TSX energy stocks are becoming dividend income powerhouses. There are several reasons for this. Firstly, oil is trading consistently over US$100 per barrel. Oil supply is not keeping up with rising post-pandemic demand. Consequently, US$100 per barrel oil could be a norm for longer than many expect.

Secondly, TSX energy stocks have become lean production machines. In March 2020, oil temporarily traded at a negative price. During this time, Canadian oil companies had to massively reduce costs and streamline operations. Debt reduction became a major priority.

Why are TSX energy stocks so profitable today?

Consequently, many TSX energy stocks today can now sustain their operations and pay dividends for US$40 per barrel or less. The current combination of high energy prices and lean operating strategies is translating into a huge excess cash flow generation.

Canadian energy stocks are generating more cash than they ever have before. Rather than invest in new energy production, they are rewarding shareholders with substantial share buybacks and dividend increases.

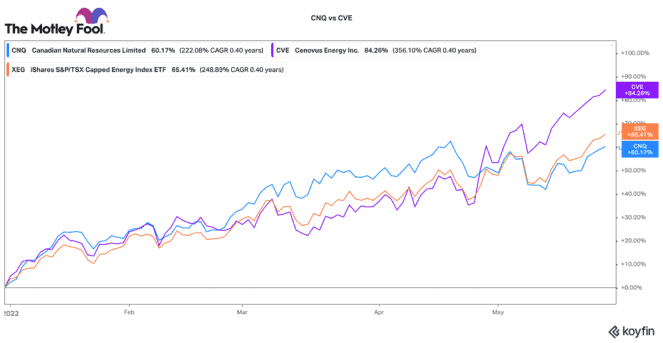

Two TSX energy stocks that have substantially rewarded shareholders in the past few years are Canadian Natural Resources (TSX:CNQ)(NYSE:CNQ) and Cenovus Energy (TSX:CVE)(NYSE:CVE). One is the incumbent energy patch leader, and another is an up and comer with big potential. I’ll explain the benefits of buying one versus the other.

CNQ: The top TSX energy stock for income

Canadian Natural Resources is in many regards considered the Canadian energy king. For years and years, it has been one of the best-managed energy companies in Canada. Over the past 20 years, it has delivered an impressive 1,400% return. Over 15% of that total return came from dividends!

CNQ has grown its dividend by a compounded annual growth rate of 15.3% over the past 10 years. In March, it just increased its quarterly dividend again by 28%!

Even in 2020, it still maintained its dividend through the oil crash. CNQ has incredibly stable and profitable operations. It has over 30 years of oil reserves, and it can produce oil/gas with low-cost, factory-like efficiency.

The market has rewarded CNQ for its quality. Its stock is up 103% over the past year. Certainly, this is not the cheapest energy stock. However, for a nice 3.6% dividend yield (that is likely to keep growing) and some modest upside, this is a great TSX energy stock to buy and tuck away for the next few years.

Cenovus: A strong outlook for total returns

If you are looking for a TSX energy stock with significant income and capital upside, then Cenovus Energy looks very promising. It is among the largest integrated energy producers in Canada.

Cenovus acquired Husky Energy last year. It took on a lot of debt to fund the purchase. At the time, the market did not like the deal. However, so far it has executed very well. With oil prices elevated, it has been using excess cash to quickly improve its balance sheet.

It just reached its $9 billion net debt target. Cenovus now plans to return 50% of any excess cash flow back to shareholders. Last quarter, it increased its annual dividend by 300% to $0.42 per share!

Its next target is to hit $4 billion of net debt. After, it plans to return 100% of excess cash flow back to shareholders. That could spell significant dividend increases, special dividends, and share buybacks.

CNQ or Cenovus?

Today, Cenovus stock only has a 1.5% dividend yield (even after its huge increase). It is smaller and somewhat riskier than CNQ. However, given that it is a cheaper TSX energy stock, it also has a lot more torque to the upside. For safe, reliable income, I’d go with CNQ. For fast-growing income and higher total returns, I’d place my bet with Cenovus.