One of the best Canadian stocks for investors looking for resiliency and growth potential over the past few years has been Shaw Communications (TSX:SJR.B)(NYSE:SJR).

Prior to the announcement of Rogers acquiring Shaw, it was a top stock, because it was a resilient business that was also undervalued. Plus, it offered solid growth potential.

The acquisition may have been slightly shocking, but it’s not surprising. It should help Rogers to grow rapidly and take on BCE to be the largest Canadian telecom stock.

Takeovers are almost always very rewarding for shareholders. Investors usually receive a nice premium, and often you get a choice if the company being acquired isn’t being taken private, such as in this case, since it’s being acquired by Rogers.

So, if you really like the business and believe that the merger or acquisition can add shareholder value, you can stick with the company. Otherwise, you can take the premium payout and enjoy the returns on your investment.

That’s why a stock that the market considers a potential takeover target is often considered a positive quality for investors.

So, with that being said, another high-quality Canadian stock that could be a potential takeover target is Corus Entertainment (TSX:CJR.B).

Is Corus the next Shaw?

Corus has been considered a potential takeover opportunity for a while. In many cases, I think Corus was thought of as a likelier potential takeover target than Shaw.

Whether one of the major Canadian telecom companies or an American media company wanted to acquire it, Corus has attractive assets and generates incredible free cash flow.

Not to mention, the stock has been so cheap for so long. Therefore, many have speculated that a bigger media company could look to acquire Corus for its impressive assets and the synergies they could create. That’s exactly the sort of reason that Rogers acquired Shaw — for its high-quality businesses and the potential synergies that they create.

Why Corus is a top Canadian stock

Whether or not Corus gets taken out, the stock is still an attractive investment for Canadians today. Corus has been a top recovery stock since the coronavirus pandemic began.

The stock was a higher risk investment in turnaround mode when the pandemic hit. So, many investors bailed on the company.

Investors were concerned that the impact on revenue and major debt load the company had would cause problems. The Canadian stock, though, was still generating impressive cash flow.

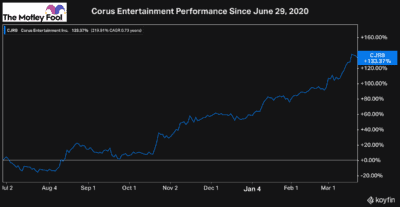

As I’ve mentioned, after it plummeted following its June 2020 earnings report, that would be the worst point for Corus’s business, and that was the most opportune time to buy for long-term investors.

Since then, Corus investors have seen a more than 130% return on their investment. However, even today, after the incredible recovery over the last nine months, Corus is still an attractive investment.

The Canadian media stock still only trades with a forward price-to-earnings ratio of less than 10 times. And its dividend, which only pays out roughly 33% of its earnings, yields 3.85%.

This combination of long-term growth potential in addition to the value it offers today makes Corus one of the most attractive Canadian stocks you can buy.

So, whether or not the company gets taken over, if you’re looking for a top stock to buy today, Corus is among the very best.