As many investors know, given that the market has been selling off consistently all year, there are plenty of quality stocks to buy today. Several of the best companies in Canada with significant long-term growth potential, such as WELL Health Technologies (TSX:WELL), are some of the best growth stocks you can buy, especially as they fall in price.

WELL isn’t the only stock to consider. There are tonnes of other options for investors. However, the healthcare tech stock is certainly among the top candidates, especially if you’re looking for a growth stock with years of opportunity to expand its operations.

If you’ve been considering WELL Health as it falls in price, or you’re just looking for one of the best growth stocks to buy now, here’s why WELL should be near the top of your buy list.

Healthcare is a defensive industry

As its name suggests, WELL Health Technologies is a tech stock. And as we’ve seen all year, tech stocks have been some of the hardest-hit stocks due to their sky-high valuations before the selloff and the fact that these stocks typically come with more risk.

With that being said, though, WELL’s entire business model is about supporting the healthcare industry. And healthcare is one of the most defensive industries.

So, the fact that WELL is a tech stock allows investors to buy it cheaply. However, because it operates in a defensive industry, it has the potential to continue growing its business even if the economy’s growth might be slowing down. And so far, that’s exactly what we’ve been seeing, showing that WELL Health is one of the best growth stocks to buy at this price.

WELL Health continues to fire on all cylinders

Last week, WELL provided another business update, and, as usual, the company continues to post impressive growth.

WELL reported a 40% year-over-year increase in omnichannel patient visits. It also continued to show strong and profitable growth in two of its largest subsidiary businesses, Circle Medical and WISP, with preliminary May results indicating a combined annual run rate of more than $110 million, which would be more than 150% growth year over year.

Another one of its most recent acquisitions, CognisantMD, is supporting roughly 45,000 monthly patient referrals and consults, which is already up roughly 30% from when it was acquired in December 2021.

Most importantly, though, WELL maintained its guidance for 2022. That means the company is still expecting to earn around $525 million in revenue and roughly $100 million in adjusted EBITDA. If you’re looking for high-quality and reliable growth stocks that continue to perform effectively, WELL is one of the best to buy now.

WELL Health stock is one of the best stocks to buy while it’s ultra cheap

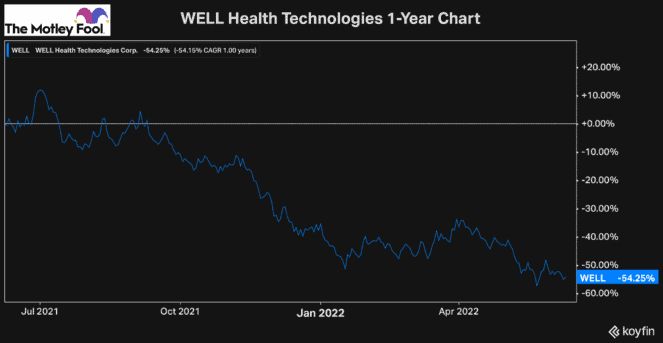

WELL Health stock has been cheap for some time. However, recently, its continued selloff has made the stock extremely cheap.

With WELL stock trading at roughly $3.60 a share, the healthcare tech stock has a forward enterprise value (EV) to sales ratio of just 2.3 times. Even its EV-to-EBITDA ratio of just 12 times is cheap for a rapidly growing tech stock, which is expected to grow its EBITDA at a 15% compounded annual growth rate over the next two years.

Therefore, while this high-potential tech stock is trading well undervalued, it’s easily one of the best growth stocks you can buy now.