Shares of cannabis producer HEXO (TSX:HEXO)(NYSE:HEXO) were down 27.80% at the close of trading on Friday after a brutal sell-off. Investors in HEXO stock learned of a sparsely detailed overnight equity offering through an after-hours announcement on Thursday. They subsequently reacted with shock when the grim transaction details emerged on Friday morning. There could be more to this story.

Why did HEXO stock fall 28% on Friday?

Less than an hour after Thursday’s market closing bells on the New York Stock Exchange and the TSX, emerging marijuana giant HEXO announced that it was issuing new shares. The new equity raise would be executed through an “…overnight marketed public offering” that was to be priced in the “…context of the market.”

Thursday’s news release didn’t disclose how many shares the company would sell in the overnight deal. Its existing shareholders could only speculate over how much dilution they would suffer overnight.

To add more context, the $452 million cannabis firm once filed a prospectus that allowed it to raise up to $1.2 billion from the markets over time, before amending it to limit the equity size to $700 million.

What if the company had decided to use all of its remaining equity raising capacity in one giant dilutive transaction?

An early market update on Friday provided the missing details.

The company’s Friday press release stated, “The underwriters for the offering have agreed to purchase 47,457,628 units at a price of US$2.95 per unit for total gross proceeds to the company of approximately US$140 million.”

The company ideally desired near-market pricing for its shares. However, the market demanded a significant 8% discount to Thursday’s closing price of US$3.20 per share. And the company still willingly accepted the terms.

Perhaps the company was under some liquidity pressure. It had to accept the lower valuation to get the money.

Was the company under pressure to raise money?

One question an observer could ask concerning the company’s overnight transaction is: Why the rush?

Honestly, it’s not unusual for a company to sell shares in an underwritten overnight deal. However, given the significant general decline in cannabis stocks since February this year, one would think it’s ideal to take one’s time to shop for the best price in this cooled-off market – unless one is pressed for time.

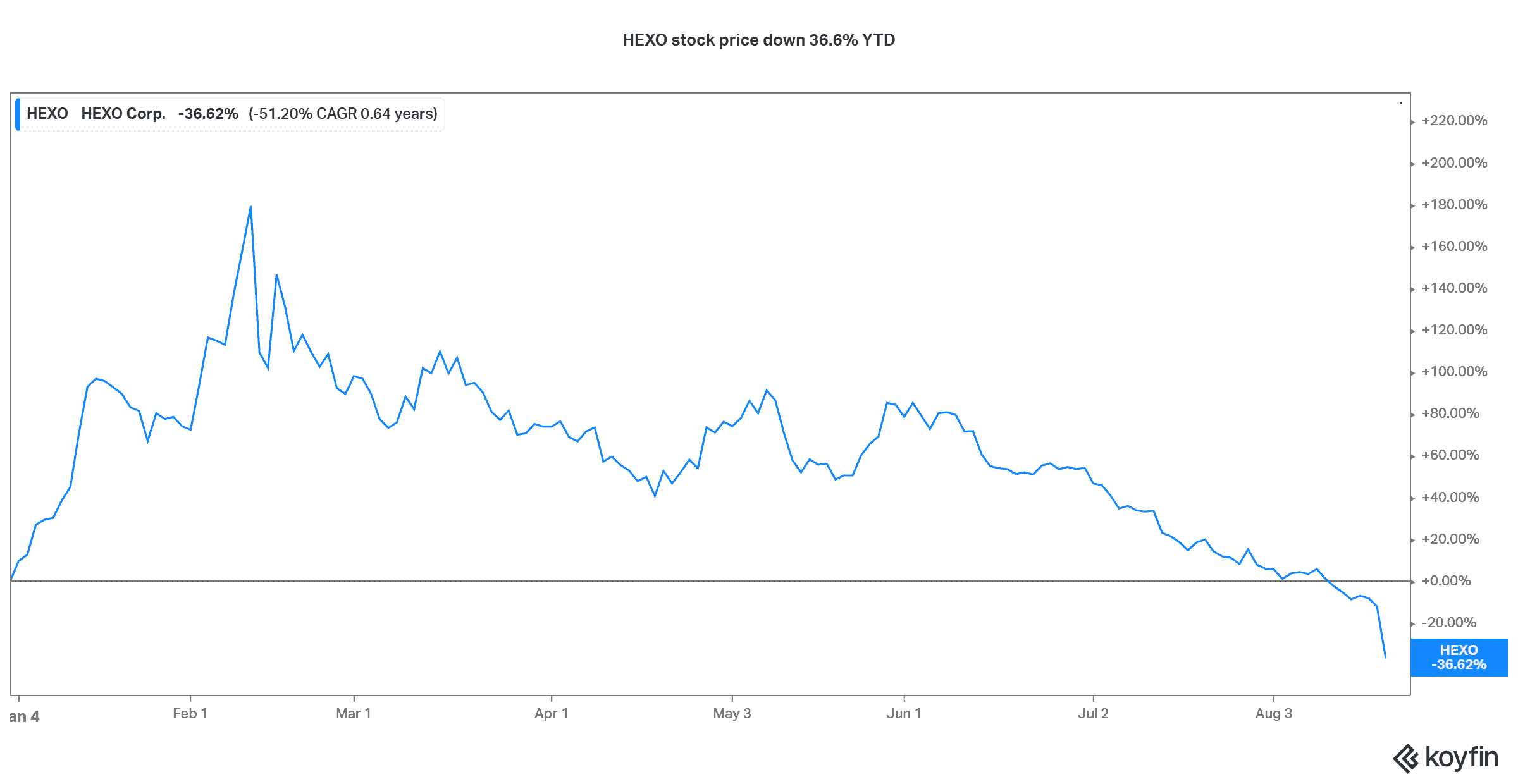

Hexo stock is down 36% year to date after falling 77% from February highs. Source:Koyfin

The cannabis producer didn’t have time and had limited bargaining power.

HEXO is about to acquire Redecan in a $925 million dollar transaction to become a market-leading cannabis firm in Canada. The acquirer (valued at $452 million today) will pay $400 million in cash consideration and settle the balance in shares.

However, the company had about US$229 million (C$287 million) in an escrow account by Thursday. It also reported $81 million in cash and cash equivalence on its balance sheet by April 30 this year. Clearly, the company needed to raise new financing to execute the proposed acquisition.

Redecan’s shareholders will vote on the acquisition deal on Wednesday, August 25. The transaction could close soon after the vote. It seems that the buyer had just a few days left to raise money.

If cash availability is a key consideration in Wednesday’s vote, the company had to show any undecided Redecan shareholders that it had all the money to pay them out once they approve the merger.

“The company expects to use the net proceeds from the offering to satisfy a portion of the cash component of the purchase price payable to the Redecan shareholders on the closing of the Redecan acquisition… The offer is expected to close on or about August 24, 2021…”

Just in time!

Foolish bottom line

HEXO’s latest stock offering may close just a day before its acquisition target’s key shareholder vote on a proposed merger. The acquisition could be concluded soon after Wednesday’s shareholder approval, yet the acquiring firm was a bit low on cash.

Being a little too low on cash can trigger sell-offs on any company’s shares — and more so if the company’s perceived “desperation” results in accepting an 8% discount to market prices on new stock sales. That said, a quick 28% decline was too harsh on the promising cannabis play. We could see some recovery this week.