Inflation can be scary to grapple with. Defined as an increase in the price of a common basket of goods and services, inflation erodes the buying power of your dollars. The thought of your hard-earned money being worth less year after year is difficult for most investors to swallow, especially if it occurs behind the scenes.

Still, investing during periods of high inflation isn’t all doom and gloom. The economy moves through cycles, and periods of high inflation are usually followed by periods of low inflation, or even deflation. Even the double-digit inflation seen in the late 1970s eventually subsided.

That being said, what can investors to do protect themselves from inflation? Buy commodities? Gold? Crypto? I think the simplest solution is buying a broadly diversified portfolio of stocks using a low-cost index exchange-traded fund, or ETF and holding for the long-term. Here’s why.

Historical performance of assets

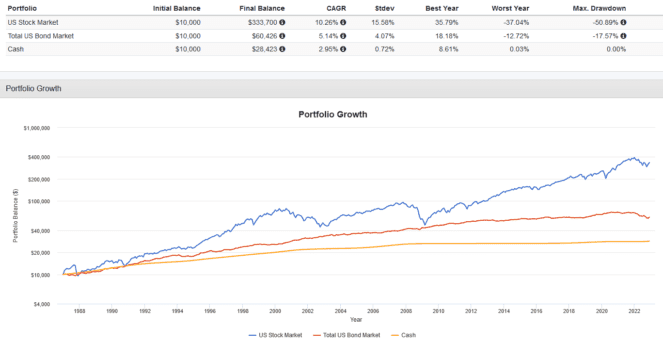

Let’s take a look at how three broad asset classes performed from 1987 to present. They are U.S. stocks, U.S. bonds, and cash.

We see that U.S. stocks had the overall best returns, but also incurred the highest risk in terms of volatility (standard deviation) and peak-to-trough losses (max drawdowns). This make sense – by investing in riskier assets like stocks, we generally get compensated with better long-term returns (the equity risk premium).

As you move into lower-risk assets, your returns are lower. With bonds, we still earn a decent, albeit smaller return from the credit and interest rate risk premiums. Finally, the returns for risk-free assets like cash are extremely low; hence, the term “risk-free rate”.

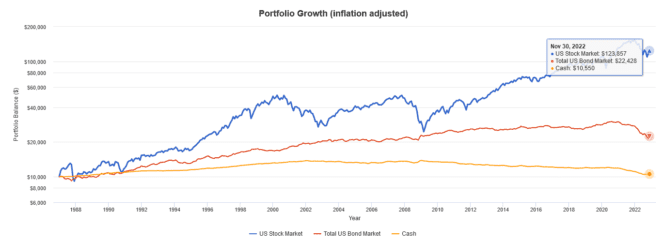

However, these returns are not adjusted for inflation. Throughout this time, inflation has also been steadily creeping up. Therefore, we need to adjust these returns for its effects.

After adjusting for inflation, cash only returned an annualized 0.15% versus 2.95% before inflation. A $10,000 investment in cash would have returned $28,423 before inflation, but only $10,550 after. For bonds, inflation reduced our 5.14% return to just 2.27%.

However, the stocks still did fairly well. Inflation only reduced the 10.3% annualized return of the U.S. stock market down to 7.3%. All considered, 7.3% is still a fantastic long-term rate of return that will double your money every 10.3 years according to the rule of 72.

That being said, there’s still a use case for bonds and cash. Investors with a shorter time horizon or lower risk tolerance should consider an allocation to these assets, which can help lower volatility and reduce the impact of market crashes.

An ETF to fight inflation

So, the historical evidence shows that over the long term, stocks are the most reliable inflation hedge. The key to success here is ensuring broad diversification, paying low fees, maintaining a long-term perspective, and holding steadfast even when the market crashes.

A great ETF to buy here is the Vanguard Total U.S. Stock Market ETF (TSX:VUN). This fund holds over 3,500 U.S. stocks from all 11 market sectors and market caps. It is a great way of passively matching the average return of the world’s biggest market over time. Best of all, it costs a low expense ratio of only 0.16%.