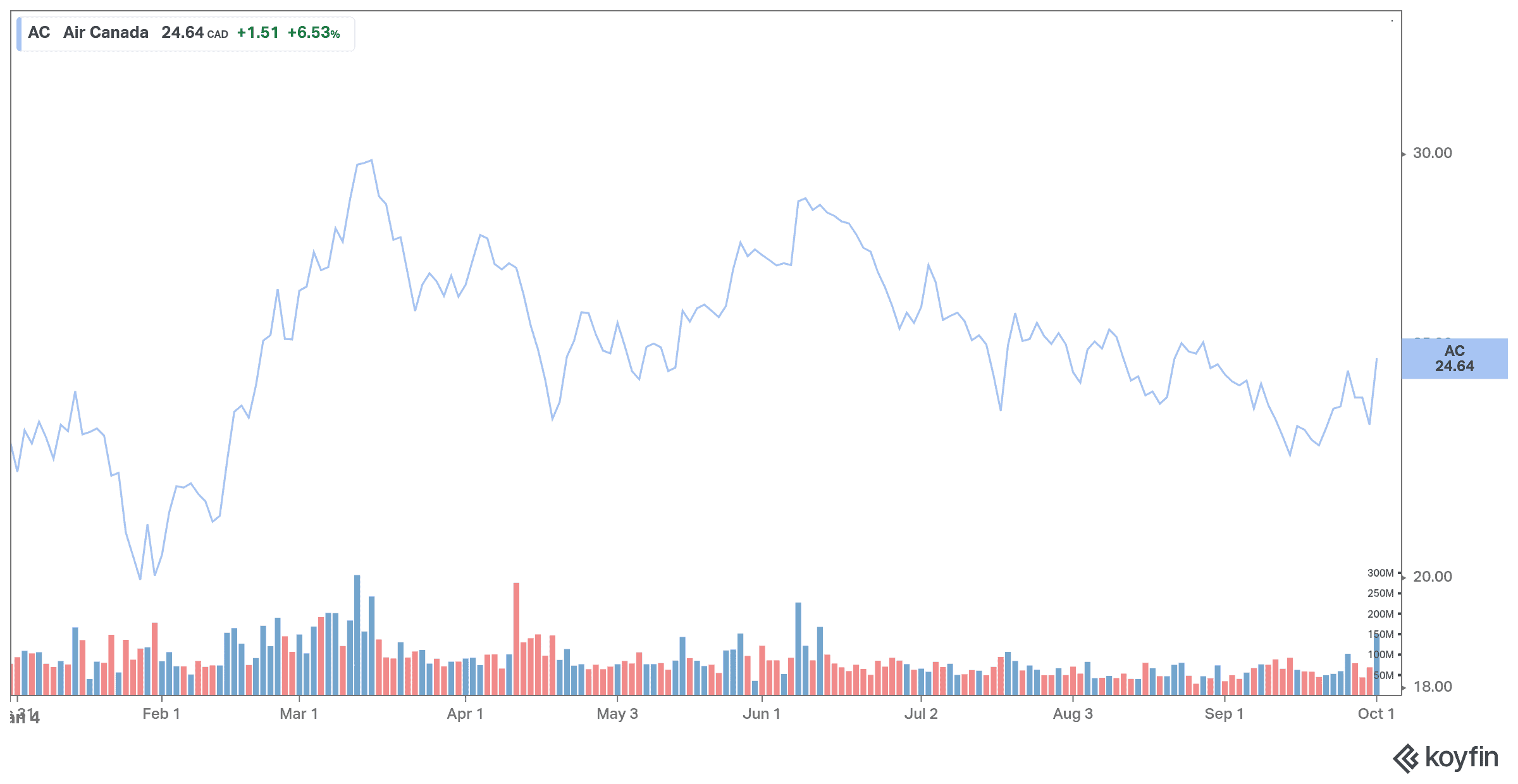

Things are improving for Air Canada, and it shows in its stock price. Indeed, the stock rallied nearly 4% last week. Let’s look at what may have driven this rally in Air Canada stock.

Air Canada resumed flights between India and Vancouver and Toronto

Good news was announced Monday, which likely helped to boost Air Canada’s share price. Indeed, the airline announced Monday the reinstatement of non-stop flights to and from Delhi, India, after a break of more than five months. The Government of Canada recently lifted restrictions on air travel to India, which were in place due to the COVID-19 pandemic. The carrier’s first flights from Delhi to Toronto and Vancouver arrived Monday. Air Canada is the main carrier connecting India and Canada.

“People are eager to reunite with family and friends and we are very pleased to resume service immediately from India to our Toronto and Vancouver hubs following the lifting of restrictions by the Government of Canada. We continue to be focused on the growing visiting friends and relatives market, and together with the long-standing cultural and business ties between Canada and India which are expected to grow over the coming years, Air Canada remains strongly committed to this important Asia-Pacific market,” said Mark Galardo, senior vice president, Network Planning and Revenue Management at Air Canada.

Partnership with federal tourism agency to lure U.S. frequent flyers

Also on Monday, Air Canada announced a partnership with a federal tourism agency to attract frequent U.S. travelers.

A Canadian official said Canada is trying to use the allure of travel benefits to convince America’s frequent flyer elite to fly north with Air Canada, as the country ramps up efforts to revive crucial traffic from the United States.

To help reverse the drop in traffic, the government tourism organization Destination Canada launched its first campaign targeting frequent American travelers on Monday, in partnership with the country’s largest carrier.

According to the plan, up to 20,000 American frequent flyers with carriers like American Airlines, Southwest Airlines, and Delta Air Lines could achieve the corresponding status when they fly with Air Canada north of the border.

Frequent flyer status provides travelers with benefits such as priority boarding that would normally cost a premium fare or fee.

The carrier resumed service to Antigua and Barbuda

On Friday, Air Canada announced the resumption of its flights on Sunday, October 3, to and from Toronto to St. John’s, Antigua, and Barbuda.

Antigua and Barbuda will see an increase in air travel for the winter season, as demand for the destination increases among travelers looking to escape the cold.

Nino Montagnese, vice president, Air Canada Vacations, further added, “Canadians are anxious to travel to the beautiful locations they’ve been dreaming of, and we’re ready to respond to their needs. Our packaged holidays from Toronto to Antigua, available as of October 3rd, give them the opportunity to experience a stunning corner of the Caribbean and create new memories under the sun.”

Flights resumption means more passengers on board, which, in turn, means more revenue for the carrier. Travel demand could increase faster than expected, as fears about new COVID variants continue to subside amid vaccination rates rise. A faster-than-expected recovery could drive a positive trend in the company’s financials in the coming quarters. Air Canada has already started to prepare for an expected increase in demand over the coming holiday season.

During the pandemic, the Canadian airline tried to cut unnecessary costs and strengthen its freight business, which could have a positive impact on its long-term profitability.

Shares of Air Canada are up 60% over one year, but they are still down nearly 50% from its pre-pandemic levels. This is an undervalued stock worth considering as it recovers.