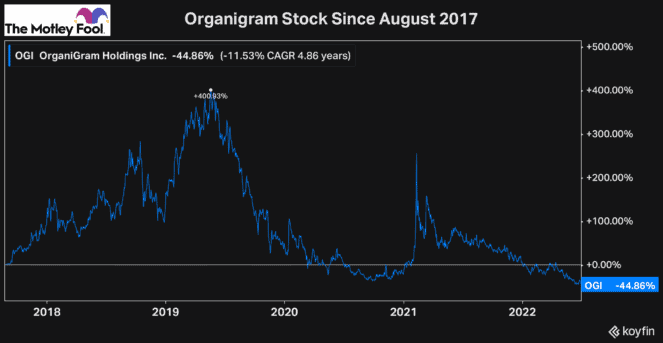

For years, pot stocks were some of the best and most popular growth stocks that investors could buy. Leading up to legalization, cannabis stocks saw insane growth in their share prices. And while it wasn’t the top performer, even a company like Organigram (TSX:OGI)(NASDAQ:OGI) and its stock price grew by over 400% from August 2017 to May 2019.

But as I and many of my fellow Fools warned investors at the time, the cannabis sector would likely take years to reach profitability and was almost sure to have several significant growing pains.

Although many stocks rallied rapidly, it was clear that the growth the industry would achieve would take a lot longer than many expected. So, after pot stocks reached hefty valuations and the growth in sales failed to keep up, these stocks have been selling off consistently for years now.

The first selloff came soon after legalization, which can be attributed to the speculative buying leading up to that point and the massive valuations many pot stocks, including Organigram stock, had.

However, the selloff has continued in recent years, as sales growth has slowed for many of these companies, and consistent profitability is still a ways off for many in the industry.

And now, with highly uncertain and risk-averse market conditions, it’s no surprise that these long-term, higher-growth stocks continue to lose value.

But while the industry has faced numerous headwinds and growing pains in recent years, it can’t sell off forever. At some point, after selling off for so many years, these stocks will begin to offer value.

Are cannabis stocks worth a buy today?

Nearly four years after cannabis was legalized in Canada, many of the largest and best-known stocks continue to struggle to break even. Most are still growing revenue. However, with significant competition, both from other companies and the black market, the industry continues to face significant headwinds.

One of the reasons Organigram is so attractive is that it’s cheaper than many of its competitors, has been growing well, and is much closer than many of its competitors to reaching profitability.

Organigram has long been a stock that was focused on the long haul and ensuring its operations and economics were as efficient as possible.

So, after the massive years-long selloff in cannabis stocks, there’s no question that if you’re looking to buy now, Organigram continues to offer some of the best value.

As pot stocks have sold off, Organigram has lost a tonne of value. In just the last 15 months, the stock has lost nearly 80% of its value. Today its market cap is just $370 million. And with a net cash position, its enterprise value (EV) is even less at just $230 million.

But to get a true understanding of how cheap Organigram is, let’s look at its valuation metrics and compare them to its competitors.

How cheap is Organigram stock?

Right now, with Organigram trading ultra-cheap and with its economics improving, especially as it gains scale, the stock trades at a forward EV-to-EBITDA ratio of just 14.9 times. That’s not ultra-cheap. However, it is attractive for a long-term growth industry like cannabis.

What’s really impressive about that number, though, is that most of the stock’s competitors aren’t even expected to earn positive EBITDA next year, which means Organigram is one of the few stocks that has a meaningful forward EV-to-EBITDA ratio to help value the stock.

Because the majority of the industry is still unprofitable, the forward EV-to-sales ratio is a better measure to compare valuations amongst each other. And with Organigram stock trading at a forward EV-to-sales ratio of just 1.5 times, it’s much cheaper than almost every competitor in its industry, with some stocks like Canopy Growth trading at more than 3.3 times sales.

So, not only does Organigram’s operations and economics look more impressive, but its valuation is also a lot more compelling than its competitors.

And when you consider Organigram stock hasn’t been this cheap since September 2017, more than a year before cannabis was legalized, it’s clear that if you have the patience to wait, Organigram stock is one of the best cannabis companies to buy in this environment while it’s ultra-cheap.