To complete your order, it is necessary to enable JavaScript.

Motley Fool Canada - Order Now!

Already a member? Login

Discover Motley Fool Canada’s solution designed to zero in on emerging, potentially fortune-making mega-trends at their earliest stages!

Discover why “Genesis Trends” are so critical to identify ...

And why “Genesis Trend” stocks jumping 593%, 264%, even 976% in recent months could be just the beginning of a NEXT wave of fortune-making trends…

Announcing Trend-Spotter, the Motley Fool Canada service built to pinpoint emerging trends at their earliest stages!

This is unlike any other time in our lives, Fool.

Now, I can completely understand if your attention has been elsewhere, but I need to alert you to something that’s been happening in the markets.

During market rebounds, some stocks will spring back more rapidly than others. You may see a growth stock outperform the market by two fold… Or even three fold, on more rare occasions.

However, in recent months, a select group of stocks began racking up gains that exceed the market’s returns by 10X, 15X, even 20X or more!

Which has translated to returns of 593%, 264%, even 976% in just MONTHS.

(And we’ll dig into each one of those stocks in just a moment…)

Now, if you’ve been invested in the market since the pandemic began in March 2020, chances are you’ve seen your portfolio rebound. Blue chip technology companies such as Amazon, Apple, and Microsoft have also seen strong returns in recent months.

And after EVERYTHING that’s happened in the market over the last year, I’d imagine the question on every Canadian investor’s mind is simply: “What’s NEXT?”

Are the returns above – which range from 593% to 976% – an opportunity passed by… OR the first stocks to rise from a much larger trend?

Ones that could lead investors to a “road map” of where the market’s biggest returns could lie not just in 2021 - but the entire decade ahead?

Well, settle in, because you’re about to discover…

Why we think we're experiencing an EXPLOSION of potentially fortune-making trends right now…

That could reset the “haves” and “have nots” of the investing world… for good!

To understand why this year could go down as an era-defining year in investing, we need first to dig into the concept of “Genesis Trends.”

Now, we’ll provide an exact definition in just a moment… But first, I want to show you what one looks like in action.

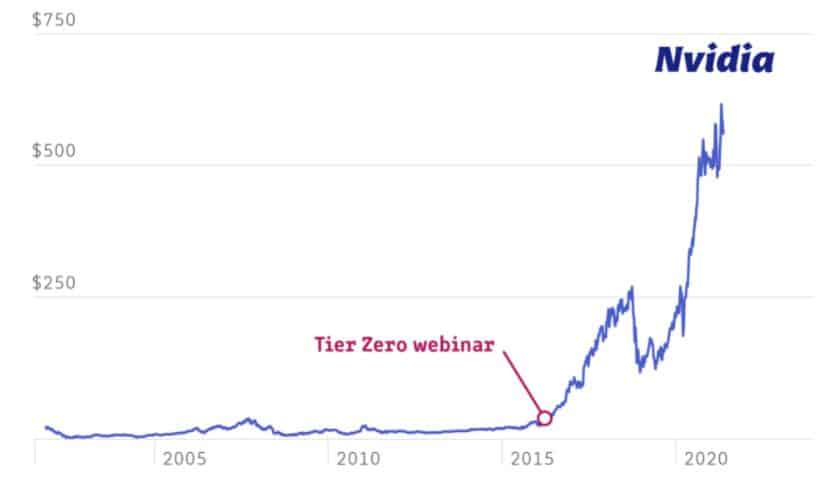

Let’s take just a moment to focus on NVIDIA (NASDAQ: NVDA). It’s a company you’ve likely heard of; it's had outstanding performance over the past five years.

Just take a moment to appreciate how remarkable that is…

From nearly a decade of no returns…

To 10X returns in less than five years! In fact, the year this “Genesis Trend” took off, NVIDIA was the top-performing stock in the entire S&P 500!

And 2021 could become the year of the “Genesis Trend”!

Now, I haven’t sent you this invitation today to discuss some single breakout technology or isolated trend.

I’m confident you need to be laser focused on an opportunity that’s potentially much larger.

Because I believe we could be seeing the next era of technology and investing trends…

Generating a wave of powerful new “Genesis Trends” that today are only at their beginning.

Because history has shown there have been past years when investors could suddenly discover the emergence of MANY powerful trends that appeared in a narrow window of time.

The moment the Internet came about – wasn’t everyone in technology drooling about the next potential billion-dollar idea?

And we saw when the Internet went mainstream in 1995, a MASSIVE wave of new trends emerged!

In just a narrow window of time, e-commerce rose, search engines grew, and massive data centers began dotting the American landscape.

Just 12 years later, the launch of the iPhone heralded another new era. Suddenly, anyone in technology was drooling about the “app” that could become the next billion-dollar idea.

And almost instantly, a new wave of trends began!

Beyond the emergence of “apps,” we saw a wave of mobile commerce companies, the acceleration of cloud computing... the list could go on and on.

And now, we could be at the beginning of a similar moment at which a series of massive trends suddenly rises at once. I call it the DIGITAL WAVE.

Now in 2021, the reality is no one could have predicted this moment… It’s the result of perhaps millions of businesses and hundreds of industries all embracing a rapid digital shift at once in response to the coronavirus.

Just consider for a moment how coronavirus has changed our lives. In early May, 100 million Americans reported working from home. With stores closed or limited, online shopping boomed. Doctors’ offices have moved online.

Now, here’s what’s important about “Genesis Trends.”

They’re moments where technologies or growth markets suddenly hit a point of rapid acceleration that effectively creates the beginning — or “Genesis” — of a new trend.

During the emergence of “Genesis Trends”…

Growth rates can suddenly reach new – often much higher levels.

Winners and losers of industries can be rapidly reset.

Companies that establish EARLY leadership positions become difficult to disrupt.

In short, as I’ll demonstrate in just a moment, historically, these have been excellent times to discover stocks that can grow 10X, 20X, or even more.

Now, as I just mentioned, this “digital wave” is causing massive shifts in industries across the entire economy.

And that is creating a WAVE of “Genesis Trends” – just like we saw in 1995 and 2007!

And I’m willing to bet most investors still don’t appreciate how many ENORMOUS new business opportunities have emerged seemingly overnight in the past year alone… and could continue to emerge going forward…

So, allow me to show you…

How “Genesis Trends” in 3 of the world’s largest industries have ALREADY led to returns of 593%, 264%, even 976%!

To fully understand how rapid growth from this “digital wave” is re-shaping industries, let’s check in on three unique opportunities that already emerged in 2020.

And in just a moment, I’ll show how they already contributed to returns of 593%, 264%, even 976%!

First up, let’s look at the tectonic shift in online shopping.

Now, I already mentioned that the birth of e-commerce itself became a “Genesis Trend” when the Internet went mainstream in 1995.

However, with e-commerce today being among the most massive industries on Earth (e-commerce spending hit $2.5 trillion last year!), investors can be richly rewarded for watching for the birth of new trends in the space.

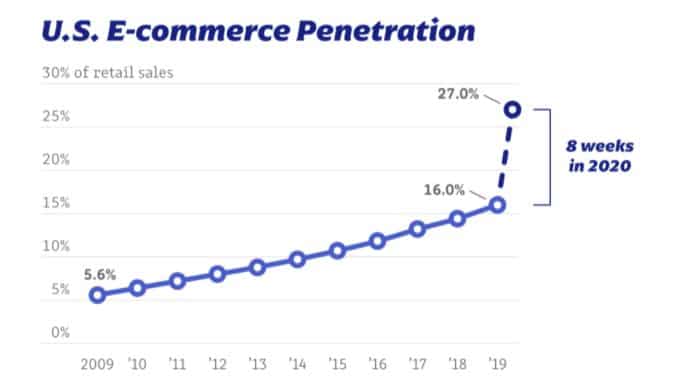

And here’s what’s amazing: 2020 may have been the most transformative moment in e-commerce history so far. That’s because after the global pandemic began, the space saw a decade’s worth of growth in just 8 weeks of time!

If you’re having a hard time wrapping your mind around that kind of growth, just take a look at the chart below.

Of course, a long-time e-commerce giant like Amazon has benefited and will continue to benefit from this…

But all this growth – this extreme acceleration of e-commerce growth – in just weeks is creating a wave of opportunity for much smaller companies.

Or, we can look at the mind-boggling growth in new software trends.

With more than 100 million Americans working from home and companies embracing remote work – suddenly there’s been a MONUMENTAL shift across demand for software!

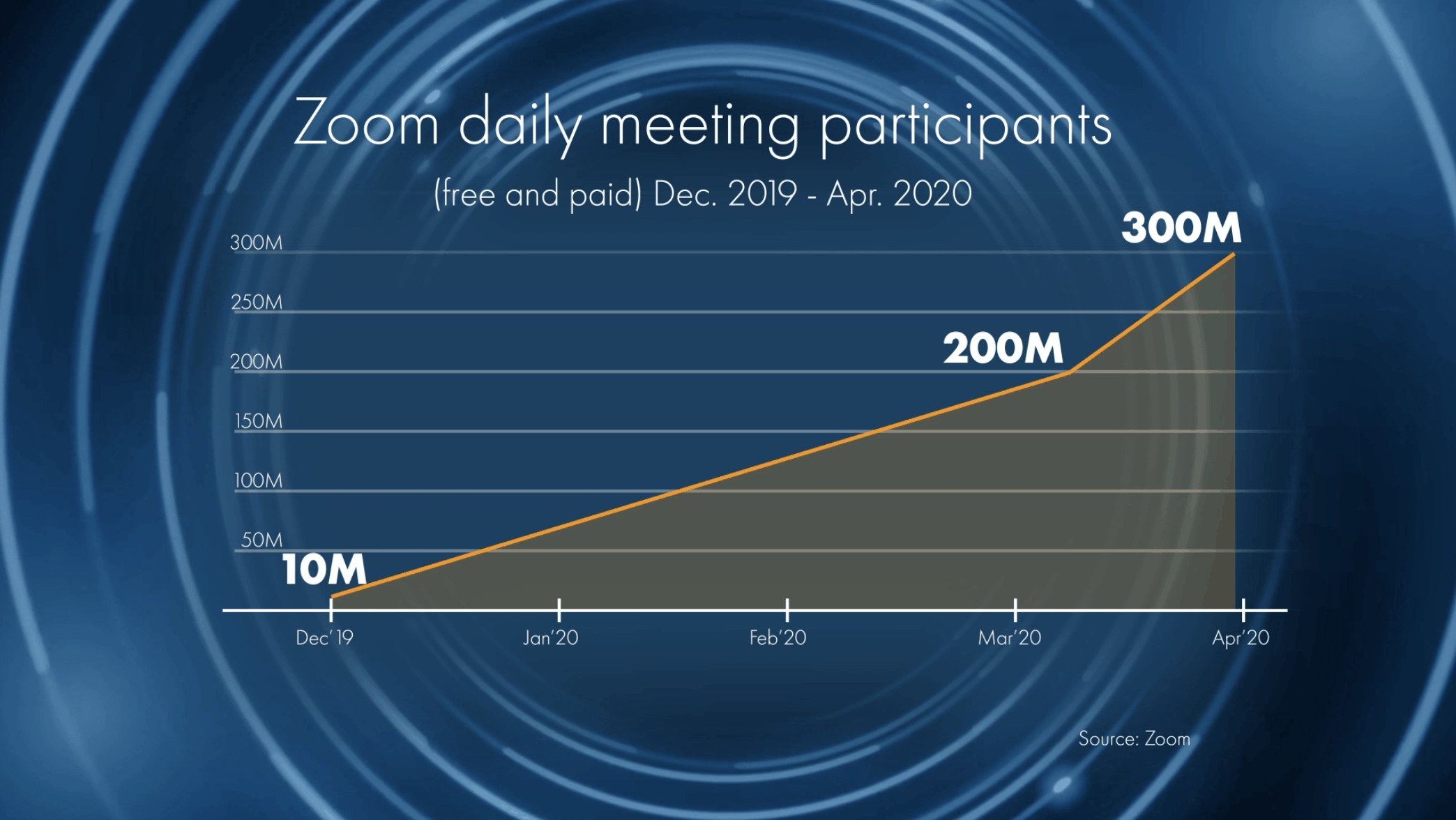

Such as Zoom videoconferencing, which saw 30-fold growth in less than four months!

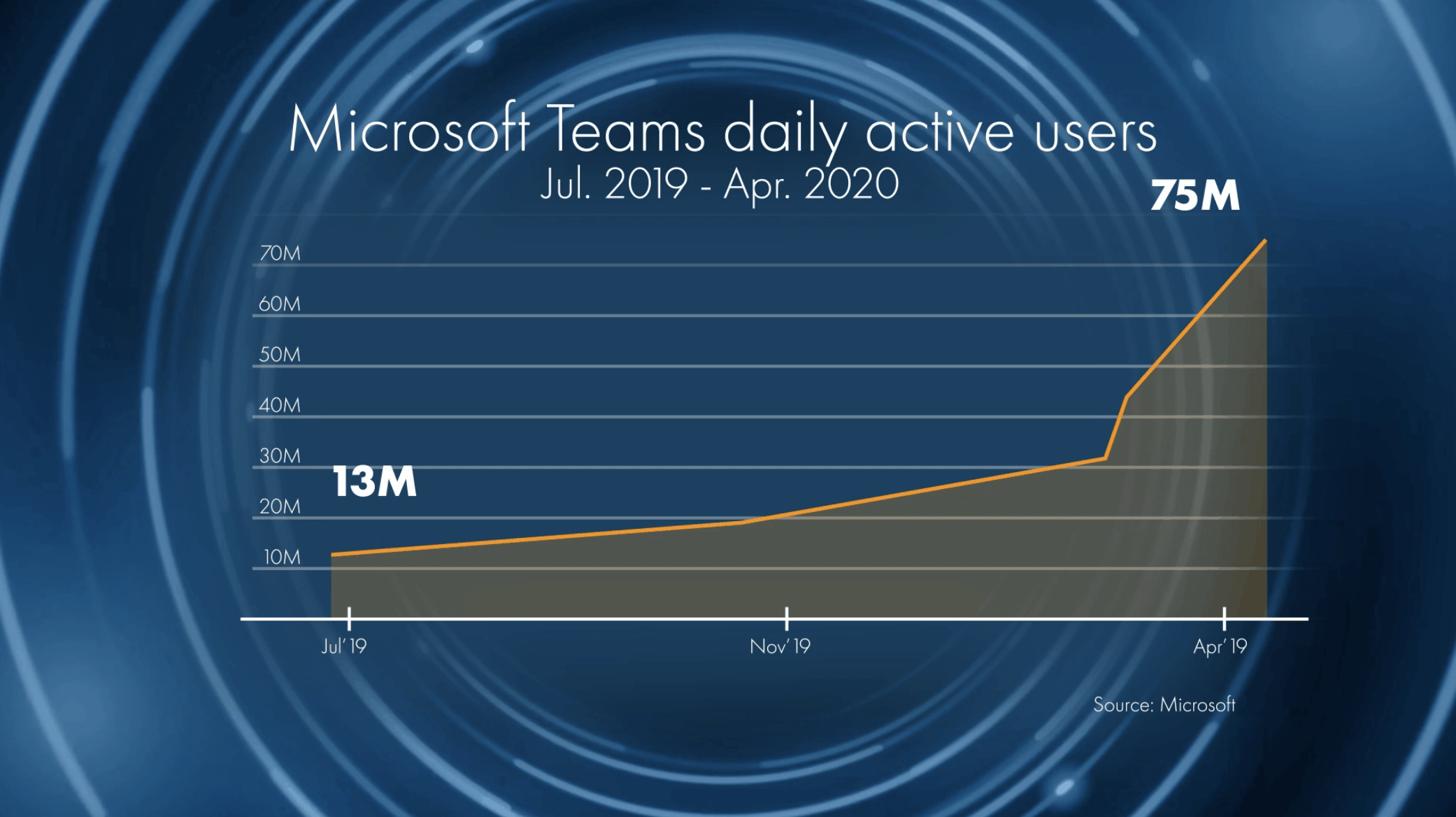

Or we can look at the growth in Microsoft Teams, which is software built to facilitate remote workforce communications:

The key point: This is a market experiencing sudden (and quite rapid) growth… Clocking in at 30X and 5X growth in just months!

And finally, healthcare was radically transformed in 2020. With doctors and patients wanting to limit in-person contact, the industry has rapidly embraced digital solutions like virtual healthcare visits.

In fact…

Between March 2 and April 14 of 2020, virtual healthcare visits grew a stunning 4,345%…

Leading healthcare researcher Frost & Sullivan called it a “tsunami of growth.”

Now, if you’re an investor on the lookout for high-growth investments, a market suddenly experiencing 4,000%+ growth in just weeks is the thing dreams are made of…

And as “Genesis Trends” have taken off, so have investor returns.

1,031% returns in just 134 days!

All that growth in e-commerce (a decade’s worth of progress in 8 weeks!) sent the fortunes of specialty e-commerce companies soaring.

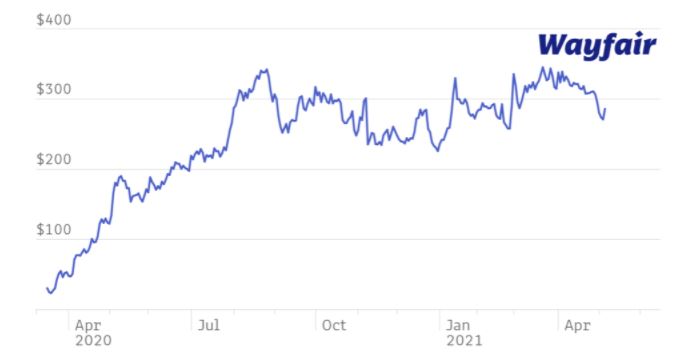

Take Wayfair (NYSE: W). Heading into 2020, its share price was falling, and investors were giving up on its growth story. Selling furniture and home goods online was proving to be a more difficult task than expected…

However, since it became clear in March that the events of 2020 would rapidly accelerate online shopping, Wayfair’s shares gained 1,031% in just 134 days! Wayfair is still up 976% since mid-March 2020!

And Wayfair is far from the only specialty online retailer experiencing a sudden “Genesis Trend.” E-commerce companies selling everything from masks to pet food online are suddenly seeing massively accelerating sales growth (and their share prices are following!).

766% returns in just 137 days!

As I showed earlier, software like Zoom and Microsoft Teams have seen growth of 30X and 5X in just months.

Remote workforce trends that were already underway have suddenly seen incredible acceleration, providing select cloud computing and software companies with a massive tailwind of growth.

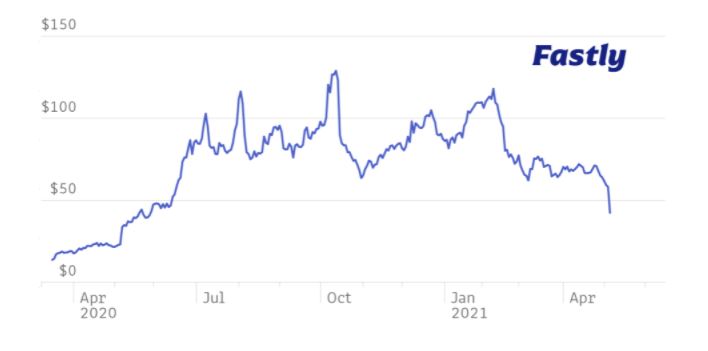

Fastly (NYSE: FSLY) has spent years building a leadership position in “edge networking” – developing a devoted customer base.

Edge networking moves data and applications closer to customers… It makes the infrastructure of the Internet better.

And in a world shifting to companies working remote, with spiking Internet traffic… Well, suddenly being the leader in this category in a time of rapid expansion looks A LOT more valuable.

And sure enough, Fastly’s stock has taken off in 2020, up 264% since mid-March 2020!

501% returns in just 130 days!

Finally, let’s take a look at how “Genesis Trends” in virtual healthcare are driving returns.

Livongo (formerly traded as NASDAQ:LVGO) is a connected health company that helps people manage chronic conditions like diabetes and hypertension.

With coronavirus disproportionately affecting segments of the population that are older or subject to chronic conditions, well… It should be obvious that technology that can help save lives is more in demand than ever!

Especially one like Livongo, which allows for more remote alerts and can keep its users out of riskier healthcare settings.

And Livongo was acquired by Teladoc in late 2020 — an event that even further illustrates the incredible momentum that this trend has achieved!

As you can imagine…

If virtual healthcare visits are exploding by more than 4,000% in little over a month, this “Genesis Trend” could see MANY outsized winners in not just the years but the decade ahead!

Which brings me to…

How YOU can begin positioning your portfolio to capture the potentially incredible upside from what could be 2021's most powerful “Genesis Trends”!

Looking at the returns above, you either have a smile on your face stretching ear to ear because you own those stocks…

Or you’re probably asking yourself, “Have I already missed the boat?"

The rise of powerful “Genesis Trends” has had a fairly predictable outcome to date. After all, it makes sense that if trends suddenly accelerate 2X, 5X, 30X… even 40X…

The companies that are leaders in those trends have seen their own sales growth (and share prices) suddenly accelerate as well.

Historically, we saw this with how NVIDIA went from almost a decade of flat returns to returning more than 10X in five years.

And now we’re seeing it today…

With share prices of companies leading “Genesis Trends” seemingly turning on a dime and seeing gains of 6X, 9X, even 11X in just months!

So, yes, the truth is… Some gains have simply already passed. You’ve seen as much in the examples above.

However, you can rest assured that the three stocks and trends I outlined above are just a small fraction of the stocks and trends we’re carefully following…

... that could see business acceleration in 2021, potentially putting them on the forefront of the next decade’s most powerful trends!

Just take a moment to consider all the powerful trends that are seeing MASSIVE shifts in demand that I haven’t even covered in this invitation!

The “death of cash” and explosion of digital banking: Many stores during the pandemic have signs on cash registers humbly requesting, “Sorry; no cash, please.” Today, the use of digital payments is exploding, while old models of “branch banking” are rapidly disintegrating. One technology company that doesn’t have a single physical “bank” reportedly has signed up 11 million new customers for direct deposit in recent months alone!

The COVID vaccine: The pandemic caused a sudden shift in drug development toward medications that treat the coronavirus. Beyond just companies developing and producing vaccines, this has had deep implications on the growth of healthcare software and technologies that facilitate drug development. We’re very excited about one of these companies!

The next wave of streaming: With movie theaters closed down and entertainment options limited, consumers have begun streaming at unprecedented levels. Consider that Disney launched its Disney+ service in November 2020 and is ALREADY reporting more than 100 million streaming subscribers! Then there are opportunities in connected TV advertising... and much more!

Now, I could go on and on…

After carefully studying the market in recent months, it’s my belief that this year could provide investors a “road map” for not just the years ahead…

But the biggest trends that could stretch out the entire next decade.

Meaning if you want to build a strategy for trends that could be emerging in their earliest stages, you’ll want to pay close attention to what I have to say next…

I’ve already described why today could be the right time for investing in “Genesis Trends.”

But how do you pick the right stocks?

As we’ve seen today, trend investing can really lead to life-changing results.

And in my experience as a long-time analyst at The Motley Fool, successful trend investing that can lead to discovering stocks that rise 10X, 20X, sometimes even 50X or more really comes down to three key “pillars.”

First, it requires discovering the right trend.

Today, we’ve discussed why we could be seeing the “Year of the Genesis Trend.”

And by now, I’m sure you fully understand why I’m so confident this is a moment when multiple powerful trends could just now be getting started…

Second, it comes down to investing at the right time.

Which, again, I’ve shown today the kind of returns difference that’s historically occurred when investors can get into the most powerful trends early… instead of waiting to get in along with the rest of the crowd.

And the third and final element is identifying the right stock.

I’ve discussed why companies that are leaders when “Genesis Trends” first start to accelerate are immediately put in a very enviable competitive position…

But let’s just take a moment to look back at 2007, the last time we saw an explosion of “Genesis Trends” similar to what I’m predicting for 2021 and beyond…

On January 9th, 2007, we saw an event that defined not only the next decade of technology but the basic foundation of life as we know it.

That was the unveiling of the iPhone.

But what you may not know is there were actually two companies at that event: Apple and its exclusive partner, Cingular – now AT&T – which launched service on the phone.

A lot of investors I knew at the time preferred investing in AT&T. They knew smartphones would be huge and figured AT&T would grow regardless of whether Nokia, Research in Motion and its Blackberry phone, or Apple ultimately won the smartphone battle.

Of course, you can guess the results since that fateful date.

Apple has returned more than 4,209%, turning every $50,000 into around $2.1 million, while AT&T’s share price is actually down around 20%!

And that is the power of the RIGHT STOCK.

Because you can nail the right trend, you can pinpoint the right time it’s taking off, but if you don’t have the right stock… well, as we just saw with AT&T, it simply won’t matter.

Which is precisely why The Motley Fool dedicates incredible amounts of resources to our trend research.

In fact, historically, nearly all our greatest winners correspond to timing right at the beginning of incredible trends.

And to capitalize, we’ve built dedicated research around what we believe are many of the most important trends members like you should capitalize on right now.

Then we build portfolios to focus on that specific opportunity, which you can quickly and easily follow along with.

As you know, we really believe in transparency here at the Fool, so let’s just review what trends we’ve targeted of late. And, more important, the returns from those portfolios.

In June 2020, we launched Next-Gen Supercycle, which was focused on the birth of 5G and the digital transformation resulting from it.

That Next-Gen Supercycle portfolio was returning 34.5% in mid-July, whereas the S&P 500/TSX was just 27.9%.

Next up we have Future of Entertainment, which focused on streaming and was launched in March 2020 – right before the global pandemic began.

Yet amazingly, that portfolio is returning 90%, whereas the S&P 500/TSX stands at a mere 26.2%!

In February 2020, we launched Cloud Disruptors 2020, which was built solely around opportunities in the cloud computing space.

That portfolio is up 75.3% versus the market’s mere 22% return…

And finally, if you rewind to more than a year ago, we have Augmented Reality & Beyond, which was launched in June 2019 and stands at 99% returns versus the market’s 29.9%.

If you would have put a million US dollars in Augmented Reality’s picks when it first went live, you’d already have US$991,000 in profits... in fact, you’d be looking at more than a million dollars in gains!

Or, you could have dropped it in a fund that performed with the market, and you’d be looking at roughly US$299,000 in profits so far.

I think I know which one I’d prefer.

That said, we have heard from our members that there’s a gap in the strategies we're offering. That is, we’ll have portfolios that go very deep on specific trends like cloud computing, augmented reality, or 5G…

… And we’ll ALSO offer portfolios like The Partnership Portfolio, based around our CEO Tom Gardner’s investing philosophies…

… But until recently, we didn't have a portfolio that’s built to dynamically target newly emerging trends and new opportunities immediately as they arise.

Offering research on specific trends, but also built to be a complete portfolio solution.

That's why...

I’m now pleased to announce that we’re accepting new members into Extreme Opportunities: Trend-Spotter.

As I just said, it’s a portfolio not solely built around a specific trend, but rather identifying the most promising trends as they emerge, and then providing our highest-conviction stock opportunities on each.

We first began developing what would become Trend-Spotter all the way back in February 2020.

(Which I’m sure by now feels like a lifetime ago.)

The concept was to design a service built around pinpointing the three anchors of trend investing I referenced earlier: identifying the right trend… at the right time… and selecting the right stocks for that trend.

… And then using that framework to build a complete trend-focused portfolio.

Now, of course, as I’ve outlined today, the events of 2020 really kicked our efforts toward building out Trend-Spotter into overdrive!

We wanted to take advantage of all the emerging trends today, but we also wanted to give our investing team the time to conduct deep due diligence into what their top trends are.

Now, please note that this will be a very opportunistic portfolio, as opposed to something that you set and forget.

We wanted to build a solution that can dynamically focus on trends immediately after they emerge. Which probably has you wondering…

What exactly will I get when I become a member of Trend-Spotter today?

For starters, anyone who joins Trend-Spotter will receive full breakdowns on seven distinct trends.

For each one, we’ve identified our two highest-conviction stocks, which are official recommendations from the service.

Of course, we would never promise that these stocks will perform as well as some of our historical recommendations, but we have a lot of pride in our track record of picking the right trends and the top stocks in them across time, but that all starts from the right process.

Which is why we’ve taken our learnings over time and built a proprietary 13-step checklist, which is where our team begins its hunt for the trends that it will ultimately bring members inside the service.

That checklist is built to separate the temporary investing fads from the trends that are actually built to last.

What’s more, we’ll be targeting different kinds of trends in Trend-Spotter.

The core of our portfolio is what we call “macro trends.”

An example is the next wave of specialty e-commerce that’s sent a stock such as Wayfair up more than 976%.

Now, I should note, Wayfair is not a recommendation inside Trend-Spotter. Our team selects only its highest-conviction stocks for each trend, and, believe it or not, Wayfair did not make the list.

But here’s where it gets extremely exciting. The team will also select what it's calling “micro trends.”

These are trends that are more under the radar and opportunistic.

They could be limited-time opportunities in a corner of the market we believe is cheap…

They could be driven by unseen events that are rapidly changing, like what we saw with the global pandemic…

Or they could be in market opportunities small enough to be totally missed by the media, but with the potential for surprisingly lucrative futures!

Here’s just a quick preview of what kind of stocks members will find inside Trend-Spotter…

Because as I’ve noted, you can pinpoint just the right trend…

And invest at exactly the right moment…

But if you don’t have the right stocks, it won’t matter!

Trends have played a massive part in some of the Fool’s greatest stock stories, for certain. But remember, they’re still ultimately stock stories.

Whether its e-commerce propelling Amazon to 21,345% plus returns since we first recommended it.

Or artificial intelligence propelling NVIDIA forward by more than 12,589%....

The list could obviously go on and on…

Of course, I can’t reveal the stocks that have been selected inside Trend-Spotter right here, as that wouldn’t be fair to the members who accept today’s invitation and fully commit to this trend-based investing strategy…

… But I can say this.

Amazon and NVIDIA are great companies. In fact, I personally own both. That said, Trend-Spotter will generally be looking much more at emerging opportunities.

In fact, I want to make it clear that a big focus for Trend-Spotter will be locating stocks that are OUTSIDE services like Stock Advisor Canada. We may still have some overlap, but we’re devoting tremendous resources to research stocks and trends…

And with Trend-Spotter focused on being the solution for emerging trends, the advisors in the service are focused on bringing all-new recommendations into it.

Here’s a couple of examples that new members will find among the stocks currently inside Trend-Spotter:

A tiny stock worth a little more than a billion dollars that’s finally unifying the way companies manage social media into one simple package. It’s a massive market opportunity, but yet again, this company has never been recommended by a single Motley Fool Canada service. This recommendation can be found only inside Trend-Spotter!

An online retailer that’s seen e-commerce orders accelerate at a tremendous rate in recent months. This is a stock our analysts have been researching, and it’s riding massive e-commerce tailwinds that recently emerged!

Does that mean every stock inside Trend-Spotter will be outside the existing Fool universe of recommendations? No.

But it also means our focus isn’t telling you that Amazon is one of our top e-commerce stocks, because I’m guessing you probably already know that…

Instead, we’re focusing on more emerging opportunities.

Which brings up the question… who is leading the way for Trend-Spotter?

Precisely because we’re looking at extreme emerging opportunities, Trend-Spotter is led by Seth Jayson and Emily Flippen, two Fools who have a substantial amount of experience working not only with trends…

… But also researching brand-new stocks not yet found in any of our services.

Let’s start by discussing Seth Jayson.

First off, he’s one of the sharpest analysts at the Fool. You may know him from being the long-time advisor on our U.S. Hidden Gems small-cap service, where he of course spent years uncovering little-known opportunities.

And today, he leads Extreme Opportunities: Artificial Intelligence as the lead advisor. It’s worth noting that Artificial Intelligence is outperforming the market in dramatic fashion, beating the index by 2 to 1.

He has an incredible track record and level of expertise.

Also co-leading Trend-Spotter is Emily Flippen.

Emily is the lead advisor for Extreme Opportunities: Marijuana Masters, which, despite the incredible amount of turbulence in the industry, has seen returns of 102% versus just 32.8% returns for the S&P 500 across the same time span.

Emily has been personally working with the Rule Breakers team to discover up-and-coming stocks for Rule Breakers and is also a specialist in the China investing space.

We’ve really put together the perfect team of analysts for a service based on investing in emerging trends.

Speaking of which, here’s how membership inside Trend-Spotter will look, once you join…

Trend-Spotter features seven distinct trends and 22 total stock recommendations…

The instant you join, you’ll receive comprehensive write-ups on each trend, including precisely why our analysts pinpointed them.

Plus, each and every stock will come with a proprietary research report created specifically for Trend-Spotter.

Now, I’ve already discussed that Trend-Spotter is built to be opportunistic. The team is constantly analyzing evolving market trends, watching for moments of opportunity, and researching stocks that are presently not found in ANY Motley Fool service.

Which is why we’re targeting guidance on a brand-new trend every single quarter. Of course, I use that word “targeting,” because there is that opportunistic element here.

Meaning that if market dynamics change, Trend-Spotter will cover new opportunities directly as they arise.

Plus, once we’ve selected a trend, our job is nowhere near done. We’ll add stocks to existing trends as opportunities emerge, as well as re-recommend stocks if the team’s confidence in them grows.

Overall, it’s a dynamic portfolio that’s been designed specifically for trend investing.

And of course, we’ll also publish a monthly news roundup, answer member questions, and provide a quarterly digest on the most important and up-to-date news impacting the stocks in our portfolio.

Let’s take just a moment to review everything you’ll immediately discover if you make the bold decision to join Trend-Spotter today and begin investing alongside this really dynamic and brand-new service:

You’ll receive immediate membership to Trend-Spotter, which includes reports on seven trends and 22 stock recommendations that each come with proprietary research write-ups. All of that is available right now.

In addition, you’ll receive a year of continuing access to the service, where we’re targeting the release of a new trend report every quarter. It’s expected Trend-Spotter will issue 1 to 3 recommendations per month on average, with a specific focus on stocks that have yet to appear in Stock Advisor Canada.

With that all said, there’s only one final thing to discuss...

The matter of price.

Now, as you might expect, access to Extreme Opportunities: Trend-Spotter isn’t free. But it’s a whole lot less than you might think…

Consider the extensive research you’ve just witnessed on recent market events and emerging “Genesis Trends”…

And then consider the costs associated with paying our global research team to research emerging trends and stocks outside the Stock Advisor Canada universe...

From which they've selected only a handful that meet our stringent criteria inside Extreme Opportunities: Trend-Spotter.

And our goal is simply nothing less than giving investors committed to investing in this powerful trend the best solution possible.

With complete quarterly trend reports, new stock recommendations, and market updates and commentary ALL focused on this single, powerful, opportunity…

We're offering one year of access to Extreme Opportunities: Trend-Spotter for just $999.

Now, I must also note that since Extreme Opportunities: Trend-Spotter is a unique solution designed to give you access to research developed across seven distinct trends and including 22 current stock recommendations already on our members-only website… we simply cannot offer refunds on this offer.

You see, we built Trend-Spotter for investors who are committed to building forward-looking portfolios with the right strategy.

So, if a group of short-term traders were able to gain access, they could quickly trade on its recommendations and then cancel WITHOUT paying their fair share.

(Including that tiny micro-cap that’s not found in any other Motley Fool Canada service…)

They could push up prices of the stocks and do a huge disservice to investors who are genuinely committed to this strategy for the long run.

However, because I never want to rush you into a hasty decision, just remember that all members joining through this invitation are fully covered by The Motley Fool’s Ironclad 30-Day Satisfaction Guarantee!

If for any reason you’re not completely satisfied with our Trend Spotter portfolio, asset allocation guidance, continuing recommendations, and market updates within the next 30 days…

Then simply contact our helpful customer service team and they’ll happily work with you to provide the membership fee paid as a credit to one of our other Motley Fool Canada portfolio services.

With all that said, just click the button below to view the full terms of your offer!

To always knowing what’s coming next,

Eric Bleeker

Senior Technology Analyst

Returns as of 10/3/21 unless otherwise noted. John Mackey, CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Teresa Kersten, an employee of LinkedIn, a Microsoft subsidiary, is a member of The Motley Fool’s board of directors. Auri Hughes owns shares of Zoom Video Communications. David Gardner owns shares of Amazon and Apple. Eric Bleeker owns shares of Amazon, Apple, Nvidia, and Zoom Video Communications. Seth Jayson owns shares of Amazon, Apple, Microsoft, and Nvidia. Tom Gardner owns shares of Zoom Video Communications. The Motley Fool owns shares of Amazon, Apple, Fastly, Microsoft, Nvidia, and Zoom Video Communications. The Motley Fool has a disclosure policy. Motley Fool Canada owns shares of Zoom Video Communications and Shopify.

Trend-Spotter includes U.S. stocks. All billing is in CAD. You will be billed according to your choice below and then $999 for each year thereafter.

This product is non-refundable.

Having trouble ordering or have any questions for us? Just send them to [email protected], and we’ll get back to you ASAP!