Market pullbacks are events that we typically are worried about seeing. After years of solid growth, stocks begin to pull back and can erase a tonne of value in just weeks. However, as devastating as a market pullback can be, they can be great opportunities. It all depends on how you react to the situation.

The key, of course, when the market starts to sell off is not to panic and instead focus on the big picture and the long run. However, it also helps to know what to expect when the market is pulling back. Different stocks react differently to different market conditions.

So if you’re worried about a potential market pullback coming up, here’s what you can expect and how it may impact growth stocks.

These stocks are always the most volatile

The first and one of the most important things to know about growth stocks in a market pullback is that they are some of the most volatile investments on the market.

This makes sense for a couple of reasons. First, high-quality dividend stocks become more appealing in a market crash, so these stocks aren’t very volatile. Meanwhile, value stocks will sell off from a correction too, but because they are already cheap, there’s not much value left to lose.

So growth stocks will be more volatile than value or dividend stocks by default. However, that’s not the only reason they are so volatile.

Growth stocks lose much of their premium

Another major factor in the performance of a growth stock through market corrections is that these companies are usually trading with a significant growth premium ahead of time.

So as the market starts to sell off, the premium that these companies have eroded, and the metrics used to value them are reduced significantly, which could result in a major fall in prices.

Investors are no longer willing to pay a premium for two reasons. There is a lot more risk when the market is selling off and every other stock is becoming mighty cheap, so it makes no sense to pay a premium for growth.

It’s important to know how volatile growth stocks can be in a market correction because it can help you to avoid a major mistake. While you don’t want to sell high-quality growth stocks even if you’re worried about a sell-off, more speculative growth stocks should certainly be avoided.

One of the top growth stocks in Canada

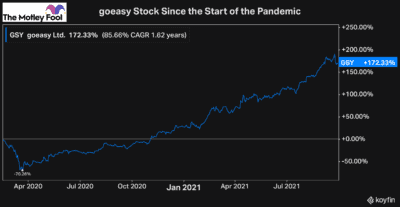

If you want to see a great example of a high-quality growth stock’s performance through a pullback, consider how goeasy (TSX:GSY) performed through the pandemic.

As you can see, the stock initially sold off by more than 70%, a significant amount. Part of this is due to the fact that it’s an incredible growth stock that traded with a major premium. However, it was also because goeasy is a financial stock and many investors thought its business could be at risk of major losses.

Nevertheless, for those investors who held, bought more, or even initiated a position, the payoff has been incredible. Not only is the stock up 172% from where it was before it sold off, but it’s gained a whopping 815% from the bottom on March 23, 2020.

This goes to show the major opportunity investors have when the market is correcting, especially to buy growth stocks. But, conversely, it also shows how much these stocks can fall when fear is taking over.

So if you want to make sure you’re positioned as optimally as possible for long-term growth, I’d ensure you don’t have any super high-risk, highly speculative stocks in your portfolio, especially today, when the market environment has so much uncertainty.

And more importantly, the next time the stock market does sell off, I’d make sure to be ready with cash and take full advantage.