I don’t know when the next bear market is going to arrive. Nor do I know how severe it will be. But I do know one thing: when it does come, I’ll be buying stocks. Historically, bear markets have been the best times to initiate or add to positions, as they allow you to buy stocks at lower prices than they were at before. Of course, you need to identify stocks that will actually recover after the bear market is over, rather than be destroyed by it. In this article, I’ll be reviewing three stocks that I will likely buy in the next bear market.

CN Railway

Canadian National Railway (TSX:CNR)(NYSE:CNI) is a stock I already own. I bought it in the last bear market in March 2020, after beginning to accumulate my position a few years prior. The 2020 bear market allowed me to get in at a lower price than I had been able to get previously, lowering my adjusted cost base.

CNR is exactly the type of stock that’s great to buy in a bear market. As economic conditions deteriorate, CN’s shipping volumes will inevitably decline, leading to lower revenue and earnings. That will send the stock price lower, but the rebound in the ensuing economic recovery will send it higher. We saw this play out in 2020, when CNR crashed to $95 but quickly soared as high as $150 when the post-COVID economic recovery became inevitable.

Shopify

Shopify (TSX:SHOP)(NYSE:SHOP) is a tech stock I don’t own but would buy at the right price. Shopify has excellent growth metrics for the past 12 months, with revenue up more than 90%. The only problem is that the stock has gotten very expensive. At today’s prices, SHOP trades at 114 times earnings and 51 times sales. These are pretty steep multiples, even for a growth stock. Now, Shopify isn’t just any growth stock. With a 110% revenue growth rate in its most recent quarter, it’s an ultra-growth stock. But that growth is likely to decelerate in the year ahead, so I’d wait for a lower price before buying it. A bear market, perhaps, could provide the opportunity.

Alibaba

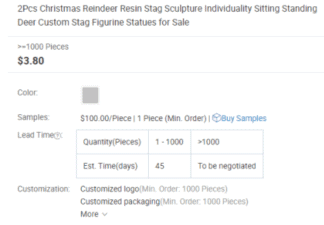

Moving to international stocks, we have Alibaba Group (NYSE:BABA). This is a stock I just started buying recently — the first non-North American stock in my portfolio. Alibaba is a giant in global e-commerce — a supplier of goods to vast numbers of goods to buyers worldwide. Unlike Amazon, which mainly specializes in small sales to individual consumers, Alibaba is more “wholesale.” Below is a sample order page I found by searching for “figurine” on Alibaba. As you can see, the page is encouraging buyers to order in bulk, with special customization options for those who buy 1,000 items or more.

As you can see, it’s possible to order an individual item, but the order page is incentivizing larger purchases, which is ideal for business customers. Through this business model, Alibaba has become the supplier of choice to “drop shipping” e-commerce businesses that resell Chinese goods in North America. It’s a lucrative niche that has paid off well for Alibaba, leading to 47% annualized revenue growth and 16% annualized EPS growth over the last five years.