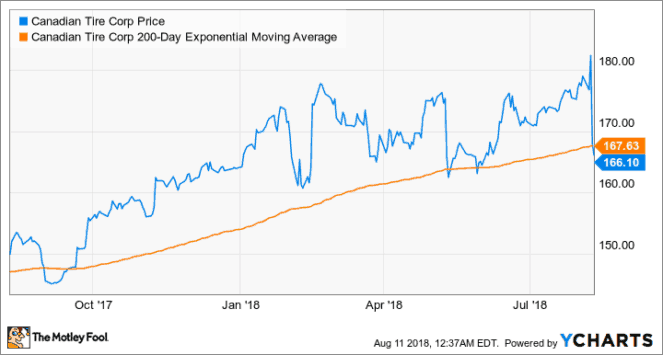

If you’re looking for a stock to buy on the dip after a fairly turbulent week for the TSX, I’ve got you covered with a Canadian dividend grower that’s outperformed the market consistently over the long haul. After clocking in a seemingly weak quarterly result, the stock has been punished by investors, probably a lot more than it should have been given its circumstances.

Canadian Tire (TSX:CTC.A) stock fell a whopping 9% in the two trading sessions following the release of its Q2 2018 numbers. If you skimped over the quarterly report and went straight for the adjusted EPS numbers, there’s no question that you’d think that the company clocked in an absolutely abysmal quarter that’s worthy of a correction.

Canadian Tire missed analyst expectations by a landslide, and given the general public’s already fearful over the retail industry as a whole given the disruptive potential of e-commerce, I think the damage was excessive and overblown, leaving contrarian value investors an opportunity to scoop up shares of the Canadian icon at a considerable discount.

Was the quarter really that bad?

It wasn’t great, but there’s no way the stock should have fallen by 9% in just two days if Mr. Market were efficient at pricing stocks.

In a previous piece, I noted that adjusted earnings numbers are not a great metric to determine how a company truly faired in a given quarter. Much of the time, management is required to make subjective accounting choices that may not always be neutral. That means management may be adopting aggressive or conservative accounting choices that will ultimately overstate or understate results for a quarter, respectively.

In the case of Canadian Tire’s Q2 numbers, I think they were understated, leading investors to believe that the sky was falling when in reality, things weren’t as ugly as they seemed.

Not only did Canadian Tire exhibit a conservative accounting choice (will lead to better-looking results in future quarters) by expensing $84.9 million from the adoption of new accounting methods (IFRS 9), but when combined with the one-time headwind of poor weather conditions for the quarter, I believe the quarter wasn’t nearly as ugly as it seemed based on shallow metrics like adjusted EPS.

Simply put, the weather conditions for April stunk.

They hurt sales across the board. It wasn’t Canadian Tire’s fault, but most investors didn’t seem to care. They cringed at the earnings miss and ditched the stock to the curb without further investigation. I believe investors’ reaction to the results were very rash and completely unwarranted.

Foolish takeaway

Given lower expectations, conservative accounting procedures that are paving the way for “prettier” future results, the promising potential behind the Triangle loyalty program and the recent partnership with pet retailer, Petco, I think the stock is a strong buy on the dip and believe that Mr. Market is mispricing Canadian Tire to the downside.

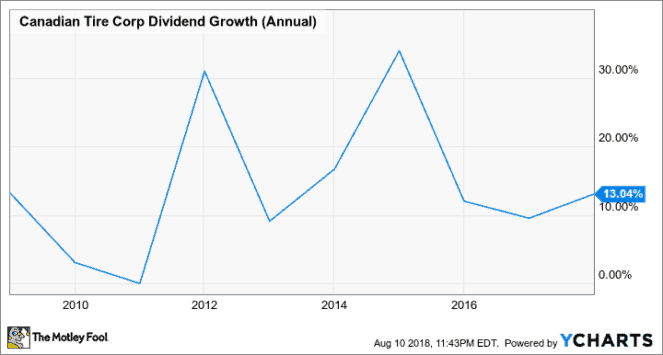

If you adjust for the weak April weather conditions, and conservative accounting decisions, I think Canadian Tire really had an okay quarter. The stock currently has a 2.2% dividend yield that may not seem impressive on the surface either. When you look at the company’s history of generous dividend increases, however, Canadian Tire looks like a complete steal and by year-end.

I wouldn’t rule out an upside correction to make up for what I believe is a severe overreaction to a quarter. For now, Canadian Tire’s going to be in the penalty box, but it’s a minor penalty, and once it’s released, I think a bounce-back is in the cards.

Stay hungry. Stay Foolish.