Canada Goose Holdings (TSX:GOOS)(NYSE:GOOS) has been one of the hottest Canadian IPOs in recent memory. The luxury parka maker led by CEO Dani Reiss delivered a blowout Q1 fiscal 2019 quarter that caused shares to take off like a coiled spring. There’s no question that the quarter was one that was during a seasonally weak period for apparel. After all, who buys parkas after the winter season comes to a close?

A quarter for the ages!

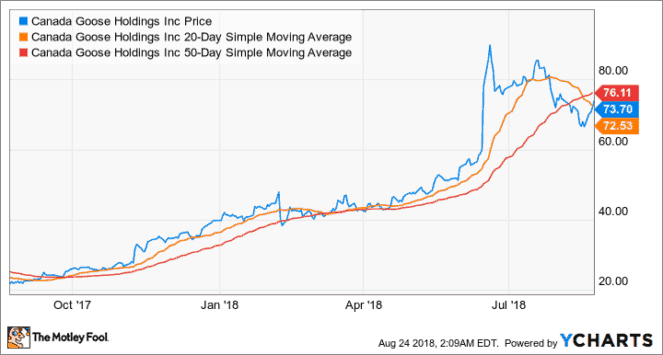

The goose rallied 50% in the trading sessions that followed the legendary quarterly beat, which saw total revenues rocket 58% year over year with an applause-worthy 1610 basis point gross margin improvement on a year-over-year basis.

The company’s direct-to-consumer (DTC) channel is primarily responsible for the remarkable improvements to both sales growth and margins. And with brick-and-mortar stores slated to open in prime urban locations, I think there are plenty of reasons to believe that the top-line (and gross margin) growth momentum can continue over the next few years.

Add the ambitious expansion into the Chinese market into the equation, which I think will be a profoundly profitable success, and I believe Canada Goose can and will fly much higher over the next three years.

A strong play on millennials

Compared to the Baby Boomers or Generation X, we know that in aggregate, millennials aren’t buying homes, they’re not starting families, and they’re not buying new luxury cars. Nope. These are all ridiculously expensive, especially when you consider the rise of the “gig” economy that’s the norm among millennials. Less stability and a lack of affordability mean a multi-decade mortgage is out of the question. So, too, are starting large families and new luxury car purchases.

Housing prices are going, going, gone. They’re absurdly expensive, especially in markets like Vancouver or Toronto. Moreover, millennials understand that given their unique circumstances, the traditional “scripted route” of getting a mortgage straight out of college and having a child by 30 is less practical than it used to be. That’s not to say that millennials in aggregate aren’t making money though, they’re just weighing the opportunity costs and adjusting their spending patterns given the profoundly different environment that exists today compared to years past.

One thing is clear though: millennials are spending, they’re just spending in different way than their parents (or grandparents) did. And as the millennial generation approaches peak consumer spending, their spending habits are going to become more influential in changing the way capital is allocated in the free markets — so much so such that investors may want to consider adjusting their portfolios to cater to the millennial boom.

How does this relate to Canada Goose?

In a recent article, I went over the most remarkable consumer spending trends that the millennial generation has and will likely continue to exhibit. One of the most remarkable takeaways is the fact that millennials are more likely than prior generations to purchase clothing that they don’t necessarily need.

Millennials are opening up their wallets for discretionary goods, and luxury outerwear maker Canada Goose has a front-row seat to this profound shifting of spending from real estate (and insurance) to lower-cost discretionary items like clothing.

Moving forward, the Goose is guiding for revenue growth of at least 20%, adjusted EBITDA margins of at least 50 basis points. I’d encourage investors to consider the at least part of the guidance, as the company has the potential to surprise itself once again.

Foolish takeaway

Canada Goose has powerful growth drivers in the works. That said, I think investors should get some skin in the game before the company expands its reach across the globe. This growth story is just getting started, and there are profoundly influential trends that are working in goose’s favour, most notably the rise of millennials and their affinity for discretionary purchases.

With that in mind, I think Canada Goose makes a solid case for why it should be a $100 stock. But in the meantime, watch out for the death cross, as a better entry point could very well be on the horizon.

Stay hungry. Stay Foolish.