News about Aurora Cannabis’s (TSX:ACB)(NYSE:ACB) one-time disposal of all its remaining stock position in Green Organic Dutchman (TSX:TGOD) at a 14.5% discount to its closing price on Tuesday could have raised new questions about the marijuana giant’s cash position. Could the company be desperate for cash?

What do we know?

Aurora reported a fair value of $139 million on its 28.8 million TGOD share position at the end of March 2019, but the company has accepted to sell the block of shares at just $86.5 million to a syndicate of bankers. Management couldn’t wait for The Dutchman’s stock to recover so as to avoid a loss.

Could this be a sign of desperation?

Maybe, but we already know that these shares were no longer held for strategic reasons after some clear intention to abandon the strategic investment and a reclassification to marketable securities late last year, so they could be sold any time management deemed necessary, and the realized cash return on the position is a nice 81% based on the acquisition price of $1.65 in January 2018.

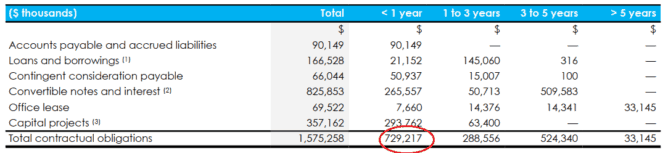

That said, there are signs that the leading cannabis grower could need some more cash resources to meet its contractual obligations, and these were already huge by March this year. There was talk of nearly $730 million in less than 12 months to March 2020, yet the company only had $390 million in cash and cash equivalents at the end of March and had a significant operating cash burn averaging $60 million per quarter.

The company has a deep investment portfolio of marketable securities from which it could make disposals from time to time, and this was valued at $273 million by March. TGOD stock was part of this portfolio, and it’s not surprising that the company made a block sale this week on the same day the investee reported the bullish news of an important production licence receipt from Health Canada.

Operations cash burn could go away soon

The company continues to generate impressive revenue growth to this day, and there’s a guidance for positive adjusted EBITDA, which was given for the June 2019 quarter. Adjusted EBITDA is a good proxy for the company’s cash generation potential from daily operations. I would expect operating cash burn to decline going forward, as revenue growth continues in the local medical and recreational front and a strong export sales performance.

Is the company desperate for cash?

I wouldn’t view the company’s liquidity position as close to desperate right now, although Aurora will most likely need new cash injections for growth projects, especially after the new Germany local production tender win that requires a new facility build, but the debt markets have been very forthcoming after a recent credit facility upgrade at BMO to $350 million and the over-subscribed US$345 million senior notes offering early this year.

A short-form prospectus to raise up to US$750 million was filed in April this year, and I will be keen to check how cash flows looked like in the upcoming earnings report on September 11 to gauge if a new financing raise could be called for soon.

That said, the anticipated report is coming in 73 days after a quarter close on June 30. So much time has lapsed, but that will be the most recent update we can read from to ascertain if the company is indeed in dire need for a new cash injection.

But I wouldn’t fret about anything yet as long as the marketable securities investment portfolio still has adequate liquid assets while operating cash burn rate declines during the new financial year 2020.

Foolish bottom line

The pot company isn’t any desperate yet and may never be.