Buying stocks on dips has become quite a popular strategy among value investors and close followers of Warren Buffett. While you may think it’s a low-risk way to make a quick buck, the buy-the-dip strategy only works if you’re buying the stock of a wonderful business that’s been overly punished for a reason that’s not detrimental to the medium or long-term thesis.

Believe or not, most stock drops are warranted, as the businesses behind a dipped stock may have a tough road ahead or the stock may have run a bit ahead of itself. Consequently, buying on dips isn’t as effective as most beginner investors would think. An investor must do their homework and ensure that a fall isn’t the result of an issue with the underlying company.

In some instances where the general public is overly negative, however, value investors have a chance to take the role of a true contrarian, whether the excess negativity is caused by an event that’s only material in the short term or if the stock under question is pulling back due to no other reason other than sheer negative momentum.

Consider Restaurant Brands International (TSX:QSR)(NYSE:QSR), a dipped dividend-growth stock that’s down nearly 14% from its all-time high, mainly because of negative Tim Hortons’ headlines have been making the news once again.

Tim Hortons’ President Alex Macedo is committed to repairing the communications channel between management and franchisees, but in the meantime, it looks like the flow of bad press is going to continue acting as a drag on Tim Hortons and Restaurant Brands stock. Over the longer-term though, it’ll be the quarterly results that’ll dictate the trajectory of the stock, and given the impressive fundamentals, I’d say Restaurant Brands isn’t going to remain depressed for very long.

The parent company behind Tim Hortons, Burger King, and Popeyes Louisiana Kitchen has a remarkably high growth ceiling and a relatively predictable, robust operating cash flow stream that’s poised to grow through thick or thin.

With several near- to medium-term catalysts on the horizon (same-store sales growth initiatives, expansion into new international markets, and new ordering tech), Restaurant Brands looks like a safe way for Canadian investors to have their capital gains together with a high dividend (3.2% yield at the time of writing).

Generous annual dividend hikes? Yes, please!

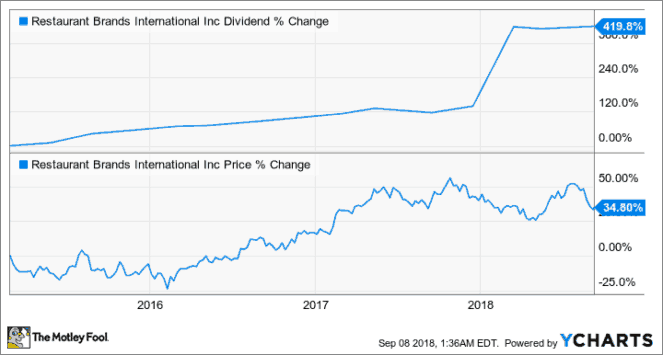

Over the last three years, Restaurant Brands has rewarded investors with massive raises on a consistent basis, including the whopping 114.3% dividend hike delivered after the release of the company’s Q4 2017 quarterly report. Wow, talk about a double-double with a side of capital gains over the past few years!

While the overnight doubled dividend is an anomaly, given the highly predictable nature of the company’s cash flow stream, I wouldn’t at all be surprised to see double-digit percentage hikes to the dividend every single year.

Buy the stock on the dip and just forget you own it, as the growing dividend makes you rich over the course of decades.

Stay hungry. Stay Foolish.