The Taj Mahal. The Great Pyramid of Giza. Mt. Rushmore.

You don’t have to be a history buff to recognize those names. All three monuments have stood the test of time. They’ve honoured what they’ve intended to honour, all while standing up to everything Mother Nature has thrown their way.

They represent the meaning of beauty and endurance.

Now, in times of extreme volatility, wouldn’t you want beautiful and enduring stocks in your portfolio? Wouldn’t you want to be able to weather any economic storm?

Well, high-quality dividend stocks could provide that stability you’re looking for; especially at this particular point in time.

A common worry I’m seeing in the news is the current state of the Canadian economy. And for good reason.

Investors are on edge. There’s still no NAFTA deal. Manufacturing is slumping. And, of course, export tariffs on Canadian aluminum and steel pose a significant risk.

But despite all that stress, there are companies out there that will pay you big dividend income quarter after quarter, year after year, and even decade after decade. As studies show time after time, these dividend stocks will solidify your wealth-building. Furthermore, they can provide a comfy defensive cushion when markets get a bit crazy.

Bankable bet

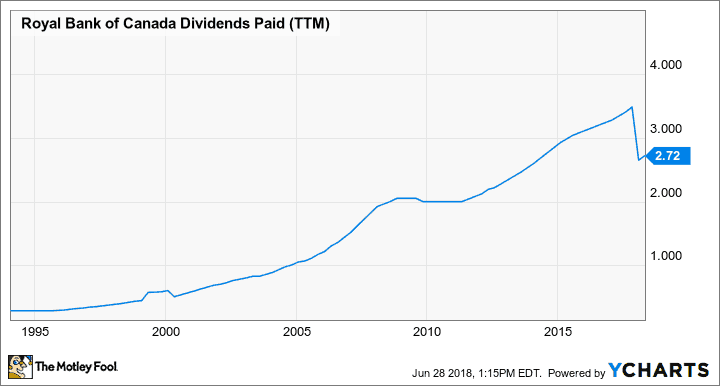

Take, for instance, banking giant Royal Bank of Canada (TSX:RY)(NYSE:RY). The company has paid uninterrupted dividends for more than 20 years. Moreover, it has grown its payout at a solid clip of roughly 7% over the past decade.

Just think back at how many shocks and meltdowns we’ve had over the years. Yet no matter what, RBC keeps taking care of business: conservative banking, while rewarding shareholders with growing dividends.

Now, I don’t have a crystal ball. I can’t tell you exactly what’s going to happen with the economy and how. Forecasting has always proven to be a worthless exercise, and even more so with the unpredictability down in the U.S.

But what I’m definitely confident about is this: simple “cash cow” companies like RBC will build wealth over time, no matter what market elements investors face.

The bottom line

Always do your best to find stocks that stand the test of time. Companies that print cash and increase dividend payments year after year are the true monumental wonders of investing.

As far as RBC goes, I wouldn’t go all-in at this exact point in time. The stock has gained steadily in recent years and currently has a yield of about 2.8%. Historically speaking, that’s pretty low for RBC shares.

That said, RBC should always be on your watch list for a significant pullback.

No stock is worth owning at any price. But RBC is one of those rare stocks that’s worth owning even at a decent price.