Now is a great time to be a buyer of TSX dividend stocks. Many top dividend stocks have drastically fallen in the past few months. Several are trading at multi-year low valuations. This also means you get to pick up dividend stocks with higher-than-average yields.

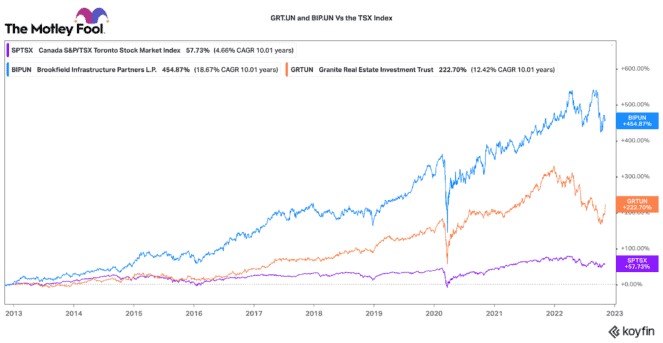

Over the past decade, the TSX Index has delivered an average annual return of only 4.66%. Many top dividend stocks are yielding dividends near or above that rate today. Contrarian investors are primed to beat the index by simply buying high-quality dividend stocks on the recent correction. Here are two high performers on my radar right now.

A top TSX infrastructure stock for dividend growth

Brookfield Infrastructure Partners (TSX:BIP.UN) has delivered a total return that is over three times larger than TSX Index over the past 10 years. Since 2012, shareholders have earned a 14.77% average return, or 297% in total, from this dividend stock.

Brookfield operates an array of high-quality assets, including ports, railroads, utilities, pipelines, midstream operations, data centres, and cell towers. In its recent third-quarter (Q3) results, Brookfield grew funds from operation (FFO) (a key profitability metric for real assets) 25% to $525 million. On a per-unit basis, FFO increased 15%.

Brookfield is very well capitalized. It could profit from a tough economic environment by buying up distressed or marked-down assets. Today, this TSX stock pays a 4% dividend, and it just increased its dividend by 6% this quarter.

Today, this dividend stock trades for only 12 times FFO. That is the cheapest it has been since 2019 (other than the March 2020 crash). When the market recovers, investors should be primed for attractive upside and market-beating returns. In the meantime, they can own this defensive business that pays an attractive, growing dividend.

A top real estate stock

Granite Real Estate Investment Trust (TSX:GRT.UN) is another quality dividend stock that has returned market-beating returns. Over the past decade, investors have earned a 10% average annual return. While not as impressive as Brookfield Infrastructure, it does beat the TSX Index by nearly two times.

Granite owns a large portfolio of industrial, warehousing, and logistics properties in Canada, the United States, and Europe. Despite the market hitting real estate stocks hard in 2022, Granite has performed very well operationally and financially.

While it has yet to announce Q3 results, it had a very strong second quarter. FFO increased 16% to $72 million. FFO increased 10% on a per-unit basis. Industrial fundamentals in its core markets have been remarkably strong and that has supported very high rental rate growth this year. Granite currently has a robust development pipeline, which should help to further bolster FFO growth this year and into 2023.

Granite stock is down 32% in 2022, and it trades at a huge discount to its intrinsic value. The recent buy-out of Summit Industrial REIT indicates just how cheap Granite is.

At 15.9 times FFO, Granite stock has not been this cheap since 2018. Today, investors can lock in a 4.3% dividend that pays out distributions monthly. If investors take a long-term approach to this stock, they are likely to enjoy a strong combination of high dividends and market-beating total returns.