Special Free Report From The Motley Fool

Fellow investing Fool,

Thank you for joining us and we’re thrilled that you’re on board! My name is Iain Butler, and I’m the Chief Investment Advisor of Motley Fool Canada.

You’ve made a wonderful step towards achieving your financial goals, and having some fun along the way, and I can’t wait for you to get started. Before you jump into the service, however we’ve prepared a special report that will help give you a taste of what’s in store for you over the months and years to come as a member The Motley Fool Canada.

I don’t necessarily classify myself as any one “sort” of investor, but I do recognize the importance of mixing things up. For me, I think this report does a great job of capturing what this means.

Included are, what I believe to be, a collection of highly attractive opportunities pulled from investing’s most classic disciplines: growth, income, and value.

Now, of course, I can’t promise that these selections will go up, down, or sideways. However, I do sincerely believe that in concert, investing in these five selections will leave you well-positioned to expand your net worth, regardless of what the market throws at us over the next 12 months, or years(!).

Here’s to growing richer, together, over the years to come,

Iain Butler, CFA

Lead Advisor, Motley Fool Canada

BlackBerry (TSX:BB)(NYSE:BB)

BlackBerry (TSX:BB)(NYSE:BB)

We’ve moved BlackBerry to a “Hold” position in light of recent volatility. While we still have high-conviction in the business itself, we’re advising potential buyers to be cautious considering the current climate. For our full thought process behind this update, please review our “Hold” update in full here.

BlackBerry operates as a security software and services company in securing, connecting, and mobilizing enterprises worldwide.

Why Buy:

- The company’s increasingly expansive platform continues to generate multiple wins.

- BlackBerry’s seemingly weak financial performance has masked the emergence of its Software and Services business.

- Strong, experienced leadership has already put the company in a leadership position from which it can grow or possibly find an acquirer.

BlackBerry last appeared as a “Best Buy Now” in Stock Advisor Canada in July 2019 after the stock slumped on the back of nothing that we could determine had any impact on anything. We were of the mind then that BlackBerry was on the right path, and we’re still of that mind. The market, however, has had a very different take for much of our time with this company. To us, this has been more about time horizon than anything. The market’s is short. Ours is long. As we outlined in our two BlackBerry recommendations, this was a company in rather dire shape. There were pieces, but to put them in place and effectively create an entirely new, successful company was going to take time.

Maybe this week will serve as the stake in the ground and finally the market will realize the relevance of what BlackBerry has been building toward.

In case you missed it (apparently the Globe did, as, strangely, there was no mention), yesterday (December 1, 2020) news broke that BlackBerry has crawled into bed with the mighty Amazon.

Despite financial terms not being released, it’s hard to read through the release and not get the sense that this is a culmination of sorts. BlackBerry’s mission has been to take the pieces that were left after its consumer-facing hardware business burned to the ground and build a backbone software offering that would serve an increasingly connected world. Even though there has been plenty of evidence the company has been on the right track, this development really crystallizes the path that BlackBerry has been on. The stock soared on the news, though it pulled back through the afternoon. Whatever. Yesterday’s move is meaningless in the grand scheme of things. If what’s put forward in yesterday’s release comes to fruition, we’re looking at a significantly bigger company in a few years’ time. We think the risk/reward scenario is highly attractive and suggest getting on board for the next three years, as CEO John Chen rounds out his decade of transformation.

Disclosure: Write-up from 12/2/2020. Iain Butler owns shares of BlackBerry. Jared George owns shares of BlackBerry. The Motley Fool owns shares of BlackBerry.

Kneat.com (TSXV:KSI)

Kneat.com (TSXV:KSI)

kneat.com designs, develops, and supplies software for data and document management, mainly within the pharmaceutical industry.

Why Buy:

- It has a blue-sky potential to standardize and simplify what’s currently a high-friction process.

- It has continued demonstration of significant uptake with a land-and-expand, SaaS model.

- A well aligned, founder-led management team shares our interests.

What Kneat.com does

At its core, Kneat is a software company. Its current product, Kneat Gx is an application focused on complete and comprehensively documented validation of processes, products, equipment, and software within the life sciences industry. Costly validation that is required due to the stringent regulatory environment that surrounds the industry.

Every manufacturing process, piece of equipment, and computer system involved in the manufacturing of pharmaceutical, biotechnology, and medical device products must be validated in accordance with existing regulations.

Traditionally, validation testing has been a manual, paper-intensive activity, whereby test documents had to be developed, printed, approved, executed, post approved, and filed, ready for regulatory audit in the future. Fun stuff.

In many companies in the life sciences industry, much of this is still done on paper using wet ink to record test results, apply proof of signature, and date stamp. This process can leave life sciences companies susceptible to production delays, high costs associated with data and document management, and risk of non-compliance, all of which amounts to situations they’d prefer avoid.

Kneat Gx is here to help. Boiling it down, Kneat’s software is disrupting necessary, yet tremendously inefficient systems that exist within a massive global industry. This is a formula we’ve seen time and again in the Fool’s history, and when it works out, it REALLY works out.

What makes it unique?

Kneat is gaining traction because it offers a piece of software that is better than what’s otherwise available. As indicated, traditional pen-and-paper is the industry norm, and this will change.

Customers are quoting up to 100% increased productivity, up to 50% reductions in cycle times, and up to 80% savings in man hours as a result of using Kneat Gx. These efficiency improvements may also result in a quicker time to market for products, while still enhancing the compliance capability to the strict regulations of the industry.

Why we like the stock today

It is still very early innings in this company’s life-cycle. Ground floor even. Yet, significant progress has already been made in the pursuit of the company’s “land and expand” business model – with expand being where the real opportunity lives. To this point, we’re very much in “land” mode. With Kneat stringing together an impressive run of signing on some of the world’s biggest life science companies to its client roster. The most recent of which was just announced on June 11.

The land portion of the model has already resulted in tremendous revenue growth, albeit from a standing start. We expect earnings and free cash flow will follow suit as customers grow more accustomed to the software and expand its utilization throughout their respective organizations.

Potential risks

This kind of potential does not come free. There will be strife and emotional pain in our journey with Kneat, and it could come from any number of directions.

Most concerning would be some kind of technological flub. A flaw in the software at some point down the line, especially given the regulatory sensitivity that exists, could even be a death blow. It’s not foreseeable that this will occur, but stranger things have happened.

Less severe, the sales cycle can be long. Even once they’ve landed, the rate of uptake and expansion is unknowable. This is likely more of a factor once the masses become more attuned and quarterly figures scrutinized, but even though baseline revenue is sticky and recurring, growth, especially quarter to quarter, will not be easy to project for those who care about such things. This will cause noise but is not likely something we’ll worry too much about.

Another factor for most companies this size is access to capital. Sales teams and technology developers are expensive, and Kneat is not yet in a position that it can fund itself. Access to outside money is still required, for now anyways, to achieve the vast potential on hand. Although, thanks to a recent equity offering, Kneat’s balance sheet is currently very well stocked with cash.

Why this could be the next Home Run stock

Even prior to Kneat’s most recent deals, the company believed it was working towards an annual recurring revenue base (ARR) of $35 million. At the end of the first quarter, ARR stood at just $2.6 million, which was up considerably year-over-year but still nowhere near the company’s full potential.

As new deals land, and further expansion occurs, and that potential ARR figure grows we get a touch jittery with excitement thinking of how the market might take to this situation. As it stands, we believe Kneat flies well below the radar of most, but it won’t be this way for long given the progress made and potential that’s on offer.

Disclosure: Write-up from 7/13/2020. The Motley Fool owns and recommends shares of kneat.com.

Real Matters (TSX:REAL)

Real Matters (TSX:REAL)

Real Matters provides technology and network management solutions to mortgage lending and insurance industries in Canada and the United States.

Why Buy:

- The business has demonstrated significant operating leverage that should lead to accelerated growth.

- It’s disrupting a huge market and showing success taking share.

- It has a founder-led management team that’s well incentivized to make this into a much

bigger company.

We’ve met this company on two prior occasions. The first time was shortly after it IPOd. The business made a good enough first impression, but it was largely our hesitancy towards IPOs that led us to passing—something that made us look pretty smart as the stock declined precipitously throughout 2018, bottoming below $4 per share.

In hindsight, that decline was more opportunity than not, and we stopped looking smart as the calendar turned to 2019. We’ll get into the “why,” but understand that adult words were frequently muttered as we watched Real Matters climb from under $4 per share to north of $30 back in August, which is when we took our second close look.

What struck on that second look, more so than on the first, is that we’ve got a business here that’s capable of greatness. The company’s performance justified the stock’s run from $4 to $30, and provided macro conditions co-operate (more below), we think there’s plenty more where that came from.

Indeed, this is one of those situations that it’d be easy to say “Well, dang, missed that one.” But armed with a better appreciation for the business and its drivers than when it IPO’d, we’re more confident than at any time in Real Matters’ public life of what it’s capable of over the long term.

The Business

In case you missed those two previous looks, what we’re dealing with here is a company that has developed and introduced what they term “network management” software for the residential real estate industry in North America (but very largely the U.S.).

Real Matters has built a software-based platform upon which service providers in the mortgage industry compete for volumes provided by the company’s clients—that is, the lending industry (banks and such).

More specifically, appraisal and title and closing services are where Real Matters is helping its clients drive efficiencies.

The company, founded by CEO Jason Smith, got its start back in 2004 and originally targeted the appraisal process. It launched the platform in Canada in 2006 and the U.S. in 2008. Appraisals are mandatory in the U.S. for most mortgage purchase transactions, and appraisals or other valuation services are typically conducted for most refinance transactions and home equity loans. Real Matters software acts as somewhat of a ranking system for people that perform appraisals (appraisors). Thus, providing mortgage lenders—again, Real Matters’ clients—with the highest- quality appraisors for a specific geography or property type. Historically, the appraisal industry was a mish-mashed mess—something that led to wonky estimates with inefficiencies and slippage everywhere. Real Matters software brings order to a historically unorganized, though important segment of the industry.

Title and closing services were added to the platform via acquisition in 2016. Though smaller, this has been the faster growing of the two. Real Matters is an approved title agent with the industry’s largest title insurance underwriters. The company offers and/or coordinates title services for refinance, purchase, commercial, short sale and REO transactions to financial institutions in all 50 states and the District of Columbia. As an independent title agent, the company provides all services required to close a mortgage transaction, including title search, closing and escrow services, and title policy issuance.

Really then, Real Matters’ software is tackling the plumbing of the residential real estate industry in North America. Improving the efficiencies of deal flow and limiting costs along the way. Because for lenders in the industry, they can only write business as fast as the machine will allow them. A more efficient machine increases overall volumes and serves as a win-for-all-type situation.

The Opportunity

We view the opportunity as two-pronged. And it’s largely a continuation of what we’ve seen from the company during its public life.

What matters most to Real, um, Matters is market share. This is a platform business, and like all platform businesses, the more volume that crosses the platform, the better.

Market share for appraisals at the end of fiscal 2019 stood at 10.6% and the company counts clients across the various lending tiers. Real Matters believes it is the largest provider of residential mortgage appraisals in the U.S., which brings with it somewhat of a network effect. Essentially, it’s built a platform where appraisors and lenders meet. That’s a platform the best appraisors will want to be on, which in turn will attract more lenders, which in turn attracts more appraisors … and round we go. The opportunity is to see that market share figure continue higher.

The same goes for the title and closing services portion of the platform. The market for these services is actually bigger than appraisals ($10 billion vs. $2.3 billion); however, it’s a relatively new business for Real Matters, and market share is about 1%. The company has had reasonable success signing tier-three and -four mortgage lenders but is still waiting for a tier-one lender to sign on. The hope is that relationships on the more established appraisal side will smooth this process.

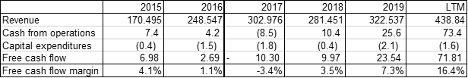

Gathering market share is one thing. It’s how these increased volumes translate to the bottom line and the company’s free cash flow profile that’s the really beautiful thing about this company—something that’s conveyed by the table below.

Source: S&P Global Market Intelligence.

Real Matters, like so many of its software peers with big market opportunities has demonstrated an ability to grow the top line. That’s all well and good. The reason—like, the reason—it’s a recommendation today, however, is because of that last row in the table.

As revenue has grown, an increasing portion of that revenue has fallen into free cash flow. That, Fools, is not a dynamic that many of Real Matters’ fresh-faced software peers have been able to demonstrate and is proof that we’ve got a business here that has legs.

We expect Real Matters to continue to gain market share with both of its verticals—something that will translate to continued sales growth and, most importantly, a fattening free cash flow margin. That will translate to a potentially much more valuable company in the years ahead.

Risks and Considerations

Recall the post-IPO stock price performance that we felt so smart about, and notice in the table above how revenues performed in 2018 relative to 2017. The decline that occurred was related to activity levels in U.S. housing—something that relates directly to a macro-theme that, in the short term, anyways, probably stands as our primary consideration.

During 2018, interest rates and therefore mortgage rates were ticking higher. This negatively impacted U.S. housing activity, leading to less traffic flowing across Real Matters’ platform. Remember, more volume = good. Less volume = bad.

Interest rates, though, changed direction in 2019 and continued lower earlier this year in response to the pandemic. Lower rates have led to a significant increase in refinance transactions in the U.S., and this has corresponded to improved (relative to 2018) volumes flowing across Real Matters’ platform.

As the business exists today, higher interest rates are likely to result in a lower stock price. In our opinion, rates are likely range bound at best, and therefore, we see the likelihood of a rising-rate environment taking hold as slim to outright impossible. Nevertheless, I will note that the U.S. 10-year Treasury bond did move to its highest yield since March during Monday’s market madness, and Real Matters’ stock price was off by about 6% or so. There is a connection.

Longer term, loan underwriting capacity has to improve for the lending industry to grow. This should play into Real Matters’ hands and help to improve market share for both of its product lines. Continual improvements to market share should more than offset any short-term impacts that interest rates have on industry activity.

Another dynamic to consider is that this is a company that indicates it’s got more verticals to explore. There’s more to come on this front at its investor day on November 23. Stay tuned.

Foolish Bottom Line

With interest rates likely pinned to the floor, we foresee that U.S. housing activity will remain robust and Real Matters’ platform will become increasingly relevant, as lending institutions seek to improve their capacity and address the demand that exists.

Longer term, given the company’s free cash flow profile and clean balance sheet, we could see it evolve in any number of ways to better serve what’s an enormous industry, which is where things could get really interesting.

For now, we suggest at least beginning to build a position, and we’ll look forward to what the company puts forward at its investor day in a couple weeks’ time.

Disclosure: Write-up date: 11/11/2020. The Motley Fool recommends shares of Real Matters.

Stingray Group (TSX:RAY.A)

Stingray Group (TSX:RAY.A)

Stingray distributes music/content to consumers and businesses through a variety of platforms.

Why Buy:

- Stingray is the largest independent media company in Canada.

- Its multi-platform model generates strong recurring cash flows, has shown resiliency

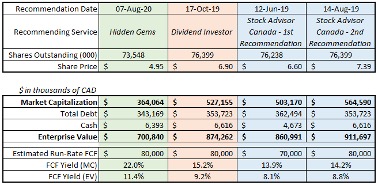

through the pandemic, and is now showing signs that the worst is over. - The stock is exceedingly cheap with a FCF yield around 22%.

Stingray Group (TSX:RAY.A) is a name that will be familiar to members of our sister services Hidden Gems Canada and Dividend Investor Canada.

This report will draw heavily from those write-ups-mainly because I see no need to reinvent the wheel.

If you’re a member of those other front-end Foolish services, you may have already checked the performance of Stingray on those respective scorecards. And if you’ve done so, you might then be somewhat disappointed to see Stingray pop up again. To offer something of a “spoiler” for non-members of those other services, let me just say that all prior recommendations are both underperforming the market and in net loss positions. So, why am I effectively doubling down on a “loser?” Haven’t I heard of the Foolish principle of adding to winners?

I have. But truthfully, given that the oldest of those prior recommendations is just 14 months old, I’m not sure we can judge them-for good or ill-just yet. Another Foolish tenet, after all, is importance of long-term thinking. To that end, I still think (and will demonstrate below) that those other services got good prices on Stingray. By extension, I think we’re getting a great price on Stingray.

Let’s reintroduce the company here for the newcomers, and then I’ll add my two cents later for why I think now is the time to bring Stingray to Gems.

What Does Stingray Do?

Stingray is in the music business. Its core purpose is to provide curated music services for every moment and on every platform, including radio, television, subscription video on demand (SVOD), in-store, and in-apps. If you’ve ever tuned your TV to one of those music-only stations, you’re probably listening to Stingray. If you shop in a Walmart, or SportCheck, or eat at a Subway, you’ve likely been unknowingly consuming Stingray’s offerings.

The company was co-founded by CEO Eric Boyko in 2007. Its first product was The Karaoke Channel, which, umm, is something of a niche (but still important) category within the broader music industry. Since then, though, the company has made around 40 acquisitions at a total cost approaching $800 million in order to expand and diversify its business. Today, Stingray operates in four primary delivery “channels.”

Radio Stations

The largest of the acquisition string was the late 2018, nearly $500 million purchase of Newfoundland Capital Corp (NCC)-owner/operator of 72 local radio stations and 29 repeating stations reaching millions of happy listeners each week. At the time of acquisition, NCC was the number two private radio business in all of Canada and third by revenue.

Admittedly, the NCC deal seems a bit of head scratcher upon first glance. Well into the 21st century internet age with its myriad apps and online distribution channels, what is the attraction of buying a bunch of radio stations? The short answer is that the economics are enticing; it turns out that even today, radio cranks out a lot of cash. The radio stations also provide a large platform of music lovers to which Stingray can cross-promote (advertise) its various digital offerings.

In addition to cross-promotion, radio stations provide a platform for future acquisitions. Present- day radio requires almost no capital expenditures to maintain, and, as a mature industry, newcomers aren’t exactly knocking down doors to enter the industry and compete. With its scale, Stingray can continue to gobble up smaller stations, realizing cost synergies and printing cash along the way.

Television

TV Stingray is a leading digital music and video provider reaching 400 million subscribers in 156 countries. This is its legacy business, which is not expected to grow, so we won’t spend much time on it.

Commercial Music

Stingray provides business-to-business (B2B) in-store music that reaching tens of thousands of establishments across Canada. Next time you’re in Tim Hortons, Sobeys, or Loblaw (TSX:L), perk up your ears. Chances are that background music is provided by Stingray.

Business to Consumer (B2C)

Stingray’s Subscription Video on Demand (SVOD) has nearly 440,000 paying customers via important distribution agreements with Amazon (NASDAQ:AMZN), Telefonica, and Comcast. Users pay a monthly subscription fee for unlimited music programming: classical, concerts, jazz, and, yes, karaoke. Who wouldn’t want to pay $7 per month to their cable provider for unlimited karaoke awesomeness?

Well, me, for one, and probably the rest of Team Canada as well (we’re not a singing bunch). Although its partners take a cut of the profits, this is still a very profitable, high-margin business.

How Does Stingray Win?

Stingray is in the business of content (music) distribution. Its goal is to profitably acquire more content and then expand that distribution (i.e., get more customers). Signing deals with the likes of Apple (NASDAQ:AAPL), Comcast, and Roku (NASDAQ:ROKU) is really important. These deals demonstrate the value Stingray’s products offer. Feel free to check out the 4.8 rating for the Stingray Music app (with over 25,000 ratings) in the Apple app store.

To further this pursuit of content and distribution, Stingray has and will continue to acquire. In 2017, Stingray bought Yokee Music, which has three apps regularly ranked in the music categories Top 10 in 100 countries. In 2018, Stingray bought Qello Concerts, a leading service for on-demand performances, concert films, and documentaries. And then again, there was the massive, transformative 2019 acquisition of NCC-a business that produced $53.3 million in EBITDA (earnings before interest, taxes, depreciation, and amortization) and nearly $40 million in free cash flow during its final four quarters pre-acquisition. Stingray paid roughly nine times EBITDA and just over 12.5 times free cash flow for NCC.

At the time of acquisition NCC’s EBITDA margin was around 31%, but Stingray expects that to grow as it reduces costs. Indeed, now more than a year after the NCC deal was completed, the combined company EBITDA margin is approaching 40%.

Still, the pressing question today should be, why, after being a comparatively poor performer to date for other Foolish services, is Stingray right for you today? It’s simple: the market (incorrectly) hates it.

What’s the Market Missing?

Those prior Foolish recommendations correctly, in my opinion, identified Stingray as a cash flow story. Both Iain and Bryan pointed out the anticipated cash flow produced by Stingray, post-NCC acquisition, expressing it in terms of yield. The guided run rate following the NCC deal was first for approximately $70 million in annual “adjusted” free cash flow (FCF), which is a figure calculated and presented by Stingray (usually, I balk at companies calculating FCF for me, but Stingray’s calculation is actually more conservative than traditional “simple” FCF computation). Management’s estimates later rose to $80 million.

Management would seem to have a good handle on their business. In the first full fiscal year following NCC acquisition, Stingray produced $78.4 million in FCF. Indeed, in the six full quarters of the “new” combined Stingray/NCC, it has produced a total of $106.2 million in adjusted FCF. Of that, more than two-thirds-$72.4 million-has been deployed in shareholder- beneficial pursuits:

$31.7 million in dividends;

$22.5 million in net debt repayment;

and $18.2 million of share repurchases.

We’ll come back to these in a moment, but first, I mentioned that prior Foolish recommendations marvelled over the perceived cash flow yield. They were right to do so, with expectations for FCF production converting to a 13-15% yield. And yet, the stock is selling today at a perceived 22% yield! Prior Foolish recommendations, in fact, weren’t “wrong”-a 15% cash flow yield is rare and difficult to find. We’re just getting an even better deal.

Source: Analyst calculations.

How does this happen? Isn’t the market supposedly “efficient?” If so, should situations like this even exist?

The “why” of it all remains unclear, but I suspect it’s because Stingray’s most recent quarter was, well, awful. The conventional radio business is very sensitive to economic conditions. Businesses tend to pull back on ad spending during times of economic distress; the past few months of pandemic-induced uncertainty would certainly qualify as such.

Thus, for their first fiscal quarter, during what we anticipate being the worst of the pandemic pullback, Stingray saw radio-related revenue fell 62% year over year and more than 45% sequentially from the fourth quarter of FY 2020. In turn, this led total revenue to fall by 35%.

Looking at share price, it seems the market expects these depressed headline numbers to persist. In spite of management indicating on the most recent quarterly conference call that things are improving and that the present quarter will likely see radio revenue down in the 40% range (that sounds bad, but remember, Q1-FY21 was down 62%), at present and for the last few weeks, they’ve been “hitting about 80% of the sales flow of last year” (so the current run rate is down about 20%), and they expect to be back to even by the end of the year.

If you think management has a decent track record of honesty and on delivering on what they say they’re going to do (and I believe there is evidence supporting this belief), then things could be about to get interesting. For starters, as indicated above, they’ve essentially said the worst is over. As stores reopen, radio sales will improve. They’ve also sought to bolster their customers-great long-term thinking-by announcing the “Stingray Stimulus Plan,” a $20 million program of radio advertising grants to more than 5,000 local businesses in markets across Canada where Stingray operates. If you help customers get through bad times, you’ll likely retain a good chunk of them in better days.

Remember, This Is a Cash Flow Story

Management has indicated they expect their EBITDA to stay around $120 million. The NCC deal conversion of EBITDA to FCF has been at roughly a two-thirds rate, so there’s your $80 million FCF run rate. What should we expect them to do with their cash? Look again to the three shareholder-friendly pursuits above:

Dividends: Stingray currently yields a very healthy 6.1%. I don’t expect it to increase the payout during a pandemic-it would be bad optics to do so at a time when the company benefits from government wage support for furloughed workers. But then, I also don’t expect it to cut the payout, since the present dividend is well covered by FCF generation, requiring just $22 million annually to support.

Debt Repayment: Following the NCC acquisition, Stingray’s leverage rose substantially. Total debt stands at $343 million as of the end of Q1-FY21. Management indicated on the most recent call that, “We want to bring down our debt quickly before year-end to below $300 million.” If you think that the present enterprise value (market capitalization plus net debt) of just over $700 million is “correct,” then every dollar of debt repaid needs to result in an offsetting dollar of equity appreciation to maintain that valuation.

Share Repurchases: Buybacks have been halted during the pandemic, but don’t expect this to persist. Management explicitly called out the company’s FCF yield (FCF divided by market capitalization) on the Q1 conference call and on the benefits of retiring shares at such yields. In prior conference calls, they’ve talked about return on investment hurdles for acquisitions. Well, a 22 % FCF yield is effectively a 22% return on investment for cash spent on repurchases. Expect Stingray to announce a new share-buyback plan (or “Normal Course Issuer Bid” to use the industry parlance) as it hits its debt-repayment target above.

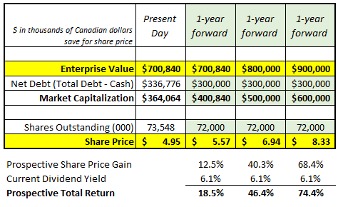

Looking out a year, a Stingray that uses its cash flow as per the three pursuits above-maintaining its present dividend, bringing debt below $300 million, and buying back a few shares (say, roughly 1.5-1.6 million)-is also a Stingray that delivers an attractive one-year return assuming the present enterprise value is “correct.” And I don’t think it correct; I think it’s too low, particularly if management does what they say they’re going to do.

And then, what if enterprise value rises to levels seen at the time of our earlier recommendations? It’s a pretty great outcome for today’s investors, that’s what.

This brings me to the last “financial argument” point, and it’s one that I hope doesn’t come to pass. If we can see the business trends, appreciate the FCF yield, and do the math above, then so too can management. This makes me wonder (fear) if Stingray’s time in the public eye may be shorter than we hope for.

Understand, this is pure speculation on my part, but the longer this stock is discounted (disrespected?) by the market, I think it increasingly likely that management just says, “The heck with this,” and takes Stingray private. It wouldn’t be much of a stretch; they already have significant equity stakes (likely somewhere between 40% and 60%-see the summary box above) and complete voting control by wont of owning all the multiple voting stock.

Should management/insiders decide they’re not being appropriately compensated for being a public company-and with a 22% FCF yield at present, I’m going to definitively they currently are not-they could pretty easily opt to take it private, and there wouldn’t be a darn thing we could do about it save to hope they pay us a token premium if they did so. Mr. Market can remove this risk by bidding the shares substantially higher.

The Foolish Bottom Line

Stingray has been overly punished in the pandemic panic. This has turned an already attractive post-NCC valuation case (which is what enticed our Foolish brethren in the first place) into what I think is a no-brainer.

Or, if you prefer your recommendation codas to feature bad puns, we consider the present risk/reward balance here as having us keen to tune in for a business that’s presently going for a song. Welcome to Gems, Stingray.

By Buck Hartzell. Iain Butler, Bryan White, and Buck Hartzell unknowingly contributed to this report-a real team effort!

Disclosure: Write-up from 8/7/2020. John Mackey, CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. David Gardner owns shares of Amazon and Apple. Jim Gillies owns shares of Amazon and Apple and has the following options: short January 2021 $150 puts on Apple. The Motley Fool owns shares of and recommends Amazon, Apple, Roku, and Stingray Digital Group Inc and recommends the following options: long January 2022 $1920 calls on Amazon and short January 2022 $1940 calls on Amazon.

Tecsys (TSX:TCS)

Tecsys (TSX:TCS)

Tecsys is involved in the development, marketing, and sale of supply chain management software.

Why Buy:

- It has recurring revenue from its transition to software as a service (SaaS) model with the SaaS valuation premium.

- It has ownership with skin in the game.

- There are potential growth catalysts developing in healthcare and increased online sales.

As the newest member of the Canadian investing team, I’ve been spending most of my time coming up to speed on the companies recommended across our services. While learning about the companies, I’m watching for similarities with companies I’ve followed in the past and potential growth catalysts that are on the horizon or already unfolding.

Finding similarities with investments that have done well in the past may not always lead to the same outcomes, but I think it is a good way of prioritizing which companies to research first.

A company that stood out to me right away here in Hidden Gems is supply chain software expert Tecsys (TSX:TCS), because it immediately reminded me of Adobe (NASDAQ:ADBE) and Autodesk (NASDAQ:ADSK). Why? Because the company is going through a transition from licensing its software to selling it as a service via the cloud, and it looks to be handling the transition quite well.

Of course, that single piece of information doesn’t stand up on its own. To qualify as a recommendation, we need more to go on, and I’ve found plenty more to like as I’ve dug into the company. That’s why I’ve been pestering Jim about Tecsys, and after a few weeks of my harassing him with my findings, he suggested I make the company a re-recommendation. [Jim note: Indeed, inclusion in last week’s Best Buys Now only emboldened him, Fools.]

Now, it’s possible he just wanted me to shut my yap and leave him alone. But more likely, since I know he places the member experience in Hidden Gems over a little peace and quiet, I’m confident that it’s really because he too sees the potential in Tecsys to top the market from here. [Jim note: Can confirm.] Let’s take a look, shall we?

The Business

Anytime we recommend a company multiple times, it makes sense to go back and read the previous recommendation(s) to get up to speed on the basics of the business and how the thesis has played out to date.

If you’re already familiar with that initial write up, there are only a few changes worth noting. The most important is the need to understand that Tecsys is undergoing a transition from perpetual license sales with maintenance contracts to a Software-as-a-Service (SaaS) sales model.

The other changes are more minor. Some small acquisitions have been made along the way, its flagship product has gone from being called EliteSeries to Itopia, and its offering is increasingly resonating with ecommerce customers—notably, Uniqlo and Sephora—but the dominant niche position in the healthcare industry and strict focus on supply chain solutions remain in place. It also still counts the U.S. as its most important market, accounting for roughly 60% of sales.

Multiple Catalysts

With some of the basics out of the way, we can talk about the fun stuff, which are what looks like a successful transition to a SaaS model—arguably, a catalyst on its own—and which appears to be happening concurrently with couple of other catalysts.

To say the U.S. healthcare system has its challenges is a bit like saying its political climate has been a bit abnormal of late. Both statements are accurate, but, if anything, they underestimate the severity of each situation. The COVID-19 outbreak put a spotlight on both and why they need to be resolved sooner rather than later.

I’ll leave the politics to the pundits, because it’s the news of supply chain breakdowns that matter for Tecsys. Throughout the initial outbreak, there were constant headlines about the lack of personal protective equipment (PPE) in hospitals across the United States. This was partly a function of the supply chain for PPE globally, but in the U.S., there were also notable headlines about much of the safety stock hospitals did have being obsolete and defective.

In some cases, these were simple things, such as the elastics breaking down on masks, but they weren’t well tracked, and it was a big problem when they were needed most. It was also interesting that when in a pinch to locate emergency supplies, it wasn’t possible to get them quickly enough.

Part of this is undoubtedly due to everybody tripping over each other to try and buy the same things at once, and the U.S. having its outbreak start while Europe was further along (meaning

Europe was probably further ahead in line with its orders). But a recent survey of hospital administrators showed that investing in supply chain improvements was second only to patient safety.

With supply chain costs consuming roughly 40-55% of the average hospital budget—second only to labour—there’s an additional incentive for hospitals to get more efficient—particularly at a time when budgets have been stretched by the delay of elective procedures.

Transitions Are Hard

This is a tailwind for Tecsys, and it comes at a time when many healthcare systems are looking at systems that were installed in the late 90s and realizing that an upgrade is probably past due.

Of course, replacing a system that manages your inventory—even it is falling short—isn’t easily done. This is part of why healthcare systems see it as a problem now. I think this is part of why Tecsys has seen start-and-stop growth in the past, too—along with healthcare systems being frozen by continued changes in U.S. healthcare law. However, if my reading of the news and the recent acceleration in sales for Tecsys are any indication, things are starting to change.

Changing from a licensing model to a SaaS model for established software companies is hard, too. If you glance back at Autodesk’s results from 2014 through 2018, you’ll see its transition wasn’t a walk in the park, with sales declining by roughly a third and operating profit going from $300 million to a loss of $420 million at the bottom.

Autodesk looked like it was losing customers and bleeding sales, but it really wasn’t. The computer-aided design (CAD) giant was just recognizing sales on a different cadence. Customers were paying a much smaller fee each month instead of laying out substantial sums every few years for an upgrade.

Fast forward to 2020, and Autodesk is in a much better place with sales and operating profit at all-time highs and an operating margin approaching the previous peak. In total, customers are either paying the same or a little bit more if they previously delayed upgrades, and we’re seeing that now.

This is the path I believe Tecsys is on, but it appears to be having a better go of it, with sales continuing to grow and margins already recovering. What’s notable here is that Tecsys has seen a decline in its licensing business; it’s just that its SaaS, maintenance, and services revenues have been able to make up for these declines and then some, resulting in the company posting 38% sales growth last year and 19% in its first fiscal quarter (Tecsys has an April year-end).

That last figure is a decline, but it’s worth keeping in mind that it includes part of the lockdown period, and its SaaS and services backlogs continue to grow. I’ll take that kind of a slowdown when offices are closed, and a good portion of its customers had all hands on deck battling the pandemic.

Management

When initially recommended, management and insiders owned 30% of the stock; today, that figure is 25%. We might not like a declining ownership stake, but don’t get too worried here— much of this seeming “lesser stake” can be attributed to a follow-on share offering in April, which increased the share count. Thus, insiders here still very much have a vested interest in seeing the company do well. Perhaps more importantly, the founding brothers remain in operational roles and have overseen the company’s transition to the cloud.

This was a profitable company churning out cash flow before the transition. Managers who had their focus elsewhere likely would’ve been happy to keep collecting paycheques from a steady business. The willingness to push the business forward through a challenging transition suggests to us that management remains engaged and focused on the long-term potential of the company.

Valuation and Metrics to Watch

It’s rare that four times sales and 40 times operating cash flow can be called cheap. That’s where Tecsys trades now, and I reasonably can’t call it inexpensive. But I am comfortable that it’s trading at a reasonable price that could prove to be a bargain that beats the market. To get there, Tecsys will need to continue growing sales at a 15-30% annual pace. If it does that, I don’t think it needs to deliver much in the way of margin expansion. If the outlook is for margins to also expand and the sales growth is sustained, I think we’re going to be very happy with the returns in a few years.

In the current market, that’s a conservative view for a growing software company transitioning to the cloud. Companies such as Alteryx (NYSE:AYX) at 16 times sales with worse cash flow dynamics and similar sales growth currently fetch higher multiples, largely because they have more buzz around them as cloud companies.

Stalwarts such as Adobe (at 45 times cash flow) and Autodesk (38 times) that have already transitioned to the cloud fetch similar or better multiples. Even Microsoft (NASDAQ:MSFT), which is very much a cloud company these days, trades for 10 times sales and 26 times operating cash flow.

These are all companies with attractive prospects, in my view, but they’re either already much (much) larger than Tecsys with similar valuations or are of similar size or smaller with much less attractive valuation dynamics. In both cases, they already have the attention of investors. My preference is to take the company that is showing signs of growing into a bigger player in its industry while still underfollowed and not commanding a premium valuation.

With each earnings release, we’re going to want to pay attention to all of the traditional income statement and cash flow metrics. But we’re also going to want to watch the backlog of activity, movements in unearned revenue (a liability on the balance sheet), and annual recurring revenue (ARR) growth, because they give us a good indication of the company’s outlook over the next few quarters.

Risks

Most economies have begun to recover over the last couple of months, but COVID still has the potential to disrupt the broader economy. Tecsys, as mentioned, also raised capital during the initial outbreak to be sure it had the cash on hand to sustain the business through a shutdown. In hindsight, it’s clear this wasn’t necessary, but we can’t know what the outcome might have been or how it might unfold if renewed lockdowns are required. So, while not thrilled with that capital raise (it was at a price 39% below where the stock sits today), I’m viewing it as a security blanket of sorts if COVID starts to pull down the broader economy again.

Tecsys gets roughly 60% of its sales from the U.S. and another 20% from other markets, so currency movements can impact its financial performance. Currency movements aren’t so much of a risk but more akin to something that can cause volatility in results.

The Foolish Bottom Line

I’ve mostly talked about the similarities I see between Tecsys and Autodesk, because they’ve both gone through, or are going through, transitions to the cloud. This makes sales more predictable, which should make budgeting and cash flow more predictable, too.

Despite their difference in size, the two companies share other qualities. Near the top of the list is that both have products that stand out from the offerings of their competition. There’s little doubt in my mind that picking up and moving your business to the cloud is a bit easier to do when your customers would prefer not to switch to another platform.

Management has also noted that moving to the cloud has bolstered their sales pipeline, because it’s easier for customers to explore the product and test it out. So, while the company’s move to the cloud comes at an opportune time to win new customers who are already looking to update their systems, I think it’s just as important that Tecsys already has a leadership position in the healthcare space and the attention of potential customers.

Write up by Nate Parmelee and Jim Gillies on 10/2/2020.

Disclosure: Nate Parmelee owns shares of Autodesk and Microsoft. Teresa Kersten, an employee of LinkedIn, a Microsoft subsidiary, is a member of The Motley Fool’s board of directors. The Motley Fool owns shares of and recommends Adobe Systems, Alteryx, Autodesk, Microsoft, and Tecsys Inc and recommends the following options: long January 2021 $85 calls on Microsoft and short January 2021 $115 calls on Microsoft.