Organigram Holdings (TSX:OGI)(NASDAQ:OGI) is a top Canadian pot stock that is currently trading at a discount. The company reported lower revenue in the second quarter, but sales are expected to improve in the third quarter.

Organigram missed estimates in Q2 2021

Organigram posted second-quarter revenue below analyst expectations. The pot company’s net revenue was $14.6 million in the second quarter of 2021 compared to $23.2 million in the same quarter a year earlier. Organigram missed analysts’ estimates of $19.1 million. Q2 2021 net revenue decreased compared to Q2 2020 mainly due to a significant drop in wholesale revenue and a lower average selling price in Q2 2021.

Net sales were also lower due to missed sales opportunities, with some employees testing positive for COVID-19, forcing a significant number of facility staff to isolate.

The Canadian cannabis company recorded a net loss of $66.4 million in the quarter ended February 28, significantly larger than the loss of $6.8 million in Q2 2020. Organigram currently has $232 million in cash and short-term investments.

Organigram’s CEO Greg Engel said, “Although second quarter 2021 results have been called into question by industry dynamics, COVID-19 and staff limitations at our plant, we believe it there are excellent prospects for the industry, Organigram and our shareholders … In the shorter term, we are currently looking to generate higher revenues in the third quarter of 2021 as our new product portfolio continues to gain traction and we become better equipped to meet demand.”

Organigram expects Q3 2021 revenue to be higher than Q2 2021, as the company improves demand fulfillment with increased staffing.

Organigram signed a deal with British American Tobacco

In March, Organigram signed an agreement with a subsidiary of British American Tobacco (BAT), under which the British company will take a 19.9% stake in the cannabis producer for $221 million. Under the agreement, BAT will purchase 58.3 million Organigram shares at a price of $3.792 each.

Organigram says it has also signed a product development collaboration agreement with BAT, which will see the creation of a “centre of excellence” that will focus on the development of the next generation of cannabis products with an initial focus on CBD.

According to Organigram, BAT’s investment is expected to accelerate its research and development program and product development activities in addition to strengthening its ability to penetrate U.S. and international markets.

Last week, the cannabis company acquired The Edibles & Infusions Corp. This acquisition positions Organigram to drive significant incremental near-term revenue growth from soft chews, the largest edible product category.

Raymond James analyst Rahul Sarugaser said the deal will help consolidate Organigram’s already strong position in the Canadian edibles market and add quality soft paste manufacturing expertise to its range of chocolate products.

The company is targeting first sales of chews in the fourth quarter of 2021 subject to certain achievements, including, but not limited to, the timing of receipt and commissioning of certain ancillary equipment, completion of documentation of quality assurance, hiring of required staff, and obtaining product listings from provincial boards.

The pot stock is undervalued

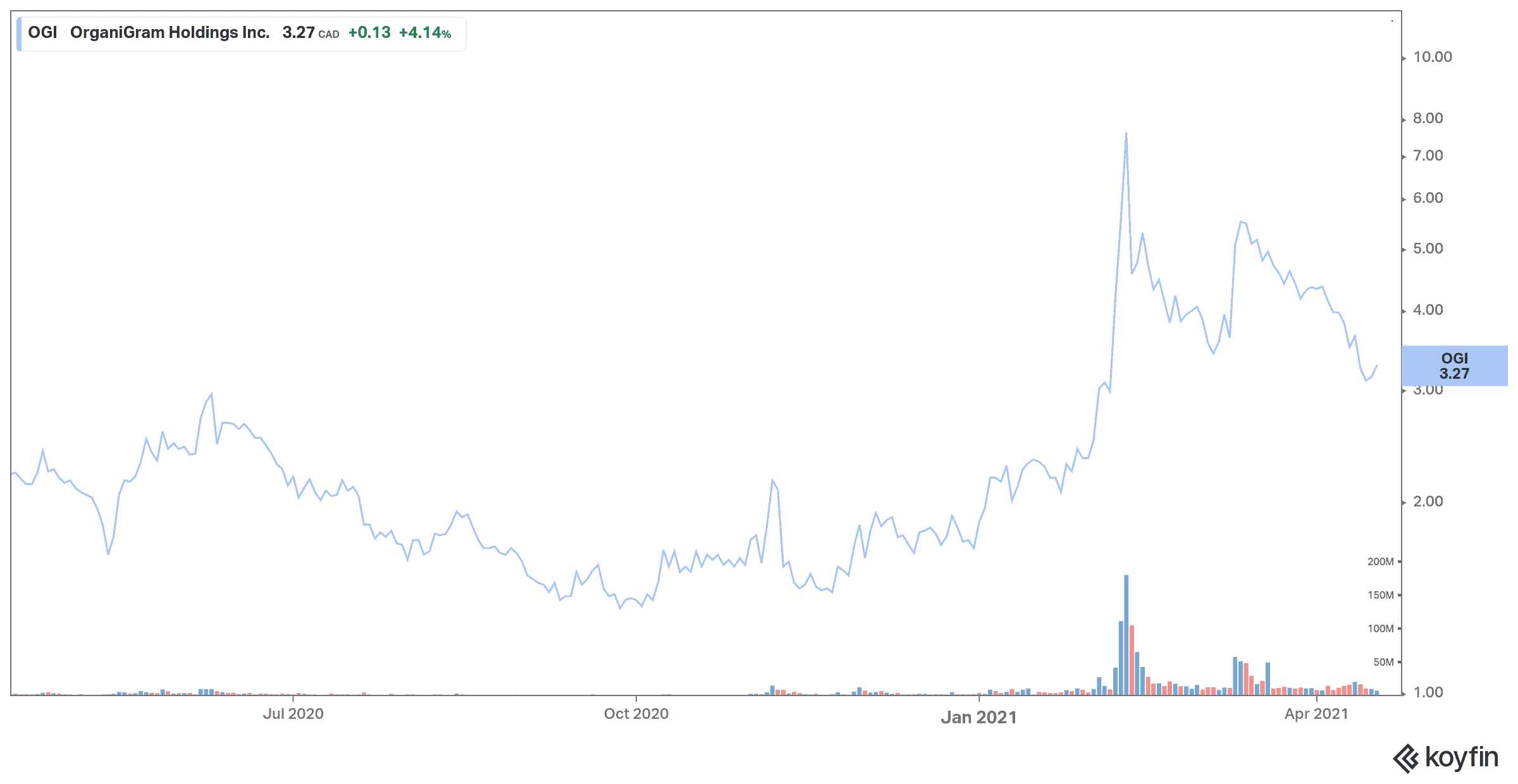

Organigram stock has a five-year PEG ratio of 0.11. A PEG ratio under one indicates that a company is undervalued based on its future expected growth. As its PEG is near zero, Organigram is very cheap. The pot stock has lost a third of its value over one month.