Marijuana firm Aurora Cannabis (TSX:ACB)(NYSE:ACB) has entered into one of the biggest medical cannabis supply deals by a Canadian pot grower with an Israeli firm to-date. This comes after the Canadian marijuana firm announced its two-year supply agreement with Cantek, a leading cannabis market player in Israel.

Aurora Cannabis said it “intends” to supply a “minimum of 4,000 kilograms of bulk dried cannabis flower” per annum to Cantek in a two-year deal that could be extended. The volume involved could make the ACB deal one of the largest export deals to Israel by a Canadian firm to-date.

Has Aurora Cannabis found a long-term growth market?

Israel has emerged as the second-largest medical cannabis market outside Canada. The largest such market is Germany. Patient numbers have been growing fast since last year and there’s above-average consumption of medical marijuana in Israel.

Perhaps a successful entry into Israel is a good development for any Canadian pot firm. Given a lower than anticipated demand in the local market, export deals are more than welcome. Moreover, co-branding deals help introduce Canadian medical brands to a new market. The latest developments are welcome to alleviate short term pain for Canadian licensed producers.

That said, Israel has arguably one of the most favourable climates for cannabis growing. The country could grow tonnes of dried marijuana at a fraction of Canadian producers’ cost. I am not very confident that we could count the Israeli market as a long-term export market for Canadian growers, however, as tables could be turned in a few years’ time.

Similar deals by Canadian marijuana competitors

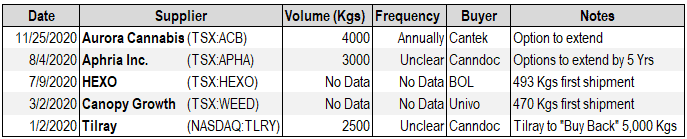

Earlier companies that announced export deals to Israel include Tilray, Canopy Growth, HEXO and Aphria. I discussed the HEXO deal earlier. The other deals can be summarized in the table below.

As things stand, Aurora has signed one of the largest supply deals with an Israeli firm to date. Aphria did not clarify in its August announcement whether the 3,000 kilograms mentioned were annual volumes or they were the total deal size during the first two years of the agreement. HEXO and Canopy Growth gave no deal volume data, though they made first shipments of 493 kilograms and 470 kilograms each, respectively.

The Tilray deal happened much earlier in January. The company did not specify whether the 2,500 kilograms of pot indicated were annual volumes or just a once-off volume.

Most intriguing, however, is that Tilray also agreed to buy double the volume of cannabis from the Israeli firm. This was expected to happen from mid-year this year. Such detail could imply that we shouldn’t take Israel export deals as potentially long-term.

Indeed, Canadian suppliers could lose the Israel market as soon as local companies ramp up production. Perhaps Cronos Group, which has a local subsidiary in Israel, could retain market share there.