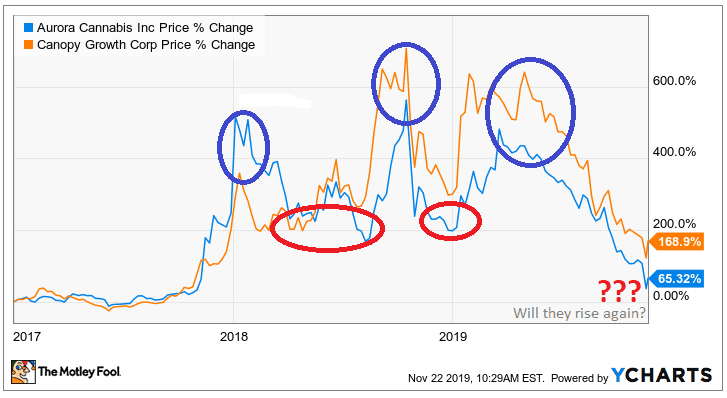

Following the Canadian marijuana industry has been quite an experience since late 2016, the stocks’ price volatility needed someone with nerves of steel to resist dumping positions during bloodbaths, but some new TFSA millionaires were undoubtedly made over the past three years when capital gains topped 600% more than once.

Falling in love with an aggressive Aurora Cannabis (TSX:ACB)(NYSE:ACB) early in 2017 was an irresistible temptation, and shares indeed delivered phenomenal returns that year, then gave up a lot in 2018 and rallied again late last year only to go bust and spill a lot of blood on the streets in 2019.

Industry stocks move very much in sync, and choosing between one and abandoning the other between Aurora’s peers like Canopy Growth (TSX:WEED)(NYSE:CGC) has largely been a matter of preference, although the later was blessed with billions from Constellation Brands that made the company one of the best financed ones in the sector.

I once recommended trimming positions in 2018 when times were much better to reduce exposure and book some gains, but the plunge in 2019 was just too much, although this is common on overhyped stocks when sentiment turns negative.

If one had opened a position on Aurora or Canopy Growth early in January 2017 and never sold, chances are high that they still have a 65% gain on ACB and 168% up on WEED, but those who bought at the tops around the blue circles may have to wait for some years for share prices to bounce back to prior highs so they can recoup losses.

That said, if one were to buy today’s lows, could marijuana stocks rise sharply once again to make new TFSA account millionaires?

There are some possibilities

The Canadian market is proving have a slow growth potential, but this could be a result of a slower than necessary retail store rollout, as distribution channels aren’t as far reaching as the old underground pot market due to stringent regulation.

I was thrilled to read of a fired up Fire & Flower Holdings that plans to increase its pot retail footprint six fold from 22 locations by August this year to 135 locations by the end of 2021.

Aurora’s investee Alcanna Corp expects to expand retail locations too and Canopy Growth is already enjoying a growing retail presence in some provinces.

Even if more retails locations fail to drive massive growth within Canada, there’s still the potential chance of a new federally legalized United States marijuana market that everyone is lining up to invade through the guise of hemp market ambitions.

News of a signed bill that permanently lifts the legal risk on state licensed producers down south could spark a new wave of hype that could lift all North American marijuana related tickers.

That said, we still have another chance to see how the cannabis industry will tackle an infant edibles market in Canada from December this year. Any positive news could still lift some animal spirits.

Further, I wouldn’t ignore the prospects of a budding European market that Canadians have had the opportunity of gaining some first mover advantage in (although there’s serious completion from the Dutch), but the whitewash win by Canadian firms in a Germany production tender was evidence enough that they can conquer this new market and bring boat loads of Euros back home.

Aphria is getting ready to do just that, and Canopy invoiced over $10 million in product exports in the recent past quarter.

I don’t know where else can 200% plus year-over-year revenue growth rates be found in mature economies of North America and Europe apart from cannabis, and it appears that the industry could still find favour among investors again.

This time, however, the gains could be tied to more sober valuation multiples and require longer holding periods before being realized.