The juicy income yields from BTB Real Estate Investment Trust’s (TSX:BTB.UN) stable distribution and the recently outperforming CanWel Building Materials Group Ltd. (TSX:CWX) stock’s dividend payout are too rich and compelling to pass on today, while the strong and ever-improving fundamentals for the respective payers can easily allow one to sleep well at night.

Here’s why.

BTB REIT

BTB REIT is a relatively small, solidly stable, and growing REIT that holds 71 high-quality retail, office, and industrial properties situated in Quebec and eastern Ontario.

The trust commenced operations in 2006 and has offered investors high-quality monthly distributions that appear very dependable and ripe for a payout increase in the near future after the recent strategic refocusing efforts.

BTB REIT has consistently paid a stable $0.035 a unit every month for nearly four years now; it’s currently yielding 8.79% annually. The payout rate, at 88.9% of recurring FFO and 97.6% of AFFO, compares well with the best executors in the industry for the most recent quarter.

Occupancy levels have been high and stable for a good number of years now. In 2017, more than 16% of its leases expired, and BTB successfully renewed them at an average increase in revenue of 5.6%. BTB concluded lease transactions with new tenants to increase total portfolio occupancy levels from 90.5% in 2016 to 91.4% in 2017.

Although the REIT’s total debt level, at 64.2%, isn’t that great currently, BTB managed to reduce its mortgage debt ratio from 59.1% early last year to 56.1% as of last quarter.

The 2017 strategic refocus

In 2017, BTB initiated an ambitious strategy to reposition its portfolio by disposing of underperforming properties. Nine properties were proposed to be sold, and larger, better-performing assets are being acquired.

As an example of how BTB is successfully growing its portfolio’s efficiency, the CEO gave a snapshot of the strategy in the REIT’s latest annual report; he illustrated that BTB disposed of three properties that were generating $590,000 of annual net operating income (NOI) for a total of $11.5 million and redeployed this capital, purchasing a property that generates “upwards of $1.7 million of annual NOI and the purchase price was $23.2 million.”

The REIT spent “twice as much as the proceeds of the sale of the said three properties to generate almost three times the NOI.” The plan could enable BTB to migrate to a better property portfolio that provides more earnings growth.

BTB’s total assets increased 16% in 2017, as a result of acquisition activities, and the REIT is in much greater operating shape this year after recording a 12.6% increase in rental income for the first quarter of 2018 — a 16.3% increase in NOI, and a 64.5% increase in net income for the period.

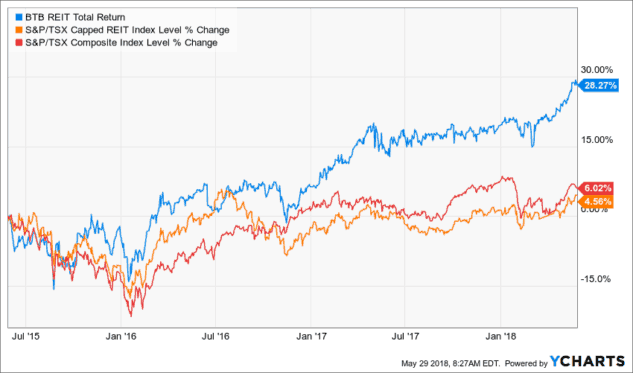

BTB’s performance in 2018 could surpass that achieved in the past several years, and investors could enjoy more capital appreciation going forward, at potentially faster rates than achieved over the past three years.

CanWel Building Materials

CanWel is a Canada-based wholesale distributor of building materials and home renovation products.

The group’s equity has received good valuation growth recently, with the stock gaining 8.5% over the past three months thanks to record quarterly revenues reported for the first quarter of this year. Coupled with the significant gross margin and operating margin expansions the group has been witnessing over the past five years, profitability is on a sustainable growth trajectory.

Revenue growth for CanWel has been steady at a compound annual rate of 9.37% for the last five years. Most impressive was the group’s normalized net income growth rate, which stands at a massive 28.40% year on year since 2013, propelled by a massive jump in 2016.

CanWel pays a quarterly dividend of $0.14 per share, which is good for a 7.8% dividend yield on a forward-looking basis annually. It would seem like the dividend is unsustainable at a 114% payout rate for the last 12 months; however, the increasing profitability for CanWel dismisses any fears for a dividend cut, especially considering that the company managed to maintain this payout since 2011, when profitability was much lower.

The payout rate is expected to be around 106% for 2018 and could be much better should the company keep delivering beyond expectations, as it has done over the past three consecutive years.