If you just started investing, you may wonder which stocks you should buy to build your investment portfolio. Stocks in the consumer sector are a good choice. Dollarama (TSX:DOL) and Loblaw (TSX:L) are particularly interesting, as they tend to perform well in any kind of environment. Let’s look at those two stocks in more detail.

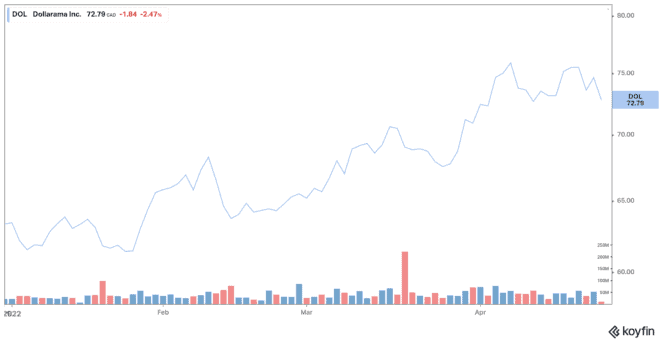

Dollarama

Dollar stores and convenience stores stocks can offer stability and decent returns during an economic downturn, as consumers are looking to spend less. Dollarama is a well-known brand to many Canadian consumers and is attractive due to its low prices on everyday items.

The dollar-store chain reported a great performance in its latest quarter. Indeed, Dollarama posted better-than-expected earnings, as the retailer increased sales by 11%.

The company posted net income of $219.9 million during the quarter that ended January 30 compared to $173.9 million in the corresponding quarter of the previous year.

Total revenues were up 11% to $1.22 billion. Comparable sales, for their part, increased by 5.7%.

Adjusted net earnings per share rose 32.1% to $0.74. Analysts had expected adjusted earnings per share of $0.71, according to data from financial firm Refinitiv.

The Montreal retailer announced on Wednesday during the unveiling of its most recent quarterly results that Dollarama will gradually start selling items at a fixed price of $5.

Dollarama said that rolling out additional pricing points of up to $5 will help the retail chain offset inflation as well as maintain and improve its product assortment and value.

The retailer expects same-store sales (which exclude stores open fewer than 12 months) to increase by 4-5% for 2022.

Dollarama increased its quarterly dividend by 10% to $0.0553 per share from $0.503 per share. The dividend yield is currently 0.3%.

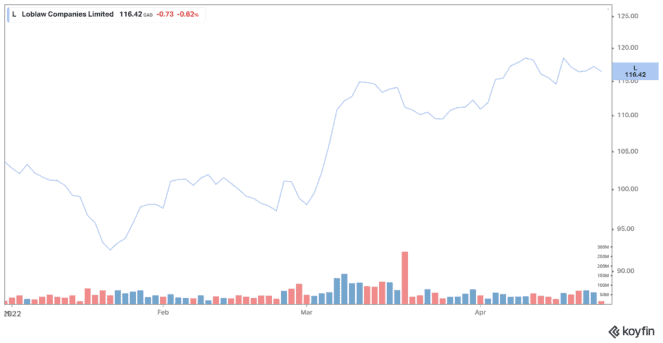

Loblaw

Food retailers are safe stocks to keep in your portfolio. Indeed, they tend to outperform in a weak market as sales increase in panic buying. Loblaw can act as a hedge against any major crisis, making it a buy for every portfolio.

Loblaw is Canada’s largest grocer, with a wide array of brands. The grocer bought Shoppers Drug Mart, has the No Frills discount option, and now even has Esso involved in his PC Optimum brand. So, Loblaw is growing, even during the pandemic.

Loblaw said its fourth-quarter earnings benefited from strong demand as consumers continued to eat at home, particularly during the holiday season.

The company said its fourth-quarter profit more than doubled from a year ago, boosted by a one-time gain related to a Supreme Court ruling on a tax case.

Net income available to common shareholders was $744 million, or $2.20 per diluted share, for the 12 weeks ended January 1. The result compares to earnings of $345 million, or $0.98 per diluted share, for the 13-week period ended January 2, 2021.

It should also be noted that Loblaw pays a quarterly dividend to investors. The dividend yield of 1.32% is not high, but it is stable. Loblaw has a history of dividend increases and is well positioned to keep increasing its dividend in the future.