inclusion in IPO Trailblazers...

Meaning every one of these stocks must have 400% potential upside to make it into the service. Period.

Of course, actions speak louder than words...

And while it may be nice to hear how much confidence Tom has in his ability to pick 400% winners in the IPO market, he'd prefer to show you.

Which is why I’m so pleased to introduce the IPO Trailblazers portfolio.

I do know two things:

#1: The IPO market simply presents too big of an opportunity to ignore. I believe every investor needs top-notch tools to target the kinds of gains we’ve discussed today.

#2: I’ve learned that it’s always a mistake to bet against Tom Gardner and his team.

This is your chance to get in on the ground floor of something truly special: Our newest ideas for taking advantage of the transformative IPO opportunity.

And here’s what else you get when you join IPO Trailblazers today:

First off, the fact of the matter is that the IPO market is evolving so rapidly that it's impossible for us to know in the present what kind of IPOs could be coming down the pike in the future.

A new company could unexpectedly file for an IPO at any second!

Which is why, in addition to the up-front IPO recommendations you’ll receive both from IPO Trailblazers, Tom and the team will also be keeping a sharp eye on upcoming IPO activity...

And if an IPO that fits his 4X requirement is unearthed, they'll be ready to jump in at a moment's notice and add that company to our official IPO Trailblazers recommendations list.

Meaning as long as you're a member, you can always rest assured you'll know precisely:

How Tom and the team feel about any promising company that files for an IPO, as well as…

Whether we think you should get in immediately, hold off for now, or simply avoid it entirely, and…

How much we plan to allocate in IPO Trailblazers, assuming we are in fact recommending the IPO.

So as you can see, we have the entire IPO market covered for you, from start to finish, in a way you probably never assumed possible.

No more wandering around in the dark trying to guess how far along private companies are in their stage of preparing to IPO...

No more scanning through hundreds upon hundreds of complicated S-1s – the form a company files with the SEC when it first wants to go public – just to have a hope of picking the right IPO to get into...

No more wondering whether you need to buy on Day 1 or hold off till later...

Our team will handle all of that for you.

All you have to do is log in to your brokerage account and execute the trade if you think it’s right for your portfolio.

On that note, here’s something else you should know about. The second you join, you’ll also get access to our proprietary “IPO University.”

IPO U is a treasure trove of educational videos, articles, interviews, and research all created exclusively to help members of IPO Trailblazers get up to speed on the complicated IPO market within just a few days’ time.

And it’s all conveniently housed right on our members-only IPO Trailblazers site for you to access at your leisure – 24/7/365, for as long as you’re a member!

Which brings us to the all-important question I’m sure you’ve been waiting for…

Just how much is access to IPO Trailblazers going to cost?

From everything you’ve seen today and the fact that you’ve read this far down in your invitation, you probably agree that the “Golden Age of IPOs” is just the start of something huge.

An opportunity to get in on a greater number of potentially game-changing companies than we’ve seen in decades… perhaps ever.

Tom Gardner has stressed to me over and over again how being able to grab a stake in a newly IPO’d company that can do what no other public company could previously do is what has the chance to genuinely set the “Golden Age of IPOs” apart from every other wealth-building opportunity we’ve seen.

These companies are truly “new,” and they bring things to the public markets that we could have never even fathomed a few years ago.

Tom is ready to roll up his sleeves and get started. He’s walking around the office fired up in a way I’ve rarely seen him.

And while we could easily just go ahead and charge more, Tom wants as many people directly alongside him for this bold IPO journey as possible.

He truly believes that if you aren’t a Member of IPO Trailblazers, you’re missing out on part of something the likes of which The Motley Fool has never done in the past.

A fortune-making ground-floor opportunity in the “Golden Age of IPOs.”

Somebody is going to grab it, and Tom isn’t waiting a second longer to be that somebody. He wants YOU right there with him.

Which is why instead of our typically higher per-year pricing, we’ve decided to set the list price IPO Trailblazers at just CA$1,999 per year.

While that isn’t cheap by any means, I do believe it represents a tremendous bargain.

I must also note that because so much of the value of IPO Trailblazers is being delivered directly up front, we also cannot offer cash refunds on this service.

Tom built IPO Trailblazers for Motley Fool investors who are committed to using the right strategy to build a portfolio full of potentially high-upside stocks.

If a group of short-term traders was able to buy IPO Trailblazers, quickly make use of its up-front recommendations, and then cancel without paying their fair share...

They could push up the prices of these tiny stocks and do a huge disservice to investors who are properly committed to this "ground-floor" investment strategy for the long run.

That all said, we do back IPO Trailblazers with our Ironclad 30-Day Satisfaction Guarantee.

Ironclad 30-Day Satisfaction Guarantee

If at ANY time during the first month of your membership you feel like IPO Trailblazers isn't properly taking advantage of the "Golden Age of IPOs" on your behalf, simply give our helpful and friendly Member Support team an email at [email protected].

They'll be happy to transfer your credit to another one of our portfolio services here at the Motley Fool Canada.

And don't worry – you won't get any cable-company runaround from them, either. Just a normal person on the other end doing whatever they can to help you out.

With that said, let’s briefly recap everything you get access to:

Tom Gardner's Top Recent IPOs: All of which are already waiting for you on our private, members-only website as we speak – accompanied by in-depth research write-ups on what makes them true "trailblazers."

Ongoing Recommendations & Coverage on Upcoming IPOs: Because our team knows how rapidly the IPO market is evolving, they'll be with you every step of the way once you join. From updates on some of the hottest private companies yet to IPO to real-time recommendations of companies in the lead-up to them going public, you'll never feel out of the IPO loop again as long as you're a member.

IPO University: Your personal treasure trove of educational videos, articles, interviews, and research, all geared toward demystifying the often overly complicated world of IPOs – conveniently accessible on our members-only website at all hours of the day!

When you add it all up, it really is incredible how much you're getting when you take advantage of this offer.

Considering we've sold other premium-tier services here at The Motley Fool for a lot more, being able to get in as a member of IPO Trailblazers for just CA$1,999 is a flat-out no-brainer in my opinion.

Besides, with our Ironclad 30-Day Satisfaction Guarantee, you can always email us within the first month of your membership, and we'll happily transfer the credit of your membership to another portfolio service of your choosing.

With all that said, I leave you with this…

Joining Tom Gardner on his search to get in on what he considers the most exciting emerging companies in the "Golden Age of IPOs" is the single best way I can imagine for you to grab your fair share of the pie.

So what are you waiting for?

If you’re ready to get started with the wealth-building journey of a lifetime right this instant, just click the button directly below.

Or if you have any further questions, we've asked our friendly Member Support team to stand ready. They can be reached at:

To getting in on the ground floor in a way you never thought possible,

David Hanson

Director of Membership

The Motley Fool

John Mackey, CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Teresa Kersten, an employee of LinkedIn, a Microsoft subsidiary, is a member of The Motley Fool’s board of directors. Abi Malin owns shares of Amazon, Apple, CrowdStrike Holdings, Inc., and Tesla. Andy Cross owns shares of Chipotle Mexican Grill and Netflix. Bill Mann owns shares of MercadoLibre and Shopify. David Gardner owns shares of Alphabet (A shares), Amazon, Apple, Baidu, Chipotle Mexican Grill, MercadoLibre, Netflix, and Tesla. Joey Solitro owns shares of Beyond Meat, Inc., Chewy, Inc., CrowdStrike Holdings, Inc., MercadoLibre, Netflix, and Shopify. Shannon Jones owns shares of Amazon and Apple. Tim Beyers owns shares of Alphabet (A shares), Apple, Chipotle Mexican Grill, Netflix, and Shopify. Tom Gardner owns shares of Alphabet (A shares), Baidu, Chipotle Mexican Grill, Netflix, Shopify, Tesla, and Zoom Video Communications. The Motley Fool owns shares of and recommends Alphabet (A shares), Amazon, Apple, Baidu, Chipotle Mexican Grill, Fiverr International, MercadoLibre, Microsoft, Netflix, Shopify, Tesla, TransDigm Group, and Zoom Video Communications. The Motley Fool owns shares of CrowdStrike Holdings, Inc. The Motley Fool recommends Safety Insurance Group, Trip.com, and Uber Technologies and recommends the following options: long January 2021 $85 calls on Microsoft and short January 2021 $115 calls on Microsoft. The Motley Fool has a disclosure policy. Motley Fool Canada owns shares of Shopify, The Trade Desk, and Zoom Video Communications.

IPO: Trailblazers includes U.S. stocks. All billing is in CAD. You will be billed according to your choice below and then $1999 for each year thereafter.

This product is non-refundable.

Having trouble ordering or have any questions for us? Just send them to [email protected], and we’ll get back to you ASAP!