Despite the devastation of the pandemic, some people actually have a healthier savings account today. This creates an opportunity to put some cash to work in your TFSA for future financial needs.

What’s the scoop?

Pandemic lockdowns forced Canadians to cut spending on a number of activities in the past six months. Gym memberships, after-work drinks, movie nights, and weekend road trips all took a hit.

The result is a budget surplus for many people who maintained their income level.

TFSA advantage

The TFSA is a good place to put the money to work. Investors can currently contribute up to $69,500. The dividends and capital gains generated inside the TFSA remains beyond the reach of the CRA. This means the full value of the profits can go straight into your pocket or be reinvested to buy more shares to grow the fund.

The power of compounding acts like a snowball rolling down a mountain. Over time, a small initial investment inside the TFSA can turn into a large pool of savings. This could be used to help buy a house or serve as retirement income.

Best stocks for a TFSA savings fund

The best stocks to own for a buy-and-hold TFSA portfolio tend to be industry leaders that have track records of boosting dividends regularly. They support the dividend growth with rising profits and free cash flow. Ideally, these companies have sustainable competitive advantages in the markets they serve.

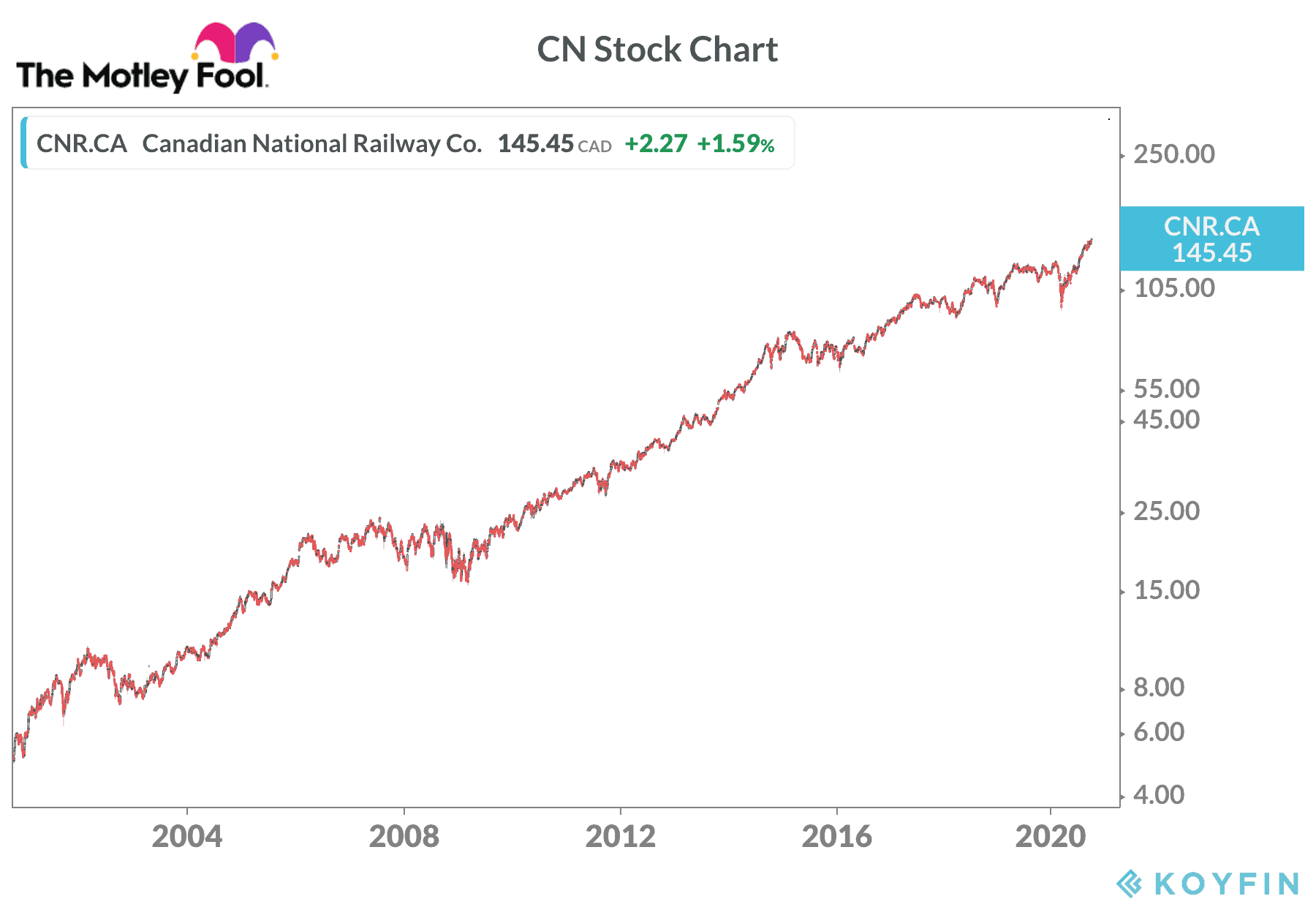

Let’s take a look at Canadian National Railway (TSX:CNR)(NYSE:CNI) to see why it might be an interesting pick.

CN

CN is one of those stocks you can buy inside your TFSA and simply forget for decades. The company is a key player in the smooth operations of the Canadian and U.S. economies. CN is unique in the rail industry with its connections to ports on three coasts. Competition with other rail companies and trucking firms exists on some routes, but there is ample business to go around.

CN generates good profits in all economic conditions. Management spends heavily to invest in network upgrades, new locomotives, rail cars, and technology to improve efficiency. The company spent nearly $4 billion last year on these capital programs.

Despite large capital budgets, CN still has significant free cash flow to pay shareholders a dividend. The compound annual dividend-growth rate since CN went public in the 1990s is about 15%. That’s one of the best performances in the TSX Index.

CN provides services in a number of key economic segments, including coal, crude oil, lumber, automotive, grain, fertilizer, and finished goods. Revenue comes from both the Canadian and U.S. operations, giving investors good exposure to the American economy through a Canadian stock.

Long-term investors have done well with the shares. A single $2,000 investment in CN just 20 years ago would be worth $56,000 today with the dividends reinvested. A $20,000 investment would be worth $560,000!

The bottom line on TFSA investing

CN stock is just one example of how small investments can grow to be significant savings using the power of compounding. The TSX Index is home to many top stocks that have generated amazing returns over the years.