“Getting rich quick” is a folly. Time and time again, unsuspecting, impatient investors have blown up their portfolios chasing speculative moonshots like cryptocurrency, meme stocks, or penny stocks.

A better alternative is to follow the Motley Fool investment philosophy, which stresses the importance of diversification and maintaining a long-term perspective.

Canadian investors currently have some fantastic options at their disposal to build wealth, such as registered retirement savings plans (RRSPs) and tax-free savings accounts (TFSAs).

Today, I’ll show you using historical evidence how making a prudent, yet simple investment 22 years ago in 2000 would have paid off today.

A choice to make

Imagine you’re starting the turn of the century with $20,000 to invest, either in your TFSA or RRSP (hypothetically, as the TFSA didn’t exist until 2009). What would you invest it in?

Without the benefit of hindsight, my pick would be a low-cost exchange-traded fund, or ETF, that tracks a broad-market, well-known index like the S&P/TSX 60.

This index provides exposure to the top Canadian blue-chip stocks across nearly every market sector. It provides instant diversification when it comes to the Canadian market.

Thankfully, in 2000 there was an ETF available for this index: the iShares S&P/TSX 60 Index ETF (TSX:XIU), which charges a low management expense ratio of just 0.20%.

Historical performance

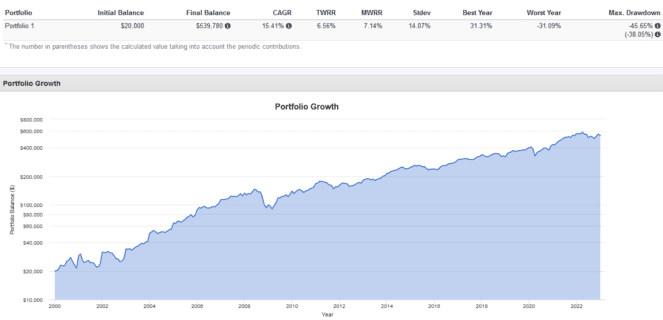

Let’s suppose you put $20,000 into XIU in 2000. Every year thereafter, you contributed the current TFSA limit of $6,500 (hypothetical, as noted earlier the TFSA did not exist until 2009).

During this time, you resolved to stay the course and never panic-sell, reinvest dividends promptly, and keep up the pace and size of your contributions. The results?

Your portfolio value at the end of 2022 would have grown to $539,780, despite a brutal -45% loss during the 2008 Global Financial Crisis. That is the power of compounding at play.

The results would be even higher if you were doing this in an RRSP and could make bigger contributions of up to 18% of your annual income. The key takeaway is to keep investing consistently!

The Foolish takeaway

Of course, you don’t have to be limited to XIU. You can always diversify further by supplementing it with ETFs that hold U.S. and international stocks, or add bonds if you want to decrease your risk.

The reason I chose XIU is because it represents a simple, yet highly diversified investment that is more than suitable for a long-term core holding. It’s a great way to start your portfolio.

Another great option if you want to scratch the stock-picking itch is by augmenting XIU with additional key Canadian stock picks you’re bullish on (and the Fool has some great suggestions below).