Home sales are still climbing, according to Vancouver’s real estate board. Prices are softening, and home sales are below the 10-year average, but there is no reason to believe the market will crash anytime soon. Undoubtedly, the housing market and the Big Six Canadian banks have never been safer.

The 2007 banking crisis in the U.S. and Europe traumatized the globe, leading to more secure lending practices. The three top residential real estate investment trusts (REITs) have substantially outperformed the S&P/TSX Composite Index in the past four years. Further, the prior year saw less-substantial price gains in these stocks, which means the shares might have some catching up to do next year on the Toronto Stock Exchange.

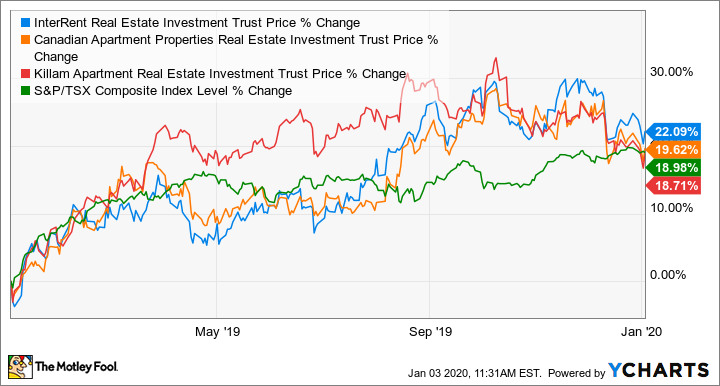

Three REITs that outperformed the S&P/TSX Composite Index

InterRent Real Estate Investment Trust (TSX:IIP.UN), Canadian Apartment Properties Real Estate Investment Trust (TSX:CAR.UN), and Killam Apartment Real Estate Investment Trust (TSX:KMP) have all outperformed the price performance of the S&P/TSX Composite Index. InterRent REIT took first place for percent change in price over the last four years at 136.3%. The price on shares of Canadian Apartment Properties REIT rose 94.83% since 2016, just 10% more than Killam Apartment REIT.

By comparison, the S&P/TSX Composite Index price only rose by 32.05% in the past four years — much less than these three leading Canadian REITs. If you want alpha-level, market-beating returns in 2020, you should invest some of your spare cash into these top TSX REITs.

REITs matched index price performance last year despite recession fears

Last summer was a flurry of headlines warning of another economic recession due to the U.S.-China trade war and pending new NAFTA talks between Canada, the U.S., and Mexico. U.S. president Donald Trump had the entire globe talking about World War III and a global slowdown in trade.

There is no doubt that trade-related politics impacted the stock market, investor returns, and company profits. Nonetheless, these three REITs still managed to exceed or at least match the performance of the S&P/TSX Composite Index.

InterRent’s price appreciated by 22.09% this past year. Canadian Apartment Properties’s percent price change came in at 19.62%.

Killam Apartment REIT was the only one of the three which did not match the 18.98% growth of the TSX index. Killam came in just shy by 0.27% or 18.71% for the year, which just about matches the index.

InterRent topped the list for dividend growth

Out of these three REITs, InterRent is the best investment you can make. InterRent performed better by price and dividend growth than both Canadian Apartment Properties and Killam Apartment REIT. Killam, which already has a high dividend yield, could only give shareholders a 10% increase in dividend payouts the past few years. Canadian Apartment Properties did slightly better at a 16.95% growth in its dividend, but it can’t compete with InterRent’s 41.16% dividend growth over the same period.

Growing dividends are a sign that the stock will retain and attract new investors. Holding the supply of outstanding shares constant, this means that the price should appreciate from the additional demand. Canadian investors interested in giving their retirement portfolios a boost next year should take note of the fantastic price performance of these three top TSX REIT stocks.