A quick browse of HEXO’s (TSX:HEXO)(NYSE:HEXO) fiscal fourth-quarter 2019 financial results, as summarized in an earnings release on October 29, could raise some goosebumps for cannabis stock investors, especially when they get to the number $0.56 — shown as a realized net realized price on one revenue line during the last quarter.

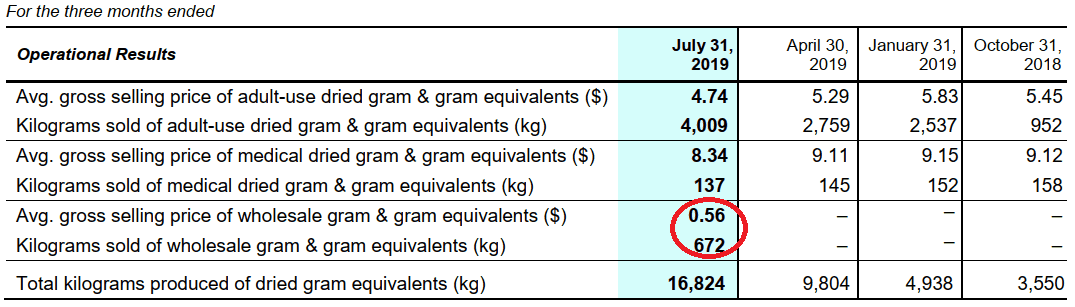

The company’s operational results were as follows:

Source: Company’s Fiscal Q4 2019 Management Discussion and Analysis.

We can see that the company realized just $0.56 per gram of cannabis and its equivalence on its 672 kilograms of wholesale product sales, and this could cause serious alarm to any investor if one is yet to go deeper into the earnings results to understand why such a phenomenon could have happened.

The company could have sold these large volumes at a price below cost of production. There definitely should be a good and sane explanation for all this.

And there’s a good one.

Marijuana firms do at times sell products among themselves at a discount, and these sales are recorded as wholesale sales revenues. Due to capacity constraints, some licensed producers have been active buyers in the wholesale market at some points in time so as to meet their supply agreements obligations and satisfy customers.

Wholesale sales have become a significant revenue component for bigger producers like Aurora Cannabis and a critical growth driver. The smaller marijuana firm sold into this market for the first time ever during the three months to July this year.

Unfortunately, as it appears, HEXO had some product returns clause in its wholesale supply contracts, if buyers failed to sell the merchandise out, and management is expecting a significant amount of this merchandise to be returned.

Actually, the company had sold its pot inventory stock at an average price of $4.36 per gram, and the revenue line could have shown $2.93 million in sales from the 672 kilograms sold into the wholesale channel. But returns will be settled at a price of about $3.80 per gram, hence the company has only realized the difference between the sales price and the returns settlement price of $0.56 per gram as the selling price to wholesale clients for proceeds of just $378,000.

Should this make investors feel any better?

My quick answer would be a qualified “yes and no.”

The $0.56-per-gram selling price would have been very concerning if management had actually signed off product at so low a price point. It should therefore be relieving to know that cannabis price wars, which are just starting, haven’t reached such a tipping and unsustainable point yet (and they may never do so.)

That said, the wholesale market was a lucrative opportunity for the company. Sales teams had managed to push large volumes at a net price higher than adult-use net realizable prices. There were no excise taxes levied on wholesale invoices, so the $4.36 a gram was all for keeps, unlike in the consumer market, where the company realized average net prices of $3.51 per gram after excise taxes.

Investors should lament this opportunity loss if the wholesale market is to underperform going forward.

Even more heart breaking is the fact that the wholesale market dealt the company two big blows at the same time.

Management had to recognize a $16.9 million impairment on inventory, which was bought from other licensed producers earlier during the year to service the adult-use market. Prices have gone down, and the company will sell this acquired product at prices lower than the cost of purchase.

This really hurts.