If you are tired of worrying about the volatility of TSX stocks, perhaps you need to just extend your time horizon. Speculating means you buy stocks with the hope that you can time the market and sell at a higher price. Investing means you buy stocks to own a stake in a business that grows earnings and creates value over time.

Sometimes, that process can take years and years. However, if you are patient, a great business can turn years and years into a fortune. If you have the time horizon to invest in great businesses, here are three TSX stocks that I would be happy to own for the next three decades.

BAM: A top TSX financial stock

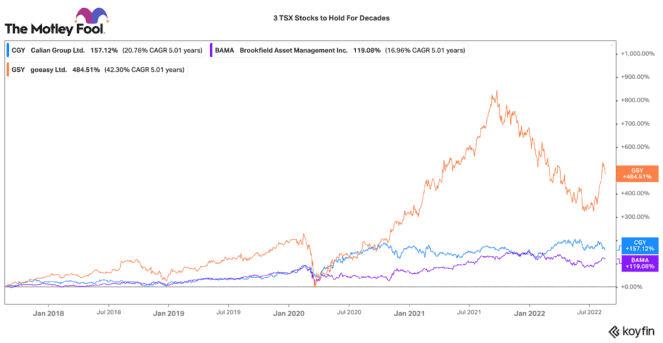

Brookfield Asset Management (TSX:BAM.A)(NYSE:BAM) is one of the largest alternative asset managers in the world. In the past 20 years, it has earned shareholders a +1,200% total return. However, that return doesn’t factor the several companies it has spun off over the years (several have provided significant returns as well).

Right now, Brookfield has $750 billion of assets under management. However, it is well on its way to hitting $1 trillion. While the company has a focus on real assets like real estate, infrastructure, renewable power, and private equity, it is expanding platforms in insurance, green investing, and even technology.

Given this TSX stock has excess capital to invest, an economic recession could be an ideal opportunity to swipe up more assets at cheap valuations. This counter-cyclical approach has provided strong approximate 14% compounded annual earnings growth over the past decade. With smart managers, high-quality assets, and a great balance sheet, it should continue this strong momentum for years and even decades ahead.

CGY: An up-and-coming growth stock

Calian Group (TSX:CGY) is a company that might be in the early stages of long-term growth story. Over the past three years, it has grown adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) by around 20% annually. That is an acceleration from a high-single-digit growth profile previously.

Calian is a conglomerate of businesses operating in healthcare, training, advanced technologies, and cybersecurity. It has been a major services provider for the Canadian military for years. However, it has now significantly expanded its customer base by service and geography.

Calian has been pushing strong single-digit organic growth, but smart acquisitions have also propelled new opportunities. The company targets $1 billion of revenue in the next few years, and that could be a great catalyst for getting more stock market attention on the TSX.

GSY: A top TSX growth stock at a cheap valuation

Speaking about growth stories, there are not many better TSX growth stocks than goeasy (TSX:GSY). While this stock is not well known, it has delivered an incredible 2,280% total return over the past decade.

goeasy provides alternative lending and home-product leasing services to Canadians. These customers are often overlooked by the large Canadian banks. While it is a riskier demographic, goeasy has very smart underwriting models that help maintain a market-leading return on equity.

This TSX stock has many years of growth ahead. It is expanding services into payments, recreational vehicle loans, car loans, and buy-now-pay-later. After a large pullback in 2022, this TSX stock trades with a 2.7% dividend and a low 10 times forward price-to-earnings ratio. For a long-term buy-and-hold strategy, now may be a great time to buy goeasy.