To complete your order, it is necessary to enable JavaScript.

Motley Fool Canada - Order Now!

Already a member? Login

PLEASE NOTE: Although the “Ground Floor Event” you’ll read about below did, in fact, take place yesterday, it didn’t actually occur until after the market had closed for the day.

This means that the handful of investors who got the full story yesterday have barely even had a chance to act on it — and, more importantly, that it’s not too late for you to join them!

With that in mind, we’d ask that you please give the information below (which we initially sent you yesterday morning) your careful and immediate consideration.

In just a few short hours the lives of a handful of in-the-know Canadian investors could potentially change forever…

Will you be one of them? You could be…

It all starts with getting the full story on the unique opportunity below — so you can decide for yourself whether or not to be front and center when the next “Ground Floor Event” takes place in a few short days.

“Past performance does NOT guarantee future results.”

As an investor, you’ve no doubt heard that legal disclaimer hundreds upon hundreds of times. We all have.

And it’s something you should always keep in mind anytime you’re contemplating putting any amount of your hard earned money into a stock, bond, mutual fund, or other investment vehicle.

But, as any seasoned and successful investor can tell you, occasionally you do find certain patterns, principles, trends, or signals that seem like they lead to winning investments more often than not (much the like the one we’ll tell you about just ahead, in fact).

Just ask legendary investors like…

Peter Lynch — who managed to grow the assets of the Fidelity Magellan Fund from just $20 million when he took it over in 1977 to a whopping $14 BILLION by 1990.

That’s a return of 70,000% across just 13 years. And many attribute his jaw-dropping success to always sticking to his simple belief that you should “never invest in an idea you can’t illustrate with a crayon.”

Bill Miller — the portfolio manager for the Legg Mason Value Trust. Under his leadership, the fund had one of the longest “winning streaks” in mutual fund history — beating the S&P 500 Index for 15 consecutive years between 1991 and 2005.

In fact, the size of his fund grew from $750 million in 1990 to $20 BILLION by 2006. His secret? Realizing that any stock — even an “expensive-looking” one — could be a value stock if it was trading at a discount to its intrinsic value.

John Paulson — the once obscure hedge fund manager, who made $15 billion for his fund in 2007 alone by spotting a pattern of mortgage defaults and subsequently shorting the housing market just before its collapse.

In 2008, his strategy made him another $5 billion… and as much as $1 billion in a single day! Which led a Wall Street Journal reporter to write an entire book about Paulson’s bet, dubbed “The Greatest Trade Ever.”

Of course, a great many of the investors who’ve attained this kind of amazing success in the market keep their “tricks of the trade” under the tightest of wraps…

And unless you’re wealthy enough to have them manage your money for you, you’ll likely never be able to benefit from their immense experience and unique strategies.

Which is why we’re so excited to introduce you to a few other very successful investors whose experience and strategies you can put to work starting today…

But in order to properly appreciate the magnitude of this opportunity, we have to go all the way back to June of 1993…

When two brothers and recent college graduates, David and Tom Gardner, decided to do something highly unusual with their hard-won English degrees and the lifelong passion for investing that had been instilled in them by their father…

Namely, launch an investment publication (from the shed behind David’s house, no less) that dared to take on the greedy and self-serving interests they felt largely controlled Wall Street…

And flew in the face of the conventional investment wisdom of the time by declaring their belief that the best person to manage your money will always be YOU.

They called their homegrown, grassroots investment newsletter The Motley Fool (an homage to one of their favourite Shakespeare plays, As You Like It)…

And at first, they only had 300-some-odd subscribers — most of whose names they’d found on a family’s wedding invitation list.

But then, one year later, they opted to launch a real-money “Fool Portfolio” on a new-fangled platform called the “World Wide Web” so that anyone with a PC and a modem could follow along as they publicly put their money where their mouths were…

And their community-based brand of do-it-yourself, long-term-focused investing obviously resonated with hardworking investors like you…

Because by December of that year, they had drawn so much attention that they were written up in The New Yorker, and a short while later they were even featured on the cover of Fortune magazine.

Over the next decade or so, they managed to publish 12 well-respected investment books — including several New York Times bestsellers... host their own nationally syndicated radio show…

And even make regular appearances on immensely popular U.S. television shows like Larry King Live... Charlie Rose... Dr. Phil... Good Morning America… and The Today Show...

Of course, it didn’t hurt that early on they put money behind stocks like…

America Online (AOL) in 1994 — which soared 20,000% over the next six years, and turned every $10,000 invested into a whopping $2 million.

Amazon.com in 1997 — which David Gardner has personally held on to over the past two decades for gains of more than 55,600%.

Starbucks in 1998 — a stock that has climbed over 2,500% since, and would have turned even a mere $1,000 investment into a meaningful $26,000 windfall.

But it wasn’t until March 8, 2002 — and the first ever “Ground Floor Event” — that they truly changed the world for individual investors like you forever…

You see, on that day, they finally did what their fans and followers had been asking them to do for so long…

And that was provide clear-cut and easy-to-understand guidance on exactly which stocks they believed hardworking individual investors should be putting their money behind at any given point in time.

They called this bold and highly anticipated new undertaking, Motley Fool Stock Advisor…

And by simply following along with David and Tom’s monthly recommendations in Stock Advisor investors of all backgrounds and experience levels were able to get in on what David and Tom considered to be the ground floor of some of the most exceptional investment opportunities of our time…

(Which is why even though David and Tom rarely recommend IPOs, we’ve come to think of these recommendations as “Ground Floor Events”.)

Of course, as you may well remember, with the collapse of the dot com bubble and ongoing concerns about global terrorism, 2002 wasn’t exactly the easiest time to be an investor…

So we think it speaks volumes about David and Tom’s disciplined long-term approach to investing that of the 24 stocks they recommended during their first year at Stock Advisor (and have either held or since sold)…

21 — or 88% — are currently in positive territory…

17 — or 71% — are currently beating the market…

14 — or 58% — have more than doubled in value…

10 — or more than 1 in 3 — are up more than 500%...

6 — or 1 in 4 — are up more than 1,000%...

In fact, all told, had you taken advantage of each of the “Ground Floor Events” that occurred during that first year of Stock Advisor, you’d be up an average of over 1,223% right now…

And just $1,000 invested into each of those early recommendations would have turned into a meaningful $293,725 stake by now.

There’s little doubt you have plenty of ideas about what you could do with that kind of extra money…

And we think it’ll give you some idea of why so many investors get so excited for the kind of “Ground Floor Events” we’ll be discussing today.

But as well as our Stock Advisor members have done so far, we think Canadian investors like you might be able to do even better going forward. Here’s why…

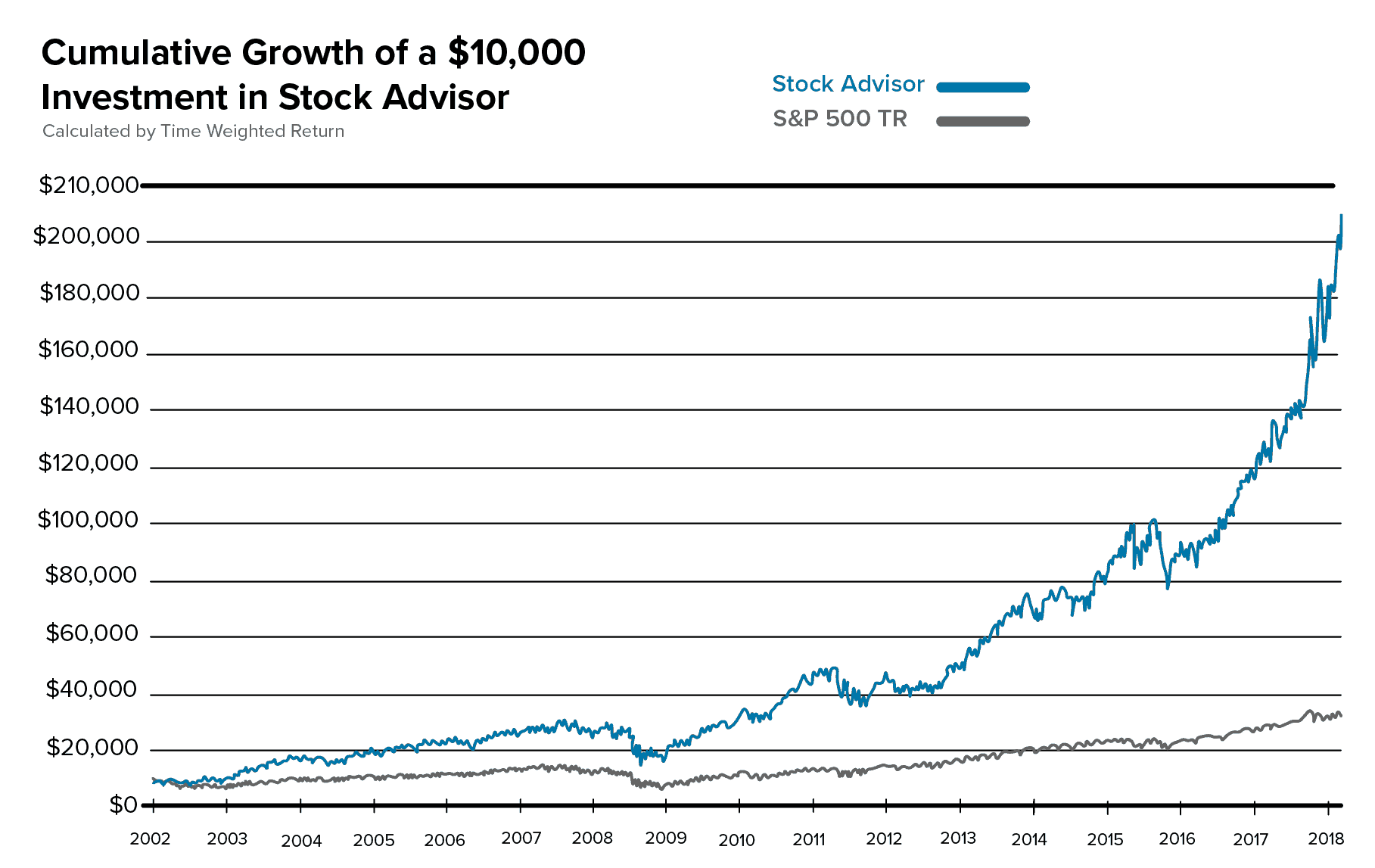

Since launching Stock Advisor in 2002, David and Tom Gardner’s average recommendation is up an incredible 349% as of July 11, 2018...

That’s a return over FOUR TIMES GREATER than the S&P 500 benchmark… and works out to a remarkable 9.25% annualized gain.

As you can see, simply paying attention to “Ground Floor Events” like the one we’ll be talking about today can have a big impact on your wealth over time.

We imagine you’ll agree that’s pretty impressive…

But, in order to truly serve all of the individual investors who needed their help, David and Tom Gardner knew they couldn’t stop there…

So following the success of Stock Advisor they launched a new stock recommendation service that focused on growth investment opportunities.

And you can bet that investors who paid attention to the “Ground Floor Events” that happened in this service are awfully glad they did right about now. Take, for instance…

The October 18, 2016 recommendation of Baidu (BIDU). Shares are up 1,849% since that day!

The June 25, 2014 recommendation of Align Technology (ALGN), which has resulted in gains of 379% so far!

Or the February 8, 2009 recommendation of MercadoLibre (MELI). To date, the stock has already soared 3,147!

Of course, it’s only fair to point out that not all of these “Ground Floor Events” have led to such massive winners — or even winners at all.

We’re also well aware that anyone can just cherry pick a few big successes here and there (and often do!)…

Which is why we’d like to point out that of all the “Ground Floor Events” that have taken place thus far in our company’s history, investors who have taken advantage have had the chance to…

At least double their money on 587 occasions…

More than triple their money on 281 occasions…

And grow their wealth by 10X or more on 43 occasions…

But as impressive as our U.S. results have been, we still felt it was our duty to try to do even more for international investors like you…

Which is why we’ve been working hard to spread the unique philosophy behind The Motley Fool — and Stock Advisor in particular — to hardworking and open-minded investors like you all over the globe…

So you can begin putting it to work for you in your own portfolio with a minimum amount of time and effort required…

And get timely recommendations that are custom-tailored to the financial markets where you actually live and work.

We started off by taking the Stock Advisor approach “Down Under” to Australia in December of 2011, where Motley Fool Share Advisor AU has gone on to batter its XAO benchmark by a factor of nearly three to one as of March 1, 2019, while ringing up an average stock return of 87%!

“The service is phenomenal, my portfolio has never looked so healthy and worry-free, and the support has always been prompt and helpful.”

— Tony, Randwick

Next, we went to London in March 2012 and opened Motley Fool Share Advisor UK. In just over six years, their average stock pick is currently up nearly 30% as of March... almost 50% greater than the return of their benchmark!

“Through the recommendations, I have repaid the initial Share Advisor membership cost many times over, I have learnt a lot, not only from the detailed analysis but also from the boards and great comments.”

— Trish G, Edinburgh

Now we’ve finally brought our incredibly successful Stock Advisor brand right here to Canada — so you can take full advantage!

“Even billionaires get ideas from The Motley Fool”

- Time Magazine

The Motley Fool stands out as an ethical oasis in an area that is fast becoming a home to charlatans."

-The Economist

But make no mistake… Stock Advisor Canada isn’t just another one of those run-of-the-mill “one-size-fits-all” investment advice services you may be familiar with…

For instance, rather than just funneling you a laundry list of stock picks from some so-called “pro” that lives and works in some far off financial centre…

We wanted to make sure that Stock Advisor Canada would be run for Canadian investors by an incredibly passionate and experienced Canadian investor…

Who not only knows the ins and outs of exactly how Bay Street works and has a deep understanding of the energy- and financial-focused Canadian markets…

But also has spent a tremendous amount of time scouring the globe for exceptional — and often overlooked — opportunities outside of Canada.

So we hired Ontario’s very own Iain Butler — who now serves both as our Chief Investment Officer for Motley Fool Canada and as the Lead Adviser of Stock Advisor Canada…

Before joining us here at The Motley Fool, Iain spent over a decade working as an analyst on the buy side of the Canadian institutional investing industry — focusing primarily on value plays.

But during his tenure as an “investment professional” Iain began to increasingly suspect what we’ve known here at The Motley Fool all along…

Namely, that this is an industry that’s built largely on hypocritical and misaligned incentives where the best interest of the clients rarely, if ever, comes first…

And that simply didn’t sit well with Iain.

So, having been a longtime fan and avid reader of The Motley Fool, he jumped at the chance to come work for us when we opened up shop here in Canada — and he’s been putting the interests of our Stock Advisor Canada members first ever since.

Like Chris W., a fellow Ontario-based investor and loyal Stock Advisor Canada member who recently wrote in to say:

“I’m so impressed by what a personal feel you guys have created. … It’s pretty impressive to ask you guys a question by e-mail and get response from you or Iain within a couple hours. Thanks for a great service!”

Or Mark V., a self-described “Canuck living abroad in Peru” who commented:

“Canadians need independent investment advice from a trusted source, and The Motley Fool is just the channel.”

And while Iain is a fantastic stock picker in his own right, he does have one very powerful “secret weapon” at his disposal that you should know about…

You see, because we wanted to Stock Advisor Canada to truly be a “go anywhere,” “best-of-breed” investment service that can help you capitalize on potentially life-change opportunities both inside and outside Canada’s borders…

We’ve given Iain and his team unrestricted access to all of The Motley Fool’s proprietary research and U.S. recommendation services.

So they can hand-deliver you full details on what they believe to be both the best Canadian-listed stock and the best U.S.-listed stock for your money each month.

And mere hours from now Iain and his team will be revealing the full details on their next “buy now” stock recommendation exclusively to their Stock Advisor Canada members.

If history is any guide, this is one “Ground Floor Event” you won’t want to miss out on…

And in just a moment, we’ll show you exactly how you can join over 26,000 investors who are already in line to get the full details on this exciting new investment opportunity.

But first we’d like to quickly tell you about a few of the potential candidates they have their eye on right now…

Including a few stocks that they have already recommended — and are strongly considering doubling down on this afternoon, like…

The tiny — yet cash rich and rapidly growing — Canadian entertainment company that is well positioned to profit as more and more “cord cutters” cancel their cable TV and start streaming their favourite shows over the Internet instead.

Much like Netflix (a stock that’s up as much as 19,212% in our U.S. Stock Advisor service) this company helps deliver content of all kinds to millions upon millions of people every day. But unlike Netflix, this company does not incur the enormous expenses that go along with creating content (like paying writers, directors, actors, etc.) — meaning a far bigger percentage of its revenues flow down to the bottom line.

If a recently completed deal between Disney and a very similar company is any indication, this stock could be worth as much as 3X what it currently is — even if it does nothing else from today forward!

But Iain and his team think it could potentially be worth far more than that — if you get in now and are disciplined enough to hold on over the long term. Which is why we’d urge you to get the full story right away!

The little-known brand behind many of Canada’s most recognizable “super brands” (including many you’re probably a regular customer of!). This one time “penny stock” has grown into a $350 billion behemoth.

But despite the fact it’s already shot up over 90% since Iain and his team first recommended it, they’re still incredibly intrigued by the fact that over 5,900 franchised outlets send this company royalty cheques week after week, month after month, and year after year…

Which puts it in the incredibly enviable position of having a steady and recurring stream of free cash flow with little need for capital reinvestment in the business.

And given that this company is now taking its extremely lucrative business model outside of Canada to places like the U.S. and the Middle East, Iain and his team think there could still be some big gains yet to come. Which is why you may want to get invested soon!

The 61-year-old — yet practically unheard of — specialty automotive parts company headquartered in rural Ontario that may well hold the key to the future of the rapidly emerging “driverless car” industry.

With companies like Apple, Google, Uber, and Tesla all racing to stake their claim on the billions — or even trillions — of dollars that some experts are predicting this massive technological shift could produce, it could only be a matter of time before this obscure Canadian company becomes world famous.

And with Bloomberg and Tech Crunch both recently reporting that Apple is already quietly recruiting a team of top engineers to come work in a new office in suburban Ottawa that is specifically focused on self-driving cars, that may happen sooner than anyone realizes!

Will one of these incredibly intriguing opportunities end up being Iain’s next official buy recommendation?

And, more importantly, will this “Ground Floor Event” lead to the same kind of incredible results that we talked about earlier?

Only time will tell… and when it comes to investment outcomes, there are simply no guarantees…

But because we want to make it easy as possible for you to join Iain and his team and position yourself properly ahead of all the excitement that’s about to take place next Wednesday, here’s something we can and will guarantee you…

If you join us in Stock Advisor Canada today and find at any point during your first 30 days that you’re not 100% satisfied with the experience, simply let us know and we’ll happily refund your ENTIRE membership fee.

If you’ve been investing for awhile, you probably know that guarantees like this are hard to come by…

But we’re more than happy to extend it to you, because that’s just how confident we are in what we have to offer you…

And we think once you see what a big impact Stock Advisor Canada can have on both your portfolio and your peace of mind, you’ll wind up feeling like Anton M., from Cambridge, Ontario, who recently told us:

“The best move I made: signing up for [Stock Advisor Canada]. I absolutely love the simplicity of the language in the reviews and articles, and I’ve learned to slow down, look around, understand the businesses better, and ask questions. And the results have paid off greatly… I’m lovin’ being a Fool!!!”

Or G. Hagelthorn, another loyal member from Ontario, recently wrote us to say…

“This is not the first [investment] newsletter I have subscribed to, but certainly one of the very best! I appreciate the candid and thorough coverage as well as the level of humbleness that comes through in your commentaries.”

Plus, we know that when you join us today, you’ll not only be able to take advantage of the “Ground Floor Event” that our members are so eagerly anticipating later today - but also the next one that will occur two weeks after that...

Which will give you plenty of time to decide if the kind of opportunities Iain and his team are uncovering are right for you… and a fair shot to take advantage if you decide they are!

And here’s just a small sampling of everything you’re entitled to when you join Iain and his team in Stock Advisor Canada today…

A FREE copy of “The Motley Fool Canada Retirement Guidebook” (a $99 value): This eye-opening 21 page special report is a must read for every Canadian investor — regardless of whether you’re already retired… or still decades from it.

Among other things you’ll discover: what the recent CPP expansion could mean for your money… a crucial “how, why, and when” primer on RRSP contributions, plus 8 RRSP tips & tricks every investor should be exploiting (but probably isn’t)… and a simple but incredibly effective way to calculate exactly how much money you’ll need to save for retirement.

Access to ALL of our other insightful members-only premium research reports (a combined value of over $475): Including “Canada’s Answer to Amazon.com”… “Wealth for a Lifetime: 11 Lessons We Learned from Warren Buffett”… and many, many more.

Full research write-ups on every last Canadian and “best of the best” U.S. stock we’re currently recommending: That way you’ll be among the first to know about the obscure Ottawa-based company that may hold the key to the future of the rapidly-emerging driverless car industry… the tiny “Internet toll booth” company that is quietly giving rise to the next Silicon Valley right here in Canada… and the one U.S.-based — but internationally-renowned — restaurant stock David, Tom, and Iain all think every investor should own today.

In-depth — yet easy-to-follow — weekly updates on all of our active recommendations: So you’ll always have all the need-to-know details on the Stock Advisor Canada stock picks you’ve chosen to invest in — without having to spend countless hours tracking down and deciphering news on the latest developments affecting companies you own.

Free run of our members-only discussion forums: Where you can quickly and easily post a question for Iain and his team anytime, day or night… or even chat with your fellow Stock Advisor Canada members — many of whom have a tremendous amount of investment experience, and can give you unique insights you simply can’t find anywhere else.

And please keep in mind, everything you can download and print from our password-protected members-only website is yours to keep with our compliments — regardless of how long you decide to stick with us.

This is just our way of saying “thank you” for giving Iain and his Stock Advisor Canada team an honest shot to help you as much as they’ve helped so many other investors just like you…

“It may sound as if I work for The Motley Fool, but this is 100% true – The Motley Fool has changed my life… I have had the kind of success which I have never dreamed of. Now I have accumulated a well-balanced portfolio.”

-Alexis Y., Ontario

“I must tell you how much I appreciate my membership to Motley Fool Stock Advisor Canada. The insights are invaluable in helping me decide where and how to invest my hard-earned dollars. I also value the balanced approach in the advice – and the reminder from time to time that investment is about reaping benefits over a longer time horizon. That is very reassuring in these days of ups and downs. Cheers.”

- Sylvie S., Ontario

And given that you’ve read this far, you’re probably giving joining these investors in Stock Advisor Canada some real thought. But, of course, you probably still have one very important question…

How much is it worth to have access to “Ground Floor Events” like the ones we’ve been discussing today?

Hundreds… or maybe even thousands of dollars? Absolutely!

Heck, we’d argue it may well be worth far more than that…

Especially if it ends up leading you to investment opportunities even a fraction as profitable as these have been for members of our original Stock Advisor service in the U.S.…

Tesla: Up 904% since it was officially recommended in Motley Fool Stock Advisor on November 16, 2012…

Netflix: Up 12,617% since it was picked for Stock Advisor on June 15, 2007…

Booking Holdings: Up 7,057% since it was featured in Stock Advisor on May 21, 2004…

But, don’t worry! You won’t have to pay anywhere near that much to “test drive” Stock Advisor Canada for a full 30 days today.

As a matter of fact, the standard asking price is just $299 per year — a bargain in itself when you consider everything it gives you access to (including the exciting $59 bonus gift we’ll tell you about just ahead)…

But if you join us through this time sensitive “pre-release” offer right now, you’ll lock in a special price of just $99 for one whole year...

Which means you can be among the mere 0.03% of Canadians who will have a front row seat for our next “Ground Floor Event” and pay 27 cents per day for the privilege…

Plus, you’ll have a full 30 days to put everything else we mentioned above to work for you — and be backed by a 100% membership-fee-back guarantee all the while.

What’s more if you join us right now, we’ll also give you complimentary access to one of the most exciting special reports we’ve put together all year (a $59 value — YOURS FREE). Have a look…

"This could be like going back in time and buying Amazon.com in 1997 — just before it shot up over 55,600%”

That’s how at least one investor here describes an incredibly intriguing — yet still completely under-the-radar — opportunity Iain and his team uncovered earlier this year.

It’s already soared 620% since Iain first got behind it — and is up 799% since Motley Fool co-founder David Gardner’s Rule Breakers service first recommended it.

(Don't forget, David Gardner actually did buy shares of Amazon.com in 1997 — and has held on for gains of over 55,600% since!)

Meanwhile, Motley Fool co-founder and CEO, Tom Gardner, has not only named this stock a “Best Buy Now” in his U.S. Stock Advisor service — but he also put $60,000 of our company’s own money behind it for the real-money Everlasting Portfolio he runs in his top tier Motley Fool ONE service.

Yet even though this up-and-coming e-commerce superstar (which is headquartered in Eastern Ontario) is already helping the likes of Tesla… Budweiser… Subway… and Red Bull to move $41 BILLION — and counting — worth of goods online each year…

Chances are, like most investors, you’ve never even heard of it!

But given that mighty Amazon.com has decided to shut down a similar business and partner with this company — rather than try to compete against it — we believe that’s all about to change…

Which is why as one final bonus for joining us today we’d like you to have a FREE copy of the in-depth research report Iain and his team just put together detailing everything you need to know about this incredible opportunity.

It’s called “Canada’s Answer to Amazon.com” — and we’d like you to accept a copy today with our compliments.

This is just one more “thank you” for giving us a shot at helping you to start growing the money you have into the wealth and security you want.

And we hope you’ll find it every bit as exciting, useful, and valuable as many of our other members have.

But there is one final thing you need to keep in mind before the next “Ground Floor Event” takes place here in a few short hours...

While we’ve made this as much of a “win-win” opportunity as we possibly can by giving you the chance to…

Be first in line to take advantage of not just one — but two — “Ground Floor Events” over the next couple weeks (don’t forget, Iain’s next two official buy recommendations come out later today and then two weeks after that)…

Lock in the absolute lowest pricing we can possibly offer at this time…

Then “test drive” everything else Stock Advisor Canada has to offer (including over $475 worth of special reports) for a full 30 days without having to risk even one dime of your membership fee…

There is one way to “lose out” on this offer…

And that’s to put it off… only to later discover you’ve missed the boat entirely.

Our next “Ground Floor Event” will be here before you know it. So please don’t risk making that mistake!

Simply scroll down to the order form or click the button below to join over 26,000 of your fellow investors who are eagerly awaiting this exciting announcement — while you still can!

Financial data as of March 1, 2019, except where otherwise specified. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. David Gardner owns shares of Alphabet (A shares), Alphabet (C shares), Amazon.com, MercadoLibre, Netflix, Priceline Group, Starbucks, and Tesla Motors. Tom Gardner owns shares of Alphabet (A shares), Alphabet (C shares), Netflix, Starbucks, and Tesla Motors. Iain Butler owns shares of Tesla Motors. The Motley Fool owns shares of Alphabet (A shares), Alphabet (C shares), Amazon.com, MarketAxess Holdings, MercadoLibre, Netflix, Priceline Group, Starbucks, Tesla Motors, and Visa.

All billing is in CAD. You will be billed according to your choice below and then $199 for each year thereafter.

Having trouble ordering or have any questions for us? Just send them to [email protected], and we’ll get back to you ASAP!