Exactly a year ago, AutoCanada (TSX:ACQ) stock seemed to have bottomed out. Unfortunately, an unanticipated COVID-19 crisis came four months later and dictated a much lower bottom on ACQ. Even so, the company’s earlier strategic recovery plan, and tactical survival plans during the pandemic allowed AutoCanada stock to emerge a big winner among TSX stocks this year with a 133% return so far this year.

Why did AutoCanada stock rise 133% this year?

AutoCanada is Canada’s only publicly listed auto dealership firm that is emerging as a powerhouse in the country’s $246 billion market.

It was once on the brink of collapse after years of poor performance, high leverage, and a bloated cost structure. ACQ emerged as a better company after management implemented a Go Forward Plan in 2018 to revive the business’ ailing fortunes.

The plan involved non-core asset sales, disposals of non-performing car dealerships, the optimization of its Finance and Insurance (F&I) and collision repair divisions as well as the creation of a used car wholesale and special finance business lines. The revamped F&I and collision repair segments generate about 20% of total revenue but contribute about 70% to gross profit.

ACQ’s strategic plan has worked wonders since implementation. The company has outperformed the Canadian new vehicle sales market by significant margins over the past seven consecutive quarters. AutoCanada is consistently gaining market share from peers and it’s doing so very fast. Even better, the new and used vehicle sales division is enjoying double-digit sales growth rates with a 22.8% year-over-year growth experienced during the third quarter of this year. The company’s market share in both new vehicles and used vehicle markets remains around 2%. There’s still more room to expand in the fragmented market.

Investors have witnessed consistent improvement at ACQ. Recent cost-cutting and cash-management initiatives during the COVID-19 pandemic yielded positive results, too.

ACQ’s impressive third-quarter results

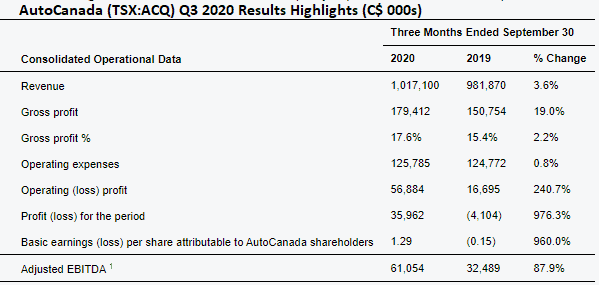

Quarterly revenue at $1.02 billion was a new record. The company had never invoiced a billion dollars within just three months before. Margins continue to expand, and profits grew strong. Leverage has declined with increased positive cash flow generation and debt repayment. Debt maturities have been extended from 13 months by February 2020 to four years. AutoCanada’s balance sheet has been significantly strengthened over the past few months, and its income statement is doing great given an 87% annual growth in adjusted EBITDA during the past quarter.

ACQ’s stock price has justifiably more than doubled this year.

Foolish bottom line

Undoubtedly, ACQ’s fundamentals have improved since I last covered the auto dealership stock in November 2019. The company is more profitable, and the balance sheet is healthier. Its latest acquisitions concluded during the fourth quarter of 2020 seem accretive, too. This includes the recent acquisitions of Auto Bugatti in Canada and Autohaus Peoria in Illinois. The Autohaus transaction enhances geographic diversification and establishes a new relationship with a new luxury brand Porsche.

The company could enjoy a first-mover advantage through launching online stores for used cars in Canada. Similar used vehicle online stores like the Japanese BeForward.jp have taken emerging markets by storm.

It’s every contrarian investor’s dream to pick up cheap shares in a troubled stock right when they are bottoming out. Contrarian investors who scooped AutoCanada stock as it bottomed out in 2019 have enjoyed good returns this year. An unprecedented pandemic couldn’t overpower the strong recovery momentum after a business reset.