Trading under $1.00, High Tide (TSXV:HITI) is likely one of the most overlooked stocks in the marijuana space today. Yet, this cannabis stock deserves more attention as it is growing and expanding fast.

The largest cannabis network in Canada

High Tide operates a chain of 83 branded retail outlets in Alberta, Ontario, Manitoba, and Saskatchewan.

High Tide has the largest cannabis network in the country in terms of revenue and it continues to grow. The pot company has focused its efforts on opening new stores in Ontario, Canada’s most populous province. By the end of fiscal 2021, it plans to operate 115 stores.

Those who can’t make it to the company’s physical stores can visit Grasscity.com and SmokeCartel.com, which saw over 33 million combined visits in 2020.

In May 2020, High Tide launched CBDcity.com. As the name suggests, it sells products focused on cannabidiol (CBD).

In addition to operating a huge physical and online business, High Tide operates Valiant Distribution, through which it designs and manufactures cannabis lifestyle products and consumer accessories.

Expansion across the country

High Tide recently announced many new retail store openings.

In March, High Tide opened branches in Burlington, Ontario, and two new stores in Calgary.

In April, the company expanded to Ottawa, Ontario, with its most recent META Cannabis retail store, the 83rd High Tide- branded store in Canada, and the 17th in Ontario. The company also opened new Canna Cabana retail stores in Medicine Hat, Alberta, and Toronto, Ontario.

Also in March, High Tide completed the acquisition of Smoke Cartel for US$8 million. With this acquisition, High Tide now operates the two largest e-commerce platforms for cannabis consumption in the world.

With the acquisition, High Tide has significantly expanded its footprint in the U.S. market and is very optimistic about its position to begin online cannabis sales should the U.S. move forward with the federal legalization of marijuana.

In May, High Tide Inc signed an agreement to purchase an 80% stake in U.S.-based Fab Nutrition LLC, a leading online retailer of hemp-derived CBD products such as oils, creams, gummy candies, and dog treats.

The agreement strengthens High Tide’s presence in the United States, where it launched its subsidiary CBDCity in May 2020.

The cannabis stock posted solid results in 1Q 2021

High Tide announced that its revenue for the first quarter of fiscal 2021 ended January 31, 2021 increased 179% year over year to $38.3 million.

Geographically, $34.2 million of these revenues were generated in Canada, $3.9 million in the United States, and $200,000 internationally.

High Tide Inc reported a net loss of $16.8 million in the first quarter of 2021 (loss of $0.04 per share) compared to a net loss of $3.9 million in the first quarter of 2020 (loss of $0.02 per share).

High Tide ended the first quarter of 2021 with cash on hand of $16.6 million, up from $7.5 million at the end of the fourth quarter of 2020 (October 31, 2020). The company’s cash balance has since increased to $33.0 million.

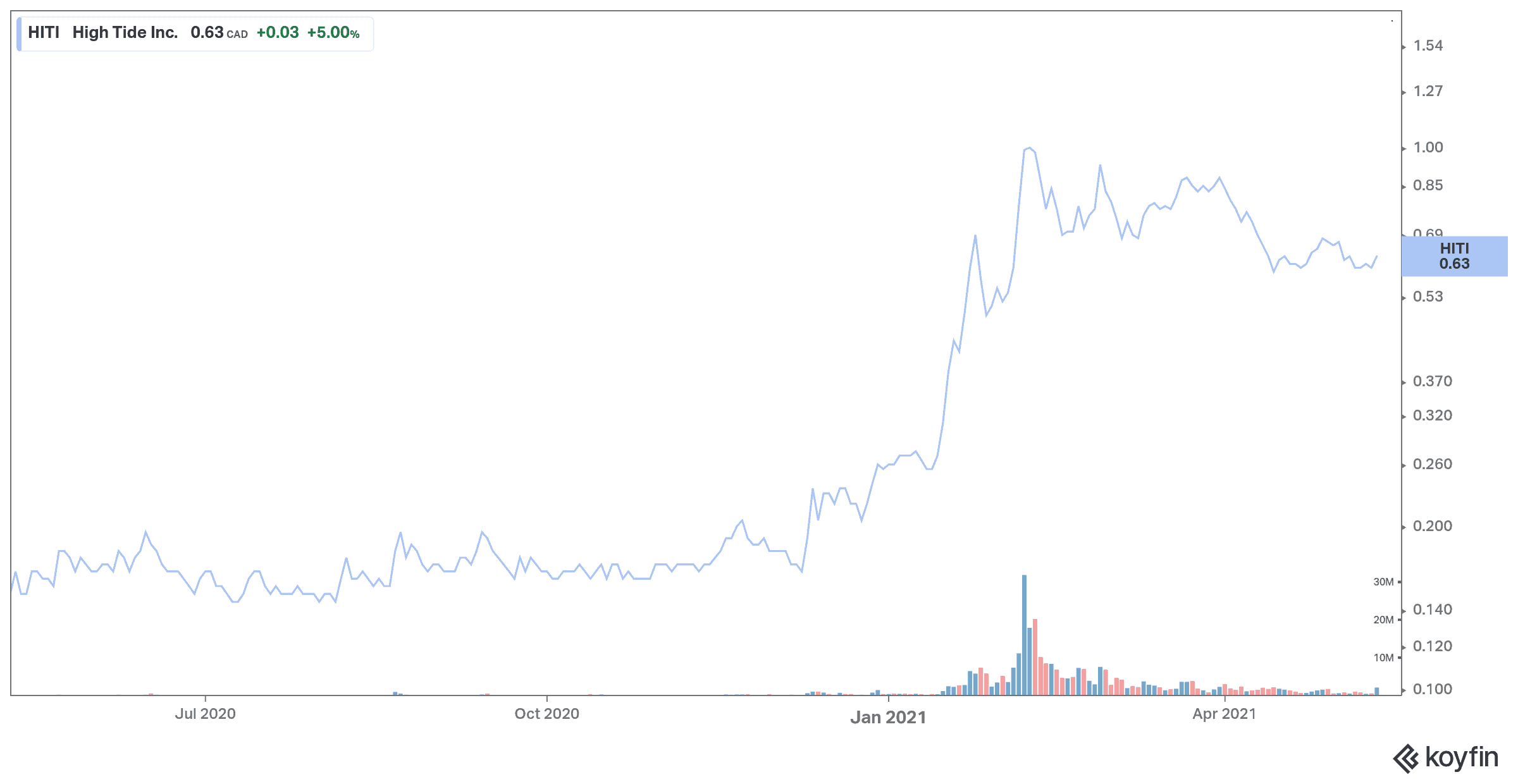

This cannabis stock has strong upside

Despite the same challenges as any retailer during the COVID-19 pandemic, the company has passed the 80 stores mark across Canada. By the end of October, High Tide is expected to have 115 stores.

The company has also applied to list High Tide shares on the NASDAQ, has completed an acquisition and is pursuing expansion opportunities in the United States and Europe.

All of these actions should help High Tide achieve its important growth targets in 2021 and increase the value of the cheap cannabis stock.