“Outrage Builds As Canada Pension Plan Retains U.S. Private Prison Stocks” read a Huffington Post article in November, as activist investors descended upon public meetings in major Canadian cities to express their frustration. These protesters took exception to the decisions the pension fund managers had made and were calling on divesting.

What was the beef all about? It seems that the CPP, with roughly one-third of a trillion dollars to manage, had made equity investments in for-profit, privately run prisons in the United States. This national fund that we all pay into has roughly 50% of holdings in public equities: stocks. Petitioners produced a reported 55,000 signatures demanding that the pension dump dubious investment choices from the portfolio.

This news reflects an important trend: investing with an ethical compass is not going away. This is why more and more companies include Environmental, Social, and Governance (ESG) in annual reports.

Now more so than ever, investors view markets and portfolios from many different vantage points. There is at least one TSX exchange-traded fund, the iShares Jantzi Social Index, built for ESG investors.

Three companies that take social responsibility seriously

Telus (TSX:T)(NYSE:TU) is a recognizable telecommunication company with an affinity for animals. Have you noticed many of the Telus ads feature adorable animals? Reading the 2017 “Stronger Together” Sustainability Report can make you feel warm and fuzzy. Telus seems to leave no ethics-minded stone left unturned, covering LGBQT, philanthropic charitable giving, water & paper consumption, air travel, and employee commuting patterns.

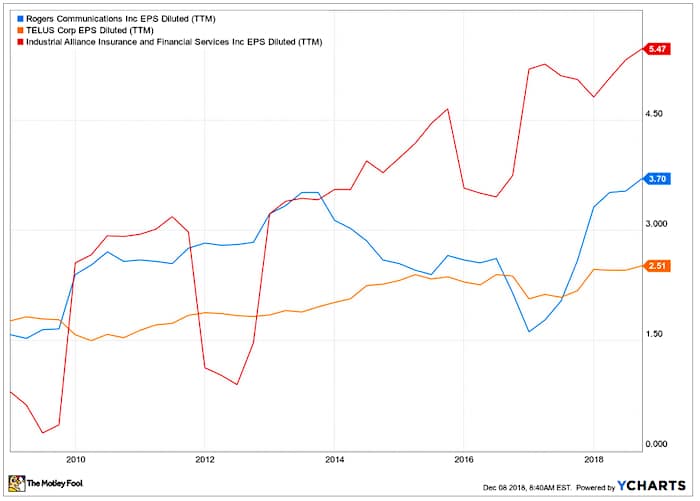

In the last five years, Telus has grown earnings per share (EPS) by 25% and now pays a 5.4% dividend.

Rogers Communications (TSX:RCI.B)(NYSE:RCI) has a strong ESG program, and the company is mindful of continued success in this department. The percentage of the workforce who are women is an area Rogers acknowledges could improve. For instance, women in the general workforce and senior manager positions accounts for 38% and 27% of employees, respectively, below the targets. When it comes to senior managers that are visible minorities, Rogers exceeds labour market availability.

In the last five years, Rogers has grown EPS by 18% and now pays a 2.7% dividend.

Industrial Alliance Insurance and Financial Services (TSX:IAG) is a stock I am predicting will soar in 2019. The company believes in “growth in line with our values.” A brilliant example of ESG is the Vancity Investment Management initiative that set sail ethically 10 years ago and continues to be a peg in the ESG sand, according to the 2017 report. Vancity does not invest in tobacco, nuclear power, weapons, adult entertainment of gaming.

In the last five years, Industrial Alliance has grown EPS by 54% and now pays a 3.4% dividend.

Take-home message

ESG investing continues to grow and will therefore be an important competitive advantage — a way to gain shareholder support. The bottom line here is that investors need not feel icky about how their retirement money grows. It is possible to capitalize on ESG stocks that reflect quality business without leaving too much of a wake. At current valuation levels, Industrial Alliance is the best choice among these three leaders.