The S&P 500 is a famous stock market index that tracks the largest 500 companies listed on U.S. exchanges. It is widely seen as a barometer for overall U.S. stock market performance.

The S&P 500 is composed of U.S. blue-chip companies like Microsoft, Apple, Alphabet, JPMorgan, and Amazon, and spans the technology, health care, financials, communications, consumer staples, consumer discretionary, industrial, and energy sectors.

The S&P 500 has delivered a solid 8% annualized return since 1957. This return is so difficult to consistently beat over time that it is widely accepted as a benchmark for fund managers to compete against.

Thanks to the proliferation of exchange-traded funds (ETFs), Canadian investors have easy means of gaining exposure to the S&P 500. Today I’ll be reviewing three different ETFs that track it, each with their own pros and cons.

Vanguard S&P 500 Index ETF (Canada & U.S. Versions)

Vanguard S&P 500 Index ETF (TSX:VFV) is the top Canadian ETF for tracking the S&P 500 index, with $6.5 billion in assets under management (AUM) and a high volume traded daily. The fund costs a management expense ratio (MER) of 0.08% to hold, plus an additional 0.15% in foreign withholding taxes on the dividends.

Being a Canadian-domiciled U.S. ETF, VFV is not currency hedged, meaning that its value can and will fluctuate based on the CAD-USD exchange rate. Generally, if the U.S. dollar appreciates, then the fund will gain additional value. Conversely, if the Canadian dollar appreciates, the ETF will lose additional value.

The U.S.-domiciled cousin of VFV is Vanguard S&P 500 Index ETF (NYSE:VOO). VOO has the exact same underlying holdings as VFV – in fact, VFV actually holds VOO in a wrapper structure. The only difference is VOO trades in USD, whereas VFV trades in CAD.

If you are able to convert CAD to USD cheaply using Norbert’s Gambit, and are holding in an RRSP to avoid foreign witholding tax, VOO would be the best pick. With a MER of 0.03%, VOO is as cheap as ETFs get, costing you just $3 per year in fees on a $10,000 portfolio.

Horizons S&P 500 Index ETF

Horizons S&P 500 Index ETF (TSX:HXS) is a bit different. While traditional ETFs hold a basket of underlying stocks, HXS doesn’t. Rather, HXS uses a derivative called a total return swap (TRS) to replicate the performance of the S&P 500.

Essentially, Horizons enters into a swap agreement with a counterparty. When you buy HXS, your investment is held as cash collateral. The counterparty is obligated to pay Horizons the total return of the index (capital gains + dividends).

For example, if the stocks in HXS increase by 8% and pay a 2% dividend, the counterparty will pay 10% to Horizons (minus fees), and HXS will increase in price by 10% (again, minus the fee).

The total return swap structure of HXS means that no dividends are paid out. Essentially, they are “reinvested” automatically into the fund (hence the term “total return”). For investors, this means you can avoid paying dividend tax in a taxable account, only paying capital gains tax when you sell.

Moreover, because the counterparty is obligated to deliver the total return of HXS, it minimizes turnover and the trading costs that come with traditional ETFs. This means less tracking error compared to the S&P 500 index, allowing you to follow the index closely.

The downsides? Mostly in the form of counterparty risk and higher fees. For the former, there is the remote possibility that the counterparty will fail to pay a return equal to that of the index when owing. For the latter, HXS has a higher MER of 0.10% and swap fee of 0.30% compared to VFV and VOO.

The Foolish takeaway

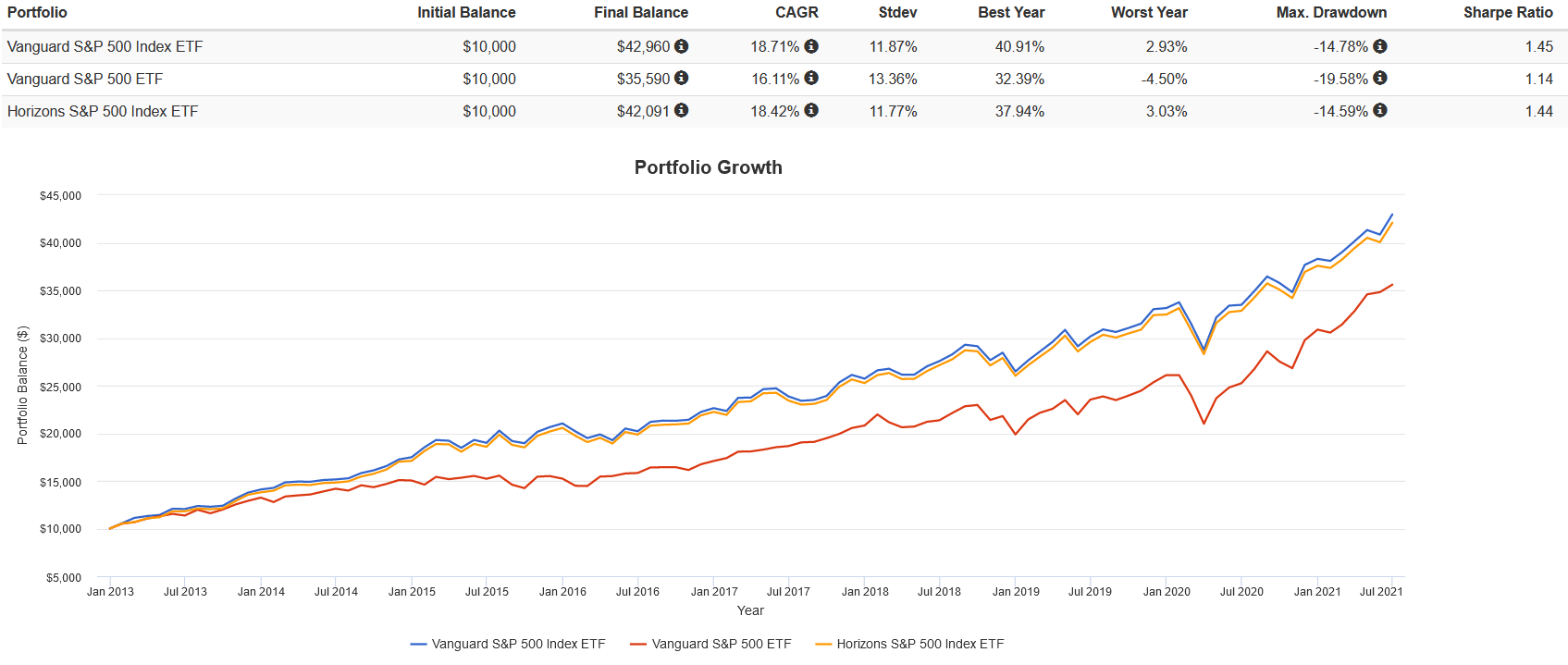

In terms of performance, all three ETFs are very similar. VFV and HXS might look like they’ve outperformed, but if you convert VOO’s performance to CAD (on the chart it is in USD), the ETFs are neck-and-neck:

My choice here boils down to tax efficient asset allocation. This means HXS for the taxable account, VFV for the TFSA, and VOO for the RRSP. Regardless, you can’t go wrong with the S&P 500 index, no matter which ETF you pick.