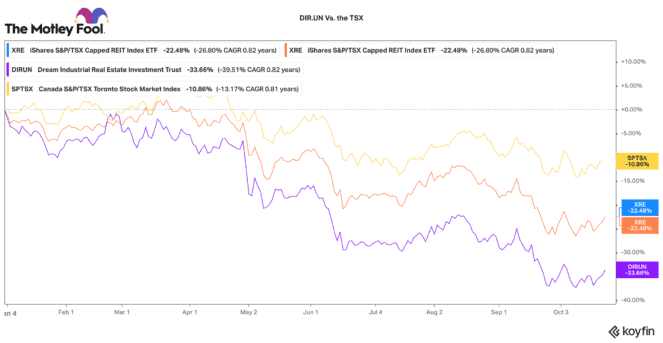

It has been a challenging time for several dividend stocks in 2022. No sector has been hit worse than real estate investment trust (REIT) stocks. The S&P/TSX Capped REIT Index is down 22.5% versus the broader S&P/TSX Composite Index, which is only down 10.8%.

Dream Industrial REIT is one of the worst-performing dividend stocks in 2022

One of the worst-performing real estate stocks this year has been Dream Industrial REIT (TSX:DIR.UN). It is down 33% since the start of 2022. Today, it trades with a huge 6.5% dividend yield. Its dividend yield has not been this high since 2018 (other than the March 2020 crash).

While it is never easy buying a dividend stock that has fallen by a considerable amount, Dream Industrial is presenting some very attractive value today. Below, I’ll discuss why the stock is down, and why it could have significant upside in the coming years.

A pivot to Europe has been a short-term headwind

In 2019, Dream Industrial made a strategic pivot to aggressively expand its industrial property portfolio into Europe. This European pivot has been very successful. The REIT purchased very attractive, well-located assets that have enjoyed high occupancy and solid rental rate growth.

Likewise, it gave the REIT access to very cheap, Euro-denominated financing, which enabled it to significantly de-lever its balance sheet and lower its overall interest rate cost.

Since this pivot, funds from operation (FFO) per unit (a key cash flow and profitability metric for REITs) rose by a compound annual rate of 11%! Net asset value (NAV) has grown from $11.76 in 2019 to $16.64 this year (a 41% increase). Its ratio of net debt-to-assets has declined from 52% to about 30%, meaningfully de-risking its balance sheet.

Great assets are being marked down to zero

The problem is that in the current market, everyone is worried about Europe and rising interest rates. The Ukraine war has elevated geopolitical and economic risks. Most investment managers have simply chosen to abandon any exposure to the region. Likewise, rising interest rates naturally push the valuations of debt heavy real estate assets down.

Consequently, Dream Industrial’s European property assets (which, make up 38% of its portfolio) have essentially been marked down to zero (or nearly worthless). Dream’s stock is back to the price it was before the European expansion strategy started in 2019. That is despite these assets having average lease terms of 5.7 years, high 99% occupancy, and inflation-indexed leases.

This REIT is still growing

Overall, Dream has a very well-positioned property portfolio. Its properties are centrally located, with a diverse mix of high-grade logistics, consumer staple, and light industrial tenants. The REIT is likely to continue enjoying double-digit rental rate growth and high-single-digit FFO/unit growth for the coming few years.

Today, this dividend stock is one of the cheapest industrial REITs in North America. It trades for 12 times FFO and a 35% discount to its NAV. It is difficult to say when sentiment will shift, but a conclusion to the hostilities in Ukraine would be a key catalyst for this stock.

A big 6.5% dividend and as much as 60% upside in the near term

If the world was to return to some form of normalcy, Dream could easily trade closer to its NAV at $16.60 per share. That could give the stock over 60% upside from today’s price.

From there, if you just collect the current 6.5% dividend yield for the coming five years, your money would have nearly doubled. That is factoring in zero growth, despite the fact that this REIT has a robust development pipeline and strong expected organic growth.

After a 33% decline a massive amount of risk has been taken out of this stock, leaving significant room for upside from dividends and capital appreciation in the coming years.