The shares of Alimentation Couche-Tard (TSX:ATD.B)(TSX:ATD.A) have been trading on a negative note for the last three weeks in a row. The multinational convenience store operator released its second-quarter of fiscal 2020 earnings yesterday after market close. The company managed to beat Bay Street analysts’ earnings estimate for the quarter.

On Tuesday, its stock settled with a 0.7% drop for the day, but it opened on a positive note earlier today with 3% gains from yesterday’s closing price. However, ATD stock couldn’t maintain these gains as it turned negative after posting the day high of $44.94.

Let’s find out what could be hurting Alimentation Couche-Tard’s stock despite its Q2 earnings beat and whether it’s an opportunity to buy its stock cheap.

Alimentation Couche-Tard’s Q2 2020 earnings

In the second quarter, Alimentation Couche-Tard’s adjusted earnings rose by 29.4% YoY (year-over-year) to US$0.66 per share. It was 28.5% higher from analysts’ expectation of US$0.51 per share.

However, the company’s YoY earnings growth rate continued to fall sharply in the third quarter. In the quarter ended April 2020, its earnings rose by 81% — mainly due to higher merchandise sales. This growth rate fell to 46.4% in the July 2020 quarter and fell further to 29.4% in the latest quarter.

Alimentation Couche-Tard declining earnings growth rate despite its Q3 earnings beat could be the primary reason for investors’ negative reaction after the earnings event.

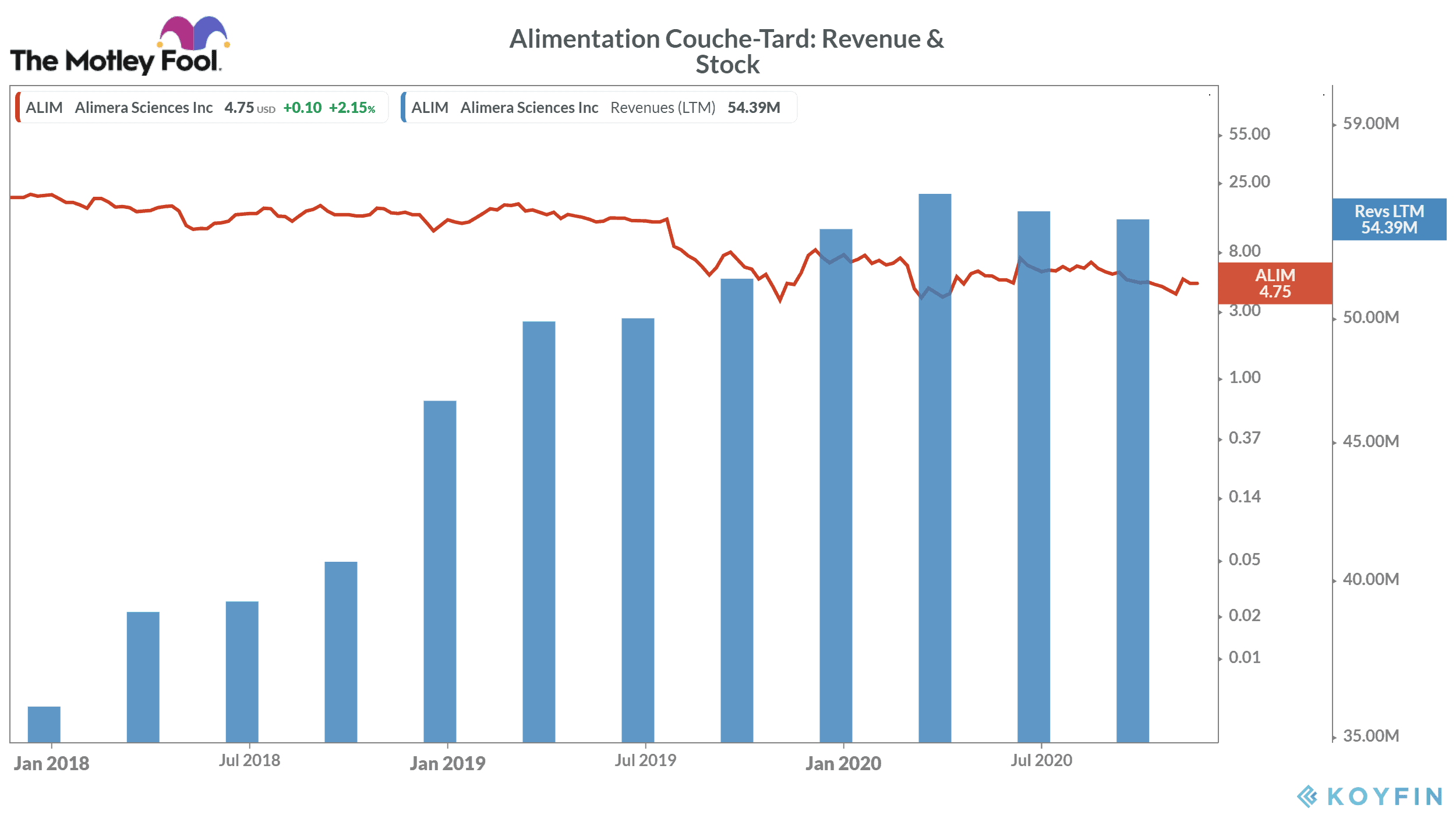

Declining revenues

During the quarter ended in October 2020, Alimentation Couche-Tard’s total revenue continued to decline for the third consecutive quarter. In Q3, it stood at US$10.7 billion — down 22.1% YoY. In the previous quarter ended July, its revenue fell by 31.4% from a year ago.

On the positive side, its merchandise and service revenue rose by 6.3% YoY in the last quarter to US$3.8 billion. Its quarterly same-store merchandise sales surged up 4.4%, 8.6%, and 11.4% in the United States, Europe, and Canada, respectively.

Other major challenges

In its Q3 earnings report, Alimentation Couche-Tard highlighted that the COVID-19 is continuing to hurt its store traffic throughout its network. On the positive side, visiting customers are seemingly buying more goods than usual as its consumer average basket size rose significantly. The company believes that currently, consumers are consolidating their trips to its stores due to the pandemic.

To expand its network, Alimentation Couche-Tard acquired 10 company-operated stores from Wadsworth Oil Company of Clanton in Alabama. The company also completed the construction of 13 stores.

Is Alimentation Couche-Tard’s worth buying?

Currently, Alimentation Couche-Tard’s stock is trading at $42.9 per share. While the stock has traded on a negative note in the last three weeks, it’s trading not far from its all-time high of $47.49 per share on TSX — posted in July. It’s up by 4.55 against a 1.6% drop in the TSX Composite Index on a year-to-date basis.

I wouldn’t compare Alimentation Couche-Tard’s latest earnings with a previous couple of quarters, as the pandemic had a temporary but high impact on its business during those quarters. While I would want the company to improve its sales in the coming quarters, its same-store merchandise and service revenue growth and the bottom line look impressive.

As the COVID-19 restrictions continue to subside gradually, Alimentation Couche-Tard’s store traffic could improve — helping it improve total sales. Such factors could drive its stock up in the coming months.