Picking a favourite stock is like picking your favourite movie: it depends on the category and the context. What is your favourite TSX stock of all time? I could make a case for Dollarama Inc. (TSX:DOL). This company had an initial public offering in October 2009 around the $10 range. Investing $10,000 in 2010 would be worth $123,000; this “hold on to your hat” stock has a compound annual growth rate of 40%.

The stock has not been around long enough to see how it would respond to tough times, like the Financial Crisis of 2008. But it is in the consumer defensive sector, which historically does well through good times and bad. Whether you are buying party hats, stickers, or anything else you can think for under a few dollars, Dollarama has the customers rolling in, and the earnings speak volumes.

How good is Dollarama?

In a few words: very good.

You don’t buy this stock for the minuscule dividend. You buy Dollarama because of the impressive earnings track record. Aside from lower earnings expectations for Q1 in 2018, there has basically never been a time when this company did not grow its earnings. Earnings per share (EPS) tend to grow $0.44 per year; current EPS are $3.9. The current enterprise value to earnings before interest, tax, depreciation, and amortization (EV/EBITDA) of 21 is just above the five-year average of 19. Keep in mind that these levels are on the high side compared to a value stock that would ideally be below 12.

You have to be patient with this stock if you want to buy it at favourable levels. One way to initiate a buy point is based on the 200-day simple moving average (SMA). The last time Dollarama touched down to its 200-day SMA was February 2016. The next closest buying point would have been earlier this year in March, when this stock nearly touched the 200-day SMA before it gapped up an astonishing 11% on the 30th of March.

A buying opportunity could be playing out for those looking to start a position with Dollarama. The stock has been mostly trading sideways since May. How would this play out? At around $115 per share, long-time holders would be looking to consolidate gains and also use this as an opportunity to trim their positions. New buyers would be happy with a trade because at such levels this could be considered a bargain for this high-flying, high-valuation stock.

If I were to pick a competitor stock that has high foot traffic and is in this sector, it would be Alimentation Couche Tard Inc. (TSX:ATD.B).

Is Couche-Tard equally as good?

In a few words: history says no.

Couche Tard is, however, a solid growth stock that trades on the TSX but has international exposure with operations in Canada, United States, Norway, Sweden, Denmark, in addition to 1,500 stores in 13 other countries. The company has recognizable store brands in Circle K, Statoil, Mac’s, and Kangaroo Express, but in 2015 the company announced it would be unifying stores under one global brand called Circle K.

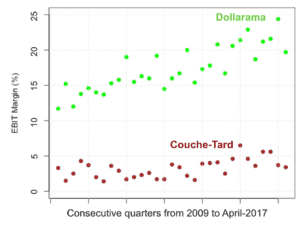

The graph below shows earnings before interest and taxes divided by sales, known as EBIT margin, expressed as a fraction, so higher is better. Dollarama is clearly on top.

One last comparison is quarterly change in EBITDA, because it is a key performance measure. In the case of Dollarama, it has increasing EBITDA in all but two of the last 30 quarters. Couche Tard has done well with increases in 23 out of 30 quarters, but not as well as Dollarama.

All hail Dollarama!