Facedrive (TSXV:FD) is a stock that saw a lot of popularity earlier this year. In the midst of the electric vehicle stock boom, Facedrive and its unique, socially responsible ride-sharing business model caught the attention of a lot of investors.

This increase in popularity saw the stock get bid up to an insane valuation, despite having little sales and a business model that hardly diversified it from major its competitors of Uber and Lyft.

Because it was so overvalued and showed little reason for its massive valuation, I warned investors to avoid Facedrive stock.

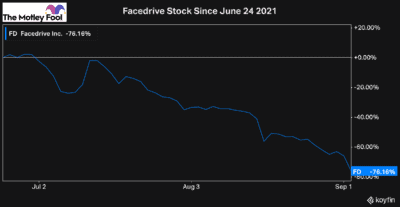

And what we’ve seen in the months since is more of the selloff, as Facedrive stock continues to be repriced by the market.

As you can see, Facedrive stock is down by more than 75% in that time. At the time of the article, Facedrive was already down 75% from its 52-week and an all-time high. Today, after another 75% drop, Facedrive trades nearly 95% off its high.

So, you may be wondering if it’s now worth a buy today.

Is Facedrive stock worth a buy below $4

It’s certainly gotten a lot cheaper, and revenues have been growing, albeit slowly. So, buying the stock today would obviously not be as unfavourable of an investment idea as it was when it was worth five times this price a few months ago.

However, it still looks overvalued. At a market cap of $325 million and sales of just $13 million, Facedrive stock has a price-to-sales ratio of 24 times. That’s compared to Uber and Lyft with price-to-sales ratios of 6.4 and 6.8 times, respectively.

Not to mention, at just $13 million in sales, Facedrive stock hardly has any market share in an industry where scale is crucial.

So, rather than buying Facedrive stock today, here are two top growth stocks to buy instead.

A top crypto stock with far more potential than Facedrive

In my opinion, one of the best stocks to buy today for growth investors is Galaxy Digital Holdings (TSX:GLXY). There are many possibilities when it comes to the cryptocurrency and blockchain industry, and Galaxy offers investors numerous ways to take advantage.

Its asset management, mining, trading and investment banking segments are all booming from the increase in popularity of cryptocurrencies and the consistent long-term rally we are seeing in the major coins.

Meanwhile, its principal investment segment offers exposure to tonnes of new, up-and-coming technologies.

Unlike Facedrive stock, Galaxy Digital is one of the leaders of its industry and offers some of the best diversification and growth potential of any stock today.

So, if you’re looking for a long-term investment that can grow considerably, Galaxy Digital is a much better choice in this environment.

A top healthcare tech stock

Another stock that’s become extremely popular among Canadian investors in the last few years is WELL Health Technologies (TSX:WELL).

However, unlike Facedrive stock, in my view, the popularity of WELL Health stock is warranted. It’s an incredible business that’s been growing rapidly by acquisition.

These acquisitions it’s making aren’t just any company either. WELL has been strategically investing in businesses that add a tonne of value and synergies to its business model. As recently as yesterday, it just announced another acquisition, this time of a Silicon Valley-based telehealth and e-pharmacy company.

Just like Galaxy Digital, WELL Health is a rapidly growing company that’s disrupting its industry.

So, rather than Facedrive, if you’re looking for a long-term growth stock, I’d strongly consider WELL Health. It has years of opportunity to expand its operations ahead of it.